|

市场调查报告书

商品编码

1687347

窗膜:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Window Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

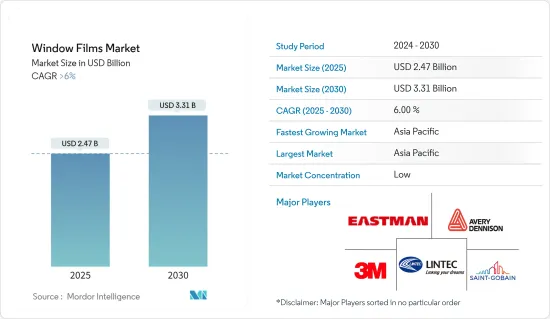

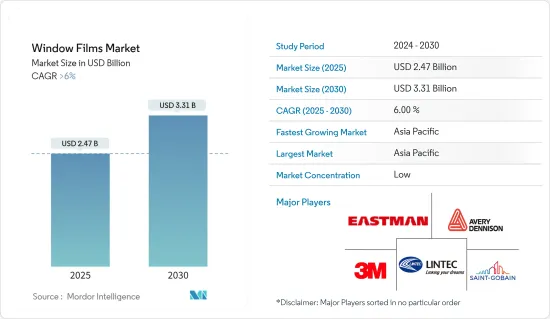

预计 2025 年窗膜市场规模将达到 24.7 亿美元,到 2030 年将达到 33.1 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 6%。

2020 年新冠疫情对建设产业产生了负面影响。由于物流和原材料短缺,该行业面临挑战。这也对窗膜市场产生了负面影响。然而,疫情过后汽车业产销激增,推动了市场的成长和復苏。

主要亮点

- 从中期来看,消费者对减少碳足迹的关注度不断提高以及对安全的日益关注是推动市场成长的关键因素。

- 然而,窗膜的应用需要一定的技术专业知识,需要改进技术和应用问题才能扩大窗膜市场的成长。此外,智慧玻璃市场的成长可能会阻碍窗膜市场的发展。

- 此外,人们对紫外线 (UV) 防护的兴趣日益浓厚,预计将为该行业提供新的成长机会。

- 预计亚太地区将主导市场,并在预测期内实现最高的年增长率。

窗膜市场趋势

建筑业占据市场主导地位

- 窗膜用于建筑业以控制阳光。它反射太阳的热量并有助于维持建筑物内的舒适温度。

- 在建筑领域,窗膜有各种用途,包括装饰膜、紫外线 (UV) 阻隔防窥膜膜、防眩防涂鸦、防涂鸦膜、隔热膜以及安全膜。预计到 2030 年,全球建筑业规模将达到 8 兆美元,主要由印度、中国和美国等国家推动。

- 中国正经历建筑业的繁荣。中国拥有全球最大的建筑市场,占全球建筑投资总额的20%。预计到2030年,建筑支出将接近13兆美元。

- 根据国家统计局的数据,中国建设产业商务活动指数(BASI)从2023年11月的55.9上升至12月的56.9。 BASI 得分高于 50 表示行业成长,2023 年 10 月的 BASI 得分为 53.5。

- 根据印度工业和国内贸易促进部的数据,2022 年流入印度建筑开发领域的外国直接投资 (FDI) 股权价值为 1.25 亿美元。 2022年美国私人建筑支出成长,几乎是公共部门建筑支出的四倍。美国在建设产业占有重要份额,2022 年的年度支出超过 17.93 亿美元。

- 根据美国人口普查局(USCB)的数据,2023年12月的建筑支出经季节性已调整的后年化率预计为2.096兆美元,比11月修订后的2.0783兆美元高出0.9%。此外,预计2023年建筑价值将达到19,787亿美元,比2022年的18,487亿美元高出7.0%。

- 因此,预计上述发展将在未来几年推动建设产业对窗膜的需求。

亚太地区占市场主导地位

- 预计亚太地区将主导市场,其中中国和印度占最大份额。中国是该地区GDP最高的国家。中国是成长最快的经济体之一,目前是世界上最大的生产国之一。该国的製造业对该国的经济贡献巨大。中国是亚太地区建设业大国之一,工业和建设业约占GDP的50%。

- 预计该国的人口趋势将继续刺激住宅的成长。家庭收入水准的提高加上农村人口向都市区的转移预计将继续推动中国住宅建筑业的需求。公共和私营部门对经济适用住宅的日益关注预计将推动住宅建筑行业的成长。

- 印度是建设产业最大的市场,房地产和城市发展产业正在崛起。据印度品牌股权基金会 (IBEF) 称,预计到 2030 年,印度房地产行业的规模将达到 1 兆美元,到 2025 年将国内生产总值) 贡献约 13%。预计这将增加对窗膜的需求并促进该地区的市场发展。

- 在建筑需求强劲的同时,印度的汽车产业也正在崛起。例如,根据印度汽车工业协会(SIAM)的数据,预计2023年乘用车产量将从2022年的365万辆增加至458万辆,成长率为25.5%。此外,2023年全国摩托车销量超过1,586万辆。

- 此外,OICA表示,中国汽车产量将在2023年达到3,016万辆,年增率为10.6%。

- 牛津经济研究院也预测,到2037年,中国、美国和印度将占全球建筑工程的51%。这意味着这两个亚太国家在全球范围内的建筑量庞大,这可能会在预测期内大幅推动对窗膜的需求。

- 由于这些因素,预计该地区的窗膜市场在预测期内将稳定成长。

窗膜行业概况

全球窗膜市场较为分散,排名前两家的公司占据了全球市场的大部分份额。市场的主要企业(不分先后顺序)包括伊士曼化学公司、3M、艾利丹尼森公司、圣戈班和琳得科公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 对安全和防盗窗膜的需求不断增加

- 人们对减少碳足迹的兴趣日益浓厚

- 限制因素

- 技术、保固和施工问题

- 智慧玻璃市场成长

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按类型

- 阳光调节/防紫外线膜

- 装饰膜

- 安全防护膜

- 防窥膜

- 隔热膜

- 其他的

- 按最终用户产业

- 车

- 建筑与施工

- 住宅

- 商业的

- 基础设施和设施

- 海洋

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 越南

- 马来西亚

- 印尼

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 土耳其

- 北欧的

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 卡达

- 奈及利亚

- 阿拉伯聯合大公国

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Armolan Greece

- Avery Dennison Corporation

- Eastman Chemical Company

- HYOSUNG CHEMICAL

- Johnson Window Films Inc.

- LINTEC Corporation

- NEXFIL

- Rayno Window Film

- Saint-Gobain

- TORAY INDUSTRIES INC.

第七章 市场机会与未来趋势

- 人们对紫外线防护的兴趣日益浓厚

The Window Films Market size is estimated at USD 2.47 billion in 2025, and is expected to reach USD 3.31 billion by 2030, at a CAGR of greater than 6% during the forecast period (2025-2030).

The COVID-19 pandemic in 2020 adversely affected the construction industry. The industry faced challenges due to logistics and raw materials' unavailability. This also negatively impacted the window films market. However, the automotive industry's upsurge in production and sales post-pandemic propelled the market's growth and recovery.

Key Highlights

- Over the medium term, the major factors driving the market's growth are increasing emphasis on reducing carbon footprint and increasing safety and security concerns among consumers.

- However, some technical expertise is required to install window films, and the technicality and installation issues need to be improved to increase the growth of the window film market. Also, the growth in the smart glass market may cause hindrances to the window film market.

- Also, the growing concern for ultraviolet (UV) protection is projected to create new growth opportunities for the industry.

- Asia-Pacific is expected to dominate the market and will likely witness the highest annual growth rate during the forecast period.

Window Films Market Trends

The Building and Construction Segment to Dominate the Market

- Window films are utilized in the construction industry for solar control. They can reflect solar radiation heat and maintain a comfortable temperature inside buildings. Window films are used in the construction sector for solar control due to their ability to reflect the heat from solar radiation and maintain a comfortable ambiance in terms of the temperature inside the structure or building.

- In the construction segment, window films, such as decorative, ultraviolet (UV) block, privacy, anti-glare, anti-graffiti, insulating films, and safety and security films, are used. The global construction industry is expected to reach USD 8 trillion by 2030, primarily driven by countries like India, China, and the United States.

- China is amid a construction mega-boom. The country has the largest building construction market in the world, making up 20% of all construction investment globally. The country is expected to spend nearly USD 13 trillion on buildings by 2030.

- According to the National Bureau of Statistics (NBS), in China, the construction industry's business activity index (BASI) rose to 56.9 as of December 2023 from 55.9 in November 2023. The BASI score above 50 indicates growth in the industry, and the October 2023 BASI score was 53.5.

- According to the Department for Promotion of Industry and Internal Trade of India, the foreign direct investment (FDI) equity inflow for the construction development sector in India was worth USD 125 million in 2022. The United States' spending on private construction grew in 2022 and was nearly four times larger than construction spending in the public sector. The United States holds a significant share of the construction industry, which recorded an annual expenditure of over USD 1,793 million in 2022.

- According to the US Census Bureau (USCB), construction spending in December 2023 was estimated at a seasonally adjusted annual rate of USD 2,096.0 billion, 0.9% above the revised November estimate of USD 2,078.3 billion. Moreover, the construction value was USD 1,978.7 billion in 2023, 7.0%higher than the USD 1,848.7 billion spent in 2022.

- Therefore, the aforementioned developments are expected to drive the demand for window films in the construction industry through the years to come.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market, with China and India accounting for the largest share. China has the largest GDP in the region. China is one of the fastest emerging economies, and it has become one of the biggest production houses in the world today. The country's manufacturing sector is one of the major contributors to the country's economy. China is one of the major countries in Asia-Pacific with ample construction activities, with the industrial and construction industries accounting for approximately 50% of the GDP.

- Demographics in the country are expected to continue to spur growth in residential construction. Rising household income levels combined with the population migrating from rural to urban areas are expected to continue to drive demand for the residential construction segment in the country. Increased focus on affordable housing by both the public and private sectors will drive growth in the residential construction segment.

- India is the largest market for the construction industry, with an increase in the real estate and urban development segment. According to the Indian Brand Equity Foundation (IBEF), the Indian real estate industry will likely reach USD 1 trillion by 2030 and contribute approximately 13% to the country's GDP by 2025. This will increase the demand for the window film market and propel its market in the region.

- Although the demand for construction is good, the automotive industry in India is also increasing. For instance, according to the Society of Indian Automobile Manufacturers (SIAM) India, the passenger vehicle production volume reached 4.58 million in 2023, registering a 25.5% growth over 3.65 million in 2022. Moreover, in 2023, over 15.86 million units of two-wheelers were sold domestically across the country.

- Also, according to OICA, automotive production in China reached 30.16 million in 2023, an annual increase of 10.6%.

- Also, Oxford Economics estimates that China, the United States, and India will account for 51% of all construction work done worldwide by 2037. This means a huge global construction volume will occur in the two Asia-Pacific countries and can significantly grow the demand for window films during the forecast period.

- Due to all such factors, the market for window films in the region is expected to grow steadily during the forecast period.

Window Films Industry Overview

The global window films market is fragmented, with the top two companies holding significant shares in the global market. Some of the major players in the market (not in any particular order) include Eastman Chemical Company, 3M, Avery Dennison Corporation, Saint-Gobain, and Lintec Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Safety and Security Window Films

- 4.1.2 Increasing Emphasis on Reducing Carbon Footprint

- 4.2 Restraints

- 4.2.1 Technical, Warranty, and Installation Issues

- 4.2.2 Growing Smart Glass Market

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Solar Control and UV Blocking Films

- 5.1.2 Decorative Films

- 5.1.3 Safety and Security Films

- 5.1.4 Privacy Films

- 5.1.5 Insulating Films

- 5.1.6 Other Types

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Building and Construction

- 5.2.2.1 Residential

- 5.2.2.2 Commercial

- 5.2.2.3 Infrastructural and Institutional

- 5.2.3 Marine

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Vietnam

- 5.3.1.7 Malaysia

- 5.3.1.8 Indonesia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Turkey

- 5.3.3.7 NORDIC

- 5.3.3.8 Spain

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Qatar

- 5.3.5.4 Nigeria

- 5.3.5.5 United Arab Emirates

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Armolan Greece

- 6.4.3 Avery Dennison Corporation

- 6.4.4 Eastman Chemical Company

- 6.4.5 HYOSUNG CHEMICAL

- 6.4.6 Johnson Window Films Inc.

- 6.4.7 LINTEC Corporation

- 6.4.8 NEXFIL

- 6.4.9 Rayno Window Film

- 6.4.10 Saint-Gobain

- 6.4.11 TORAY INDUSTRIES INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Concerns Regarding UV Protection