|

市场调查报告书

商品编码

1687394

磁感测器:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Magnetic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

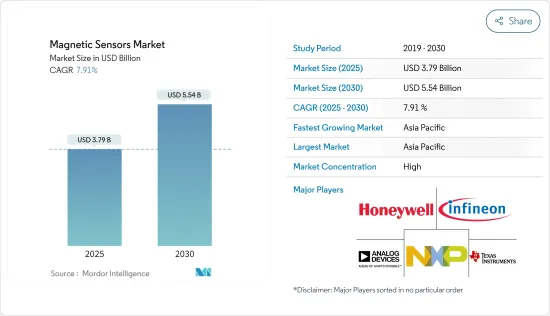

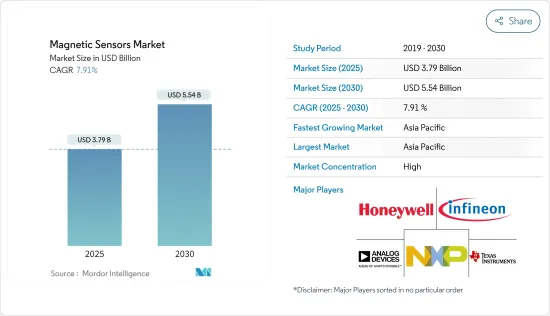

磁感测器市场规模预计在 2025 年为 37.9 亿美元,预计到 2030 年将达到 55.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.91%。

磁感测器在新导航设备、存在检测(建筑自动化相关应用)、医疗领域和汽车领域的广泛使用,正引领全球磁感测器市场发生模式转移。

主要亮点

- 全球工业物联网、家用电器、电动和混合动力汽车汽车以及高品质感测设备生产的需求不断增长,影响多个终端用户产业对磁感测器的采用。预计这将在预测期内推动磁感测器的成长。

- 由于工业 4.0 政策的推动,工厂自动化中机器人技术的采用不断增加,推动了全球市场对用于各种安全应用的磁感测器的需求。新兴国家服务业的发展以及资料中心和云端供应商的高成长率进一步增加了对这些感测器的需求,这些感测器被放置在配电单元(PDU)中,而配电单元是资料中心的重要组成部分。

- 然而,最近的 COVID-19 疫情爆发影响了半导体产业的需求和生产。亚太地区在半导体和电子产业占有重要份额,中国、台湾和韩国等国家和地区拥有全球大量纯晶圆代工厂。

磁感测器市场趋势

汽车产业占最大市场份额

- 对于汽车应用,GMR 和 TMR 感测器已被证明在连续运行期间消耗的功率低于 mW 甚至 μW。与同类感测器相比,它还能轻鬆装入更小的封装尺寸中。因此,它们在汽车零件中的使用日益增多。

- 预计汽车产业对磁感测器的需求将会增加。为了提高车辆的便利性和燃油效率,业界越来越多地使用感测设备。此外,政府机构的强制性法规,例如在汽车上安装安全装置和感测元件,也预计将为所调查市场的成长提供重大机会。

- 磁感测器供应商专注于提供可满足广泛汽车应用的高效设备。电动和混合动力电动车的需求增加和广泛采用以及汽车中 GPS 的使用也可能推动汽车产业对磁感测器的需求。

- 此外,基于霍尔和GMR的磁感测器在两轮车、三轮车和全地形车辆应用中的使用越来越多。这些感测器专为这些车辆中的切换应用以及电动车轻量化结构和减少电池操作空间、重量和功耗的位置和速度测量而开发。

亚太地区占据研究市场的最大份额

- 中国是世界上最具发展潜力的汽车、家电製造大国之一。由于防煞车系统 (ABS) 和防锁死系统等应用的使用日益增多,而磁感测器在这些应用中已广泛应用,因此汽车产业在该地区市场上占有重要地位。

- 此外,日本也向全球供应工业机器人及其零件(减速机、伺服马达、各种感测器等)。近年来工业机器人的发展对定位精度的要求较高。此外,还需要精确侦测关节角度,磁感测器发挥重要作用。

- 印度磁感测器市场正在成长,主要原因是智慧型手机越来越受欢迎,智慧型手机使用霍尔效应感测器来支援指南针应用。然而,目前限制市场的因素之一是冠状病毒的传播,印度多个邦实施封锁令,以遏制冠状病毒传播。

磁感测器产业概况

磁感测器市场竞争激烈。製造方法的改进和 TMR 技术的采用将为感测器製造商和相关行业参与者提供巨大的成长机会。该市场被认定为技术高度密集型市场。因此,市场参与者正在将 xMR 等先进技术产品纳入其产品系列中。这些公司包括 AKM、英飞凌科技、Allegro Microsystems、Melexis、TDK、Diodes 和霍尼韦尔。

- 2019 年 11 月 - Allegro MicroSystems 推出了 ATS17051,这是首批齿轮齿感测器 IC 之一,旨在为转速高达 30k RPM 的电动车牵引马达提供增量位置。该设备解决了工程师面临的牵引马达难题,包括启动和运行模式下的振动、高转速、机械空间限制、高动作温度和 ISO 26262 安全要求。

- 2019 年 6 月 - 英飞凌科技股份公司扩展了其感测器产品组合,增加了基于 AMR 的新型角度感测器,旨在在低磁场中提供高精度。 XENSIV TLE109A16 产品线旨在满足汽车和工业应用中高功能安全水平的极其精确、高速、经济高效的角度测量需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 市场驱动因素

- 加强节能係统和车辆的监管

- 消费性电子与资料中心的新兴应用

- 市场限制

- 半导体和感测器的平均销售价格(ASPS)下降

- 冠状病毒疫情影响电子产业

- COVID-19 产业影响评估

第五章 市场区隔

- 科技

- 霍尔效应

- 异性磁电阻(AMR)

- 巨磁电阻(GMR)

- 隧道磁阻 (TMR)

- 其他技术

- 应用领域

- 车

- 家电

- 工业(不包括汽车)

- 其他用途

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司简介

- Infineon Technologies AG

- Analog Devices

- Crocus Technology

- Honeywell International Inc.

- Allegro Microsystems(Sanken Electric Company)

- Murata Manufacturing Co. Ltd

- NVE Corporation

- NXP Semiconductors NV

- Omron Corporation

- ST Microelectronics NV

- TDK Corporation

- TE Connectivity

- Texas Instruments Inc.

- Investment Analysis

第七章 市场机会与未来趋势

The Magnetic Sensors Market size is estimated at USD 3.79 billion in 2025, and is expected to reach USD 5.54 billion by 2030, at a CAGR of 7.91% during the forecast period (2025-2030).

The high usage of magnetic sensors in new navigation devices, presence detection (building automation-related applications), medical areas, and the automotive sector are leading to a paradigm shift in the magnetic sensors market around the world.

Key Highlights

- The increase in demand for IIoT and the production of consumer electronics, electric and hybrid vehicles, and high-quality sensing devices, globally, are influencing the adoption of magnetic sensors across several end-user industries. This is expected to drive the growth of magnetic sensors during the forecast period.

- An increase in the adoption of robotics for factory automation, owing to the Industry 4.0 policies, is driving the need for magnetic sensors for various safety applications in the global market. The development in the services sector in the country and high growth rate of data center and cloud providers are further augmenting the demand for these sensors to be deployed in the power distribution unit (PDU), which forms a crucial part in data centers.

- However, the recent outbreak of COVID-19 is influencing both the demand and production of the semiconductor industry. Asia-Pacific holds the major share in the semiconductor and electronics industry, as countries, such as China, Taiwan, and South Korea, are home to a significant number of pureplay foundries in the world.

Magnetic Sensor Market Trends

Automotive Industry to Hold Largest Share of the Market

- In the case of automotive applications, GMR and TMR sensors have demonstrated less power consumption than mW and µW during continuous operation. They are also easily accommodated in package sizes less than their counterparts. Thus, they are finding increasing deployment in auto parts.

- The demand for magnetic sensors is anticipated to increase in the automotive industry. Sensing devices are increasingly being used in this industry to improve vehicle convenience and fuel efficiency. Also, mandatory regulations by government bodies, such as the installation of safety equipment and sensing elements in automobiles, are estimated to create significant opportunities for the growth of the market studied.

- Magnetic sensor vendors are focusing on providing efficient devices, which can serve an extensive range of automotive applications. The increase in demand and penetration of electric vehicles and hybrid electric vehicles and the use of GPS in automobiles may also fuel the demand for magnetic sensors from the automotive industry.

- Moreover, hall and GMR-based magnetic sensors are increasingly being used for motorcycles, three-wheel, and all-terrain vehicle applications. These sensors are being developed for switching applications in these vehicles, as well as the position and speed measurement for lightweight construction and reduced battery operation space, weight, and power consumption in electric vehicles.

Asia-Pacific to Hold the Largest Share of the Market Studied

- China is one of the most promising automotive and consumer electronics manufacturing nation, globally. Due to increased use of applications, such as anti-braking system (ABS) and anti-locking system, where magnetic sensors are widely utilized, the automobile industry holds an important position in the market in this region.

- Moreover, Japan is a supplier of industrial robots and their components, such as reducers, servo motors, and various sensors, to the world. The developments in industrial robots, of late, involves precision in positioning accuracy. It further requires accurate detection of joint angles, where magnetic sensors play a key role.

- The magnetic sensor market in India is mainly growing due to the proliferation of smartphones, as smartphones use hall-effect sensors to support compass applications. However, one of the factors restraining the market currently is the spread of coronavirus, as several states of India have issued lockdown orders to curb the spread of coronavirus.

Magnetic Sensor Industry Overview

The magnetic sensors market is highly competitive. The improved manufacturing practices and adoption of TMR technology are poised to offer substantial growth opportunities to sensor fabricators and associated industry participants. The market is identified to be highly technology intensive. Thus, the players in the market are integrating advanced technological products, like xMR, into their product portfolios. These companies include AKM, Infineon Technologies, Allegro Microsystems, Melexis, TDK, Diodes, and Honeywell.

- November 2019 - Allegro MicroSystems launched the ATS17051, one of the first gear tooth sensor ICs designed to provide incremental position for electric vehicle traction motors operating up to 30k RPM. The device addresses the engineers' traction motor challenges, which include vibration at startup and running mode, high rotational speed, mechanical space constraints, high operating temperatures, and ISO 26262 safety requirements.

- June 2019 - Infineon Technologies AG expanded its sensor portfolio by a new AMR-based angle sensor, which is aimed at providing high accuracy in low magnetic fields. The XENSIV TLE109A16 product line is designed to address the need for very precise, fast, and cost-efficient angle measurement at one of the high functional safety levels in automotive and industrial applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Increasing Regulations Around Energy-efficient Systems and Automobiles

- 4.3.2 Emerging Applications in Consumer Electronics and Data Centers

- 4.4 Market Restraints

- 4.4.1 Falling Average Selling Prices (ASPS) of Semiconductors and Sensors

- 4.4.2 Coronavirus Outbreak Influencing the Electronics Industry

- 4.4.2.1 Assessment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Hall Effect

- 5.1.2 Anisotropic Magneto Resistance (AMR)

- 5.1.3 Giant Magneto Resistance (GMR)

- 5.1.4 Tunneling Magneto Resistance (TMR)

- 5.1.5 Other Technologies

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Consumer Electronics

- 5.2.3 Industrial (Excluding Automotive)

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Infineon Technologies AG

- 6.1.2 Analog Devices

- 6.1.3 Crocus Technology

- 6.1.4 Honeywell International Inc.

- 6.1.5 Allegro Microsystems (Sanken Electric Company)

- 6.1.6 Murata Manufacturing Co. Ltd

- 6.1.7 NVE Corporation

- 6.1.8 NXP Semiconductors NV

- 6.1.9 Omron Corporation

- 6.1.10 ST Microelectronics NV

- 6.1.11 TDK Corporation

- 6.1.12 TE Connectivity

- 6.1.13 Texas Instruments Inc.

- 6.2 Investment Analysis