|

市场调查报告书

商品编码

1687345

磨料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Abrasives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

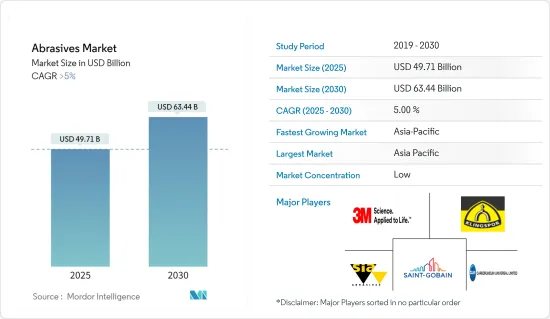

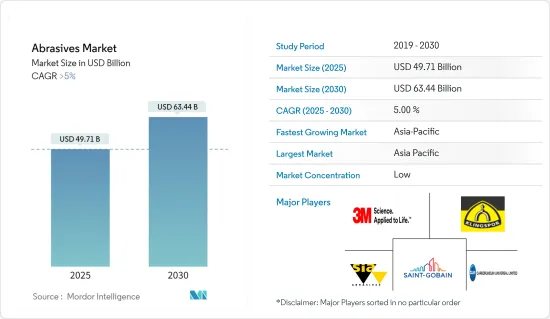

2025 年磨料市场价值预计为 497.1 亿美元,预计到 2030 年将达到 634.4 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 5%。

COVID-19疫情对磨料市场产生了负面影响。然而,疫情过后,建筑、汽车等产业对磨料的需求不断成长,正帮助市场復苏。

主要亮点

- 短期内,航太和汽车工业中磨料的使用量增加以及金属製造和加工行业的成长是预计推动市场发展的关键因素。

- 然而,有关磨料使用的严格规定预计会阻碍市场的成长。

- 然而,研发活动的活性化预计将为磨料市场带来新的机会。

- 由于印度、中国和日本等主要国家的市场发展日益加快,预计亚太地区将在预测期内占据市场主导地位。

磨料市场趋势

航太和汽车工业中磨料的使用日益增加,推动了市场

- 磨料在汽车工业中发挥着至关重要的作用。随着对更轻、更省油的汽车的需求,越来越多的製造商在高性能汽车的开发中开始使用固结研磨颗粒研磨。

- 研磨颗粒研磨在汽车工业中起着至关重要的作用,有助于生产各种零件,包括传动系统、悬吊、车身和底盘部件。

- 在航太工业中,研磨颗粒对于切割和磨削蒸气涡轮铸件、磨削涡轮叶片根部和刃磨叶片翼型等操作至关重要。

- 黏结研磨颗粒广泛应用于航太工业,例如除锈和除漆、去毛边、精打磨、精加工、漆面修饰、抛光和焊接表面准备等。

- 受强劲的经济扩张和消费者偏好变化的推动,2023年汽车产业将实现强劲成长。根据国际汽车製造商组织(OICA)的资料,全球汽车产量(包括乘用车和商用车)约为9,355万辆。这较2022年的产量约8,483万台有显着成长,成长率约10.26%。

- 亚洲-大洋洲已成为汽车生产的领导者,超过其他地区。根据 OICA资料,该地区的汽车产量将在 2023 年达到 5,511 万辆,比 2022 年的 5,002 万辆成长 10.18%。值得注意的是,这项产量主要受到中国、日本、韩国和印度等主要企业的推动。

- OICA表示,预计2023年北美汽车销量将达到1,919万辆,较2022年的1,693万辆成长13.4%。在1919万辆汽车中,有398万辆为乘用车,1521万辆为商用车,其余为重型卡车、客车和长途客车。

- 此外,根据欧洲汽车工业协会的资料,2023年欧洲新车註册量与前一年同期比较增加18.7%。预计2023年乘用车销售量将达到1,500万辆,商用车销售量将达290万辆,而2022年分别为1,264万辆及244万辆。

- 此外,航太业正在经历快速的技术进步和创新,从而增强了飞机製造能力。根据波音《2023-2042年商用展望》,随着国际和国内航空旅行恢復到疫情前的水平,预计到 2042 年全球对新型商用喷射机的需求将达到 48,575 架。

- 全球领先的飞机製造商空中巴士公司的交付预计将大幅成长11%,到2023年将达到735架民航机。这样的激增将刺激对磨料的需求并推动市场发展。

- 通用航空製造商协会预计,2023年飞机交付总量将成长9.0%,达到3,050架。随着飞机产量的增加,对磨料的需求也会随之增加。

- 鑑于这些趋势,快速发展的汽车和航太工业可能会暂时推动对磨料的需求。

亚太地区可望主导磨料市场

- 受建筑、汽车、航太和电子产业需求激增的推动,预计未来几年亚太地区将引领磨料市场。

- 中国强劲的成长势头主要得益于蓬勃发展的经济带动的住宅和商业建筑行业的快速扩张。中国正在推动永续都市化,目标是到2030年实现70%的都市化。这将导致中国建设活动增加,从而刺激该地区对磨料的需求。

- 在韩国,政府制定了雄心勃勃的计划,推出大规模重建计划,到 2025 年在首尔及其周边城市提供 83 万套住宅。其中,首尔将建造 32.3 万套新住宅,京畿道和仁川将建造 29.3 万套。此外,未来四年,釜山、大邱和大田等主要城市中心也将建造 22 万套新住宅。

- 印度快速发展的电子製造业已成为磨料的重要消费国,预计未来几年对电子产品的需求将会上升。

- 印度手机电子协会主席Pankaj Mohindroo表示,2023-2024财年,电子产品总产值预计将达到1,150亿美元。此外,2024 年 4 月,印度政府推出了一项激励计划,向国内电子製造业拨款 76 亿印度卢比,以促进该行业的发展。

- 在航太领域,中国是全球第二大民用航太市场。根据中国国家统计局和民航局的资料,截至2024年1月,中国民航机持有将达到7,351架,比2022年增加550多架。

- 印度品牌股权基金会(IBEF)指出,印度是亚洲第四大医疗设备市场,仅次于日本、中国和韩国。印度医疗器材出口规模位居全球前20位,预计2025年市场规模将达500亿美元。此外,印度医疗设备出口规模预计2022年将达29亿美元,2025年将达100亿美元。

- 鑑于这些动态,亚太地区很可能在可预见的未来主导磨料市场。

磨料磨俱产业概况

磨料市场部分分散。主要参与者(不分先后顺序)包括圣戈班、3M、Klingspor AG、sia Abrasives Industries AG 和 CUMI。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 在航太和汽车工业的应用日益广泛

- 金属製造和加工产业的成长

- 其他驱动因素

- 限制因素

- 对磨料使用的严格规定

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 材料

- 天然研磨颗粒

- 合成研磨颗粒

- 类型

- 固结研磨颗粒俱

- 涂附研磨颗粒

- 超磨粒

- 最终用户

- 金属製造

- 电子产品

- 建造

- 汽车和航太

- 医疗

- 石油和天然气

- 其他终端用户产业(工业和农业)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Abrasive Technology

- ARC Abrasives Inc.

- CUMI

- Deerfos

- Fujimi Incorporated

- Klingspor AG

- Mirka Ltd

- Noritake Co. Limited

- Saint-Gobain

- SAK Abrasives Limited

- Sia Abrasives Industries AG

- Tyrolit-Schleifmittelwerke Swarovski AG & Co. KG

第七章 市场机会与未来趋势

- 增加研发活动

- 其他机会

The Abrasives Market size is estimated at USD 49.71 billion in 2025, and is expected to reach USD 63.44 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The COVID-19 pandemic negatively affected the abrasives market. However, after the pandemic, the rising demand for abrasives from industries like construction and automotive has helped revive the market.

Key Highlights

- Over the short term, the increasing use of abrasives in the aerospace and automotive industries and the growing metal manufacturing and fabrication industries are the major factors expected to drive the market.

- However, stringent regulations on the usage of abrasives are expected to hinder the market's growth.

- Nevertheless, growing research and development activities are expected to create new opportunities for the abrasives market.

- Asia-Pacific is expected to dominate the market during the forecast period owing to growing developments in major countries such as India, China, and Japan.

Abrasives Market Trends

Increasing Use of Abrasives in the Aerospace and Automotive Industries Driving the Market

- Abrasives play a pivotal role in the automotive industry. Owing to the demand for lightweight and fuel-efficient vehicles, manufacturers are increasingly adopting bonded abrasive grinding tools in the development of high-performance automobiles.

- Abrasive grinding plays a pivotal role in the automotive industry, aiding in the production of various components, including driveline, suspension, body, and chassis parts.

- In the aerospace industry, abrasives are crucial for tasks such as cutting and polishing steam turbine castings, grinding turbine blade roots, and polishing blade airfoils.

- Bonded abrasives have extensive applications in the aerospace industry, serving purposes like rust and paint removal, deburring, fine sanding, finishing, lacquer retouching, polishing, and weld preparation.

- In 2023, the automotive industry experienced significant growth, buoyed by robust economic expansion and evolving consumer preferences. Data from the Organisation Internationale des Constructeurs d'Automobiles (OICA) revealed a production of approximately 93.55 million units of vehicles worldwide, encompassing both passenger cars and commercial vehicles. This marked a notable uptick from the roughly 84.83 million units of vehicles produced in 2022, translating to a growth rate of about 10.26%.

- Asia-Oceania emerged as the frontrunner in vehicle manufacturing, outpacing other regions. OICA data highlighted that automotive production in this region reached 55.11 million units in 2023, up by 10.18% from 2022's 50.02 million units. Notably, this production was largely spearheaded by key players like China, Japan, South Korea, and India.

- In North America, motor vehicle sales in 2023 amounted to 19.19 million units, an increase of 13.4% compared to sales in 2022, which were reported to be 16.93 million units, according to the OICA. Out of the total 19.19 million units, passenger cars comprised 3.98 million units, commercial vehicles made up 15.21 million units, and the remaining units were a combination of heavy trucks, buses, and coaches.

- Furthermore, as per data from the European Automobile Manufacturers Association, in Europe, the overall registration of new motor vehicles increased by 18.7% in 2023 compared to the previous year. In 2023, passenger car and commercial vehicle sales reached 15 million units and 2.90 million units, respectively, compared to 12.64 million units and 2.44 million units in 2022.

- Furthermore, the aerospace industry is witnessing rapid technological advancements and innovations, bolstering aircraft manufacturing. As per the Boeing Commercial Outlook 2023-2042, global demand for new commercial jets is projected to hit 48,575 by 2042, driven by a rebound in international and domestic air travel to pre-pandemic levels.

- Airbus, a leading global aircraft manufacturer, registered a notable 11% increase in its deliveries, reaching 735 commercial aircraft in 2023. Such surges are poised to fuel the demand for abrasives and, thereby, drive the market.

- As highlighted by the General Aviation Manufacturers Association, total aircraft shipments witnessed a 9.0% uptick in 2023, totaling 3,050 units. With aircraft production on the rise, the demand for abrasives is set to follow suit.

- Given these dynamics, the burgeoning automotive and aerospace industries are poised to drive demand for abrasives in the foreseeable future.

Asia-Pacific Expected to Dominate the Abrasives Market

- Asia-Pacific is expected to lead the abrasives market over the coming years, driven by surging demand from the construction, automotive, aerospace, and electronics industries.

- China's robust growth is primarily propelled by a swift expansion in its residential and commercial building industries, bolstered by a thriving economy. The nation is undergoing a sustained urbanization push, targeting a 70% urban rate by 2030. Consequently, this heightened construction activity in China is set to bolster the region's demand for abrasives.

- In South Korea, the government has ambitious plans, aiming to roll out large-scale redevelopment projects that will deliver 830,000 housing units in Seoul and neighboring cities by 2025. Of these, 323,000 new homes will grace Seoul, with Gyeonggi Province and Incheon receiving 293,000. Additionally, major urban centers like Busan, Daegu, and Daejeon are set to welcome 220,000 new residences over the next four years.

- India's burgeoning electronics manufacturing industry has emerged as a significant consumer of abrasives, with expectations of heightened demand for electronic goods in the coming years.

- According to Pankaj Mohindroo, Chairman of the Indian Cellular and Electronics Association, the total production of electronics goods in the financial year 2023-2024 was estimated to reach USD 115 billion. In addition, the Government of India allocated INR 760 million for electronic manufacturing in the country and introduced incentive schemes to boost the electronic manufacturing industry in April 2024.

- In the aerospace industry, China stands tall as the global second-largest civil aerospace market. As of January 2024, data from the National Bureau of Statistics of China and the Civil Aviation Administration revealed a fleet of 7,351 civil aircraft, marking an uptick of over 550 from 2022.

- India, as highlighted by the Indian Brand Equity Foundation (IBEF), ranks as the fourth-largest medical device market in Asia, trailing only Japan, China, and South Korea. Globally, it stands among the top 20, with projections eyeing a USD 50 billion valuation by 2025. Furthermore, India's medical device exports, valued at USD 2.90 billion in FY 2022, are on track to reach USD 10 billion by 2025.

- Given these dynamics, Asia-Pacific is set to assert its dominance in the abrasives market in the foreseeable future.

Abrasives Industry Overview

The abrasives market is partially fragmented in nature. The major players (not in any particular order) include Saint Gobain, 3M, Klingspor AG, sia Abrasives Industries AG, and CUMI, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Use in the Aerospace and Automotive Industries

- 4.1.2 Growing Metal Manufacturing and Fabrication Industries

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulations on Usage of Abrasives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material

- 5.1.1 Natural Abrasives

- 5.1.2 Synthetic Abrasives

- 5.2 Type

- 5.2.1 Bonded Abrasives

- 5.2.2 Coated Abrasives

- 5.2.3 Super Abrasives

- 5.3 End-user Industry

- 5.3.1 Metal Manufacturing

- 5.3.2 Electronics

- 5.3.3 Construction

- 5.3.4 Automotive and Aerospace

- 5.3.5 Medical

- 5.3.6 Oil and Gas

- 5.3.7 Other End-user Industries (Industrial and Agriculture)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Abrasive Technology

- 6.4.3 ARC Abrasives Inc.

- 6.4.4 CUMI

- 6.4.5 Deerfos

- 6.4.6 Fujimi Incorporated

- 6.4.7 Klingspor AG

- 6.4.8 Mirka Ltd

- 6.4.9 Noritake Co. Limited

- 6.4.10 Saint-Gobain

- 6.4.11 SAK Abrasives Limited

- 6.4.12 Sia Abrasives Industries AG

- 6.4.13 Tyrolit - Schleifmittelwerke Swarovski AG & Co. KG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Research and Development Activities

- 7.2 Other Opportunities