|

市场调查报告书

商品编码

1687372

物理气相淀积(PVD) 涂层:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Physical Vapor Deposition (PVD) Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

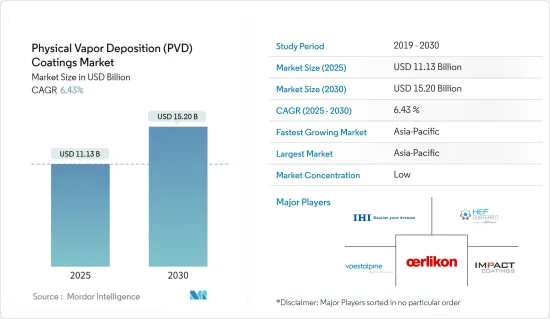

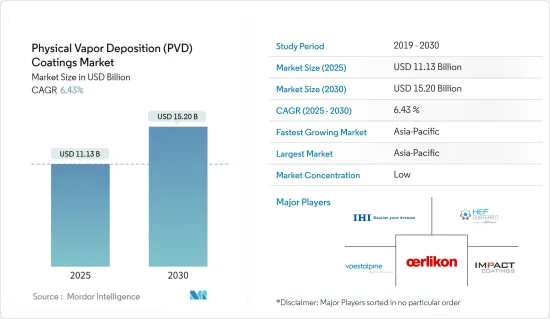

物理气相淀积涂料市场规模预计在 2025 年为 111.3 亿美元,预计到 2030 年将达到 152 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.43%。

由于世界各地政府采取的限制和封锁措施,COVID-19 疫情对市场产生了负面影响。疫情过后,全球製造业復苏对拉动市场需求发挥了关键作用。

主要亮点

- 推动市场发展的主要因素之一是电子和医疗行业日益增长的需求。

- 另一方面,各种替代品的出现预计会阻碍市场需求。

- 预计 PVD 涂层领域的研究和开发将在未来几年为市场提供积极的机会。

- 亚太地区占据市场主导地位,预计在预测期内将保持不变。

物理气相淀积(PVD) 涂层市场趋势

汽车产业可望主导市场

- PVD 涂层为汽车产业带来了许多好处。 PVD 涂层可减少引擎运动部件间的摩擦,提高整体效率。

- PVD 涂层汽车零件具有更高的表面硬度,从而增强了材料强度。在传统的内燃机和马达中,这些涂层可以显着降低重量和营业成本。

- 近年来,世界各地的汽车製造业不断成长。根据国际汽车工业组织(OICA)发布的资料,2023年汽车总产量约9,354万辆,较2022年产量增加10.3%。

- 2023年,北美汽车产量为1,616万辆,欧洲汽车产量为1,812万辆。

- 此外,由于各种环境因素,近年来电动车的生产数量有所增加。

- 根据国际能源总署(IEA)的数据,2023年电动车(EV)销量将达到近1,400万辆,其中中国、欧洲和美国将占其中的95%。今年,电动车将占汽车销量的 18% 左右,较 2022 年的 14% 大幅成长。这凸显了随着这些市场的不断发展和稳定,电动车产业正在稳步扩张。

- 2023年上半年,美国领先的电动车製造商通用汽车在国内生产了超过5万辆电动车。此外,该公司计划在2025年底建成一座年产能100万辆的电动车製造工厂。

- 由于全球对汽车的需求不断增加,预计汽车产业的 PVD 涂层将在预测期内产生正面影响。

按地区划分,亚太地区预计将占据市场主导地位。

- 由于中国、印度和日本等国家的消费量不断增加,亚太地区是 PVD 涂层消费的主要市场。

- 中国是最大的飞机製造国之一,也是最大的国内航空客运市场之一。此外,该国的飞机零件和组装製造业正在快速成长,超过 200 家小型飞机零件製造商对物理气相淀积(PVD) 涂层的使用和需求正在增加。

- 根据波音公司最新的《民用飞机展望》,到2042年中国将需要约8,560架新民航机。预计到2040年将总合8700架新飞机交付中国,市场服务价值将达到1.8兆美元。

- 此外,中国航空公司计划在未来20年内购买约7,690架新飞机,价值约1.2兆美元,预计将进一步推动PVD涂层的市场需求。 PVD涂层坚硬且摩擦力小,是航太工业理想的功能性金属涂层。

- 汽车产业也是物理气相淀积(PVD) 涂层的重要用户。根据OICA预测,2023年印度汽车产量将达585万辆左右,较2022年的545万辆成长7.2%。

- 此外,2023 年,马恆达有限公司 (Mahindra & Mahindra Ltd) 宣布核准根据马哈拉斯特拉邦政府的电动车产业促进计划,为电动车投资 1,000 亿印度卢比(1,198.96 亿美元)。该公司将透过其子公司投资七到八年的时间建立製造工厂,开发和生产马恆达的下一代电动车(BEV)。

- 日本的电气电子产业是世界领先的产业之一。日本在电脑、游戏机、行动电话和其他各种关键电脑零件的生产方面处于世界领先地位。家电占日本经济产出的三分之一。

- 根据日本电子情报技术产业协会(JEITA)发布的资料,2023年日本电子产业总产值将达到约35,266亿美元,与前一年同期比较成长近3%。

- 预计上述因素将增加亚太地区各应用产业对 PVD 涂层的需求。

物理气相淀积(PVD) 涂层产业概览

物理气相淀积(PVD) 涂层市场高度分散,国内外有许多 PVD 涂层材料製造商和服务供应商。市场的主要企业(不分先后顺序)包括 Voestalpine Eifeler Group、OC OerlikonManagement AG、IHI Corporation、Impact Coatings 和 HEF。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 电子业的需求

- 在医疗产业的应用日益广泛

- 其他的

- 限制因素

- PVD涂层的替代品

- 其他的

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 技术简介

- 热沉淀

- 溅镀沉淀

- 电弧沉淀

- 离子布植

第五章市场区隔

- 透过基板

- 金属

- 塑胶

- 玻璃

- 依材料类型

- 金属

- 陶瓷製品

- 其他的

- 按最终用户

- 工具

- 成分

- 航太与国防

- 车

- 电子和半导体(包括光学元件)

- 发电

- 其他(太阳能产品、医疗设备等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 土耳其

- 俄罗斯

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Crystallume PVD

- HEF

- IHI Corporation

- Impact Coatings AB

- Inoxcolorz Private Limited

- KOLZER SRL

- Mitsubishi Materials Corporation

- OC Oerlikon Management AG

- Red Spot Paint & Varnish Company Inc.

- Richter Precision Inc.

- Sputtek Advanced Metallurgical Coatings

- Surface Modification Technologies

- TOCALO Co. Ltd

- voestalpine eifeler Group

第七章 市场机会与未来趋势

- PVD涂层领域的持续研发

- 其他机会

The Physical Vapor Deposition Coatings Market size is estimated at USD 11.13 billion in 2025, and is expected to reach USD 15.20 billion by 2030, at a CAGR of 6.43% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the market due to the restrictions and lockdowns imposed by governments from various countries. The recovery of manufacturing industries across the world played a crucial role in increasing the demand for the market studied in the post-pandemic period.

Key Highlights

- One of the main factors driving the market is the growing demand from the electronics and medical industries.

- On the flip side, the availability of various alternatives is expected to hinder the demand for the market studied.

- Ongoing research and development in the field of PVD coatings are likely to act as an opportunity for the market studied in the coming years.

- Asia-Pacific has dominated the market and is expected to continue dominating it through the forecast period.

Physical Vapor Deposition (PVD) Coatings Market Trends

The Automotive Industry is Expected to Dominate the Market Studied

- PVD coatings have gained various advantages in the automotive industry. PVD coating reduces friction between moving parts in the engine, increasing its overall efficiency.

- Automotive parts with PVD coating improve the surface hardness and thus strengthen the material. In traditional combustion engines and electric motors, these coatings result in significant reductions in weight and operating costs.

- In recent times, there has been a rise in automotive manufacturing in countries across the globe. According to the data released by the International Organization of Motor Vehicle Manufacturers (OICA), the total number of vehicles manufactured in 2023 was around 93.54 million units, registering a 10.3% increase compared to the number of units manufactured in 2022.

- In 2023, 16.16 million vehicles were manufactured in North America, while 18.12 million vehicles were manufactured in Europe.

- In addition, there has been a rise in electric vehicle manufacturing in recent times owing to various environmental factors.

- According to the International Energy Agency (IEA), in 2023, the number of electric vehicles (EVs) sold reached close to 14 million, with China, Europe, and the United States making up 95% of these figures. EVs made up approximately 18% of the total car sales for the year, a significant increase from just 14% in 2022. This highlights that the expansion of the electric vehicle industry is steady as these markets continue to develop and stabilize.

- In the first six months of 2023, General Motors, a major manufacturer of electric vehicles in the United States, produced more than 50,000 electric vehicles in the country. Additionally, the company is planning to build a factory for EV manufacturing with a capacity of 1 million vehicles per year by the end of 2025.

- With the demand for automobiles increasing across the world, PVD coatings in the automotive industry are expected to have a positive impact during the forecast period.

Asia-Pacific is Expected to Dominate the Market by Region

- Asia-Pacific was found to be the major market for the consumption of PVD coatings, owing to increasing consumption from countries such as China, India, and Japan.

- China is one of the largest aircraft manufacturers and one of the largest markets for domestic air passengers. Moreover, the country's aircraft parts and assembly manufacturing sector has been growing rapidly, with over 200 small aircraft parts manufacturers increasing the usage and demand of physical vapor deposition (PVD) coatings.

- According to the latest Boeing Commercial Outlook, China requires around 8,560 new commercial airplanes through 2042. A total of 8,700 new deliveries in China are expected to be made by 2040, with a market service value of USD 1,800 billion.

- In addition, Chinese airline companies are planning to purchase about 7,690 new aircraft in the next 20 years, valued at approximately USD 1.2 trillion, which is further expected to raise the market demand for PVD coatings. PVD coatings are hard and have minimal friction, making them an ideal functional metal coating in the aerospace industry.

- The automotive industry is another significant user of physical vapor deposition (PVD) coating. According to OICA, around 5.85 million vehicles were manufactured in India in 2023, compared to 5.45 million vehicles in 2022, an increase of 7.2%.

- In addition, in 2023, Mahindra & Mahindra Ltd announced an investment of INR 10,000 crore (USD 1,198,96 million) for electric vehicles that have been approved under the Maharashtra government's industrial promotion scheme for electric vehicles. Through its subsidiary, the company will invest over 7-8 years to establish the manufacturing facility and develop and produce Mahindra's upcoming Born electric vehicles (BEVs).

- Japan's electrical and electronics industry is one of the leading global industries. The country is a world leader in terms of the production of computers, gaming stations, cell phones, and various other key computer components. Consumer electronics account for one-third of the Japanese economic output.

- According to the data released by the Japanese Electronics and Information Technology Industries Association (JEITA), in 2023, the total production value of the electronics industry in Japan accounted for around USD 3,526.6 billion, showcasing a rise of nearly 3% from the previous year.

- The factors mentioned above are likely to increase the demand for PVD coatings across the application industries in Asia-Pacific.

Physical Vapor Deposition (PVD) Coatings Industry Overview

The physical vapor deposition (PVD) coatings market is fragmented with the extensive availability of international and local PVD coating material manufacturers and service providers. Some of the market's major players (not in any particular order) include the Voestalpine Eifeler Group, OC OerlikonManagement AG, IHI Corporation, Impact Coatings, and HEF.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Demand from the Electronics Sector

- 4.1.2 Increasing Usage in Medical Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Alternatives to PVD Coatings

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

- 4.5.1 Thermal Evaporation

- 4.5.2 Sputter Deposition

- 4.5.3 Arc Vapor Deposition

- 4.5.4 Ion Implantation

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Substrate

- 5.1.1 Metals

- 5.1.2 Plastics

- 5.1.3 Glass

- 5.2 Material Type

- 5.2.1 Metals (Includes Alloys)

- 5.2.2 Ceramics

- 5.2.3 Other Material Types

- 5.3 End User

- 5.3.1 Tools

- 5.3.2 Components

- 5.3.2.1 Aerospace and Defense

- 5.3.2.2 Automotive

- 5.3.2.3 Electronics and Semiconductors (Including Optics)

- 5.3.2.4 Power Generation

- 5.3.2.5 Other Components (Solar Products, Medical Equipment, and Others)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Turkey

- 5.4.3.7 Russia

- 5.4.3.8 NORDIC Countries

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Nigeria

- 5.4.5.3 Qatar

- 5.4.5.4 Egypt

- 5.4.5.5 United Arab Emirates

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Crystallume PVD

- 6.4.2 HEF

- 6.4.3 IHI Corporation

- 6.4.4 Impact Coatings AB

- 6.4.5 Inoxcolorz Private Limited

- 6.4.6 KOLZER SRL

- 6.4.7 Mitsubishi Materials Corporation

- 6.4.8 OC Oerlikon Management AG

- 6.4.9 Red Spot Paint & Varnish Company Inc.

- 6.4.10 Richter Precision Inc.

- 6.4.11 Sputtek Advanced Metallurgical Coatings

- 6.4.12 Surface Modification Technologies

- 6.4.13 TOCALO Co. Ltd

- 6.4.14 voestalpine eifeler Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Research and Development (R&D) in the Field of PVD Coatings

- 7.2 Other Opportunities