|

市场调查报告书

商品编码

1687375

超高性能混凝土(UHPC):市场占有率分析、产业趋势与统计、成长预测(2025-2030)Ultra High Performance Concrete (UHPC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

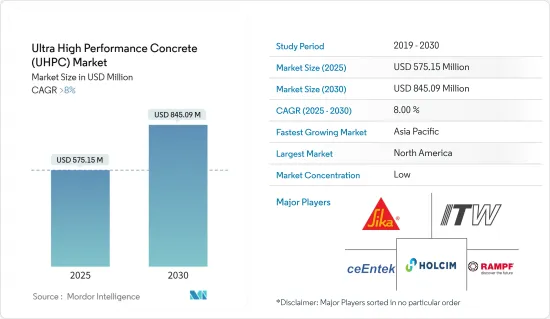

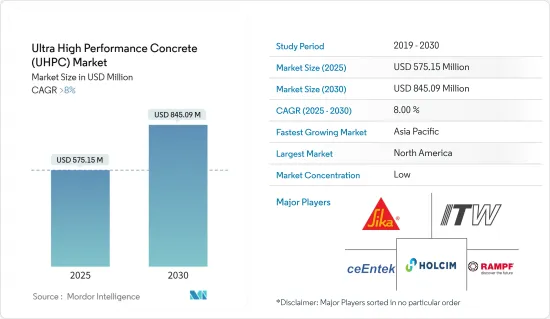

超高性能混凝土市场规模预计在 2025 年为 5.7515 亿美元,预计到 2030 年将达到 8.4509 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 8%。

新冠疫情对超高性能混凝土市场产生了负面影响。生产设施的关闭和短期停工对多种应用造成了重大损害,并限制了超高性能混凝土的消耗。儘管如此,由于主要终端用户类别的持续努力,市场仍将继续保持其发展势头,预计 2020 年及以后将取得适度进展。

推动市场发展的关键因素是全球建设活动的增加以及超高性能混凝土的益处日益增加。

与传统混凝土相比,UHPC 的材料成本较高,预计将严重阻碍市场成长。

预製建筑中使用超高性能混凝土的趋势日益增长,这可能是未来的驱动力。

预计预测期内北美将主导全球市场。然而,由于建设活动的增加,预计亚太地区在预测期内的复合年增长率最高。

超高性能混凝土(UHPC)市场趋势

浆体渗透纤维混凝土(SIFCON)席捲市场

- 泥浆浸渍纤维混凝土(SIFCON)是一种最近开发的建筑材料。 SIFCON 是一种特殊类型的纤维混凝土,纤维含量高。基质由水泥浆或流体水泥砂浆组成。

- 此复合材料用于承受爆炸载荷的结构、预力混凝土樑的修復、安全储存等。

- 总体而言,与普通纤维增强混凝土(FRC)相比,SIFCON 在两个方面有所不同:纤维含量和製造方法。一般FRC的纤维含量为体积1-3%,而SIFCON的纤维含量为5-20%。此外,与 FRC 中使用的普通混凝土不同,SIFCON 的基质由水泥浆或流体水泥砂浆组成。

- 从这些方面来看,SIFCON的製造方法与FRC的製造方法有显着差异。在 FRC 中,纤维被添加到湿或干的混凝土混合物中,而 SIFCON 则是透过将水泥浆倒入模板中预先铺设的密集纤维床中来製备的。

- 最近,人们对在防爆外壳和安全柜中使用 SIFCON 的兴趣日益浓厚。 SIFCON具有高抗衝击性和高能量吸收性。

- 目前正在进行各种研究来观察 SIFCON 的其他特性,例如添加不同体积比的钢纤维的效果。这些研究将有助于未来找到更适合SIFCON的应用。

- 预计所有这些因素将在预测期内迅速推动市场发展。

北美占据市场主导地位

- 北美占据全球市场占有率的主导地位。美国在北美建设产业中占有很大的份额。除美国外,加拿大和墨西哥也是建筑业投资的主要贡献者。

- 根据美国人口普查局的数据,2022 年私人建筑业投资为 14,342 亿美元,比 2021 年的 12,795 亿美元成长 11.7%。 2022年住宅建筑支出为8,991亿美元,较2021年的7,937亿美元成长13.3%;住宅建筑支出为5,301亿美元,较2021年的4,858亿美元下降9.1%。

- 此外,美国人口普查局统计数据显示,2023年12月建筑支出(经季节性已调整的年化率)为2.096兆美元,比2023年11月更新的估计值2.0783兆美元高出0.9%。建筑支出预计将从 2022 年的 18,487 亿美元增长 7.0% 至 2023 年的 19,787 亿美元,从而推动市场消费。

- 此外,该国大规模的基础设施投资预计将促进该国的建筑业发展,从而促进市场成长。

- 例如,根据美国运输部统计,2023年,美国运输部在国家计划项目援助计画下,对公路、桥樑、货运、港口、铁路客运和公共交通等9个大型企划投资约12亿美元。

- 据美国公路和运输建设业协会称,截至2023年11月30日,美国已承诺提供26亿美元的官方公路和桥樑资金,以支持2300多个新计画。除此之外,中国还在 2022 和 2023 财年投资了超过 1,090 亿美元,并承诺支持超过 60,000 个新计画。

- 总体而言,预计上述因素将在预测期内增加对超高性能混凝土的需求。

超高性能混凝土(UHPC)产业概览

全球超高性能混凝土(UHPC)市场本质上相对分散。主要公司包括 Holcim、Sika AG、Illinois Works Inc.、RAMPF Holding GmbH & Co. KG 和 ceEntek。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 全球建设活动活性化

- 提升超高性能混凝土的优势

- 限制因素

- 与传统混凝土相比,材料成本相对较高

- 其他的

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按产品

- 泥浆浸渍纤维混凝土(SIFCON)

- 活性粉末混凝土(RPC)

- 緻密增强复合复合材料(CRC)

- 其他的

- 按应用

- 道路和桥樑建设

- 建筑施工

- 军事建设

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- ceEntek

- ELO Beton

- Gulf Precast Concrete Co. LLC

- Holcim

- Illinois Tool Works Inc.

- Metrostav

- RAMPF Holding GmbH & Co. KG

- Sika AG

- TAKTL

- UHPC SOLUTIONS North America

第七章 市场机会与未来趋势

- 预製建筑中超高性能混凝土的趋势日益增长

The Ultra High Performance Concrete Market size is estimated at USD 575.15 million in 2025, and is expected to reach USD 845.09 million by 2030, at a CAGR of greater than 8% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the ultra-high-performance concrete market. Due to the lockdown and brief halts in production facilities, several applications suffered significant damage, limiting the consumption of ultra-high-performance concrete. Nonetheless, beyond 2020, the market developed slowly due to ongoing efforts in the main end-user categories and is likely to continue on its path.

The major factors driving the market studied include the rising construction activities across the world and the increasing benefits of ultra-high-performance concrete.

The high material cost of UHPC, when compared with conventional concrete, is expected to significantly hinder the growth of the market studied.

Growing trends toward the use of ultra-high-performance concrete in prefabricated construction are likely to act as a driving force in the future.

North America is expected to dominate the global market during the forecast period. Meanwhile, Asia-Pacific is expected to register the highest CAGR during the forecast period due to the increasing construction activities across the region.

Ultra High Performance Concrete (UHPC) Market Trends

Slurry-Infiltrated Fibrous Concrete (SIFCON) to Dominate the Market

- Slurry infiltrated fiber concrete (SIFCON) is a recently developed construction material. SIFCON could be considered a special type of fiber concrete with high fiber content. The matrix consists of cement slurry or flowing cement mortar.

- This composite material is used for structures subjected to blast loading, repair of pre-stressed concrete beams, and safe vaults.

- Generally, as compared to normal fiber-reinforced concrete (FRC), SIFCON is different in two aspects, i.e., fiber content and the method of production. The fiber content of FRC generally varies from 1% to 3% by volume, but the fiber content of SIFCON varies between 5% and 20%. Also, the matrix of SIFCON consists of cement paste or flowing cement mortar as opposed to regular concrete used in FRC.

- All of these points make the production of SIFCON far different from that of FRC. In FRC, the fibers are added to the wet or dry concrete mix, whereas SIFCON is prepared by infill-treating cement slurry into a bed of fibers preplaced and packed tightly in the molds.

- Recently, interest in using SIFCON in explosion-proof containers and safety cabinets has increased. SIFCON has high impact resistance and high energy absorption.

- Various studies have been carried out to observe the other properties of SIFCON, such as the effect of adding different volumetric ratios of steel fiber. These studies will help find more suitable applications of SIFCON in the future.

- All these factors are expected to rapidly drive the market studied during the forecast period.

North America to Dominate the Market

- North America dominated the global market share. The United States has a significant share of the construction industry in North America. Besides the United States, Canada and Mexico contribute significantly to the investments in the construction sector.

- According to the US Census Bureau, the value of private construction in 2022 stood at USD 1,434.2 billion, 11.7% higher than the USD 1,279.5 billion in 2021. Residential construction spending in 2022 was USD 899.1 billion, up 13.3% from USD 793.7 billion in 2021, while non-residential construction spending amounted to USD 530.1 billion in 2022, down 9.1% from USD 485.8 billion in 2021.

- Furthermore, as per statistics generated by the US Census Bureau, the estimated seasonally adjusted annual rate of construction spending in December 2023 was USD 2,096.0 billion, 0.9% higher than the updated November 2023 estimate of USD 2,078.3 billion. Spending on buildings increased by 7.0% in 2023 to USD 1,978.7 billion from USD 1,848.70 billion in 2022, thereby increasing the consumption of the market studied.

- Moreover, significant infrastructure investments in the country are expected to boost the country's construction sector, thus uplifting the growth of the market studied. For instance,

- According to the US Department of Transportation, in 2023, the US Department of Transport invested around USD 1.2 billion for nine "mega" projects, which include highway, bridge, freight, port, passenger rail, and public transportation, under the National Infrastructure Project Assistance Program.

- According to the American Road & Transportation Builders Association, on November 30, 2023, the United States committed USD 2.6 billion in highway and bridge formula funds to support over 2,300 new projects. This was in addition to over USD 109 billion in investment and over 60,000 new project commitments supported in FY 2022 and FY 2023.

- On the whole, the aforementioned factors are expected to increase the demand for ultra-high-performance concrete during the forecast period.

Ultra High Performance Concrete (UHPC) Industry Overview

The global ultra-high-performance concrete (UHPC) market is relatively fragmented in nature. Some of the major companies are (not in any particular order) Holcim, Sika AG, Illinois Works Inc., RAMPF Holding GmbH & Co. KG, and ceEntek.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Construction Activities Across the Globe

- 4.1.2 Increasing Benefits of Ultra-High-Performance Concrete

- 4.2 Restraints

- 4.2.1 Relatively High Material Cost When Compared with Conventional Concrete

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Slurry-Infiltrated Fibrous Concrete (SIFCON)

- 5.1.2 Reactive Powder Concrete (RPC)

- 5.1.3 Compact Reinforced Composite (CRC)

- 5.1.4 Other Products

- 5.2 Application

- 5.2.1 Roads and Bridge Construction

- 5.2.2 Building Construction

- 5.2.3 Military Construction

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ceEntek

- 6.4.2 ELO Beton

- 6.4.3 Gulf Precast Concrete Co. LLC

- 6.4.4 Holcim

- 6.4.5 Illinois Tool Works Inc.

- 6.4.6 Metrostav

- 6.4.7 RAMPF Holding GmbH & Co. KG

- 6.4.8 Sika AG

- 6.4.9 TAKTL

- 6.4.10 UHPC SOLUTIONS North America

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Trends Toward the Use of Ultra-High-Performance Concrete in Prefabricated Construction