|

市场调查报告书

商品编码

1687446

智慧照明:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Smart Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

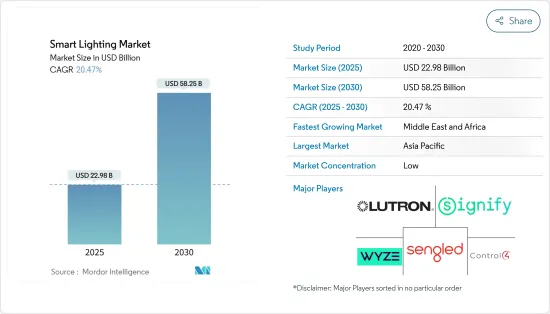

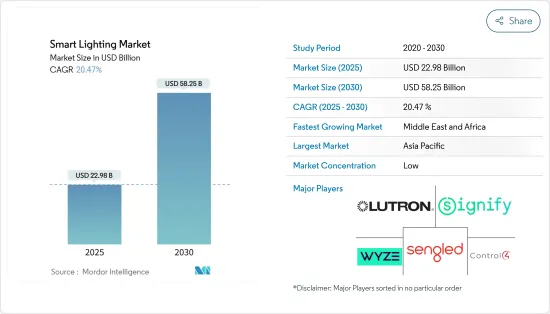

智慧照明市场规模预计在 2025 年为 229.8 亿美元,预计到 2030 年将达到 582.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 20.47%。

由于对节能家居解决方案的需求不断增加,智慧照明市场正在经历强劲成长。这一增长是由不断变化的消费行为、技术进步、积极的政府政策以及发光二极体(LED) 等技术的采用所推动的。智慧照明系统旨在优化电力使用,透过精确控制照明水平和时间表,进一步刺激市场扩张。

主要亮点

- 此外,感测器和连接的整合使智慧照明能够适应自然光和房间占用情况,有助于推动市场扩张。包括政府和环境机构制定的政策在内的全球措施都提倡节能照明,以减少碳排放和应对气候变化,从而进一步推动市场发展。

- 消费者对个人化家居环境的兴趣以及对家庭节能解决方案的需求不断增加,推动了市场成长。智慧照明系统提供广泛的客製化功能,让使用者可以调整亮度、颜色和温度以营造他们想要的氛围。此外,连网家庭的普及度激增以及人们对室内设计和家庭自动化的兴趣日益浓厚,推动了对兼具功能性和美观性的智慧照明解决方案的需求。

- 人们越来越意识到照明对健康和幸福的影响,这推动了对家庭节能解决方案的需求,同时智慧照明解决方案的采用激增,从而推动了市场成长。

- 各个品牌之间缺乏标准化通讯协定和相容性,让消费者感到困惑,使产品选择更加困难。未来前景、升级选项以及与新兴技术的互通性的不确定性进一步加剧了这一挑战,阻碍了明智的决策和采用。

智慧照明市场趋势

智慧灯具和固定装置产品类型预计将占据相当大的市场占有率

- 技术创新、能源效率目标以及对智慧城市计画的日益关注正在改变照明产业,其中智慧灯具和设备占据主导地位。这些解决方案正在重新定义全球照明系统的操作,提供增强的功能性、连接性和永续性优势。

- 世界各国政府都在推出智慧城市计划,将支援物联网的灯具和设备融入街道照明改造和即时监控等用途。值得注意的例子包括美国的智慧城市计划和印度的智慧城市计划,两者都强调了智慧照明系统的重要性。

- 2023 年 10 月,德国电信与边缘物联网解决方案公司 cThings.co 合作展示了 5G 网路切片对关键城市基础设施的潜力。此次演示是在波兰克拉科夫最近启动的 hubraum 5G 测试实验室上进行的。 things.co 和美国Valmont 合作推出的一款产品,聚焦于专为智慧城市应用而客製化的智慧灯桿。

- 智慧照明解决方案依靠物联网 (IoT) 实现设备通讯来优化照明。此网路包括感测器、继电器、网关和其他组件,用于传输运转率、时间和日光资料,以实现高效的照明管理。

- Nobi 是创新老年科技解决方案的全球领导者,并与美国最大的老年住宅营运商之一 Frontier Senior Living 建立合作伙伴关係。作为合作的一部分,Nobi 的 AI 智慧灯将安装在 56 个 Frontier 社区,涵盖 3,700 户家庭。该计划旨在提高跌倒检测和预防能力,使老年护理更加安全并挽救生命。

- Nobi 的人工智慧灯将时尚的设计与便利的功能相结合,可轻鬆融入老年人的生活空间。此灯可即时侦测跌倒并提供支援自然睡眠模式的照明,同时确保强大的隐私,从而防止跌倒。 Nobi 的人工智慧智慧灯凭藉其时尚的设计和先进的功能完美融入老年人生活环境。此灯有助于预防跌倒,即时侦测跌倒情况并根据居住者的自然昼夜节律调节照明。该灯不是标准的天花板灯具,而是配备了四个摄影机。

- 但这不是传统的CCTV摄影机。该灯并不录製视频,而是每秒拍摄一张影像。然后,人工智慧会将图像中的人物替换为火柴人,确保居住者的隐私受到保护。

亚太地区预计将占据主要市场占有率

- 智慧照明允许用户透过智慧型手机应用程式或其他连接设备控制和自动化家中的照明,从而无需手动开关。这些系统提供色彩调整、计划操作、自动调光和基本照明功能等功能。随着时间的推移,智慧照明已被证明既节能又划算,既增加了便利性又减少了开支。

- 根据报道,截至2024年初,中国网路用户数将达10.9亿,网路普及率为76.4%。数位人口的成长将推动智慧照明市场的发展。快速的经济发展推动了中国照明产业取得重大进步,发光二极体(LED)和智慧LED照明被广泛采用,改变了城市空间、家庭和企业。 LED智慧照明现已广泛应用于住宅、商业、工业和公共基础设施领域。

- 日本是亚太地区第二大智慧照明市场,经历了十年的技术变革,彻底改变了智慧家庭并重塑了社会和经济格局。这种转变是由老龄化社会对医疗保健的重视所推动的,旨在提高老年人及其家庭的生活水准。智慧家庭系统,包括照明、气候控制、安全和娱乐,可透过语音命令、行动应用程式或集中式集线器无缝操作。此外,以Softbank Robotics的 Pepper 为例,日本机器人技术也取得了进步,推出了专为智慧家庭整合而设计的机器人伴同性。

- 印度是世界第一人口大国和电力消耗大国,电力供需缺口不断扩大,导致停电事件频繁发生。随着政府大力推行节能解决方案,照明产业成为人们关注的焦点,该产业使用了全国近 18% 的电力,推动了智慧照明市场的成长。

- 智慧照明具有远端控制、自订亮度和与智慧家庭系统相容等功能,在越南迅速普及。这一增长是由都市化和能源效率意识的提高所推动的。作为越南智慧城市计画的一部分,该国 63 个省市中的 48 个正在实施智慧路灯计划,正如在河内举行的 2023 年越南-亚洲智慧城市会议所强调的那样。 Signify NV(原为飞利浦照明)正在积极推广其 CityTouch Connect App 等智慧照明解决方案,并旨在将其融入这些计划中。

智慧照明产业概况

成本、效率和品质是住宅和商业部门选择智慧照明产品时的主要考虑因素。新竞争对手的进入正在加剧竞争,降低价格并使消费者受益。这些新参与企业以更低的价格提供同等品质的产品,迫使 Signify NV 和 Acuity Brands, Inc. 等现有企业调整价格,但竞争动态使他们的价格高于新参与企业。

智慧照明公司与住宅和商业集团之间的合作正在帮助主要企业加强其市场影响力。例如,模组化智慧照明解决方案领导者 Deako, Inc. 最近与 Buildertrend 的 CBUSA 签署了为期三年的独家协议。透过此次合作,Deako, Inc. 成为 CBUSA 建筑商网路的独家智慧照明提供商,该建筑商网路每年建造超过 13,000 套住宅。开发商(包括客製化住宅开发商)现在可以使用 Deako, Inc. 的取得专利的智慧照明技术来提高新建筑的安全性、便利性和能源效率。

随着政府注重智慧城市的效率和智慧化,客户面临越来越大的压力,要求从传统照明转向智慧照明解决方案,如智慧 LED、调光器、智慧灯泡和灯,这可能会刺激对智慧照明产品的需求。

飞利浦照明(Signify)和欧司朗照明等领导企业正在利用其强大的市场影响力和先进的智慧照明解决方案,增加研发投入并扩展到邻近的竞争市场。预计此策略方针将适度增加市场竞争对手之间的竞争,从而促进更具活力的商业环境。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- PESTLE分析

第五章 市场动态

- 市场驱动因素

- 家庭节能需求日益增加

- 政府法规强制使用 LED

- 市场挑战

- 缺乏产品选择和安装意识

- 市场机会

- 新兴国家扩大物联网应用

第 6 章住宅智慧照明产品中使用的无线连线标准类型

- Wi-Fi

- Bluetooth

- ZigBee

第七章 市场区隔

- 依产品类型

- 控制系统

- 有线

- 无线的

- 智慧照明

- 控制系统

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第八章 竞争格局

- 公司简介

- Control4 Corp.(Snap One LLC)

- Lutron Electronics Co. Inc.

- Signify NV

- Wyze Labs Inc.

- Sengled

- GE Lighting(Savant Systems Inc .)

- Eaton Corporation Plc

- Acuity Brands Inc.

- Hubbell Incorporated

- Crestron Electronics Inc.

- Insteon(Smartlabs Inc.)

- EGLO Leuchten GmbH

- Eve Systems GmbH

- Nanoleaf Canada Ltd.

- Wipro Lighting Limited

- Xiaomi Corporation

- Feit Electric(LIFX)

9.控制系统供应商市场占有率分析

第十章 投资分析

第 11 章 市场的未来

The Smart Lighting Market size is estimated at USD 22.98 billion in 2025, and is expected to reach USD 58.25 billion by 2030, at a CAGR of 20.47% during the forecast period (2025-2030).

The smart lighting market is experiencing robust growth, driven by increasing demand for energy-efficient home solutions. This growth is supported by evolving consumer behaviors, technological advancements, proactive government policies, and the adoption of technologies like light-emitting diodes (LEDs). Smart lighting systems, designed to optimize electricity use, provide precise control over lighting levels and schedules, further fueling market expansion.

Key Highlights

- Additionally, the integration of sensors and connectivity enables smart lighting to adapt to natural light and room occupancy, bolstering market expansion. Global initiatives, including policies from governments and environmental agencies, advocate for energy-efficient lighting to mitigate carbon footprints and address climate change, further energizing the market.

- Consumer interest in personalized home environments, along with the increasing demand for energy-saving solutions at homes, is driving market growth. Smart lighting systems provide extensive customization, enabling users to adjust brightness, color, and temperature for their desired ambiance. Additionally, the surge in popularity of connected homes, coupled with a heightened interest in interior design and home automation, is boosting the demand for smart lighting solutions that blend functionality with aesthetic appeal.

- As awareness of lighting's effects on health and well-being rises, along with the increasing demand for energy-saving solutions at homes, the adoption of smart lighting solutions surges, propelling market growth.

- The lack of standardized protocols and compatibility among various brands creates confusion for consumers, making product selection increasingly difficult. This challenge is further exacerbated by uncertainties surrounding future-proofing, upgrade options, and interoperability with emerging technologies, which collectively hinder informed decision-making and adoption.

Smart Lighting Market Trends

Smart Lamps and Fixtures Product Type Segment is Expected to Hold Significant Market Share

- Technological innovations, energy efficiency goals, and a heightened focus on smart city initiatives are driving a transformative shift in the lighting industry, with smart lamps and fixtures leading the way. These solutions are globally redefining lighting system operations, offering enhanced functionality, connectivity, and sustainability benefits.

- Governments worldwide are rolling out smart city initiatives, incorporating IoT-enabled lamps and fixtures for purposes such as adaptive street lighting and real-time monitoring. Notable examples include the U.S.'s smart city deployments and India's Smart Cities Mission, both of which highlight the importance of intelligent lighting systems.

- In October 2023, Deutsche Telekom, in collaboration with edge IoT solutions firm cThings.co showcased the potential of 5G network slicing for vital urban infrastructure. This demonstration was held at the recent launch of the hubraum 5G Testing Lab in Krakow, Poland. The spotlight was on a smart lamp pole, a product of things.co and U.S.-based Valmont, tailored for smart city applications.

- Smart Lighting Solutions relies on the Internet of Things (IoT) to optimize lighting by enabling device communication. The network includes sensors, relays, gateways, and other components that transmit occupancy, time, and daylight data for efficient lighting management.

- Nobi, a global leader in innovative AgeTech solutions, has partnered with Frontier Senior Living, one of the largest senior housing operators in the United States. As part of this collaboration, Nobi's AI-powered Smart Lamps will be installed in 56 Frontier communities, covering 3,700 living units. This effort aims to improve fall detection and prevention, enhancing safety and saving lives in senior care.

- Nobi's AI-powered Smart Lamps fit easily into senior living spaces, combining a stylish design with useful features. These lamps help prevent falls, detect them instantly, and provide lighting that supports natural sleep patterns, all while ensuring strong privacy protection. Nobi's AI-powered Smart Lamps seamlessly integrate into senior living environments with their sophisticated design and advanced functionality. These lamps assist in fall prevention, provide real-time fall detection, and adjust the lighting to align with residents' natural circadian rhythms-all while maintaining strict privacy standards. Replacing standard ceiling fixtures, the lamps are equipped with four cameras.

- However, these are not traditional CCTV cameras. Instead of recording video, the lamps capture one image per second. The AI then replaces the person in the image with a stick figure to ensure residents' privacy is protected.

Asia Pacific is Expected to Hold Significant Market Share

- Smart lighting allows users to control and automate their home lighting through smartphone apps or other connected devices, removing the need for manual switches. These systems offer features such as color adjustments, scheduled operations, auto-dimming, and basic lighting functions. Over time, smart lighting proves to be both energy-efficient and cost-effective, enhancing convenience and reducing expenses.

- As of early 2024, China reported 1.09 billion internet users, with an internet penetration rate of 76.4%. This growing digital population is set to drive the smart lighting market. Rapid economic progress has significantly advanced the country's lighting industry, with widespread adoption of light-emitting diodes (LEDs) and smart LED lighting transforming urban spaces, homes, and businesses.s. Government-backed initiatives and favorable policies have fueled the expansion of China's smart lighting market, fostering innovation and increasing demand. LED smart lighting is now extensively utilized across residential, commercial, industrial, and public infrastructure sectors.

- Japan, being the 2nd most major market of smart lighting in the Asia Pacific, has witnessed a decade-long technological evolution, revolutionizing smart homes and reshaping societal and economic landscapes. This transformation, driven by the aging population's focus on healthcare, has improved living standards for seniors and their families. Smart home systems, including lighting, climate control, security, and entertainment, are seamlessly operated through voice commands, mobile apps, or centralized hubs. Additionally, Japan's advancements in robotics, such as SoftBank Robotics' Pepper, have introduced robotic companions designed for smart home integration.

- India, the most populous country and a key electricity consumer, struggles with a growing disparity between electricity demand and supply, causing frequent power outages. 'The lighting sector, which uses nearly 18% of the nation's electricity, is in focus as the government promotes energy-efficient solutions, driving growth in the smart lighting market.

- Smart lighting, defined by features like remote operation, customizable brightness, and compatibility with smart home systems, is rapidly gaining popularity in Vietnam. This growth is driven by urbanization and increased energy efficiency awareness. As part of Vietnam's smart city initiatives, 48 out of 63 provinces and cities are implementing smart street lighting projects, as highlighted during the Vietnam - Asia Smart City Conference 2023 in Hanoi. Signify N.V. (formerly Philips Lighting) actively promotes its smart lighting solutions, such as the CityTouch Connect App, aiming to integrate them into these projects.

Smart Lighting Industry Overview

Cost, efficiency, and quality are key considerations for residential and commercial sectors when selecting smart lighting products. The entry of new competitors into the global smart lighting market has intensified competition, driving prices down and benefiting consumers. These new entrants offer comparable quality at lower prices, pressuring established companies like Signify N.V. and Acuity Brands, Inc. to adjust their pricing, though their rates remain higher than those of the newcomers due to competitive dynamics.

Partnerships between smart lighting companies and residential, as well as commercial groups are strengthening the market presence of key players. For instance, Deako, Inc., a leader in modular smart lighting solutions, recently signed an exclusive three-year agreement with CBUSA, a Buildertrend company. This partnership designates Deako, Inc. as the sole smart lighting provider for CBUSA's builder network, which constructs over 13,000 homes annually. Builders, including custom home developers, now have access to Deako, Inc.'s patented smart light technology, enhancing safety, convenience, and energy efficiency in new constructions.

As governments in various countries are focusing on efficiency and smart adoption in smart cities, the demand for smart lighting products will rise as there is increasing pressure on customers to shift from conventional lighting to smart lighting solutions such as Smart LEDs, dimmers, and, smart bulbs and lights, etc.

Major companies, such as Philips Lighting (Signify) and Osram Licht AG, are leveraging their strong market presence and advanced smart lighting solutions by increasing R&D spending and expanding into nearby competitive markets. This strategic approach is anticipated to moderately increase the level of competitive rivalry within the market, fostering a more dynamic business environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 PESTLE Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Energy Saving at Homes

- 5.1.2 Government Regulations Mandating the Use of LEDs

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness Regarding Selection and Installation of Products

- 5.3 Market Opportunities

- 5.3.1 Increasing Adoption of IoT in Emerging Economies

6 WIRELESS CONNECTIVITY STANDARD TYPES USED IN RESIDENTIAL SMART LIGHTING PRODUCTS

- 6.1 Wi-Fi

- 6.2 Bluetooth

- 6.3 ZigBee

7 MARKET SEGMENTATION

- 7.1 By Product Type

- 7.1.1 Control System

- 7.1.1.1 Wired

- 7.1.1.2 Wireless

- 7.1.2 Smart Lamps and Fixtures

- 7.1.1 Control System

- 7.2 By Geography

- 7.2.1 North America

- 7.2.1.1 United States

- 7.2.1.2 Canada

- 7.2.2 Europe

- 7.2.2.1 United Kingdom

- 7.2.2.2 Germany

- 7.2.2.3 France

- 7.2.2.4 Spain

- 7.2.3 Asia

- 7.2.3.1 China

- 7.2.3.2 Japan

- 7.2.3.3 India

- 7.2.4 Australia and New Zealand

- 7.2.5 Latin America

- 7.2.6 Middle East and Africa

- 7.2.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Control4 Corp. (Snap One LLC)

- 8.1.2 Lutron Electronics Co. Inc.

- 8.1.3 Signify N.V.

- 8.1.4 Wyze Labs Inc.

- 8.1.5 Sengled

- 8.1.6 GE Lighting (Savant Systems Inc .)

- 8.1.7 Eaton Corporation Plc

- 8.1.8 Acuity Brands Inc.

- 8.1.9 Hubbell Incorporated

- 8.1.10 Crestron Electronics Inc.

- 8.1.11 Insteon (Smartlabs Inc.)

- 8.1.12 EGLO Leuchten GmbH

- 8.1.13 Eve Systems GmbH

- 8.1.14 Nanoleaf Canada Ltd.

- 8.1.15 Wipro Lighting Limited

- 8.1.16 Xiaomi Corporation

- 8.1.17 Feit Electric (LIFX)