|

市场调查报告书

商品编码

1687374

二硫化钼 (MoS2):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Molybdenum Disulfide (MoS2) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

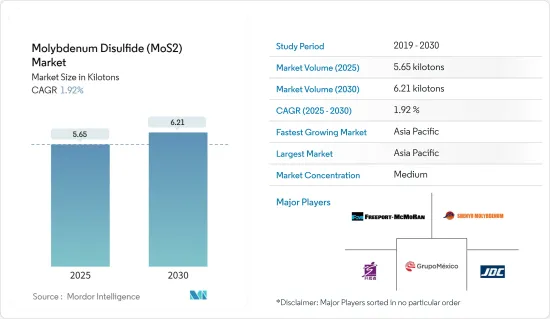

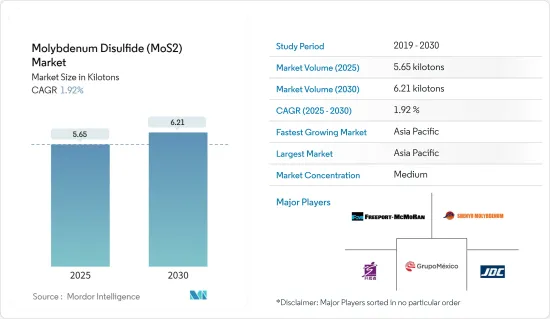

二硫化钼(MoS2)市场规模预计在 2025 年达到 5.65 千吨,在 2030 年达到 6.21 千吨,预测期(2025-2030 年)的复合年增长率为 1.92%。

主要亮点

- 新冠肺炎疫情为该地区各国带来了重大影响,导致数百万人被困在家中,企业、生产和製造设施关闭,经济活动停滞不前。然而,市场在 2022 年仍保持了成长轨迹。

- 短期内,润滑剂在各终端产业的应用日益广泛是推动市场发展的主要因素。此外,汽车产业对硫化钼的需求不断增加预计将推动市场成长。

- 然而,预计更好的替代品的出现将阻碍市场的成长。

- 然而,电动车市场的成长预计将在未来提供机会。

- 亚太地区占据全球市场主导地位,其中中国、印度等国家占据最大的消费量,预计未来这一趋势仍将持续下去。

二硫化钼(MoS2)市场趋势

汽车领域占据市场主导地位

- 二硫化钼作为润滑剂添加剂和干润滑剂被覆剂有多种用途。二硫化钼润滑脂和润滑剂用于各种应用,包括轴承、底盘润滑点和链条驱动器。

- 二硫化钼主要用于汽车工业,作为各种零件的润滑脂中的润滑剂,包括球窝接头、踏板轴、车轮轴承、转向连桿和润滑控制臂。

- 根据国际汽车工业组织(OICA)预测,全球汽车产量将从2021年的约8,000万辆增加到2022年的8,500万辆以上,成长率为6%。

- OICA 表示,在北美,2022 年的汽车产量将达到 1,480 万辆,较 2021 年的 1,340 万辆产量增加 9.88%。

- 在欧洲,德国是主要的汽车製造国之一。德国汽车製造业是欧洲地区整体汽车产量的主要股东。该国是主要汽车製造品牌的所在地,例如大众、梅赛德斯-奔驰、奥迪、宝马和保时捷。

- 此外,电动车产量的增加可能会推动电动车领域的市场需求。例如,根据 EV Volumes 的数据,预计 2022 年全球电动车 (EV) 销量将达到 1,052 万辆,与 2021 年相比成长率为 55%。

- 因此,由于全球汽车工业的不断发展,预测期内二硫化钼的使用量预计也将增加。

亚太地区占市场主导地位

- 亚太地区拥有多种製造活动,包括航太和国防、汽车製造、电气和电子以及建筑。这使得二硫化钼的消费量大量增加,拉动了市场需求。

- 在亚太地区,中国、东南亚和南亚的航太市场预计将以显着的速度成长,这将进一步支持研究市场的需求。在中国,根据波音《2022-2041年民用飞机展望》,到2041年将交付约8,485架新飞机,市场服务价值将达5,450亿美元。

- 此外,根据印度民航机基金会 (IBEF) 的数据,预计到 2036 年印度的航空旅客人数将达到 4.8 亿,超过日本(略低于 2.25 亿)和德国(略高于 2 亿)的总合,这将要求该国到 2038 年增加约 2,380 架新的股权飞机。

- 而中国已成为各类汽车产销最大、最占优势的国家。根据中国工业协会预测,2022年汽车产量预计将达到2,702万辆,较2021年的2,608万辆成长约3.4%。

- 过去几年,印度一直致力于电动车领域。根据 CEEW 能源融资中心的报告,到 2030 年,电动车将为印度带来 2,060 亿美元的商机,其中汽车製造和充电基础设施需投资 1,800 亿美元。

- 此外,预计到2025年,印度的电子产品市场规模将达到4,000亿美元。此外,根据印度品牌股权基金会(IBEF)的数据,预计到2025年,印度将成为全球第五大家电和电子产业。

- 因此,由于亚太地区各国终端用户产业的快速成长,预计该地区将在预测期内主导全球市场。

二硫化钼(MoS2)产业概览

二硫化钼市场较为分散,存在大量大型参与者。二硫化钼 (MoS2) 市场的主要企业包括(不分先后顺序)Freeport-McMoRan、金堆城钼业、洛阳神宇钼业、嵩县拓荒钼业有限公司和墨西哥集团。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 扩大润滑剂在各终端产业的使用

- 汽车产业需求增加

- 扩大在 LED、雷射和其他电子应用领域的使用

- 限制因素

- 有更好的替代品

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 类型

- 二硫化钼(MoS2)粉末

- 二硫化钼(MoS2)结晶

- 应用

- 润滑剂和涂料

- 半导体

- 催化剂

- 其他用途

- 最终用户产业

- 车

- 航太和国防

- 电气和电子

- 建造

- 化工和石化

- 其他终端用户产业(重型机械和溶剂)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Advanced Engineering Materials Limited

- American Elements

- Freeport-McMoRan

- Grupo Mexico

- Jinduicheng Molybdenum Co. Ltd

- Luoyang Shenyu Molybdenum Co. Ltd

- Merck KGaA

- Moly metal LLP

- Rose Mill Co.

- Songxian Exploiter Molybdenum Co.

- Tribotecc

第七章 市场机会与未来趋势

- 电动车市场正在成长

- 其他机会

The Molybdenum Disulfide Market size is estimated at 5.65 kilotons in 2025, and is expected to reach 6.21 kilotons by 2030, at a CAGR of 1.92% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic majorly affected countries across the regions, resulting in severe lockdowns, confining millions of people in their homes, and shutting down businesses, production, and manufacturing facilities resulting in no economic activity. However, the market retained its growth trajectory in 2022.

- Over the short term, the major factor driving the market studied is the growing application of lubricants in various end-use industries. Moreover, increasing demand for molybdenum sulfide from the automotive industry is expected to fuel the growth of the market.

- On the flip side, the availability of better alternatives is expected to hinder the growth of the market.

- Nevertheless, the growth in the electric vehicles market is expected to act as an opportunity in the future.

- The Asia-Pacific region dominated the global market and is expected to continue doing so, with countries such as China and India accounting for the largest consumption.

Molybdenum Disulfide (MoS2) Market Trends

Automotive Segment to Dominate the Market

- Molybdenum disulfide is used as a lubricant additive or as a dry lubricant coating for various applications. Molybdenum disulfide greases and lubricants are used for various applications such as bearings, chassis lubrication points, chain drivers, and many other applications.

- Molybdenum disulfide is primarily used in the automotive industry in the form of greases for the lubrication of various parts, including ball joints, pedal shafts, wheel bearing and steering linkages, and lubrication control arms.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), global automotive vehicle production increased to more than 85 million units in 2022 from approximately 80 million units in 2021 at a growth rate of 6%.

- In North America, according to the OICA, automotive production in 2022 accounted for 14.8 million units, an increase of 9.88% compared to the production in 2021, which was reported to be 13.4 million units.

- In Europe, Germany is among the key manufacturer of vehicles. The automobile manufacturing industry in Germany is a prominent shareholder of the overall automotive production in the European region. The country hosts major car-making brands, including Volkswagen, Mercedes-Benz, Audi, BMW, Porsche, etc.

- Furthermore, the rising production of electric vehicles is likely to enhance the market demand from the electric vehicle segment. For instance, according to the EV Volumes, global electric vehicle (EVs) sales reached 10.52 million units in 2022, registering a growth rate of 55 % compared to 2021.

- Hence, owing to the increasing automotive industry across the world, the utilization of molybdenum disulfide is also expected to increase during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is a hub for various manufacturing activities, including aerospace and defense, automotive manufacturing, electrical and electronics, construction, and many others. This includes a huge consumption of molybdenum disulfide for these activities and thus boosting the demand of the market studied.

- In the Asia-Pacific region, China, Southeast Asia, and South Asia aerospace market are expected to rise at a significant rate, which will further support the demand for the studied market. In China, according to the Boeing Commercial Outlook 2022-2041, around 8,485 new fleet deliveries will be made by 2041 with a market service value of USD 545 billion.

- Moreover, India is projected to have 480 million flyers, which will be more than that of Japan (just under 225 million) and Germany (just over 200 million) combined by 2036, and for that to happen, India will need approximately 2,380 new commercial airplanes by 2038, as stated by Indian Brand Equity Foundation (IBEF).

- Additionally, China has been the largest and most dominant nation in terms of vehicle production and sales of all types. In 2022, automotive production in the country reached 27.02 million units, which increased by approximately 3.4%, compared to 26.08 million vehicles produced in 2021, as stated by the China Association of Automobile Manufacturers.

- For a few years, India has been working in the country's electric vehicle sector. According to a CEEW Centre for Energy Finance report, India has a USD 206 billion opportunity for electric vehicles by 2030, which will demand a USD 180 billion investment in vehicle manufacturing and charging infrastructure.

- Moreover, the Indian electronics market is expected to reach USD 400 billion by 2025. Additionally, India is expected to become the fifth-largest consumer electronics and appliances industry in the world by 2025, as stated by the India Brand Equity Foundation (IBEF).

- Hence, with the rapidly growing end-user industries in countries of the Asia-Pacific region, the region is expected to dominate the global market during the forecast period.

Molybdenum Disulfide (MoS2) Industry Overview

The molybdenum disulfide market is partially fragmented, with a considerable number of major players. Some of the major players in the molybdenum disulfide (MoS2) market include (not in any particular order) Freeport-McMoRan, Jinduicheng Molybdenum Co. Ltd, Luoyang Shenyu Molybdenum Co. Ltd, Songxian Exploiter Molybdenum Co., and Grupo Mexico among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Application of Lubricants in Various End-use Industries

- 4.1.2 Increasing Demand from Automotive Industries

- 4.1.3 Growing Utilization in LEDs, Lasers and other Electronic Industry Applications

- 4.2 Restraints

- 4.2.1 Availability of Better Alternatives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Molybdenum Disulfide (MoS2) Powder

- 5.1.2 Molybdenum Disulfide (MoS2) Crystals

- 5.2 Application

- 5.2.1 Lubricants and Coatings

- 5.2.2 Semiconductor

- 5.2.3 Catalysts

- 5.2.4 Other Applications

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defense

- 5.3.3 Electrical and Electronics

- 5.3.4 Construction

- 5.3.5 Chemical and Petrochemical

- 5.3.6 Other End-user Industries (Heavy Equipment and Solvents)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Advanced Engineering Materials Limited

- 6.4.2 American Elements

- 6.4.3 Freeport-McMoRan

- 6.4.4 Grupo Mexico

- 6.4.5 Jinduicheng Molybdenum Co. Ltd

- 6.4.6 Luoyang Shenyu Molybdenum Co. Ltd

- 6.4.7 Merck KGaA

- 6.4.8 Moly metal LLP

- 6.4.9 Rose Mill Co.

- 6.4.10 Songxian Exploiter Molybdenum Co.

- 6.4.11 Tribotecc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in the Electric Vehicles Market

- 7.2 Other Opportunities