|

市场调查报告书

商品编码

1687453

室内农业:市场占有率分析、产业趋势和成长预测(2025-2030)Indoor Farming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

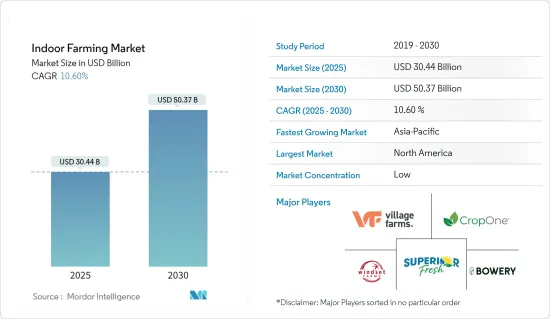

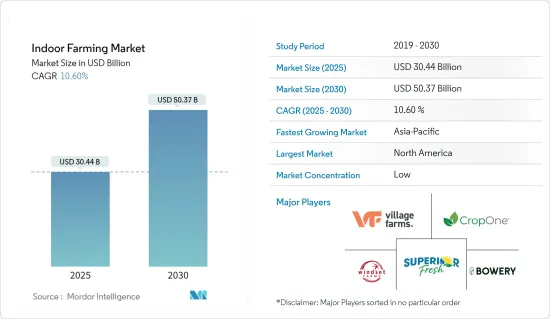

室内农业市场规模预计在 2025 年为 304.4 亿美元,预计到 2030 年将达到 503.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.6%。

主要亮点

- 日益增强的健康意识和无残留食品的消费为室内农业等先进技术的使用铺平了道路。人们在自家小规模种植所需的作物,并透过获取无虫害食品来获得更高的产量。

- 在各种种植类型中,土壤种植占据市场主导地位。与传统农业相比,它能够改善植物的收穫週期,从而推动市场成长。根据设施类型,玻璃温室和聚乙烯温室占据了市场占有率,而室内深水栽培系统预计在预测期内将以最高的复合年增长率成长。中东对永续粮食生产的需求日益增长,这可以透过在农业中采用室内垂直农业技术来实现。

- 2021年,北美占据了最大的市场占有率。美国在该地区贡献了最大的份额,其次是加拿大和墨西哥。室内农业越来越受欢迎的主要原因之一是它能够利用更少的资源来实现更高的产量。例如,根据美国农业部 (USDA) 的数据,垂直农场种植的生菜的平均产量是传统生菜的两倍。受政府政策推动,亚太地区的室内农业市场正在快速成长。

室内农业市场趋势

气候条件对生产的影响

欧盟委员会预计,到2030年,欧盟农业用地面积可能从2017年的1.76亿公顷下降到1.72亿公顷,欧盟可耕地面积也将从2017年的1.065亿公顷下降到1.04亿公顷。

根据世界银行统计,南亚地区耕地占比将从2017年的43.2%下降到2020年的43%。因此,新兴南亚国家耕地面积减少和污染加剧预计将增加对替代种植的需求,包括室内种植。

人均耕地面积正稳定减少,解决方法在于提高生产力。因此,需要产量作物来解决农地短缺问题,同时又不影响产量,而这可以透过室内农业来实现。农业用地减少的主要原因是各个开发中国家的都市化、土地向道路、工业和住宅等非农业用途的转变以及土壤侵蚀和污染。中国约有3.34亿英亩可耕地,其中约3,700万英亩未开垦,人口成长带来重大威胁。增加耕地面积的另一种方法是提高耕地的产量和生产力。这些包括产量品种、肥料和农药管理、机械化、灌溉管理以及采用室内农业等新农业技术。

随着全球可耕地面积的减少,室内农业可以透过使用水耕和人工照明为植物提供只有在户外种植才能获得的营养和光照来帮助提高产量。因此,预测期内对室内农业设备的需求可能会增加。

北美占据市场主导地位

2021 年,北美占据了全球室内农业市场占有率。高效 LED 照明和加强的室内控制正在推动美国种植者采用大规模室内农业。预计此类做法将减少约 50% 的能源照明成本,并减少受控环境农业的碳足迹。根据美国农业部 (USDA) 的数据,垂直农业种植的生菜平均产量是传统生菜的两倍。目前,温室种植是美国室内农业的主导。随着纽约、芝加哥和密尔瓦基等都市区人口开始居住,废弃的仓库、废弃的高层建筑被维修以适应室内农业,增加了新鲜食品的产量。在美国,温室番茄的需求正在推动水耕市场的需求。室内农业是美国发展最快的产业之一。

根据联合国粮食及农业组织统计,墨西哥的旱地面积约为1.015亿公顷,增加了对室内农业的需求。加拿大也正经历成长趋势,并且是全球水耕番茄出口的主要贡献者。该地区水耕和气气耕系统的成长正在推动整个室内农业市场的发展,这主要是因为人们越来越注重采用创新和高效的技术来提高产量。北美国家在室内种植各种各样的作物,包括叶菜类蔬菜、草本植物、水果、微型菜苗和花卉。室内垂直农业系统提供有机食品,北美消费者对不含杀虫剂和除草剂的食品的需求日益增长,这是室内垂直农业的主要推动力。

室内农业产业概况

室内农业市场高度分散,主要企业占有较小份额,其他较小参与者则占有较大份额。

市场高度分散,主要收益公司如 Village Farms International Inc.、Superior Fresh Inc.、Crop One Holdings Inc.、Windest Farms Inc. 和 Bowery Inc. 占据了部分市场占有率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 市场限制

- 波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 栽培系统

- 水耕栽培

- 水耕

- 水产养殖

- 土壤基

- 杂交种

- 设施类型

- 玻璃或聚乙烯温室

- 室内垂直农场

- 货柜农场

- 室内深水养殖系统

- 其他设施类型

- 作物类型

- 水果和蔬菜

- 绿叶

- 莴苣

- 羽衣甘蓝

- 菠菜

- 其他叶菜类

- 番茄

- 草莓

- 茄子

- 其他水果和蔬菜

- 香草和微型菜苗

- 罗勒

- 草药

- 香艾菊

- 小麦草

- 其他香草和微型菜苗

- 花朵

- 多年生植物

- 年度的

- 室内植物

- 其他花卉

- 其他作物

- 水果和蔬菜

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 新加坡

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲国家

- 北美洲

第六章 竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- AeroFarms

- Bright Farms Inc.

- Bowery Inc.

- Crop One Holdings

- Metropolis Farms Inc.

- Garden Fresh Farms

- Village Farms International Inc.

- Green Sense Farms LLC

- Sky Greens(Sky Urban Solutions)

- Superior Fresh Farms

- Windset Farms

- Gotham Greens

第七章 市场机会与未来趋势

The Indoor Farming Market size is estimated at USD 30.44 billion in 2025, and is expected to reach USD 50.37 billion by 2030, at a CAGR of 10.6% during the forecast period (2025-2030).

Key Highlights

- An increase in health consciousness and consumption of residue-free food has paved the way for the usage of advanced techniques, like indoor farming. People are growing the necessary crops in their own houses on a small scale to have food free from pests, resulting in a higher yield.

- Among the various growing types, soil-based indoor farming dominates the market. Its ability to enhance the harvesting cycle of plants, when compared to traditional farming, is driving its market growth. By facility type, glass or poly greenhouses occupy a larger market share, while the indoor deep-water culture system is anticipated to witness the highest CAGR during the forecast period. There is an increase in the demand for sustainable food production in the Middle East, which is achievable by adopting indoor vertical farming technologies in agriculture.

- North America accounted for the largest market share in 2021. The US is a major contributor to the region's share, followed by Canada and Mexico. One of the primary reasons indoor farming has been gaining significant traction is because of its ability to produce more with fewer resources. For example, as per the US Department of Agriculture (USDA), the average yield of conventional lettuce farming doubled twofold when cultivated through vertical farming. The indoor farming market in the Asia-Pacific region is growing rapidly, with the industry benefiting from government policies.

Indoor Farming Market Trends

Effect of Climate Conditions on Production

According to the European Commission, the amount of land used for agricultural purposes may fall to 172 million ha in 2030 from the current level of 176 million ha in 2017, with a corresponding decline in the level of EU arable land, from 106.5 million hectares in 2017 to 104 million hectares in 2030.

According to the World Bank statistics, South Asia declined the arable land percentage of the total land from 43.2% in 2017 to 43% in 2020. Thus, a reduction in arable land and an increase in pollution in the developing countries of Southern Asia are expected to increase the demand for alternative cultivation, including indoor farming.

Due to the continuous decline in the per capita availability of farmland, the practice of increasing productivity is a way out. Thus, there is a need for high-yielding crops, which can solve the problem of farmland scarcity without compromising production volumes, which can be attained through indoor farming. The decline in agricultural land has been mainly due to diversion for non-agricultural purposes, such as urbanization, roads, industries, and housing, and soil erosion and pollution in various developing countries. In China, there are approximately 334 million acres of arable land, of which around 37 million acres are non-cultivable, and the growing population poses a major threat. The alternative to creating more arable land is to enhance the yield and productivity of cultivated land. These technologies include high-yielding varieties, the management of fertilizers and pesticides, mechanization, irrigation management, and employing new farming techniques, such as indoor farming.

As the cultivable land is decreasing globally, indoor farming may help increase production by using hydroponics and artificial lighting to provide plants with nutrients and light, as they would only receive when grown outdoors. Thus, the demand for equipment for indoor farming may increase during the forecast period.

North America Dominates the Market

North America accounted for the highest global indoor farming market share in 2021. With the help of high-efficiency LED lights and enhanced indoor management practices, US growers have adopted large-scale indoor farming. Such practices are expected to reduce energy lighting costs by about 50%, thus, reducing the carbon footprint of controlled environment agriculture. As per the US Department of Agriculture (USDA), the average yield of conventional lettuce farming doubled twofold when cultivated through vertical farming. Currently, the indoor farming industry in the US is predominantly dominated by greenhouse crop production. The onset of urban population dwellings across cities, such as New York, Chicago, and Milwaukee, has propelled the environment for indoor farming with activities such as revamping derailed vacant warehouses, derelict buildings, and high rises, which has, in turn, led to an increase in the production of fresh grown foods altogether. The demand for greenhouse tomatoes in the United States is driving the market demand for hydroponic operations. Indoor farming is one of the fastest-growing industries in the United States.

According to the UN Food and Agriculture Organization, drylands in Mexico occupy approximately 101.5 million hectares of land, thereby boosting the need for indoor farming practices. Canada has also seen a positive growth trend, contributing significantly to the world exports of hydroponically grown tomatoes. The region's growth of hydroponics and aeroponics systems is driving the overall indoor farming market, mainly due to the increasing focus on adopting innovative and efficient technologies to improve yields. A wide variety of crops, such as leafy vegetables, herbs, fruits, micro greens, and flowers, are grown through indoor farming in the countries of North America. Indoor vertical farming systems have provided organic food, which has become the major driving force for indoor vertical farming along with the increasing demand for pesticide- and herbicide-free food among the consumers of North America.

Indoor Farming Industry Overview

The market for indoor farming is highly fragmented, with the top players accounting for a minor share and the other small companies capturing a major share in the market.

The market is highly fragmented, with major revenue-generating companies, which are Village Farms International Inc., Superior Fresh, Crop One Holdings, Windest Farms, and Bowery Inc, among others, cornering some parts of the market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Growing System

- 5.1.1 Aeroponics

- 5.1.2 Hydroponics

- 5.1.3 Aquaponics

- 5.1.4 Soil-based

- 5.1.5 Hybrid

- 5.2 Facility Type

- 5.2.1 Glass or Poly Greenhouses

- 5.2.2 Indoor Vertical Farms

- 5.2.3 Container Farms

- 5.2.4 Indoor Deep Water Culture Systems

- 5.2.5 Other Facility Types

- 5.3 Crop Type

- 5.3.1 Fruits and Vegetables

- 5.3.1.1 Leafy Vegetables

- 5.3.1.1.1 Lettuce

- 5.3.1.1.2 Kale

- 5.3.1.1.3 Spinach

- 5.3.1.1.4 Other Leafy Vegetables

- 5.3.1.2 Tomato

- 5.3.1.3 Strawberry

- 5.3.1.4 Eggplant

- 5.3.1.5 Other Fruits and Vegetables

- 5.3.2 Herbs and Microgreens

- 5.3.2.1 Basil

- 5.3.2.2 Herbs

- 5.3.2.3 Tarragon

- 5.3.2.4 Wheatgrass

- 5.3.2.5 Other Herbs and Microgreens

- 5.3.3 Flowers and Ornamentals

- 5.3.3.1 Perennials

- 5.3.3.2 Annuals

- 5.3.3.3 Ornamentals

- 5.3.3.4 Other Flowers and Ornamentals

- 5.3.4 Other Crop Types

- 5.3.1 Fruits and Vegetables

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Singapore

- 5.4.3.6 South Korea

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AeroFarms

- 6.3.2 Bright Farms Inc.

- 6.3.3 Bowery Inc.

- 6.3.4 Crop One Holdings

- 6.3.5 Metropolis Farms Inc.

- 6.3.6 Garden Fresh Farms

- 6.3.7 Village Farms International Inc.

- 6.3.8 Green Sense Farms LLC

- 6.3.9 Sky Greens (Sky Urban Solutions)

- 6.3.10 Superior Fresh Farms

- 6.3.11 Windset Farms

- 6.3.12 Gotham Greens