|

市场调查报告书

商品编码

1687401

模拟软体:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Simulation Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

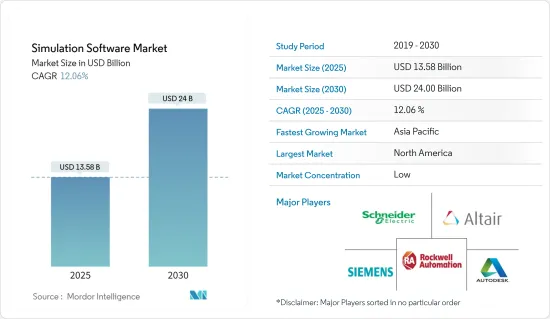

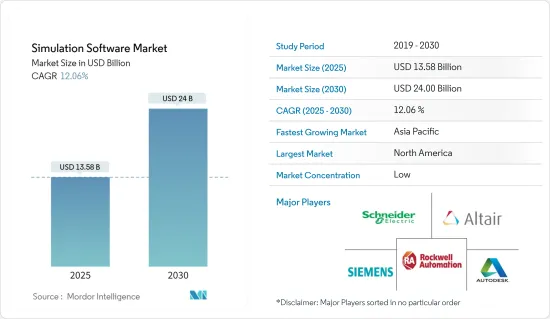

模拟软体市场规模预计在 2025 年为 135.8 亿美元,预计到 2030 年将达到 240 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.06%。

对于依赖先进设计、测试和建模环境的产业来说,模拟软体至关重要。该技术广泛应用于汽车、航太、国防、能源、通讯和教育等关键领域。该软体使用户能够创建数位原型、模拟真实世界的应用程式并测试复杂系统,而无需进行物理实验。这可以降低成本、提高效率并加快创新週期。

主要亮点

- 关键驱动因素:汽车产业对成长的影响汽车产业是模拟软体市场扩张的主要贡献者。对电动车 (EV) 和自动驾驶技术的需求日益增长,需要先进的模拟工具来设计、测试和改进复杂的车辆系统。这些工具对于开发和优化动力传动系统、电池系统和车载资讯娱乐技术至关重要。同样,在航太和国防工业中,模拟软体对于模拟高风险环境、提高飞机设计的安全性和性能以及增强国防系统和关键任务操作至关重要。在能源领域,模拟软体越来越多地被应用于优化风能和太阳能等可再生能源系统,并减少可变性和不可预测性。

- 云端基础的模拟软体:成长趋势云端基础的模拟软体市场正在经历显着成长。与传统的内部部署解决方案相比,云端平台具有扩充性、灵活性和成本优势。云端基础的系统允许使用者透过网路存取强大的模拟工具,促进协作并减少前期投资的需要。这一趋势与整个产业向数位转型的转变相吻合。云端基础的解决方案还支援人工智慧 (AI) 和机器学习 (ML) 的集成,以实现更有效率的模拟和工作流程最佳化。

汽车产业需求不断成长

主要亮点

- 对电动车模拟的需求日益增加:电动车 (EV) 发展的激增推动了对先进模拟工具的需求。汽车製造商使用模拟软体来设计和测试电动车组件,包括电池系统和充电基础设施。透过模拟真实世界的性能,製造商可以在开发早期发现潜在问题,从而降低成本并缩短上市时间。

- 模拟自动驾驶技术:自动驾驶汽车需要在各种条件下进行大量测试,而这些条件在现实世界中很难复製。模拟软体使自动驾驶系统能够在多种道路和天气条件下进行虚拟测试,以确保在复杂环境中安全运作。主要汽车製造商和科技公司正在采用这些工具来加速自动驾驶汽车的发展。

- 数位孪生增强汽车开发:数位双胞胎(实体产品的虚拟复製品)越来越多地被用于汽车模拟,以模拟车载技术,从资讯娱乐系统到安全功能。利用数位双胞胎,汽车製造商可以模拟不同条件下的性能,以改善使用者体验和车辆安全性。

向云端基础的模拟解决方案的转变仍在继续

主要亮点

- 云端平台的灵活性和扩充性:云端基础的模拟软体由于其固有的灵活性和扩充性而越来越受欢迎。这些解决方案使各种规模的公司无需进行大量的基础设施投资即可使用先进的模拟工具。该云端平台支援全球协作,使工程师和设计师能够即时存取和分析模拟资料。

- 对于中小企业来说具有成本效益:云端基础的模拟解决方案的订阅模式可降低资本支出,并使中小企业也能使用先进的工具。这种可扩展性允许使用者根据计划需求调整计算资源,从而提高成本效益。

- 整合人工智慧和机器学习:人工智慧驱动的模拟工作流程可以透过并行运行多个场景来确定最有效的配置,从而优化设计过程。此功能在製造业中尤其有用,即使效率稍微提高一点也可以节省大量成本。

模拟软体市场趋势

汽车产业成长可望加速

- 汽车领域的加速成长:虚拟原型製作、碰撞测试和系统操作的需求持续推动汽车产业对模拟软体的依赖。这些工具可协助製造商无需建立实体原型即可提高车辆安全性和性能。此外,汽车零件製造商正在采用模拟技术来降低研发成本。

- 汽车性能监控中的数位双胞胎:数位双胞胎在汽车行业的整合使製造商能够模拟即时车辆性能资料,有助于在维护问题变得严重之前发现它们。这种积极主动的方法提高了车辆的可靠性,同时有助于满足监管排放气体和安全标准。模拟工具对于开发和测试电动车电池至关重要,市场机会正在扩大。

- 即时模拟工具的兴起:即时模拟软体正成为汽车製造商的重要工具。工程师使用这些系统不断测试车辆零件,以优化其在不同驾驶条件下的性能。例如,BMW等公司正在开发自动驾驶技术模拟中心,以加速电动和自动驾驶汽车的创新。

- 云端平台推动市场效率:云端基础的模拟平台为汽车公司提供经济高效且扩充性的解决方案。减少测试时间、增加协作和提高产品品质的能力正在推动中小企业采用该技术,进一步促进模拟软体市场这一领域的成长。

北美引领类比模拟软体市场

- 技术创新的市场领导地位:在强大的技术进步和强劲的研发投资的推动下,北美占据全球模拟软体市场的最大份额。航太、汽车和医疗保健领域处于模拟软体采用的前沿。 Ansys、达梭系统和西门子等领先公司正在推动技术创新,帮助产业优化业务、降低成本并提高安全性。

- 政府措施推动市场成长永续性和效率的监管压力正在刺激各行各业采用模拟软体。例如,汽车製造商正在投资模拟工具以满足符合政府绿色经济目标的严格排放标准。在国防部门,政府资助的计划使用模拟软体进行任务规划和系统开发。

- 北美医疗保健产业正在采用模拟工具。模拟软体在医疗训练、手术规划和医疗设备开发的应用正在加速发展。这些应用的复杂性要求先进的模拟技术,进一步加速这些市场超越传统工程学科的扩张。

- 透过云端平台实现扩充性:云端基础的模拟软体在北美的采用持续成长,从而大大节省了成本,并实现了从远端位置进行即时模拟。扩充性可适应所有组织,包括小型、中型和大型企业,这有助于其在该地区的模拟软体市场占有率扩大,并巩固其在全球行业领域的领导地位。

模拟软体产业概况

分散的市场,全球参与者众多模拟软体市场高度分散,由跨国公司和利基解决方案供应商组成。虽然西门子股份公司、欧特克公司和罗克韦尔自动化公司等公司继续占据主导地位,但规模较小的公司也在为特定的工业应用贡献创新。此类比赛推动了从汽车到学术研究等领域的进步。

推动创新的主要企业:西门子、罗克韦尔自动化、Schneider电气、欧特克和 Ansys 等全球公司正在推动航太、汽车和製造等行业的技术边界。各公司凭藉强大的研发和市场拓展能力,在满足不断变化的客户需求的同时,推动全球模拟软体市场的成长。

主要趋势:云端、人工智慧、数位双胞胎:云端基础的解决方案、人工智慧数位双胞胎的融合正在改变市场。采用这些技术的公司将会获得成功。为了保持竞争力,企业,尤其是中小型企业,必须优先考虑软体的易用性、跨平台功能和具有成本效益的解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

- 市场驱动因素

- 汽车产业需求不断成长

- 日益转向云端基础的模拟解决方案

- 市场限制

第五章 市场区隔

- 部署类型

- 本地

- 云

- 最终用户产业

- 车

- 资讯科技/通讯

- 航太和国防

- 能源与采矿

- 教育与研究

- 电气和电子

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Altair Engineering Inc.

- The MathWorks Inc.

- Autodesk Inc.

- Cybernet Systems Corp.

- Bentley Systems Incorporated

- PTC Inc.

- CPFD Software LLC

- Design Simulation Technologies Inc.

- Synopsys Inc.

- Siemens AG

- Ansys Inc.

- Dassault Systeemes SE

- Simio LLC

- Lanner Group Ltd

- SIMUL8 Corporation

- CONSELF Srl

- SolidWorks Corporation

- Rockwell Automation Inc.

- The COMSOL Group

- Schneider Electric SE

第七章市场投资分析

第八章 市场机会与未来趋势

The Simulation Software Market size is estimated at USD 13.58 billion in 2025, and is expected to reach USD 24.00 billion by 2030, at a CAGR of 12.06% during the forecast period (2025-2030).

Simulation software is integral to industries that depend on advanced design, testing, and modeling environments. This technology is widely utilized across key sectors such as automotive, aerospace, defense, energy, telecommunications, and education. The software enables users to create digital prototypes, simulate real-world applications, and test complex systems without the need for physical experimentation. This leads to cost reduction, increased efficiency, and faster innovation cycles.

Key Highlights

- Key Drivers: Automotive Industry's Impact on Growth The automotive sector is a significant contributor to the expansion of the simulation software market. The rising demand for electric vehicles (EVs) and autonomous driving technologies necessitates sophisticated simulation tools to design, test, and refine complex vehicle systems. These tools are essential for developing and optimizing powertrains, battery systems, and in-vehicle infotainment technologies. Similarly, in the aerospace and defense industries, simulation software is critical for modeling high-risk environments, improving safety and performance in aircraft design, and enhancing defense systems and mission-critical operations. In the energy sector, simulation software is increasingly adopted to optimize renewable energy systems such as wind and solar power, mitigating variability and unpredictability.

- Cloud-Based Simulation Software: A Growing Trend The market for cloud-based simulation software has experienced notable growth. Cloud platforms offer scalability, flexibility, and cost advantages over traditional on-premise solutions. With cloud-based systems, users can access powerful simulation tools over the internet, fostering collaboration and reducing the need for significant upfront infrastructure investments. This trend aligns with the broader industry shift toward digital transformation. Cloud-based solutions also support artificial intelligence (AI) and machine learning (ML) integration, enabling more efficient simulations and optimized workflows.

Rising Demand from the Automotive Sector

Key Highlights

- Increased Need for EV Simulation: The surge in electric vehicle (EV) development has amplified the need for advanced simulation tools. Automakers leverage simulation software to design and test EV components, such as battery systems and charging infrastructure. By simulating real-world performance, manufacturers can identify potential issues during the early stages of development, reducing costs and time-to-market.

- Simulation for Autonomous Driving Technologies: Autonomous vehicles require extensive testing under various conditions, which can be difficult to replicate in the real world. Simulation software allows for the virtual testing of autonomous driving systems across multiple road and weather conditions, ensuring their safe operation in complex environments. Major automakers and technology firms have embraced these tools to accelerate the development of autonomous vehicles.

- Digital Twins Enhance Vehicle Development: Digital twins-virtual replicas of physical products-are increasingly used in automotive simulation to model in-vehicle technologies, from infotainment systems to safety features. By using digital twins, automakers can simulate performance under diverse conditions, improving user experience and vehicle safety.

The Growing Shift to Cloud-Based Simulation Solutions

Key Highlights

- Flexibility and Scalability of Cloud Platforms: Cloud-based simulation software is gaining traction due to its inherent flexibility and scalability. These solutions allow companies of all sizes to access advanced simulation tools without heavy infrastructure investments. Cloud platforms support global collaboration, enabling engineers and designers to access and analyze simulation data in real-time.

- Cost-Effectiveness for SMEs: The subscription model of cloud-based simulation solutions reduces capital expenditure, making advanced tools accessible to small and medium enterprises (SMEs). This scalability allows users to adjust computational resources according to project needs, enhancing cost efficiency.

- AI and Machine Learning Integration: AI-driven simulation workflows can optimize design processes by running multiple scenarios in parallel, identifying the most efficient configurations. This capability is particularly valuable in manufacturing, where even minor gains in efficiency can result in significant cost savings.

Simulation Software Market Trends

Automotive Segment is Expected to Grow at a Faster Pace

- Automotive Segment Growth Accelerates:The automotive sector's reliance on simulation software continues to grow, driven by the need for virtual prototyping, crash testing, and system op mization. These tools help manufacturers improve vehicle safety and performance without the need for physical prototypes. Automotive suppliers are also adopting simulation technologies to reduce research and development (R&D) costs.

- Digital Twins in Automotive Performance Monitoring: The integration of digital twins in the automotive industry allows manufacturers to simulate real-time vehicle performance data, helping detect maintenance issues before they escalate. This proactive approach improves vehicle reliability while aligning with regulatory standards on emissions and safety. Simulation tools are vital in the development of EV batteries and testing, further expanding market opportunities.

- Real-Time Simulation Tools Gain Popularity: Real-time simulation software is becoming a pivotal tool for automotive manufacturers. Engineers use these systems to continuously test vehicle components, optimizing performance under various driving conditions. For instance, companies like BMW are developing simulation centers for autonomous driving technologies, helping accelerate the innovation of electric and autonomous vehicles.

- Cloud Platforms Enhance Market Efficiency: Cloud-based simulation platforms are providing cost-effective, scalable solutions for automotive companies. The ability to reduce testing times, enhance collaboration, and improve product quality is driving adoption among SMEs, further contributing to the sector's growth within the simulation software market.

North America Leads the Simulation Software Market

- Market Leadership in Technological Innovation: North America holds the largest share in the global simulation software market, underpinned by strong technological advancements and substantial R&D investments. The aerospace, automotive, and healthcare sectors are at the forefront of simulation software adoption. Major players, including Ansys, Dassault Systemes, and Siemens, are driving innovation, helping industries optimize operations, reduce costs, and improve safety.

- Government Initiatives Fuel Market Growth: Regulatory pressures regarding sustainability and efficiency are spurring the adoption of simulation software across industries. For example, automotive manufacturers are investing in simulation tools to meet stringent emissions standards, aligning with governmental green economy goals. In the defense sector, government-backed projects depend on simulation software for mission planning and system development.

- Healthcare Sector Embraces Simulation Tools: In North America, the healthcare sector is increasingly utilizing simulation software for medical training, surgical planning, and medical device development. The complexity of these applications demands sophisticated simulation technologies, further driving market expansion beyond traditional engineering fields.

- Scalability with Cloud Platforms: The adoption of cloud-based simulation software continues to grow in North America, providing significant cost savings and enabling remote, real-time simulations. The ability to scale across organizations, from SMEs to large enterprises, is broadening the market share of simulation software in the region, cementing its leadership in the global industry outlook.

Simulation Software Industry Overview

Fragmented Market with Global Players: The simulation software market is highly fragmented, with a mix of multinational corporations and niche solution providers. Companies like Siemens AG, Autodesk Inc., and Rockwell Automation Inc. maintain dominant positions, while smaller entities contribute to innovation in specific industry applications. This competition fosters diverse advancements across sectors ranging from automotive to academic research.

Leading Companies Drive Innovation: Global players such as Siemens, Rockwell Automation, Schneider Electric, Autodesk, and Ansys are pushing technological boundaries in industries like aerospace, automotive, and manufacturing. Their strong R&D capabilities and market reach enable them to meet evolving customer needs while driving global growth in the simulation software market.

Key Trends: Cloud, AI, and Digital Twins: The integration of cloud-based solutions, AI, and digital twins is transforming the market. Companies that embrace these technologies are poised for success. To remain competitive, firms must prioritize software usability, cross-platform functionality, and cost-effective solutions, particularly for SMEs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of the COVID-19 on the Market

- 4.4 Market Drivers

- 4.4.1 Rising Demand from the Automotive Sector

- 4.4.2 The Growing Shift to Cloud-Based Simulation Solutions

- 4.5 Market Restraints

5 MARKET SEGMENTATION

- 5.1 Deployment Type

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 IT and Telecommunication

- 5.2.3 Aerospace and Defense

- 5.2.4 Energy and Mining

- 5.2.5 Education and Research

- 5.2.6 Electrical and Electronics

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia

- 5.3.4 Australia and New Zealand

- 5.3.5 Latin America

- 5.3.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Altair Engineering Inc.

- 6.2.2 The MathWorks Inc.

- 6.2.3 Autodesk Inc.

- 6.2.4 Cybernet Systems Corp.

- 6.2.5 Bentley Systems Incorporated

- 6.2.6 PTC Inc.

- 6.2.7 CPFD Software LLC

- 6.2.8 Design Simulation Technologies Inc.

- 6.2.9 Synopsys Inc.

- 6.2.10 Siemens AG

- 6.2.11 Ansys Inc.

- 6.2.12 Dassault Systeemes SE

- 6.2.13 Simio LLC

- 6.2.14 Lanner Group Ltd

- 6.2.15 SIMUL8 Corporation

- 6.2.16 CONSELF Srl

- 6.2.17 SolidWorks Corporation

- 6.2.18 Rockwell Automation Inc.

- 6.2.19 The COMSOL Group

- 6.2.20 Schneider Electric SE