|

市场调查报告书

商品编码

1687432

塑化剂-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Bio-plasticizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

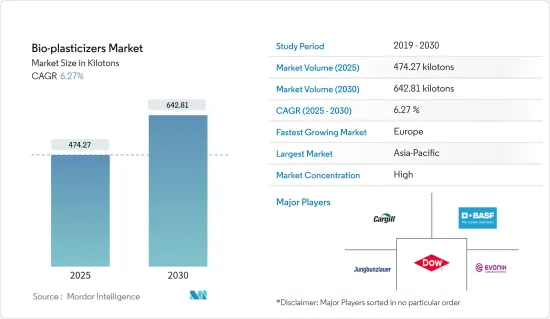

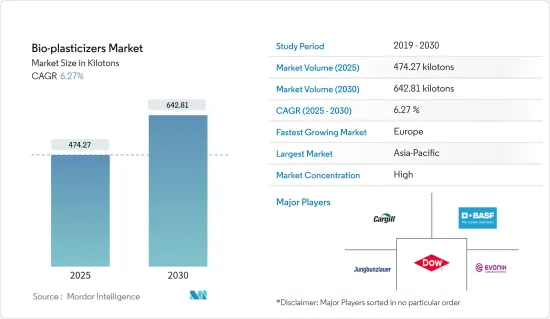

预计 2025 年塑化剂市场规模为 474.27 千吨,到 2030 年将达到 642.81 千吨,预测期内(2025-2030 年)的复合年增长率为 6.27%。

2020 年,新冠疫情对市场产生了负面影响。疫情期间,由于政府实施封锁,建设活动暂时停止。这导致地板材料、墙壁材料、电线电缆等领域的生物塑化剂消费量下降,对生物塑化剂的需求产生负面影响。但在此情况下,食品和电商领域的包装需求大幅增加,刺激了对含有生物塑化剂的包装材料的需求,从而推动了市场成长。

主要亮点

- 短期内,柔性 PVC 生物塑化剂需求的增加以及邻苯二甲酸酯塑化剂的禁令预计将推动市场成长。

- 与传统塑化剂相比,塑化剂的成本较高,可能会阻碍市场成长。

- 对生物基塑化剂的持续研究可能会在预测期内为市场创造机会。

- 预计亚太地区将主导市场。此外,预计亚太地区在预测期内的复合年增长率最高。

塑化剂的市场趋势

地板材料、屋顶和墙壁材料的需求增加

- 塑化剂有助于减少所需的水量,使混凝土更坚固、更易于加工。这些通常是有机材料,或有机和无机材料的组合,用于降低水分以提高可加工性。

- 塑化剂的加入量约为水泥重量的0.1~0.4%。此用量可将所需水量减少 5% 至 15%,同时还可提高可加工性,坍落度约为 3 至 8 公分。塑化剂一般会夹带少于 2% 的空气。

- 根据中国国家统计局的数据,2021年中国建筑业产值达25.92兆元(4.02兆美元),而2020年为23.27兆元人民币(3.37兆美元)。这增加了对地板材料和墙壁材料的需求,并扩大了生质塑胶的市场。

- 在印度,建筑业是经济成长的重要支柱。印度政府的目标是为约13亿人提供住宅,并积极推动住宅建设。

- 此外,根据美国人口普查局的数据,2022 年美国年度新建筑价值将达到 1.792 兆美元,而 2021 年为 1.626 兆美元。此外,2022 年美国住宅建筑年价值为 9,080 亿美元,比 2021 年的 8,030 亿美元成长 13%。

- 因此,随着节约水资源的要求不断提高,地板材料和墙壁材料中塑化剂的使用量正在迅速增加。

- 由于这些因素,预计预测期内全球对塑化剂的需求将会成长。

亚太地区将主导市场成长

- 亚太地区建筑业是世界上最大的建筑业。随着中阶变得更加富裕以及越来越多的人迁入城市,这一数字正在以健康的速度增长。

- 基础设施的改善以及主要企业进入中国利润丰厚的市场也推动了该产业的发展。

- 近年来,随着中央政府推动基础设施投资以维持经济成长,中国建设产业迅速发展。中国是建设产业的领导者,2022年建筑业增加价值将达1.29兆美元。

- 此外,2022年日本新建住宅总占地面积约6,900万平方公尺,低于2021年的7,000万平方公尺。此外,2022年日本开工的住宅数量约为859,500套。这导致电线电缆、地板材料和墙壁材料等应用中塑化剂的消费量增加。

- 土地开发、豪华饭店、办公大楼、国际会展中心、大型主题乐园建设营运等外商投资限制也已取消。未来几年,由于基础设施和运输业的成长,该地区的生物塑胶市场预计将成长。

- 印度包装工业协会(PIAI)也表示,印度正成为塑胶包装产业的首选目的地。包装产业是印度经济第五大产业。

- 医疗健康产业稳定成长,全国医疗健康支出和医疗健康设施数量逐年增加。印度政府更开放的政策也允许100%的外国直接投资进入医疗设备市场。

- 印度政府推出了 NHP 计划,这是世界上最大的政府资助医疗保健计划。 《2022 年经济调查》显示,2021-22 年印度的医疗保健公共支出将占 GDP 的 2.1%,而 2020-21 年这一比例为 1.8%。此外,印度政府计划推出价值 5,000 亿印度卢比(68 亿美元)的信贷奖励计划,以加强该国的医疗保健基础设施。

- 因此,预计上述因素将在预测期内对市场产生重大影响。

塑化剂产业概况

塑化剂市场本质上是部分整合的。市场上的主要企业(不分先后顺序)包括陶氏化学、赢创工业股份公司、嘉吉公司、BASF股份公司和 Jungwanslauer Switzerland AG。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 柔性 PVC 需求不断成长

- 更严格的邻苯二甲酸酯法规促进塑化剂的使用

- 限制因素

- 塑化剂替代品的可用性

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按类型

- 环氧大豆油(ESBO)

- 蓖麻油

- 柠檬酸盐

- 琥珀酸

- 其他类型

- 按应用

- 电线电缆

- 薄膜和片材

- 地板材料、屋顶、墙壁材料

- 医疗设备

- 消费品

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Avient Corporation

- BASF SE

- Cargill, Inc.

- DIC CORPORATION

- Dow

- Emery Oleochemicals

- Evonik Industries AG

- Hebei Jingu Plasticizer Co. Ltd.

- Jiangxi East Huge Dragon Chemical Co. Ltd.

- Jungbunzlauer Suisse AG

- LANXESS

- Matrica SpA

- OQ Chemicals gmbH

- Roquette Freres

第七章 市场机会与未来趋势

- 扩大生物基塑化剂的研究

The Bio-plasticizers Market size is estimated at 474.27 kilotons in 2025, and is expected to reach 642.81 kilotons by 2030, at a CAGR of 6.27% during the forecast period (2025-2030).

COVID-19 negatively impacted the market in 2020. During the pandemic, construction activities were temporarily halted due to the government-imposed lockdown. This led to a decrease in the consumption of bio-plasticizers based on flooring and wall coverings, wires, and cables, which, in turn, negatively impacted the demand for bio-plasticizers. However, the demand for packaging from the food and e-commerce segment significantly increased during this situation, which, in turn, stimulated the demand for packaging materials made up of bio-plasticizers, thus enhancing the market growth.

Key Highlights

- Over the short term, the augmenting demand for bio-plasticizers for flexible PVC and the prohibition on phthalate-based plasticizers are expected to drive the growth of the market.

- The high cost of bio-plasticizers, when compared with conventional plasticizers, is likely to hinder the growth of the market.

- Ongoing research on bio-based plasticizers is likely to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market. It is also likely to witness the highest CAGR during the forecast period.

Bio Plasticizers Market Trends

Increasing Demand from Flooring, Roofing and Wall Covering

- Bio-plasticizers help reduce water requirements and make concrete strong and workable. These are generally organic substances or a combination of organic and inorganic substances that help reduce water content for workability.

- The quantity of plasticizers added is about 0.1%-0.4% by weight of cement. This amount reduces 5%-15% of the water requirement and also leads to an increase in workability from about a 3-8 cm slump. A plasticizer, in general, entrains less than 2% air.

- According to the National Bureau of Statistics of China, the output value of the construction works in the country accounted for CNY 25.92 trillion (USD 4.02 trillion) in 2021, compared to CNY 23.27 trillion (USD 3.37 trillion) in 2020. This led to an increase in the demand for flooring and wall covering, which, in turn, increased the demand for the bioplasticizers market.

- In India, the construction sector is an important pillar for the growth of the economy. The government is taking a number of steps to make sure that the country has good infrastructure by a certain date.The Indian government has been actively boosting housing construction as it aims to provide houses to about 1.3 billion people.

- Furthermore, according to the US Census Bureau, the annual value of new construction put in place in the United States accounted for USD 1,792 billion in 2022, compared to USD 1,626 billion in 2021. Moreover, the annual value of residential construction put in place in the United States was valued at USD 908 billion in 2022, an increase of 13% compared to USD 803 billion in 2021.

- Thus, with the growing demand for the conservation of water resources, the use of plasticizers is rapidly increasing in flooring and wall coverings.

- Owing to all these factors, the demand for bio-plasticizers is likely to grow across the world during the forecast period.

The Asia-Pacific Region to Dominate the Market Growth

- The Asia-Pacific construction industry is the largest in the world. It is growing at a healthy rate because the middle class is getting richer and more people are moving to cities.

- The expansion of the industry has also benefited from the addition of infrastructure and the entry of significant players from the European Union into China's lucrative market.

- China's construction industry has developed rapidly in the past few years, due to the central government's push for infrastructure investment as a means to sustain economic growth. China was leading in the construction industry, with an added value of USD 1.29 trillion in 2022.

- Also, the total floor space of new homes built in Japan in 2022 was about 69 million square meters, which was less than the 70 million square meters built in 2021. Additionally, in 2022, approximately 859,500 housing starts were initiated in Japan. This led to an increase in the consumption of bio-plasticizers for applications like wire, cables, flooring, and wall coverings.

- Foreign investment restrictions have also been lifted for land development, high-end hotels, office buildings, international exhibition centers, and building and running big theme parks. Over the next few years, the bioplasticizers market in the region is likely to grow due to growth in the infrastructure and transportation sectors.

- The Packaging Industry Association of India (PIAI) also says that India is becoming a place where the plastic packaging industry likes to be. The packaging industry is the fifth-largest sector in the Indian economy.

- The healthcare industry is growing steadily, with spending on healthcare and the number of medical facilities in the country going up every year. Indian government policies that have been made more open have also made it possible for 100% foreign direct investment in the medical devices market.

- In India, the government introduced the world's largest government-funded healthcare program, the NHP Scheme. In the Economic Survey of 2022, India's public expenditure on healthcare stood at 2.1% of GDP in 2021-22, compared with 1.8% in 2020-21. Additionally, the Indian government is planning to introduce a credit incentive program worth INR 500 billion (USD 6.8 billion) to boost the country's healthcare infrastructure.

- Therefore, the abovementioned factors are expected to have a significant impact on the market during the forecast period.

Bio Plasticizers Industry Overview

The bio-plasticizers market is partially consolidated in nature. Some major players in the market (not in any particular order) include Dow, Evonik Industries AG, Cargill, Inc., BASF SE, and Jungbunzlauer Suisse AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Flexible PVC

- 4.1.2 Stringent Phthalate Regulations to Boost the Use of Bio-Plasticizers

- 4.2 Restraints

- 4.2.1 Availability of Alternatives to bio-plasticizers

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Epoxidized Soybean Oil (ESBO)

- 5.1.2 Castor Oil

- 5.1.3 Citrates

- 5.1.4 Succinic Acid

- 5.1.5 Other Types

- 5.2 By Application

- 5.2.1 Wire and Cables

- 5.2.2 Film and Sheet

- 5.2.3 Flooring, Roofing and Wall Covering

- 5.2.4 Medical Devices

- 5.2.5 Consumer Goods

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avient Corporation

- 6.4.2 BASF SE

- 6.4.3 Cargill, Inc.

- 6.4.4 DIC CORPORATION

- 6.4.5 Dow

- 6.4.6 Emery Oleochemicals

- 6.4.7 Evonik Industries AG

- 6.4.8 Hebei Jingu Plasticizer Co. Ltd.

- 6.4.9 Jiangxi East Huge Dragon Chemical Co. Ltd.

- 6.4.10 Jungbunzlauer Suisse AG

- 6.4.11 LANXESS

- 6.4.12 Matrica SpA

- 6.4.13 OQ Chemicals gmbH

- 6.4.14 Roquette Freres

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Research In Bio-Based Plasticizers