|

市场调查报告书

商品编码

1687451

UV LED-市场占有率分析、产业趋势与统计、成长预测(2025-2030)UV LED - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

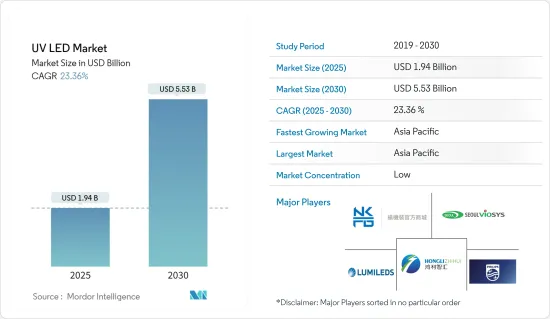

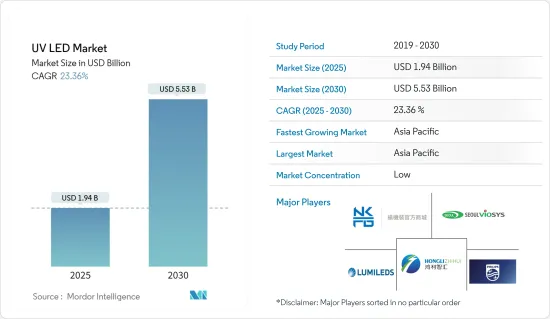

预计 2025 年 UV LED 市场规模为 19.4 亿美元,到 2030 年将达到 55.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 23.36%。

在预计预测期内,各种应用对紫外线 LED 的需求不断增长,以及供应商为进一步增强技术和创造新使用案例而做出的不断努力,将支持所研究市场的成长。

近年来,在紫外线灯(汞、准分子、氙气、汞合金等)已运作数十年的应用中,LED 的采用率显着增长。 UV-LED 的流明密度、稳定性和运作的最新技术改进也使其成为替代传统紫外线光源(如拱灯、热阴极灯、冷阴极灯、汞弧灯和栅格灯)的有效解决方案。此外,由于紫外线 LED 不含有害汞、消费量更低、不会产生臭氧,因此更环保,这也促使其在各种应用中广泛应用。

在光电子领域,UV LED 包括波长范围约为 200nm 至 400nm 的产品,并具有多种封装形式,包括表面黏着技术、通孔和 COB(板载晶片)。 UV LED 有许多独特的应用。然而,这些 LED 的应用高度依赖其功率和波长。

在过去十年中,受消费者接受度不断提高和技术创新的推动,LED 技术的普及度显着提高。例如,根据欧盟委员会联合研究中心和国际能源总署 (IEA) 的估计,LED 在照明产业的渗透率预计将从 2012 年的 1.8% 成长到 2030 年的 87.4%。这些趋势有望推动人们对 LED 技术的认识和接受,为市场创造良好的前景。

然而,紫外线LED的高成本以及紫外线对用户健康的不利影响是该市场成长的主要挑战。此外,UV LED 的低效率和可靠性问题可能会对研究市场的成长构成挑战。

由于 COVID-19 疫情爆发,全球市场对紫外线 LED 的需求显着增加,这得益于其表面消毒和杀菌特性。预计大流行过后医疗保健产业将获得重大推动,从而推动对先进的灭菌和消毒应用解决方案的需求。

UV LED市场趋势

UV-C LED 将主导市场占有率

- 全球对卫生的关注,尤其是医疗保健、酒店和公共空间产业,正在推动对基于 UV-C LED 的解决方案的需求。这些 LED 具有许多优点,包括消毒时间更快、化学品使用量减少以及不含有害产品。此外,UV-C LED 技术的进步使其更有效率、使用寿命更长且更经济实惠。

- 目前製造商正在投入资源进行研发,以提高 UV-C LED 的效率,使其更加方便并适用于各种应用。因此,UV-C 领域预计将大幅扩张,为 UV LED 模组製造商、组件供应商和系统整合商提供宝贵的机会。人们对杀菌处理的重要性和 UV-C LED 的好处的认识不断提高,预计将推动市场成长显着。

- UV-C LED 模组适用于在空气或水循环的系统中产生 UV-C 光。推动 UV-C LED 模组成长的关键因素包括环保 LED 的快速扩张和紫外线固化系统应用的不断增加。由于UV-C LED在消毒方面的实用性,水净化的快速普及是推动UV-C LED产业成长的关键因素。

- 此外,预计在预测期内,将 UV-C LED 技术融入消费性产品和家用电器将为扩大 UV-C LED 市场创造宝贵机会。此外,输出功率和可靠性的提高,以及近期 UV-C LED 单价的下降,正在显着推动市场成长。

亚太地区预计将经历强劲成长

- UV LED 技术在紫外线固化製程的应用日益广泛,推动着市场的成长。与传统干燥工艺相比,紫外线固化工艺更受欢迎。因为结果好得多,废品率更低,整个过程使产品更易溶解、更耐刮。

- UV LED 可用于涂料行业的固化目的,因为它们节能、热量损失小、不含汞、製造占地面积比传统 UV 灯小得多,并且具有更好的光学设计。由于紫外线固化黏合剂比传统黏合剂系统具有诸多优势,该国包装产业的紫外线固化黏合剂使用量大幅成长。

- 日本的汽车工业是世界上最大的汽车工业之一。日本自1960年代以来一直是世界汽车产量前三大国家之一。日本有丰田、铃木、本田等主要汽车製造商。这些公司的服务中心遍布日本各地。紫外线固化在汽车行业的日益广泛应用预计将创造成长机会并扩大该国的市场。

- 韩国以其蓬勃发展的电子製造业而闻名。 UV LED 广泛应用于电子製造过程,包括紫外线固化黏合剂、被覆剂和油墨。随着电子产业的持续成长,製造业对 UV LED 的需求预计会增加。

- 其他亚太地区包括台湾、印度和新加坡。新加坡的公司正在开发新产品并改进现有产品,以满足最终用户的需求并增加市场占有率。

UV LED 产业概览

UV LED 市场高度分散,主要参与者包括 Lumileds Holding BV、Koninklijke Philips NV、NKFG Corporation、鸿利智汇集团和首尔伟傲世 (Seoul Viosys) 等。市场上的公司正在采取联盟和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2024 年 3 月,日亚化学开始大量生产流行的 434 系列封装的新型 UV-B(308nm)和 UV-A(330nm)LED。在保持 434 系列紧凑的 3.5mm x 3.5mm 尺寸的同时,新发布的 UV-B 和 UV-A LED 分别提供业界领先的 90mW 和 100mW(350mA 时)输出,从而最大限度地提高光通量密度。

- 2023 年 11 月,Crystal IS 宣布安丽已在其家用水处理系统 eSpring 中采用该公司的 UVC LED 技术。 UV LED 和 eSpring e3 碳过滤器的独特组合使新 eSpring水质净化能够有效杀死 99.9999% 的细菌、高达 99.99% 的病毒和高达 99.9% 的囊肿。 UV C LED 的使用也使得新款 eSpring水质净化器成为更环保的产品。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 新冠疫情及其他宏观经济因素的影响及后果

第五章市场动态

- 市场驱动因素

- 环保UV LED配置

- 紫外线固化市场采用率不断提高

- 适应性更强,总拥有成本更低

- 市场限制

- 製造复杂性和技术限制不断增加

第六章市场区隔

- 依技术

- UV-A

- UV-B

- UV-C

- 按应用

- 光学感测器和仪器

- 仿冒品检测

- 消毒

- 紫外线固化

- 医学光疗

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚太地区

- 中国

- 日本

- 韩国

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 智利

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 北美洲

第七章竞争格局

- 公司简介

- Lumileds Holding BV

- Koninklijke Philips NV

- NKFG Corporation

- Hongli Zhihui Group

- Seoul Viosys Co. Ltd

- Nichia Corporation

- Semileds Corporation

- EPIGAP OSA Photonics GmbH

- CRYSTAL IS Inc.(Asahi Kasei Corporation)

- Luminus Inc.

- LITE-ON Technology Corporation

第八章投资分析

第九章 市场机会与未来趋势

The UV LED Market size is estimated at USD 1.94 billion in 2025, and is expected to reach USD 5.53 billion by 2030, at a CAGR of 23.36% during the forecast period (2025-2030).

The growing demand for UV LEDs across different applications and increasing efforts made by vendors to enhance the technology further, giving rise to new use cases, are anticipated to support the growth of the market studied during the forecast period.

In recent years, the adoption of LEDs has grown significantly in applications wherein UV lamps (mercury, excimer, xenon, amalgam, etc.) have operated for decades. Recent technological improvements in the flux density, stability, and operating hours of UV-LEDs have also made them an efficient solution for replacing traditional UV light sources such as arch lamps, hot and cold cathode lamps, mercury arc lamps, and grid lamps. Moreover, the fact that UV LEDs are more environmentally friendly, as they do not use harmful mercury, consume less energy, and do not produce ozone, also supports its adoption across various applications.

In optoelectronics, UV LEDs consist of approximately 200 nm to 400 nm products with various package styles, including surface mount, through-hole, and COB (chip-on-board). There are many unique applications for UV LEDs. However, the application cases of these LEDs are greatly dependent on the output power and wavelength.

In the last decade, the prominence of LED technology has grown significantly, driven by increasing consumer acceptance and technological innovations. For instance, according to estimates by the European Commission's Joint Research Center and the International Energy Agency (IEA), the penetration of LEDs in the lighting industry is estimated to grow to 87.4% by 2030, from just 1.8% in 2012. Such trends are anticipated to drive the awareness and acceptance of LED technology, creating a favorable outlook for the market studied.

However, factors such as the higher cost of UV LEDs and the negative impact of UV light on users' health are significant challenges for the market's growth. Furthermore, lower efficiency and issues related to the reliability of UV LEDs may challenge the growth of the market studied.

With the outbreak of COVID-19, the global UV LED market witnessed a significant growth in demand due to its effectiveness in disinfecting surfaces and germ-killing properties. The healthcare sector received a significant boost post-pandemic, which is anticipated to drive the demand for advanced solutions for sterilization and disinfection applications.

UV LED Market Trends

UV-C LED to Hold Major Market Share

- The global focus on hygiene, especially in healthcare, hospitality, and public spaces industries, has increased the demand for UV-C LED-based solutions. These LEDs provide numerous benefits, such as shorter disinfection times, decreased chemical usage, and the absence of harmful byproducts. Moreover, advancements in UV-C LED technology have resulted in improved efficiency, longer lifespan, and greater affordability.

- Manufacturers are currently dedicating resources to research and development to improve the efficiency of UV-C LEDs, making them more convenient and applicable for various uses. Consequently, the UV-C sector is anticipated to experience considerable expansion, presenting valuable opportunities for UV LED module manufacturers, component providers, and system integrators. The growing understanding of the significance of disinfection and the benefits of UV-C LEDs is projected to drive a substantial increase in market growth.

- UV-C LED modules can help generate UV-C light in systems where air and water circulate. Some critical factors advancing the growth of UV-C LED modules include the rapid expansion of the use of environment-safe LEDs and the increase in the application of UV curing systems. Since UV-C LED is practical for disinfection, a surge in the adoption of water purification is a significant factor driving the growth of the UV-C LED industry.

- Furthermore, it is expected that the integration of UV-C LED technology into consumer products and household appliances will create a valuable opportunity to expand the UV-C LED market during the forecast period. Moreover, advancements in output power and reliability and the recent decrease in unit cost prices for UV-C LEDs are significantly driving the market's growth.

Asia-Pacific Expected to Witness Significant Growth

- The increasing use of UV LED technology in the UV curing process is driving the market's growth. The UV curing process is preferred over traditional drying, as the results are much better, rejection rates are low, and the entire process enhances the solvency and scratch resistance of the product.

- UV LED is helpful in curing purposes in the coating industries, as it is more energy-efficient, loses very little heat, contains no mercury, can be manufactured with a much smaller footprint, and has a far better optical design than traditional UV lamps. The use of UV-curable adhesives in the packaging industry is growing tremendously in the country, owing to their advantages over conventional adhesive systems.

- The Japanese automotive industry is one of the most prominent and largest industries in the world. Japan is one of the top three countries with the highest number of cars manufactured since the 1960s. The country is home to some of the major automotive players, such as Toyota, Suzuki, and Honda. These companies have an extensive presence in the country, along with their service centers. The growing application of UV curing in the automotive industry is expected to offer opportunities in the country and augment the market's growth.

- South Korea is known for its thriving electronics manufacturing industry. UV LEDs are used extensively in electronics manufacturing processes such as UV curing adhesives, coatings, and inks. As the electronics industry continues to grow, the demand for UV LEDs in manufacturing is expected to increase.

- The Rest of Asia-Pacific includes Taiwan, India, and Singapore. The companies in Singapore are developing new products or incorporating features in the existing products to meet the demand of the end users and increase their market shares.

UV LED Industry Overview

The UV LED market is highly fragmented with the presence of major players like Lumileds Holding BV, Koninklijke Philips NV, NKFG Corporation, Hongli Zhihui Group, and Seoul Viosys Co. Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In March 2024, Nichia started mass production of the new UV-B (308 nm) and UV-A (330 nm) LEDs in its popular 434 series package. While maintaining the compact 3.5 mm x 3.5 mm size of the 434 series, the newly launched UV-B and UV-A LEDs deliver industry-leading outputs of 90 and 100 mW, respectively (at 350 mA), thus maximizing flux density.

- In November 2023, Crystal IS Inc. announced that Amway had chosen its UVC LED technology for its eSpring home water treatment system. With a unique combination of UV LEDs and eSpring e3 carbon filter, the new eSpring water purifier is 99.9999% effective at killing bacteria, viruses up to 99.99%, and cysts up to 99.9%. The use of UV C LEDs also makes the new eSpring water purifier a more environmentally friendly product, as the new device consumes 25% less energy during active use compared to the previous model.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19, After Effects, and Other Macroeconomic Factors

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Eco-friendly Composition of UV LED

- 5.1.2 Rising Adoption of the UV Curing Market

- 5.1.3 Increasing Adaptability Fueled by Low Total Cost of Ownership

- 5.2 Market Restraints

- 5.2.1 Increasing Manufacturing Complexity and Technical Limitations

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 UV-A

- 6.1.2 UV-B

- 6.1.3 UV-C

- 6.2 By Application

- 6.2.1 Optical Sensors and Instrumentation

- 6.2.2 Counterfeit Detection

- 6.2.3 Sterilization

- 6.2.4 UV Curing

- 6.2.5 Medical Light Therapy

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Chile

- 6.3.4.3 Mexico

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Lumileds Holding BV

- 7.1.2 Koninklijke Philips NV

- 7.1.3 NKFG Corporation

- 7.1.4 Hongli Zhihui Group

- 7.1.5 Seoul Viosys Co. Ltd

- 7.1.6 Nichia Corporation

- 7.1.7 Semileds Corporation

- 7.1.8 EPIGAP OSA Photonics GmbH

- 7.1.9 CRYSTAL IS Inc. (Asahi Kasei Corporation)

- 7.1.10 Luminus Inc.

- 7.1.11 LITE-ON Technology Corporation