|

市场调查报告书

商品编码

1687442

全氟烷氧基烷 (PFA):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Perfluoroalkoxy Alkane (PFA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

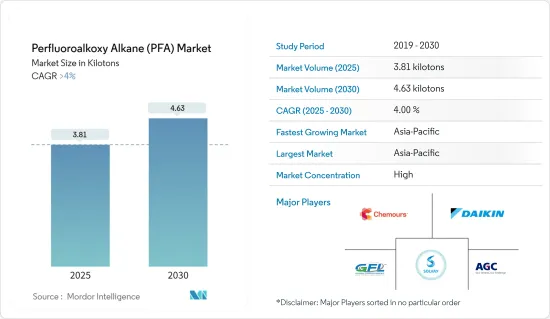

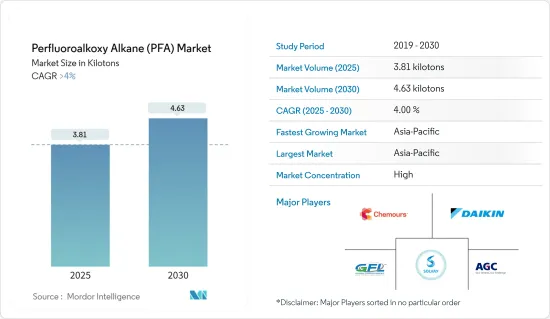

全氟烷氧基烷市场规模预计在 2025 年为 3.81 千吨,预计在 2030 年将达到 4.63 千吨,预测期内(2025-2030 年)的复合年增长率将超过 4%。

由于旅行限制导致供应链中断,COVID-19 疫情对市场产生了负面影响。但此后市场已復苏。自那时起,石油和天然气、化学加工和半导体行业的稳定成长推动了市场的发展。

主要亮点

- 关键流体输送管应用对高纯度和超纯度 PFA 的需求不断增长是推动市场成长的主要驱动力之一。此外,PFA 树脂在半导体行业日益广泛的使用也有望推动市场成长。

- 另一方面,PFA 的环境和健康风险可能会减缓市场成长。

- PFA 在锂离子电池中的应用日益广泛,也可能促进市场成长。

- 由于化学加工、石油和天然气、电气绝缘和半导体等行业的需求旺盛,亚太地区很可能在未来几年引领 PFA 市场。

全氟烷氧基烷(PFA)市场趋势

化学加工应用可望主导市场

- 全氟烷氧基烷(PFA)经常用于化学加工行业,因为它们可以承受高温、机械衝击和热应力。

- PFA具有优良的耐化学性,渗透性低,透光性率高,耐紫外线和可见光,表面光滑,表面能低,耐候性优良,耐高温和热稳定性好,防水性和抗污性优良,纯度高,电气性能优良,不燃烧且发烟量少,因此用于防腐蚀衬里和涂层。

- PFA 在化学加工工业中的应用包括密封件、O 形环、垫圈、编织填料、机械轴封、阀座、阀桿填料、衬里阀门、配件、泵、视镜、流量计、衬里管、浸管、塔、管柱、伸缩接头、波纹管、软管管、油管、捲管、过滤器、衬里、罐、管柱交换器、水雾器、电缆。

- 美国是世界主要化工产品生产国之一。 2022年该国化学品生产指数为95.5,与前一年同期比较去年同期成长2.24%。

- 根据经济分析局预测,2022年美国化学产品产业增加价值约5,013.9亿美元,与前一年同期比较成长12%。

- 随着化学加工产业的兴起,世界各地的一些大公司已经开始扩大业务或进入化学加工产业。例如,2022年12月,沙乌地阿美与法国石油公司道达尔能源合作,在沙乌地阿拉伯投资110亿美元开发石化综合体。

- 因此,化学加工应用很可能在未来几年引领市场。

亚太地区可望主导市场

- 亚太地区已成为世界化学加工中心。中国、印度、日本等国家的化学工业正在快速成长。亚洲占据全球化学品市场的最大份额。过去十年来,该地区一直占据全球化学品市场的一半以上。

- 中国不仅是最大的化学品市场,也是成长最快的市场之一。根据VCI(德国化学工业协会)的数据,到2022年,中国将成为全球第三大化学品出口国,占全球化学品出口以金额为准的9.3%。

- 同时,印度是世界第三大聚合物消费国、第四大农药生产国和第六大化学品生产国。到 2025 年,化学品的需求预计将以每年 9% 的速度成长。据 IBEF 称,到 2025 年,化学工业预计将为印度的 GDP 贡献 3,000 亿美元。

- 全氟烷氧基烷(PFA)用于半导体,因为它们在变化的负载下能够持续很长时间。此外,其更好的电气性能和抗应力开裂性能使其成为半导体行业的理想选择。据印度电子和半导体协会称,到 2025 年,该国的半导体元件业务价值将达到 323.5 亿美元。政府正在进行的「印度製造」宣传活动可能会吸引对该国半导体产业的投资。

- 日本占全球半导体製造设备和材料销售额的30%以上。 SEMICON Japan 2022 将于 2022 年 12 月在东京 Big Sight 举行,届时将汇集参与微电子製造供应链的国内外公司,深入了解最新的技术创新、发展和趋势。在日本,半导体製造业的发展势头强劲,推动了对 PFA 的需求。

- PFA 的摩擦係数较低,且耐热、耐化学腐蚀。因此,它们经常用于石油和天然气工业的密封件、垫圈和滑动轴承。中国虽然是世界第二大油气消费国,但产量却只排第六。预计2023年该国原油产量将达2.08亿吨,较2022年成长1.6%。

- 总体而言,预计亚太地区将在预测期内引领市场。

全氟烷氧基烷(PFA)产业概览

全氟烷氧基烷(PFA)市场日益被主要企业垄断,排名前五或六家的公司占据了大部分市场占有率。市场的主要企业包括科慕公司、DAIKIN INDUSTRIES、古吉拉特邦氟化学公司、索尔维、AGC 公司、3M 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- PFA 树脂在半导体产业的应用不断扩大

- 关键流体输送管应用对高纯度和超纯 PFA 的需求不断增加

- 限制因素

- 与 PFA 相关的环境和健康危害

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 供应概况

- 原料分析

第五章 市场区隔

- 产品类型

- 水性分散体

- 颗粒/粉末

- 应用

- 石油和天然气

- 化学加工工业

- 光纤

- 半导体

- 烹调器具和烤盘涂料

- 电气绝缘

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 越南

- 马来西亚

- 印尼

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 俄罗斯

- 土耳其

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 埃及

- 卡达

- 奈及利亚

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- 3M

- AGC Inc.

- Daikin Industries Ltd

- Gujarat Fluorochemicals

- Hubei Everflon Polymer Co. Ltd

- Li Chang Technology(Ganzhou)Co. Ltd

- RTP Company

- Solvay

- The Chemours Company

- Zeus Industrial Products Inc.

- Zibo Bainaisi Chemical Co. Ltd

第七章 市场机会与未来趋势

- 扩大 PFA 在锂离子电池的应用

The Perfluoroalkoxy Alkane Market size is estimated at 3.81 kilotons in 2025, and is expected to reach 4.63 kilotons by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the market because of the travel restrictions causing supply chain disruptions. However, the market has since recovered. Since then, steady growth in the oil and gas, chemical processing, and semiconductor industries has driven the market.

Key Highlights

- The growing need for high- and ultra-high-purity PFA in critical fluid transport tubing applications is one of the main drivers of market growth. The growing use of PFA resin in the semiconductor industry is also expected to increase market growth.

- On the other hand, the environmental and health risks of PFA are likely to slow the growth of the market.

- The growing use of PFA in lithium-ion batteries may also boost the growth of the market.

- Due to high demand from industries like chemical processing, oil and gas, electrical insulation, and semiconductors, Asia-Pacific is likely to lead the PFA market over the next few years.

Perfluoroalkoxy Alkane (PFA) Market Trends

Chemical Processing Applications are Expected to Dominate the Market

- Perfluoroalkoxy alkane, or PFA, is used a lot in the chemical processing industry because it can withstand high temperatures, mechanical shock, and thermal stress.

- PFA is used for corrosion protection liners and coatings because it has good chemical resistance and low permeation, good light transparency, good resistance to UV and visible light, smooth surface, low surface energy, good resistance to weathering, high temperature and thermal stability, water repellent and anti-staining, high purity, excellent electric properties, and does not burn and makes little smoke.

- Some of the applications of PFA in the chemical processing industry include seals, o-rings, gaskets, braided packing, mechanical seals, valve seats, valve stem packing, lined valves, fittings, pumps, sight glasses, flow meters, lined pipes, dip pipes, columns, tanks, expansion joints, bellows, hoses, tubing, convoluted tubing, filters, de-misters, strainers, column packing, heat exchanger tubing, and lining and tracing heating cables.

- The United States is one of the world's leading producers of chemical products. In 2022, the chemical production index in the country was 95.5, indicating a 2.24% growth over the previous year.

- According to the Bureau of Economic Analysis, the value added by the chemical products industry in the United States in 2022 was around USD 501.39 billion, a 12% rise over the previous year.

- With the rising chemical processing sector, several big firms throughout the world have begun to develop their operations or enter the chemical processing industry. For example, in December 2022, Saudi Aramco cooperated with TotalEnergies, a French oil company, to develop a petrochemical complex in Saudi Arabia for an anticipated USD 11 billion investment.

- Thus, it is likely that chemical processing applications will lead the market during the next few years.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific has grown to be the hub for chemical processing across the world. The chemical industry in countries such as China, India, and Japan has been growing rapidly. Asia holds the largest share of the global chemical market. Over the last decade, the region has continuously accounted for more than half of the global chemical market.

- China is not just the largest market for chemicals, but it is also one of the fastest expanding. According to the VCI (Association of the Chemical Industry e.V.), in 2022, China was the world's third-largest chemical exporting nation, with a share of 9.3% of global chemical exports based on value.

- India, on the other hand, is the third-largest consumer of polymers, the fourth-largest producer of agrochemicals, and the sixth-largest producer of chemicals in the world. The demand for chemicals is expected to expand by 9% per year by 2025. According to IBEF, the chemical industry is expected to contribute USD 300 billion to India's GDP by 2025.

- Perfluoroalkoxyalkane (PFA) is used in semiconductors because it lasts longer under changing loads. Also, its better electrical properties and resistance to cracking under stress make it a great choice for the semiconductor industry. According to the India Electronics and Semiconductor Association, the country's semiconductor component business will be valued at USD 32.35 billion by 2025. The government's ongoing "Make in India" campaign is likely to lead to investments in the country's semiconductor industry.

- Japan accounts for more than 30% of global semiconductor manufacturing equipment and material sales. SEMICON Japan 2022 brought together Japanese and international companies from across the microelectronics manufacturing supply chain in December 2022 at Tokyo Big Sight for insights into the latest technological innovations, developments, and trends. The growing efforts in the country to make more semiconductors are driving up the demand for PFA.

- PFA has a low coefficient of friction and is resistant to heat and chemicals. This makes it a popular choice for seals, gaskets, and slide bearings in the oil and gas industry. China is the world's second-largest consumer of oil and gas, yet it ranks just sixth in terms of production. The country's crude oil production rose to 208 million metric tons in 2023, marking a 1.6% increase compared to 2022.

- Thus, because of the above factors, it seems likely that Asia-Pacific will lead the market during the forecast period.

Perfluoroalkoxy Alkane (PFA) Industry Overview

The perfluoroalkoxy alkane (PFA) market is majorly consolidated in nature, with the top five or six players accounting for the majority of the share in the market. The major players in the market include The Chemours Company, Daikin Industries, Gujarat Fluorochemicals, Solvay, AGC Inc., and 3M, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application of PFA Resin in the Semiconductor Industry

- 4.1.2 Increasing Demand for High- and Ultra High-purity PFA in Critical Fluid Transport Tubing Applications

- 4.2 Restraints

- 4.2.1 Environmental and Health Hazards Associated With PFA

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Supply Overview

- 4.6 Raw Material Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Aqueous Dispersion

- 5.1.2 Pellets/Powder

- 5.2 Application

- 5.2.1 Oil and Gas

- 5.2.2 Chemical Processing Industry

- 5.2.3 Fiber Optics

- 5.2.4 Semiconductor

- 5.2.5 Cookware and Bakeware Coatings

- 5.2.6 Electrical Insulation

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Vietnam

- 5.3.1.7 Malaysia

- 5.3.1.8 Indonesia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Russia

- 5.3.3.8 Turkey

- 5.3.3.9 Rest of the Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 Nigeria

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 Daikin Industries Ltd

- 6.4.4 Gujarat Fluorochemicals

- 6.4.5 Hubei Everflon Polymer Co. Ltd

- 6.4.6 Li Chang Technology (Ganzhou) Co. Ltd

- 6.4.7 RTP Company

- 6.4.8 Solvay

- 6.4.9 The Chemours Company

- 6.4.10 Zeus Industrial Products Inc.

- 6.4.11 Zibo Bainaisi Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Use of PFA In Lithium-ion Batteries