|

市场调查报告书

商品编码

1687371

粉末冶金:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Powder Metallurgy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

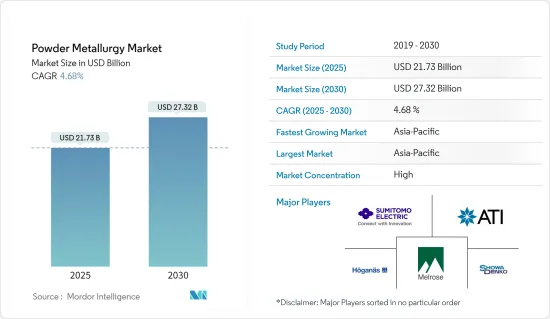

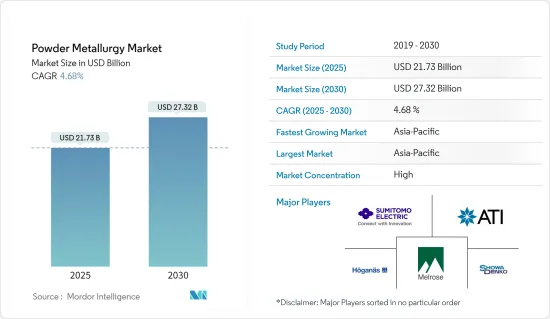

预计 2025 年粉末冶金市场规模为 217.3 亿美元,到 2030 年将达到 273.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.68%。

2020年,新冠疫情对市场产生了负面影响。不过,目前估计市场已达到疫情前的水平,并预计将继续稳定成长。

主要亮点

- 粉末冶金越来越多地被汽车OEM所采用,这是推动市场的主要因素之一。此外,电气和电磁应用的日益普及也有望推动市场成长。

- 另一方面,原材料和工具成本的上升可能会减缓市场成长。

- 粉末冶金在医疗领域的应用日益广泛以及航太和国防部门的快速成长预计将为市场创造机会。

- 粉末冶金市场由亚太地区主导,预计未来几年将出现最高的成长率。

粉末冶金市场趋势

汽车应用主导市场

- 粉末冶金零件可以具有自由控制的孔隙率,并可具有自身的润滑性,从而可以过滤气体和液体。这使得粉末冶金成为製造具有复杂弯曲、凹坑和突起的零件的绝佳方法。

- 这种灵活性可以开发具有多种成分的机械零件,包括金属和非金属以及金属和金属组合,从而可以生产具有高尺寸精度的汽车零件,确保一致的性能和尺寸,并且很少产生废料或材料浪费。

- 轴承和齿轮是采用粉末冶金工艺製造的最常见的汽车零件。该製程也用于许多汽车零件,包括底盘、转向、排气、变速箱、避震器组件、引擎、电池、座椅、空气滤清器和煞车盘。

- 汽车零件由多种金属製成,包括黑色金属(铁、钢、钢合金、不銹钢)和有色金属(铜、青铜、铝合金、钛合金)。粉末冶金的重点是改善净形、利用热处理、应用特殊表面处理和提高精度。

- 根据欧洲汽车工业协会(ACEA)的报告,2022年前三个季度全球乘用车产量约5,000万辆,较2021年同期成长近9%。

- 此外,根据中国汽车工业协会的数据,从2021年12月到2022年12月,全国生产的新能源汽车数量增加了96.9%。因此,预计预测期内电动车市场的扩张将增加市场需求。

- 由于这些因素,汽车领域对粉末冶金的需求正在增加。

亚太地区占市场主导地位

- 随着经济成长和人们的消费能力增强,亚太地区已成为最重要的粉末冶金市场之一,也是製造商的主要投资目的地。

- 近年来,中国、印度和日本等国家良好的经济趋势推动了对粉末冶金产品和应用的需求。

- 根据中国工业协会统计,中国是全球最大的汽车生产基地。预计2022年中国汽车产量将达2,700万辆,比2017年的2,600万辆成长3.4%。

- 此外,2022年前七个月,全国汽车产量为1,457万辆,与前一年同期比较去年同期成长31.5%。

- 此外,根据印度汽车工业协会(SIAM)的数据,预计2021-22 年(2021 年 4 月至 2022 年 3 月)印度汽车业将生产 22,933,230 辆汽车,而 2020-21 年(2020 年 4 月至 2020 年 365 月)生产 25,65 月)生产 25,65 月)生产 25,65 月)生产 25,65 月)。

- 此外,该地区的航太航天业也正在显着发展。例如,波音公司《2022-2041年商用飞机展望》预计,到2041年,波音将向中国交付8,485架新飞机,市场服务价值将达到5,450亿美元。

- 因此,由于上述因素,亚太地区很可能在预测期内占据市场主导地位。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 汽车OEM对粉末冶金的偏好日益增加

- 扩大在电气和电磁应用的使用

- 限制因素

- 原料和工具成本上涨

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 产品类型

- 铁

- 有色金属

- 应用

- 车

- 工业机械

- 电气和电子

- 航太

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- ATI

- Catalus Corporation

- fine-sinter Co., Ltd.

- HC Starck Tungsten GmbH

- Showa Denko Materials Co., Ltd.

- Hoganas AB

- Horizon Technology

- Melrose Industries PLC

- Miba AG

- Perry Tool & Research, Inc.

- Phoenix Sintered Metals, LLC

- Precision Sintered Parts

- Sandvik AB

- Sumitomo Electric Industries, Ltd.

第七章 市场机会与未来趋势

- 粉末冶金在医疗领域的应用日益广泛

- 航太和国防领域的快速成长

The Powder Metallurgy Market size is estimated at USD 21.73 billion in 2025, and is expected to reach USD 27.32 billion by 2030, at a CAGR of 4.68% during the forecast period (2025-2030).

In 2020, COVID-19 negatively impacted the market. However, the market has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the future.

Key Highlights

- Powder metallurgy is being used more and more by automotive OEMs, which is one of the main things driving the market. Moreover, the growing implementation of electrical and electromagnetic applications is also expected to provide market growth.

- On the other hand, rising costs of raw materials and tools are likely to slow the market's growth.

- The increasing adoption of powder metallurgy in the medical field along with the rapid growth in the aerospace and defense sector is expected to provide opportunities to the market.

- The Asia-Pacific region led the market for powder metallurgy, and it is expected to have the highest growth rate over the next few years.

Powder Metallurgy Market Trends

Automotive Applications to Dominate the Market

- Powder metal parts have great control over how porous they are and can lubricate themselves, which lets them filter gases and liquids.Because of this, powder metallurgy is a very good way to make parts that have complicated bends, depressions, and projections.

- This flexibility to develop mechanical parts with diverse compositions, such as metal-nonmetal and metal-metal combinations, enables the production of automotive parts with high dimensional accuracy and ensures consistent properties and dimensions with very little scrap and material waste.

- Bearings and gears are the most common vehicle parts made through the powder metallurgy process. The process is also used for a large number of parts in a vehicle, including the chassis, steering, exhaust, transmission, shock absorber parts, engine, battery, seats, air cleaners, brake discs, etc.

- Auto parts are made from a wide range of metals, such as ferrous (iron, steel, alloy steel, and stainless steel) and non-ferrous (copper, bronze, aluminum alloys, and titanium alloys).The focus of powder metallurgy is to improve the net shape, utilize heat treatment, provide special surface treatment, and improve precision.

- In the first three quarters of 2022, around 50 million passenger cars were manufactured worldwide, up nearly 9% compared to the same quarter in 2021, as per the report of the European Automobile Manufacturers' Association (ACEA).

- Also, the China Association of Automobile Manufacturing says that the number of New Energy Vehicles made in the country rose by 96.9% from December 2021 to December 2022.Thus, the expanding electric vehicle market is expected to increase market demand during the forecast period.

- Due to such factors, the demand for powder metallurgy in the automotive sector is increasing.

Asia-Pacific to Dominate the Market

- Asia-Pacific has become one of the most important powder metallurgy markets and a top destination for manufacturers because its economy is growing and people have more money to spend.

- The positive economic growth trends in countries such as China, India, and Japan have boosted the demand for powder metallurgy products and applications in recent years.

- China has the largest automotive production base in the world, according to the China Association of Automobile Manufacturers (CAAM). In 2022, 27 million vehicles were expected to be made in China, which is 3.4% more than the 26 million vehicles made in 2017.

- Further, in the first 7 months of 2022, the country produced 14.57 million units of cars, registering a growth rate of 31.5% year over year.

- Also, the Society of Indian Automobile Manufacturers (SIAM) said that India's automotive industry will make 22,933,230 vehicles in FY 2021-22 (April 2021-March 2022), compared to 22,655,609 units in FY 2020-21 (April 2020-March 2020).

- Furthermore, the aerospace industry is also growing significantly in the region. For instance, the Boeing Commercial Outlook 2022-2041 predicts that by 2041, 8,485 new deliveries with a market service value of USD 545 billion will take place in China.thus boosting market growth.

- Hence, due to the aforementioned factors, Asia-Pacific is likely to dominate the market during the forecast period.

Powder Metallurgy Industry Overview

The powder metallurgy market is consolidated in nature. Some of the major players in the market (not in any particular order) include Melrose Industries PLC, Sumitomo Electric Industries, Ltd., Hoganas AB, ATI, and Showa Denko Materials Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Preference for Powder Metallurgy by Automotive OEMs

- 4.1.2 Growing Implementation in Electrical and Electromagnetic Applications

- 4.2 Restraints

- 4.2.1 Increasing Raw Material and Tooling Costs

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Ferrous

- 5.1.2 Non-ferrous

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Industrial Machinery

- 5.2.3 Electrical and Electronics

- 5.2.4 Aerospace

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ATI

- 6.4.2 Catalus Corporation

- 6.4.3 fine-sinter Co., Ltd.

- 6.4.4 H.C. Starck Tungsten GmbH

- 6.4.5 Showa Denko Materials Co., Ltd.

- 6.4.6 Hoganas AB

- 6.4.7 Horizon Technology

- 6.4.8 Melrose Industries PLC

- 6.4.9 Miba AG

- 6.4.10 Perry Tool & Research, Inc.

- 6.4.11 Phoenix Sintered Metals, LLC

- 6.4.12 Precision Sintered Parts

- 6.4.13 Sandvik AB

- 6.4.14 Sumitomo Electric Industries, Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Adoption of Powder Metallurgy Techniques in Medical Sector

- 7.2 Rapid Growth in Aerospace and Defense Sector