|

市场调查报告书

商品编码

1687360

高纯度氧化铝(HPA):市场占有率分析、产业趋势与统计、成长预测(2025-2030)High-Purity Alumina (HPA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

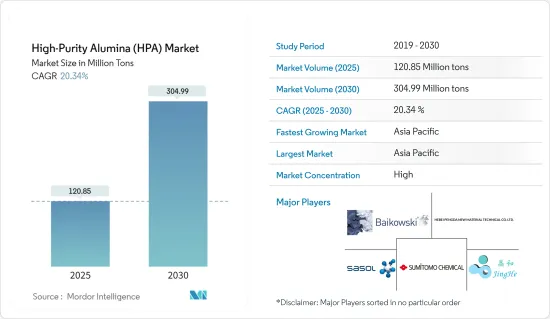

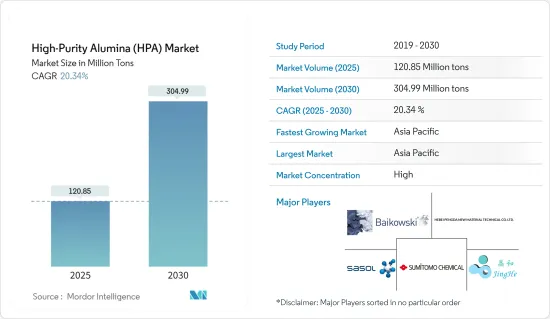

预计2025年高纯度氧化铝市场规模为1.2085亿吨,2030年将达到3.0499亿吨,预测期内(2025-2030年)的复合年增长率为20.34%。

新冠疫情阻碍了高纯度氧化铝市场的发展。最初,由于航太、汽车和电子等各行业为应对封锁措施而缩减生产或暂停运营,对高纯度氧化铝的需求下降。这一趋势减少了 LED 照明、半导体製造和锂离子电池等应用对基于 HPA 的产品的需求。然而,随着封锁和限制的放鬆以及经济活动的恢復,包括 LED 照明、半导体製造和锂离子电池在内的一系列行业对基于 HPA 的材料的需求都在回升。

主要亮点

- LED照明和锂离子电池需求的不断增长是推动高纯度氧化铝市场发展的主要因素。

- 然而,高纯度氧化铝的高成本预计将阻碍高纯度氧化铝市场的成长。

- 由于HPA在智慧型手机和手錶的防刮玻璃和光学镜片製造中的应用日益广泛,预计高纯度氧化铝市场将在预测期内提供巨大的成长机会。

- 亚太地区是高纯度氧化铝的最大市场,预计在预测期内将以最高的复合年增长率成长。中国、日本和东南亚等国家对高纯度氧化铝的高需求推动了亚太地区的主导地位。

高纯度氧化铝(HPA)市场趋势

LED照明领域可望占据市场主导地位

- 高纯度氧化铝用作製造LED(发光二极体)晶片的基板材料。 LED 晶片通常安装在基板上,以进行机械支撑和温度控管。 HPA 具有高导热性,可有效散热,提高 LED 设备的性能和使用寿命。

- LED 照明越来越受欢迎,因为它比白炽灯和萤光等传统照明技术更节能、寿命更长、更环保。住宅、商业和工业应用中对 LED 照明产品的需求不断增加,推动了对高纯度氧化铝基板的需求。

- 根据美国能源局的数据,LED照明消费量在户外领域最高,预计2025年将成长93%。

- 根据国际能源总署(IEA)的数据,LED比白炽灯可节省80-90%的能源。

- 根据国际能源总署 (IEA) 的数据,几乎所有萤光都将于 2023 年逐步淘汰,欧盟 (EU) 也更新了《生态设计指令》和《限制有害物质指令》中的规定。在非洲,南部非洲发展共同体的16个国家已经采用了区域统一的照明标准,以便在未来几年内将所有LED照明推向市场。

- 根据LED Lighting Supply预测,到2030年,LED预计将占全球照明光源的87%。全球LED市场规模预计到2030年将成长至近1,000亿美元。

- 根据TrendForce最新报告,2024年将是全球LED照明市场的关键一年,预计将有58亿盏LED灯和灯具达到使用寿命。到2026年,市场规模预计将达到930亿美元以上。随着全球社会努力实现净零排放,对节能 LED 转换的需求预计将会增加。

- 考虑到上述事实和因素,预计预测期内基于 LED 的照明应用对 HPA 的需求将会增加。

亚太地区预计将主导市场

- 亚太地区是高纯度氧化铝及其最终用途产品的中心製造地。中国、日本、韩国和台湾等国家已经建立了强大的生产和加工高纯度氧化铝的製造基础设施和供应链。

- 该地区正在经历快速的都市化和工业化,推动汽车、电子、航太和医疗保健领域对高纯度氧化铝等先进材料的需求。这些产业对高纯度氧化铝产品的需求不断增长,增强了该区域市场的主导地位。

- 此外,根据中国乘用车市场资讯联席会(CPCA)的报告,中国正在推动电动车的普及,这可能会增加未来对锂离子电池的需求。 2023年中国纯电动车和插电式混合动力汽车销量约950万辆。

- 根据《经济时报》发布的资料,2023年第三季印度电动车销量达23,900辆。

- 2024 年 3 月,塔塔电子私人有限公司 (TEPL) 宣布计划与台湾力晶半导体製造公司 (PSMC) 合作在古吉拉突邦建立半导体代工厂 (SFC)。计划总投资预计为9兆印度卢比(1,097.1亿美元)。力积电是台湾六大半导体代工厂之一。生产能力将涵盖28nm製程高效能运算(HPC)晶片、处理器电源管理(PPM)晶片、电动车(EV)、通讯、国防、汽车、消费性电子(显示器、电力电子)等领域。

- 预计预测期内亚太高纯度氧化铝市场的成长将受到上述因素的支持。

高纯度氧化铝(HPA)产业概况

高纯度氧化铝市场本质上是一体化的,市场领导者之间的竞争非常激烈。市场的主要企业(不分先后顺序)包括河北鹏达新材料科技、住友化学、沙索、Baikowski、宣城精瑞新材料等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- LED照明需求不断成长

- 锂离子电池市场的需求

- 限制因素

- 高纯度氧化铝高成本

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按类型

- 4N

- 5N

- 6N

- 依技术

- 水解

- 盐酸浸出

- 按应用

- LED照明

- 磷光体

- 半导体

- 锂离子电池

- 技术陶瓷

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- Baikowski

- Bestry Performance Materials Co. Ltd

- Hebei Pengda New Material Technology Co. Ltd

- Honghe Chemical

- Nippon Light Metal Co. Ltd

- Polar Sapphire

- Rusal

- Sasol(USA)Corporation

- Shandong Keheng Crystal Material Technology Co. Ltd

- Sumitomo Chemical Co. Ltd

- Wuxi Tuobada Titanium Dioxide Products Co. Ltd

- Xuancheng Jingrui New Materials Co. Ltd

第七章 市场机会与未来趋势

- 防止智慧型手机、手錶和眼镜刮伤的应用

- 扩大光学镜头製造的应用

The High-Purity Alumina Market size is estimated at 120.85 million tons in 2025, and is expected to reach 304.99 million tons by 2030, at a CAGR of 20.34% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the high-purity alumina market. Initially, the demand for high-purity alumina declined as various industries, including aerospace, automotive, and electronics, scaled back production or temporarily shut down operations in response to lockdown measures. This trend reduced the demand for HPA-based products in applications such as LED lighting, semiconductor manufacturing, and lithium-ion batteries. However, as lockdown and restrictions eased and economic activities resumed, there was pent-up demand for HPA-based products in various industries, such as LED lighting, semiconductor manufacturing, and lithium-ion batteries.

Key Highlights

- The increased demand for LED-based lighting and lithium-ion batteries is the major factor driving the market for high-purity alumina.

- However, the high cost of high-purity alumina is expected to hamper the growth of the high-purity alumina market.

- Enormous opportunities are expected for the growth of the high-purity alumina market during the forecast period due to the growing use of HPA in scratch-resistant glasses for smartphones and watches and in the manufacture of optical lenses.

- Asia-Pacific has become the biggest market for high-purity alumina and is projected to register the highest CAGR over the forecast period. The high demand for high-purity alumina in countries such as China, Japan, and Southeast Asia is driving the dominance of Asia-Pacific.

High-Purity Alumina (HPA) Market Trends

The LED Lighting Segment is Expected to Dominate the Market

- High-purity alumina is used as a substrate material to produce LED (light-emitting diode) chips. LED chips are typically mounted on a substrate to provide mechanical support and thermal management. HPA's high thermal conductivity helps dissipate heat efficiently, thus improving the performance and lifespan of LED devices.

- LED lighting has gained widespread adoption due to its energy efficiency, long lifespan, and environmental benefits compared to traditional lighting technologies such as incandescent and fluorescent bulbs. The increasing demand for LED lighting products in residential, commercial, and industrial applications drives the demand for high-purity alumina substrates.

- According to the US Department of Energy, the outdoor segment holds the maximum consumption of LED lighting, which is expected to grow by 93% by 2025.

- According to the International Energy Agency, LEDs save 80-90% more energy than incandescent light bulbs.

- According to the International Energy Agency, in addition to removing virtually all fluorescent lighting in 2023, the European Union updated its regulations under the Ecodesign Directive and the Restriction of Hazardous Substances Directive. In Africa, a regionally harmonized lighting standard has been adopted in 16 countries of the Southern African Development Community in order to introduce all LED lighting to the market in the next few years.

- According to the LED Lighting Supply, LEDs are expected to increase up to 87% of global lighting sources by 2030. The global LED market is expected to grow to almost USD 100 billion in 2030.

- According to TrendForce's most recent reports, the year 2024 will be crucial for the global LED lighting market, with an estimated 5.8 billion LED lamps and luminaires reaching their end-of-life. In 2026, the market is expected to reach a value of more than USD 93 billion. As the global community attempts to achieve net zero emissions, the demand for energy-saving LED conversion is expected to increase.

- Considering all the abovementioned facts and factors, the demand for HPA for LED-based lighting applications is expected to increase during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is a central manufacturing hub for high-purity alumina and its end-use products. Countries like China, Japan, South Korea, and Taiwan have established robust manufacturing infrastructures and supply chains for high-purity alumina production and processing.

- The region has experienced rapid urbanization and industrialization, thus driving the demand for advanced materials like high-purity alumina in the automotive, electronics, aerospace, and healthcare sectors. The growing demand for high-purity alumina-based products in these sectors fuels the regional market's dominance.

- In addition, China is promoting the use of electric vehicles, which may increase the demand for lithium-ion batteries in the future, according to the China Passenger Car Association (CPCA) report. In China, around 9.5 million battery-electric cars and plug-in hybrids were sold in 2023.

- The electric vehicle sales in India reached 23,900 units in Q3 2023, according to the data released by the Economic Times.

- In March 2024, Tata Electronics Private Limited (TEPL), in collaboration with Powerchip Semiconductor Manufacturing Corporation (PSMC) Taiwan, announced its plans to set up a semiconductor fabrication plant (SFC) in the state of Gujarat. The total investment amount of the project is estimated at INR 9,000 billion (USD 109.71 billion). PSMC is one of the six largest semiconductor foundry companies in Taiwan. The capacity will cover segments like high-performance computing (HPC) chips with 28nm technology, processor power management (PPM) chips, electric vehicles (EVs), telecommunication, defense, automobile, and consumer electronics (display, power electronics).

- The growth of the Asia-Pacific high-purity alumina market is expected to be supported by the abovementioned factors over the forecast period.

High-Purity Alumina (HPA) Industry Overview

The high-purity alumina market is consolidated in nature, with intense competition among the top market players. The key players in the market (not in any particular order) include Hebei Pengda New Material Technology Co. Ltd, Sumitomo Chemical Co. Ltd, Sasol, Baikowski, and Xuancheng Jingrui New Materials Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for LED-based Lighting

- 4.1.2 Demand from Lithium-ion Battery Markets

- 4.2 Restraints

- 4.2.1 High Cost of High-purity Alumina

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 4N

- 5.1.2 5N

- 5.1.3 6N

- 5.2 Technology

- 5.2.1 Hydrolysis

- 5.2.2 Hydrochloric Acid Leaching

- 5.3 Application

- 5.3.1 LED Lighting

- 5.3.2 Phosphor

- 5.3.3 Semiconductor

- 5.3.4 Lithium-ion (Li-Ion) Batteries

- 5.3.5 Technical Ceramics

- 5.3.6 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share (%) Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baikowski

- 6.3.2 Bestry Performance Materials Co. Ltd

- 6.3.3 Hebei Pengda New Material Technology Co. Ltd

- 6.3.4 Honghe Chemical

- 6.3.5 Nippon Light Metal Co. Ltd

- 6.3.6 Polar Sapphire

- 6.3.7 Rusal

- 6.3.8 Sasol (USA) Corporation

- 6.3.9 Shandong Keheng Crystal Material Technology Co. Ltd

- 6.3.10 Sumitomo Chemical Co. Ltd

- 6.3.11 Wuxi Tuobada Titanium Dioxide Products Co. Ltd

- 6.3.12 Xuancheng Jingrui New Materials Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Application in Scratch-resistant Glasses for Smartphones and Watches

- 7.2 Growing Applications in Manufacturing Optical Lenses