|

市场调查报告书

商品编码

1687370

三防胶:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Conformal Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

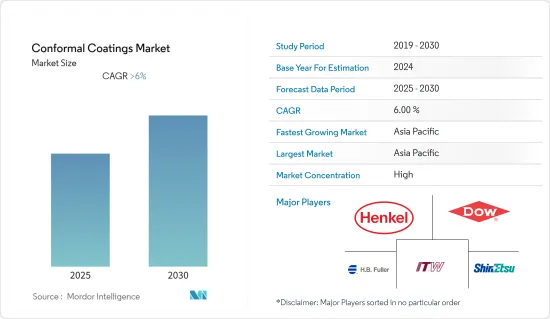

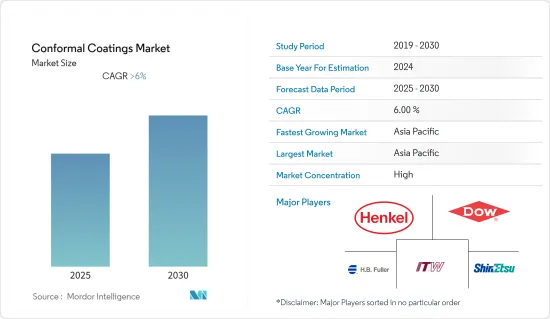

预计预测期内三防胶市场复合年增长率将超过 6%。

由于供应链中断和製造工厂关闭,COVID-19 疫情对 2021 年的市场产生了负面影响。新冠肺炎疫情大流行在短期内阻碍了航太业的发展,导致全球航空业受到限制。不过,预计 2022 年市场成长率将保持稳定。

主要亮点

- 短期内,市场受到需要三防胶的高端应用的需求不断增长的推动。

- 另一方面,三防胶损坏时昂贵的更换或维修阻碍了市场的成长。

- 亚太地区日益增长的医疗应用预计将为市场提供机会。

- 亚太地区在全球整体市场占据主导地位,其中中国和印度等国家消费量最高。

三防胶市场趋势

消费性电子产业占市场主导地位

- 三防胶的最大消费者是消费性电子产品。消费性电子产品包括娱乐、通讯和家用电器等广泛的电子设备。

- 半导体、印刷电路板、电晶体、电阻器、电容器、电感器、二极体、连接器等电子元件和其他关键元件用于製造可用电子设备。

- 根据JEITA(日本电子情报技术产业协会)预测,2021年全球电子及IT产业产值将达3.3602兆美元,与前一年同期比较成长11%。远距远程办公和在家工作的普及促进了电子设备的销售。随着数位化投资的增加促进了更先进的资料使用,解决方案和服务也在成长。预计电子业对聚碳酸酯的需求将会增加。

- 由于印度和中国等国家的需求旺盛,亚太地区的电子产业近年来迅速发展。由于人事费用低廉且政策灵活,中国对电子製造商来说是一个利润丰厚的市场。

- 由于上述所有因素,三防胶市场预计将在预测期内成长。

亚太地区占市场主导地位

- 预计预测期内亚太地区将主导三防胶市场。中国、印度和日本等国家对应用的高需求增加了所研究市场的需求。

- 中国是全球最大的电子产品製造基地,为韩国、新加坡和台湾等现有的上游製造商带来了激烈的竞争。智慧型手机、OLED 电视和平板电脑等电子产品在市场消费性电子领域的需求成长最快。

- 从以金额为准,全球超过 50% 的印刷电路板 (PCB) 是在中国製造的(见图)。此外,该国以低成本生产电路基板而闻名。

- 此外,中国航空公司计划在未来20年购买约7,690架新飞机,价值约1.2兆美元。

- 在印度,电子产品市场的需求不断成长,市场规模正在快速成长。 2020-21年印度电子产品出口额将达111.1亿美元。印度和中国电子和家用电器市场的成长可能会进一步推动亚太地区的市场成长。

- 因此,预计所有上述因素都将在预测期内增加该地区对三防胶的需求。

三防胶产业概况

从收益方面来看,全球三防胶市场部分合併。主要参与者包括陶氏、H.B.富勒公司 (Fuller Company)、汉高公司 (Henkel AG & Co. KGaA)、ITW 和工业)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 高阶应用对三防胶的需求不断增加

- 汽车业对三防胶的需求庞大

- 限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 材料类型

- 丙烯酸纤维

- 环氧树脂

- 胺甲酸乙酯

- 硅胶

- 其他类型(聚对二甲苯涂层、奈米涂层)

- 最终用户产业

- 车

- 航太和国防

- 医疗

- 消费性电子产品

- 其他终端用户产业(工业、电力和能源)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率分析**/排名分析

- 主要企业策略

- 公司简介

- Altana

- Chase Corp.

- CHT Ltd

- Dow

- Dymax

- HK Wentworth Ltd

- HB Fuller Company

- Henkel AG & Co. KGaA

- ITW

- Kisco Ltd

- MG Chemicals

- Panacol-Elosol GmbH

- Shin-Etsu Chemical Co. Ltd

- Momentive

第七章 市场机会与未来趋势

- 感测器和显示器的需求不断增加

The Conformal Coatings Market is expected to register a CAGR of greater than 6% during the forecast period.

COVID-19 pandemic has negatively affected the market in 2021 due to the disruptions in the supply chain and the closure of manufacturing facilities. The aerospace industry was hampered in the short term due to the COVID-19 pandemic since air travel was restricted around the world. However, the market excepted to retain its growth rate in 2022.

Key Highlights

- In the short term, the major factor driving the market studied is the increasing demand for high-end applications requiring conformal coating.

- On the flip side, expensive replacement and repair of conformal coatings in case of damage are hindering the growth of the market.

- Rising medical applications in Asia-Pacific are expected to act like an opportunity for the market.

- Asia-Pacific dominated the market across the globe with the largest consumption in a country such as China, India, etc.

Conformal Coatings Market Trends

Consumer Electronics Segment to Dominate the Market

- Consumer Electronics is the largest consumer of conformal coatings. Consumer electronics include various electronic devices from entertainment, and communication, to home appliances.

- The electronic components such as semiconductors, PCBs, transistors, resistors, capacitors, inductors, diodes, connectors, and other critical components are used in order to produce a proper usable electronic device.

- According to JEITA ( Japan Electronics and Information Technology Industries Association), the total global production by the electronics and IT industries registered a rise of 11% year on year in 2021 to reach USD 3,360.2 billion. The spread of telework and stay-at-home demand drove up electronic equipment. Solution services grew as more investment in digitalization promoted more sophisticated data use. It is excepted to increase the demand for polycarbonates used in the electronics segment.

- The Asia-Pacific electronic industry grew rapidly in the recent past owing to the high demand from countries like India and China. China is a strong, favorable market for electronics producers, owing to the country's low labor cost and flexible policies.

- Owing to all the aforementioned factors, the market for conformal coatings is projected to grow during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the market for conformal coatings during the forecast period. Due to the high demand for applications from countries like China, India, and Japan, the demand for the market studied has been increasing.

- China is the world's largest electronics production base and offers tough competition to existing upstream producers, such as South Korea, Singapore, and Taiwan. Electronic products, such as smartphones, OLED TVs, and tablets, among others, have the highest growth rates in the consumer electronics segment of the market in terms of demand.

- In terms of value, over 50% of global printed circuits (PCBs) are manufactured in China (as given in the graph), owing to incentives offered by the government to PCB factories. Moreover, the country is well-known for producing circuit boards at low costs.

- Moreover, Chinese airline companies are planning to purchase about 7,690 new aircraft, over the next 20 years, which were valued at approximately USD 1.2 trillion, which is further expected to boost the market demand for conformal coatings in electronic components in aerospace applications.

- In India, the electronics market witnessed a growth in demand, with market size increasing at a rapid growth rate. India's electronic goods exports fetched USD 11.11 billion in 2020-21. The growing electronics and appliances market in India and China may push the market growth further in Asia-Pacific.

- Thus, all the aforementioned factors, in turn, are projected to increase the demand for conformal coatings in the region during the forecast period.

Conformal Coatings Industry Overview

The global conformal coatings market is partially consolidated in terms of revenue. Some of the major players include Dow, H.B. Fuller Company, Henkel AG & Co. KGaA, ITW, and Shin-Etsu Chemical Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from High-end Applications requiring Conformal Coating

- 4.1.2 Large-scale demand for conformal coating from the automotive industry

- 4.2 Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Material Type

- 5.1.1 Acrylic

- 5.1.2 Epoxy

- 5.1.3 Urethane

- 5.1.4 Silicone

- 5.1.5 Other Types (Parylene coatings, Nanocoatings)

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Medical

- 5.2.4 Consumer Electronics

- 5.2.5 Other End-user Industries (Industrial, Power and Energy)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Altana

- 6.4.2 Chase Corp.

- 6.4.3 CHT Ltd

- 6.4.4 Dow

- 6.4.5 Dymax

- 6.4.6 HK Wentworth Ltd

- 6.4.7 H.B. Fuller Company

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 ITW

- 6.4.10 Kisco Ltd

- 6.4.11 MG Chemicals

- 6.4.12 Panacol-Elosol GmbH

- 6.4.13 Shin-Etsu Chemical Co. Ltd

- 6.4.14 Momentive

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from Sensors and Displays