|

市场调查报告书

商品编码

1687365

针状焦:市场占有率分析、产业趋势与统计资料、成长预测(2025-2030 年)Needle Coke - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

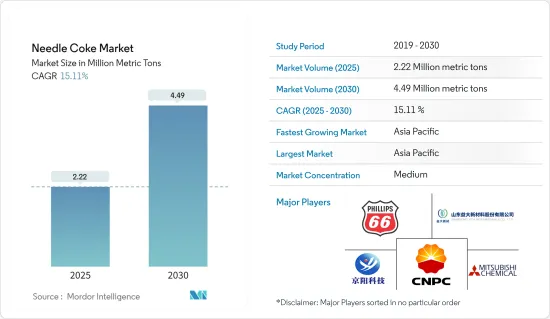

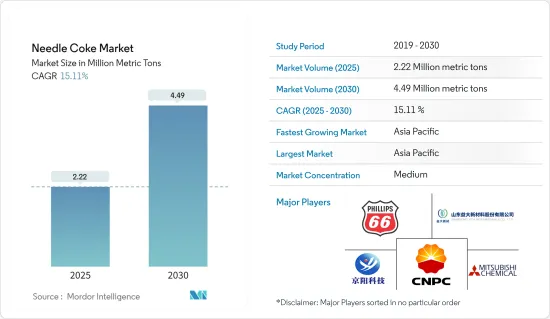

预计2025年针状焦市场规模为222万吨,预计2030年将达到449万吨,预测期内(2025-2030年)的复合年增长率为15.11%。

新冠疫情对针状焦市场产生了负面影响。疫情期间,钢厂需求减少,显着影响了石墨电极的生产,导致针状焦消费量下降。然而,由于锂离子电池和石墨电极需求的復苏,限制解除后市场实现了显着的成长率。

从中期来看,电弧炉钢製造投资的增加和政府利多政策增加废钢消费是推动市场成长的关键因素。

然而,与石油焦相关的健康危害可能会阻碍研究市场的成长。

在预测期内,全球锂离子电池产量的成长可能为市场带来机会。

亚太地区已成为主导市场。此外,由于印度、中国和日本等国家的需求旺盛,预计 2024 年至 2029 年期间其复合年增长率将达到最高。

针状焦市场趋势

石墨电极领域占据市场主导地位

针状焦是电炉石墨电极的主要原料。它是一种优质、高价值的石油焦,用于生产热膨胀係数 (CTE) 非常低的石墨电极。

由于石墨电极在钢铁等金属工业用的电炉中的应用十分广泛,因此石墨电极用针状焦的应用占针状焦用量的最大份额。

石墨具有高导热性,耐热、耐衝击。它还具有低电阻,这对于传递熔化钢所需的大电流是必要的。这使得它能够承受 EAF(电炉)中产生的极高热量。为了製造电极,必须透过煅烧和再煅烧等过程将焦炭转化为石墨,这可能需要长达六个月的时间。

石墨电极分为RP石墨电极、HP石墨电极、SHP石墨电极、UHP石墨电极四种。

石墨电极主要用于电工钢、合金钢、各种合金及非金属的生产。这些电极能够产生高热量,也用于钢铁提炼和类似的冶炼製程。废铁可以在电炉中以约 1,600°C 的温度熔化。

根据Sanergy Group Limited的资料,预计2023年全球石墨电极产量将达到878.5万吨,2024年将达到79.54万吨。

2023年12月,Graphite India Limited(GIL)向Godi India Private Ltd.投资5亿印度卢比(约600万美元)购买强制转换优先股。透过这笔投资,GIL将持有Godi India 31%的股份。 Godi India 致力于先进的研究和开发,以帮助生产用于电动车 (EV) 的永续电池和基于超级电容器的能源储存系统。 Godi India 的环保和碳中和製程包括 Aqueous Electrode ProcessingTM、Active Dry CoatingTM 和 Pranic BinderTM。此项投资符合 GIL 进军先进电池和能源储存技术的多元化策略。

2023年11月,HEG有限公司成功将其位于印度中央邦的石墨电极产能从每年8万吨扩大至每年10万吨。该公司为此次产能扩张投入了 1,200 亿印度卢比(143,741,000 美元)。至此,HEG已成为西方世界第三大石墨电极公司。

预计上述因素将在预测期内影响石墨电极应用对针状焦的需求。

亚太地区占市场主导地位

亚太地区预计将主导针状焦市场,因为它包括中国(最大的针状焦生产国和消费国)和日本等国家。

中国石墨电极消费量和生产能力均居世界第一。中国有40多家正规的石墨电极生产企业。中国市场对石墨电极的需求以及电动车产业成长所导致的锂离子电池阳极进一步多样化,都在推动针状焦需求的復苏。在可预见的未来,预计这种需求将继续稳定成长,价格也将相应上涨。

除此之外,我国政府也注重发展环保钢铁生产方式。因此,中国当局正积极推广电弧炉(EAF)技术,以减少碳排放并促进钢铁业的永续性。电弧炉技术主要以废铁为原料,利用电力进行熔炼。在国家扶持政策的推动下,预计电弧炉技术的采用将成为中国的流行趋势,从而加强对石墨电极的需求。

日本是石油、煤炭和焦油基沥青针状焦的主要生产国和出口国之一。日本公司是世界上最大的石墨电极生产商之一。石墨电极市场的主要参与者包括昭和电工、日本碳素、SEC碳素和东海碳素。

印度钢铁业正在加大脱碳力度,积极致力于减少碳排放。作为其中的一部分,在钢铁生产中采用电弧炉(EAF)技术的趋势日益增长。电弧炉依靠电力和废钢,这使其成为比传统方法更永续的选择。

随着电弧炉的采用率不断提高,预计对石墨电极的需求将会激增。印度政府取消废钢进口关税的措施将直接使电弧炉钢厂受益。再加上国家利好的政策,这些将进一步鼓励电弧炉的转变,并推动对石墨电极的需求。

日本第二大钢铁製造商 JFE 钢铁公司宣布,建设计画一座大型电弧炉 (EAF)。该 EAF 计划在 2027 年左右取代仓敷厂现有的高炉。这项策略性倡议凸显了该公司致力于根据全球气候变迁倡议控制碳排放的承诺。新建电炉将主要用于汽车等产业,预计每年可减少排放260万吨。

石墨电极在电弧炉(EAF)製程中起着至关重要的作用,而电弧炉是钢铁生产的主要方法。韩国的钢铁业非常重要,透过满足汽车、建筑和造船等行业的需求来推动该国的经济成长。根据韩国钢铁协会报告,钢铁业占韩国GDP的1.5%,占製造业的4.9%。其中,韩国是世界第六大钢铁生产国。

因此,基于上述方面,亚太地区很可能在全球针状焦市场占据主导地位。

针状焦产业概况

针状焦市场部分盘整。市场主要企业(不分先后顺序)包括菲利普斯66公司、中国石油天然气集团公司(CNPC)、山东亿达融通贸易有限公司、山东晶阳科技、三菱化学株式会社。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 增加对电弧炉钢製造的投资

- 政府政策增加废钢消费

- 限制因素

- 石油焦的健康危害

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 定价概览

第五章市场区隔

- 依产品类型

- 石油基

- 煤焦油沥青

- 按应用

- 石墨电极

- 锂离子电池

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- Baosteel Group

- China National Petroleum Corporation(CNPC)

- China Petroleum & Chemical Corporation(Sinopec)

- Indian Oil Corporation

- Liaoning Baolai Bioenergy Co., Ltd.

- Mitsubishi Chemical Corporation

- Nippon Steel Corporation

- Phillips 66

- Posco Mc Materials

- Seadrift Coke LP(Graftech International)

- Shandong Dongyang Technology Co. Ltd

- Shandong Yida New Materials Co. Ltd

- Shanxi Hongte Coal Chemical Co. Ltd

第七章 市场机会与未来趋势

- 锂离子电池推动针状焦需求

The Needle Coke Market size is estimated at 2.22 million metric tons in 2025, and is expected to reach 4.49 million metric tons by 2030, at a CAGR of 15.11% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the needle coke market. During the pandemic, the manufacturing of graphite electrodes was heavily affected due to less demand from the steel manufacturing plants, which reduced the consumption of needle coke. However, the market registered a significant growth rate after the restrictions were lifted due to the recovering demand for lithium-ion batteries and graphite electrodes.

Over the medium term, increasing investments in EAF steel manufacturing and favorable government policies to increase scrap steel consumption are significant factors driving the growth of the studied market.

However, health hazards associated with petroleum coke are likely to hinder the growth of the studied market.

The increase in lithium-ion battery production globally is likely to act as an opportunity for the market studied during the forecast period.

Asia-Pacific emerged as the dominant market. It is also expected to register the highest CAGR from 2024 to 2029 due to the high demand from countries such as India, China, Japan, and others.

Needle Coke Market Trends

Graphite Electrodes Segment to Dominate the Market

Needle coke is a primary raw material for graphite electrodes in electric furnaces. It is a premium-grade, high-value petroleum coke used to manufacture graphite electrodes with a very low coefficient of thermal expansion (CTE).

Owing to the wide application of graphite electrodes in electric arc furnaces, which are used in steel and other metal industries, the application of needle coke for graphite electrodes accounts for the largest application of needle coke.

Graphite has high thermal conductivity and is resistant to heat and any impact. Also, it has low electrical resistance, which is needed to conduct large electrical currents necessary to melt iron. Thus, it can sustain extremely high heat levels generated by EAF (electric arc furnace). Making the electrodes requires processing coke, including baking and rebaking, to convert it into graphite, which can take up to six months.

Graphite electrodes are divided into four types: RP graphite electrodes, HP graphite electrodes, SHP graphite electrodes, and UHP graphite electrodes.

Graphite electrodes are primarily used to manufacture electric arc furnace steel, alloy steel, various alloys, and nonmetals. These electrodes can generate high levels of heat and are also used in refining steel and similar smelting processes. They can melt iron scrap in an electric arc furnace at about 1,600°C.

According to data from Sanergy Group Limited, the production volume of graphite electrodes worldwide was 8785 thousand metric tons in 2023 and is projected to reach 795.4 thousand metric tons in 2024.

In December 2023, Graphite India Limited (GIL) invested INR 50 crore (approximately USD 6 million) in compulsorily convertible preference shares of Godi India Private Ltd. This investment provides GIL with a 31% equity shareholding in Godi India. Godi India is engaged in advanced Research and development to support the production of sustainable batteries for electric vehicles (EVs) and supercapacitor-based energy storage systems. Godi India's environment-friendly and carbon-neutral processes include Aqueous Electrode ProcessingTM, Active Dry CoatingTM, and Pranic BinderTM. This investment aligns with GIL's strategy to diversify into advanced battery and energy storage technologies.

In November 2023, HEG Limited successfully expanded its graphite electrode capacity in Madhya Pradesh, India, from 80 kilotons per annum to 100 kilotons per annum. The company made a substantial investment of INR 1,200 crore (USD 143.741 million) for this capacity expansion. As a result, HEG is the third-largest graphite electrode company in the Western world.

The factors mentioned above are expected to affect the demand for needle coke for graphite electrode application during the forecast period.

Asia-Pacific to Dominate the Market

Asia-Pacific is expected to dominate the needle coke market, as it includes countries such as China (the biggest producer and consumer of needle coke) and Japan.

China holds the largest share of graphite electrode consumption and production capacity in the global scenario. There are over 40 official graphite electrode manufacturers in China. The Chinese market's demand for graphite electrodes and further diversification into lithium-ion battery anodes, fueled by the EV industry's growth, are both driving a comeback in the demand for needle coke. For the foreseeable future, this demand is expected to continue to increase steadily, with corresponding pricing support.

In addition to this, the Chinese government is also focusing on developing eco-friendly means of producing steel. Hence, Chinese authorities are actively promoting Electric Arc Furnace (EAF) technology as a means to curb carbon emissions and foster sustainability in the steel industry. EAF technology relies primarily on steel scrap as its raw material, with electricity used to melt it. Driven by supportive national policies, the adoption of EAF technology is poised to become a prevailing trend in China, consequently bolstering the demand for graphite electrodes.

Japan is one of the leading producers and exporters of petroleum, coal, and tar-based pitch needle coke. Japanese companies are one of the largest producers of graphite electrodes in the world. The market giants of graphite electrodes include Showa Denko, Nippon Carbon, SEC Carbon, and Tokai Carbon.

The Indian steel industry is actively working to reduce carbon emissions through intensified efforts to decarbonize. As part of this push, there is a rising trend in adopting electric arc furnace (EAF) technology for steel production. EAFs rely on electricity and steel scrap, making them a more sustainable choice than traditional methods.

With the growing adoption of EAFs, there is a significant expected surge in demand for graphite electrodes. The Indian government's move to eliminate customs duty on scrap imports directly benefits EAF steel manufacturers. Coupled with favorable national policies, these further fuel the shift toward EAFs and drive the demand for graphite electrodes.

JFE Steel, Japan's second-largest steelmaker, announced in November 2023 its plans to construct a large-scale electric arc furnace (EAF). The EAF is slated to replace an existing blast furnace at its Kurashiki plant by around 2027. This strategic move underscored the company's commitment to curbing carbon emissions, which is in line with global climate change initiatives. The new EAF will primarily cater to automotive and other sectors, with an anticipated annual emissions reduction of 2.6 million tons.

Graphite electrodes play an important role in the electric arc furnace (EAF) process, a key method for steel production. The steel sector in South Korea is significant, driving the nation's economic growth by catering to industries like automotive, construction, and shipbuilding. The steel industry accounts for 1.5% of the nation's GDP and 4.9% of its manufacturing sector, as reported by the Korean Iron & Steel Association. Notably, South Korea ranks as the sixth-largest steel producer globally.

Hence, Asia-Pacific is likely to dominate the global needle-coke market based on the aspects mentioned above.

Needle Coke Industry Overview

The needle coke market is partially consolidated. Some of the major players in the market (not in any particular order) include Phillips 66 Company, China National Petroleum Corporation (CNPC), Shandong Yida Rongtong Trading Co., Shandong Jing Yang Technology Co. Ltd, and Mitsubishi Chemical Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Investments in EAF Steel Manufacturing

- 4.1.2 Government Policies to Increase Scrap Steel Consumption

- 4.2 Restraints

- 4.2.1 Health Hazards Associated with Petroleum Coke

- 4.3 Industry Value-Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Overview

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Petroleum Based

- 5.1.2 Coal-tar Pitch Based

- 5.2 Application

- 5.2.1 Graphite Electrodes

- 5.2.2 Lithium-ion Batteries

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Baosteel Group

- 6.4.2 China National Petroleum Corporation (CNPC)

- 6.4.3 China Petroleum & Chemical Corporation (Sinopec)

- 6.4.4 Indian Oil Corporation

- 6.4.5 Liaoning Baolai Bioenergy Co., Ltd.

- 6.4.6 Mitsubishi Chemical Corporation

- 6.4.7 Nippon Steel Corporation

- 6.4.8 Phillips 66

- 6.4.9 Posco Mc Materials

- 6.4.10 Seadrift Coke LP (Graftech International)

- 6.4.11 Shandong Dongyang Technology Co. Ltd

- 6.4.12 Shandong Yida New Materials Co. Ltd

- 6.4.13 Shanxi Hongte Coal Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Lithium-ion Batteries to Boost the Demand for Needle Coke