|

市场调查报告书

商品编码

1687407

应用安全 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Application Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

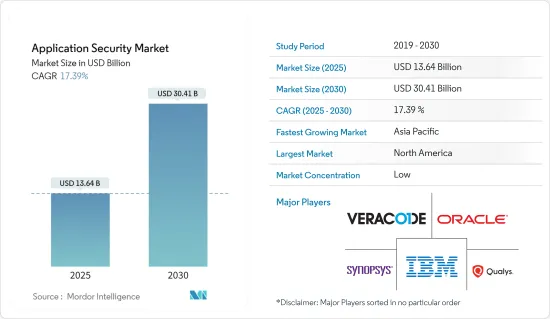

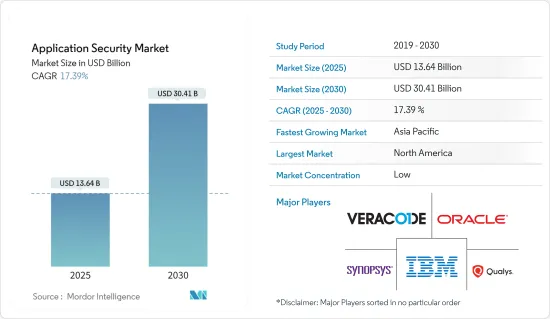

2025年应用安全市场规模预计为136.4亿美元,预计到2030年将达到304.1亿美元,预测期内(2025-2030年)的复合年增长率为17.39%。

随着越来越多的公司考虑开发应用程式、购买比以往更多的应用程式以及将开放原始码程式码纳入其应用程式中,应用程式安全性已成为必需。与这些应用程式相关的漏洞和风险正在呈指数级增长。

主要亮点

- 应用程式安全系统降低了不同应用程式(包括Web和行动应用程式)的不同操作所带来的安全风险。由于许多组织连接到各种关键业务应用程序,因此预计 Web 应用程式仍将是已确认违规行为的最常见原因。网路上资讯外洩的风险不断增加。

- 儘管资料外洩和网路犯罪的频率不断增加,但多种研究表明,职场的资讯安全,尤其是网路安全,需要更多的资金和关注。当应用程式仅用于业务关键业务(例如付款或订购商品和服务)时,公司就会留下数千个未使用的应用程式。

- 此外,机器学习和人工智慧在行动和基于网路的安全流程中的使用正在推动应用安全市场的需求。应用程式安全涉及行动和 Web 应用程式的安全开发週期的几个阶段,包括安全编码和设计。

- 人工智慧的几个专业领域,例如机器学习和专家系统,可以透过产生、预测和应用推理来识别安全漏洞、预测安全风险并提供安全程式码修復建议,从而增强应用程式的安全性。此外,安全专家还使用这些技术来自动识别攻击风险和审查代码。许多公司,包括 BR Softech、FuGen X 和 USM Business Systems,都在其应用开发计划中使用 ML 和 AI。

- 随着 COVID-19 的爆发,封锁和社交隔离措施使得几乎大多数组织转向了在家工作模式,对应用程式管理和应用程式的远端监控方面产生了巨大的需求。例如,去年,随着客户管理混合和多重云端IT 环境,对云端应用程式、整合通讯(UC) 和协作工具、视讯会议和其他 IT 资源的需求显着增加,OpsRamp 透过 OpsRamp 平台中的新功能扩展了其针对 WFH 世界的网路和 UC 监控,为解决方案供应商提供了一种满足在家工作员工需求的方法。

应用安全市场趋势

电子商务等第三方应用的增加

- 科技进步彻底改变了零售业,零售商现在藉助科技在全球提供个人化的购物体验。根据 Think with Google 的调查,84% 的店内购物者使用智慧型手机获取产品资讯和货比三家。

- 行动应用技术对于提高客户参与度和为他们提供个人化购物体验的多种选择至关重要。此外,零售商预计将透过投资行动应用程式、店内信标、应用程式内购物功能、店内行动付款、行动广告等继续改善网路购物体验。诸如此类的案例正在推动零售业的市场成长。

- 此外,零售业还拥有数千种专门为满足特定需求而设计的软体应用程式。据 IBM 称,平均每个零售连锁店使用约 450 个这样的应用程序,这一数字高于许多其他行业。随着数位化位转型的持续推进,预计将出现其他几种应用。此外,世界各地的政府法规正在推动零售商采用 API。预计这将进一步推动零售业应用安全市场的成长。

- 此外,全球疫情加速了行动电子商务(有时称为行动商务)的发展趋势。购物者可以使用行动电话安排路边取货或送货上门,以避免亲自购物的风险。因此,透过行动电话和平板电脑购物长期以来一直呈上升趋势,预计未来仍将保持在高水准。

北美占最大市场占有率

- 在数位时代,针对银行和其他金融服务机构的金融犯罪正在迅速增加。预计今年全球卡片诈骗将大幅增加。此外,骇客攻击最常见的方式是使用被盗凭证,然后利用这些凭证入侵公司的基于网路的电子邮件和其他网路应用程式。

- 北美已发生多起公司遭受网路攻击的案例。此类攻击影响了大多数终端用户产业,包括政府、BFSI 等。去年,美国近 30,000 个组织因针对微软 Exchange 电子邮件伺服器(世界上最重要的电子邮件伺服器之一)的大规模攻击而受到影响。这使得骇客能够轻鬆利用四个不同的零日漏洞,并取得从小型企业到地方政府等各类公司的电子邮件。

- 该地区的政府当局也在努力减少该地区的网路犯罪。政府的影响力也鼓励使用应用程式安全解决方案。例如,美国国防安全保障部(DHS)今年为美国各州、地方和领土(SLT)政府推出了一项新的网路安全津贴计划。

- 由拜登总统的《两党基础设施法案》推动的州和地方网路安全津贴计划将在四年内向 SLT 合作伙伴提供 10 亿美元的资金,其中本财年将提供 1.85 亿美元,以支持 SLT 努力减轻其资讯系统的网路风险。这项支援将使 SLT 政府能够管理网路安全风险,加强关键基础设施的网路安全,并为我们向当地社区提供的服务提供抵御持续网路攻击的能力。

- 此外,美国司法部 (DOJ) 和国防安全保障部 (DHS) 与政府合作伙伴于去年 7 月开发了一个新网站,以打击勒索软体威胁。 StopRansomware.gov 是个人、企业和其他组织的一站式勒索软体资讯来源。 StopRansomware.gov 是联邦政府推出的第一个协作网站,旨在帮助私人和公共公司降低勒索软体的风险。

应用程式安全产业概览

应用安全市场高度分散,公司众多。在这个市场中,许多公司正在不断创新,以求与竞争对手区分开来。市场的主要企业包括 IBM、 Oracle和摘要。市场近期的一些主要趋势:

2022 年 10 月, Oracle宣布推出适用于各种工作负载、资料类型和开发风格的 Oracle Database 23c Beta。 Oracle Database 23c 的代号为“App Simple”,强调应用程式和开发的简单性。此外, Oracle资料库服务和产品系列的进一步创新增强了Oracle在关键任务工作负载的效能、安全性和可靠性方面的地位。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业吸引力-波特五力分析

第五章市场动态

- 市场驱动因素

- 有利的政府法规

- 复杂攻击日益增多

- 第三方应用程式的兴起

- 市场限制

- 预算限制和未使用的应用程式限制了企业采用

- 业界忽视应用程式安全

第六章市场区隔

- 应用

- Web 应用程式安全

- 行动应用程式安全

- 成分

- 服务

- 託管

- 专业的

- 配置(解决方案)

- 云

- 本地

- 服务

- 组织规模

- 中小型企业

- 大型企业

- 安全测试的类型

- 静态应用安全测试(SAST)

- 动态应用安全测试(DAST)

- 互动式应用程式安全测试(IAST)

- 运行时应用程式自我保护(RASP)

- 最终用户产业

- 卫生保健

- BFSI

- 教育

- 零售

- 政府

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- IBM Corporation

- Oracle Corporation

- Micro Focus International PLC

- Checkmarx Ltd

- Veracode(Thoma Bravo)

- Synopsys Inc.

- WhiteHat Security Inc.(NTT Security Corporation)

- Rapid7 Inc.

- Qualys Inc.

- SiteLock LLC

- Contrast Security

- Positive Technologies

- Fasoo.com Inc.

第八章投资分析

第九章 市场机会与未来趋势

The Application Security Market size is estimated at USD 13.64 billion in 2025, and is expected to reach USD 30.41 billion by 2030, at a CAGR of 17.39% during the forecast period (2025-2030).

Application security has become necessary with an increasing number of companies looking to develop their apps, purchase a record number of applications, and incorporate open-source code into their applications. The vulnerabilities and risks associated with these applications have risen exponentially.

Key Highlights

- The application security systems reduce the security risks involved in the different operations of various applications, such as web and mobile applications. It has been anticipated that web applications would remain the most frequent cause of confirmed breaches, with organizations majorly connecting to various business-critical applications. On the internet, a breach risk has been continuously increasing.

- Despite the increasing frequency of data breaches and cybercrime, several types of research indicate that more money or attention still needs to be given to information security, specifically cybersecurity, in the workplace. When applications are used only within business-critical activities, such as payment-related activities or ordering goods and services, enterprises leave thousands of applications unused.

- Moreover, the usage of machine learning and artificial intelligence in mobile and web-based security processes bolsters the demand for the application security market. Application security encompasses mobile and web applications that go through several stages of the security development cycle, such as security coding and design.

- Several AI-specific fields, like ML and expert systems, could enhance application security by generating, forecasting, or applying inferences to identify security vulnerabilities, anticipate security risks, and provide security code remediation recommendations. Moreover, security professionals are also using these technologies to automate attack risk identification and code review. Numerous firms, like BR Softech, FuGen X, and USM Business Systems, use ML and AI for application development projects.

- With the outbreak of COVID-19, almost the majority of the organization had shifted to work from the home model due to the lockdown and social distancing measures that created a significant demand for managing the application and monitoring the application aspect remotely. For instance, last year, OpsRamp expanded its network, UC monitoring for the WFH world with new functionality in the OpsRamp platform that offers solutions providers a way to help customers manage hybrid and multi-cloud IT environments and meet the needs of work-from-home employees as demand for cloud applications, unified communications (UC) and collaboration tools, video conferencing, and other IT resources had increased significantly.

Application Security Market Trends

Increased Number of Third-party Applications, such as E-commerce

- Technological advancements have completely revolutionized the retail industry as retailers provide personalized shopping experiences on a global scale with the help of technology. According to Think with Google, 84% of shoppers in physical stores use their smartphones to get information about products and compare shops.

- Mobile app technology has become critical for boosting customer engagement and giving customers multiple choices regarding personalized shopping experiences. Moreover, it is anticipated that retailers will continue to improve the online shopping experience by investing in mobile apps, beacons for in-store use, in-app shopping capabilities, mobile payments in stores, and mobile advertisements. Such instances are driving market growth in the retail sector.

- Moreover, the retail industry is aided by thousands of specialty software applications designed for specific needs. According to IBM, an average retail chain uses about 450 such applications, which is higher than many other industries. Several other applications are expected to surface with the increasing shift to digitization. Additionally, supportive government regulations worldwide encourage retail players to deploy API. This is further expected to promote the growth of the application security market in the retail sector.

- Further, the global pandemic has accelerated the trend of mobile e-commerce (sometimes called m-commerce), whether buyers use their phones to schedule pick-up curbside or deliver items to avoid the risks of in-person shopping. Thus, shopping from phones and tablets has been on the rise for a long time and is expected to remain high.

North America Accounts for the Largest Market Share

- In the digital age, financial crimes against banks and other financial services institutions are accelerating rapidly. This year, card fraud is expected to increase globally with substantial growth. Furthermore, hacking via stolen credentials was most commonly seen, which are then used to hack into the enterprise's web-based email and other web applications.

- There have been multiple cases where enterprises in North America have been victims of cyber-attack. Such attacks have impacted most end-user industries, including the government, BFSI, and others. In the last year, almost 30,000 United States organizations were disrupted by a massive attack on the Microsoft Exchange email servers, which is one of the most considerable email servers on a global level. With this, the hackers could easily exploit the four separate zero-day vulnerabilities to access emails from small enterprises to local governments.

- The government authorities in the region are also working to decrease cybercrimes in the area. The government's influence also encourages the use of application security solutions. For instance, this year, the Department of Homeland Security (DHS) introduced a new cybersecurity grant program for state, local, and territorial (SLT) governments around the country.

- This State and Local Cybersecurity Grant Program, facilitated by President Biden's Bipartisan Infrastructure Act, offers 1 billion USD in funding for four years to SLT partners, with 185 million USD available in the current financial year, to assist SLT efforts to mitigate cyber risk to their information systems. With this support, SLT governments would be better positioned to manage cybersecurity risks, enhance the cybersecurity of their vital infrastructure, and provide resilience against continuous cyber attacks for the services they deliver to their communities.

- Moreover, in July last year, The United States Departments of Justice (DOJ) and Homeland Security (DHS), in collaboration with government partners, developed a new website to tackle the ransomware threat. StopRansomware.gov serves as a one-stop source for ransomware information for people, corporations, and other organizations. StopRansomware.gov is the first joint website launched by the federal government to assist private and public enterprises in mitigating their ransomware risk.

Application Security Industry Overview

The application security market is highly fragmented due to many players. Many players in the market are making innovations to differentiate themselves from their competitors. Some key players in the market include IBM, Oracle, and Synopsys Inc., among others. Some key recent developments in the market include:

In October 2022, Oracle announced Oracle Database 23c Beta, which handles all workloads, data types, and development styles. Oracle Database 23c, codename "App Simple," emphasizes application and development simplification. Further, additional innovations across Oracle's database services and product portfolio enhance Oracle's position in its performance, security, and reliability for mission-critical workloads.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - 'Porter's Five Forces Analysis'

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Favorable Government Regulations

- 5.1.2 Increased Number of Sophisticated Attacks

- 5.1.3 Increased Number of Third-party Applications

- 5.2 Market Restraints

- 5.2.1 Budget Constraints and Unused Applications Restrict Companies from Adoption

- 5.2.2 Negligence of Application Security by Industries

6 MARKET SEGMENTATION

- 6.1 Application

- 6.1.1 Web Application Security

- 6.1.2 Mobile Application Security

- 6.2 Component

- 6.2.1 Service

- 6.2.1.1 Managed

- 6.2.1.2 Professional

- 6.2.2 Deployment (Solution)

- 6.2.2.1 Cloud

- 6.2.2.2 On-premise

- 6.2.1 Service

- 6.3 Organization Size

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 Types of Security Testing

- 6.4.1 Static Application Security Testing (SAST)

- 6.4.2 Dynamic Application Security Testing (DAST)

- 6.4.3 Interactive Application Security Testing (IAST)

- 6.4.4 Run-Time Application Self Protection (RASP)

- 6.5 End-user Industry

- 6.5.1 Healthcare

- 6.5.2 BFSI

- 6.5.3 Education

- 6.5.4 Retail

- 6.5.5 Government

- 6.5.6 Other End-user Verticals

- 6.6 Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Latin America

- 6.6.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Oracle Corporation

- 7.1.3 Micro Focus International PLC

- 7.1.4 Checkmarx Ltd

- 7.1.5 Veracode (Thoma Bravo)

- 7.1.6 Synopsys Inc.

- 7.1.7 WhiteHat Security Inc.( NTT Security Corporation)

- 7.1.8 Rapid7 Inc.

- 7.1.9 Qualys Inc.

- 7.1.10 SiteLock LLC

- 7.1.11 Contrast Security

- 7.1.12 Positive Technologies

- 7.1.13 Fasoo.com Inc.