|

市场调查报告书

商品编码

1687474

铅酸电池-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Lead-acid Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

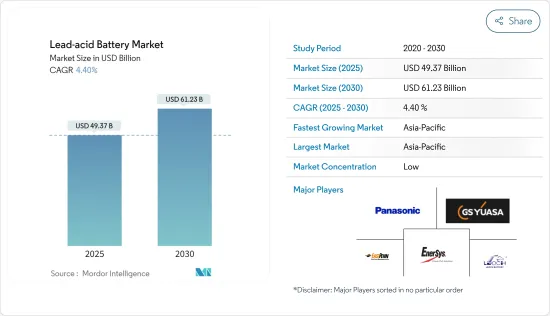

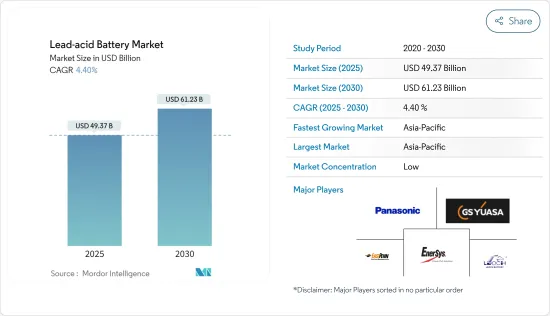

预计 2025 年铅酸电池市场规模为 493.7 亿美元,到 2030 年将达到 612.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.4%。

儘管2020年新冠疫情对市场产生了负面影响,但目前已恢復至疫情前的水准。

主要亮点

- 从中期来看,汽车销售的成长预计将刺激铅酸电池市场的成长。

- 然而,预计成本下降和锂离子电池采用率的提高将阻碍预测期内的市场成长。

- 铅酸电池市场正在经历多项技术发展,如吸收式玻璃纤维隔板 (AGM) 电池和增强型富液电池 (EFB) 技术,预计这些技术将在预测期内为市场提供重大机会。

- 预计亚太地区将主导铅酸电池市场,大部分需求来自中国、日本和印度。

铅酸电池市场趋势

SLI电池领域占据市场主导地位

- SLI 电池专为汽车使用而设计,并始终安装在汽车的充电系统中,这意味着汽车使用时电池会不断充电和放电。 50 多年来,12V 电池一直是最常用的电池。但其平均电压(在汽车中使用并由交流发电机充电时)接近 14 伏特。

- 2021 年,SLI 电池的市场占有率为 75.32%。由于全球汽车产业的成长,预计该细分市场的份额在预测期内将会扩大。OEM和售后市场不断增长的需求正在推动汽车行业的发展。

- SLI 电池市场成长的主要驱动力是对电池的需求不断增长,用于为启动马达、照明、点火系统和其他内燃机供电,同时确保高性能、长寿命和成本效益。

- 铅酸电池是全球所有传统内燃机车辆(例如汽车和卡车)中 SLI 电池应用的首选技术。

- 国际汽车工业组织 (OICA) 表示,全球汽车销售在 2020 年下滑后正在復苏。 2021年全球汽车销量较2020年成长4.96%。

- 虽然未来 30 至 40 年内传统内燃机市场预计将萎缩,但替代汽车技术预计将继续使用 SLI 铅酸电池为各种车载电子设备和安全功能供电。

亚太地区占市场主导地位

- 预计亚太地区将主导铅酸电池市场,大部分需求来自中国、日本和印度。

- 截至2021年,中国是最大的电动车市场,销量约330万辆。

- 电动车的普及与清洁能源政策相吻合。中国政府计划放宽汽车製造商的进口限制,以缩小供需缺口。目前,外国汽车製造商需缴纳25%的进口关税,或必须在中国建厂,且在中国的持股比例上限为50%。预计电动车製造商将率先从这些变化中受益。

- 此外,印度汽车产业的成长、太阳能发电工程数量的增加以及通讯基础设施的持续扩张预计将推动对铅酸电池的需求。

- 电讯业仍然是印度铅酸电池最有前景的终端用户之一。过去十年,印度通讯业实现了强劲成长。例如,根据印度电讯监管局的数据,2022 年 3 月无线和行动电话用户总数达到 11.4208 亿。

- 然而,印度铅酸电池市场正面临锂离子电池技术的挑战,这导致人们更加关注铅酸电池的研发活动。为了保持与锂离子电池的竞争力,製造商面临着提供更高品质、寿命更长、维护更少的电池的压力。

铅酸电池产业概况

铅酸电池市场比较分散。该市场的主要企业(不分先后顺序)包括Panasonic Corporation、GS Yuasa 有限公司、EnerSys、East Penn Manufacturing Co. 和 Leoch International Technology Limited。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2027 年市场规模与需求预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 按应用

- SLI(启动、照明、点火)电池

- 固定电池(电讯、UPS、能源储存系统(ESS)等)

- 可携式电池(用于家用电器等)

- 其他用途

- 依技术

- 沈水式

- VRLA(阀控铅酸蓄电池)

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 义大利

- 英国

- 俄罗斯联邦

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Johnson Controls International PLC

- Exide Technologies Inc.

- GS Yuasa Corporation

- EnerSys

- East Penn Manufacturing Co.

- C&D Technologies Inc.

- Amara Raja Batteries Ltd

- Leoch International Technology Limited

- Panasonic Corporation

第七章 市场机会与未来趋势

The Lead-acid Battery Market size is estimated at USD 49.37 billion in 2025, and is expected to reach USD 61.23 billion by 2030, at a CAGR of 4.4% during the forecast period (2025-2030).

Though COVID-19 negatively impacted the market in 2020, it has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing sales of automobiles are expected to stimulate the growth of the lead-acid battery market.

- On the other hand, declining costs and increasing adoption of lithium-ion batteries are expected to hinder the growth of the market during the forecast period.

- The lead-acid battery market has witnessed several developments in technologies like AGM (Absorbed Glass Mat) batteries and EFB (Enhanced Flooded Battery) technology, which are expected to provide great opportunities for the market during the forecast period.

- Asia-Pacific is expected to dominate the lead-acid battery market, with most of the demand coming from China, Japan, and India.

Lead Acid Battery Market Trends

SLI Battery Segment to Dominate the Market

- SLI batteries are designed for automobiles and are always installed with the vehicle's charging system, which means there is a continuous cycle of charge and discharge in the battery whenever the vehicle is in use. The 12-volt batteries have been the most commonly used for over 50 years. However, their average voltage (while in use in the car and being charged by the alternator) is close to 14 volts.

- The SLI batteries segment held a 75.32% market share in 2021. Its share is expected to grow during the forecast period, owing to worldwide growth in the automotive sector. The growing demand from OEMs and aftermarkets has boosted the automotive sector.

- The major factors attributed to the growth of the SLI battery market are the increasing demand for these batteries to power start motors, lights, ignition systems, or other internal combustion engines while ensuring high performance, long life, and cost-efficiency.

- The lead-acid battery is the technology of choice for all SLI battery applications in conventional combustion engine vehicles, such as cars and trucks worldwide.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), motor vehicle sales globally have been recovering after a downfall in 2020. In 2021, the world witnessed a 4.96% rise in motor vehicle sales compared to 2020.

- Although the conventional combustion engine market is expected to decline over the next 30-40 years, replacement car technologies are expected to continue using SLI-type lead-acid batteries to provide power for various electronics and safety features within the vehicle.

Asia-Pacific to Dominate the Market

- The Asia-Pacific is expected to dominate the lead-acid battery market, with most demand coming from China, Japan, and India.

- As of 2021, China is the largest electric vehicle market, selling around 3.3 million vehicles.

- The increasing adoption of electric vehicles aligns with the clean energy policy. The Chinese government plans to ease restrictions on automakers importing cars into the country to reduce the demand-supply gap. Currently, foreign automakers face a 25% import tariff or have to build a factory in China with a cap of 50% ownership. Electric vehicle makers are expected to be the first to benefit from this change.

- Moreover, in India, the growing automobile sector, the increasing number of solar power projects, and the continuous expansion of telecommunication infrastructure are expected to drive the demand for lead-acid batteries in the country.

- The telecom sector remains one of India's most promising end users for lead-acid battery use. The Indian telecommunication sector has registered strong growth over the past decade. For instance, according to the Telecom Regulatory Authority of India, the total wireless or mobile telephone subscriber base reached 1142.08 million in March 2022.

- However, the lead-acid battery market in India faces challenges from lithium-ion battery technology, which has led to an increased focus on research and development activities pertaining to lead-acid batteries. Manufacturers are being forced to offer high-quality, long-lasting batteries with low maintenance to sustain the competition from lithium-ion batteries.

Lead Acid Battery Industry Overview

The lead-acid battery market is fragmented. Some of the key players in this market (in no particular order) include Panasonic Corporation, GS Yuasa Corporation, EnerSys, East Penn Manufacturing Co., and Leoch International Technology Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 SLI (Starting, Lighting, Ignition) Batteries

- 5.1.2 Stationary Batteries (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.1.3 Portable Batteries (Consumer Electronics, etc.)

- 5.1.4 Other Applications

- 5.2 By Technology

- 5.2.1 Flooded

- 5.2.2 VRLA (Valve Regulated Lead-acid)

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 Italy

- 5.3.2.4 United Kingdom

- 5.3.2.5 Russian Federation

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 South Africa

- 5.3.4.4 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Johnson Controls International PLC

- 6.3.2 Exide Technologies Inc.

- 6.3.3 GS Yuasa Corporation

- 6.3.4 EnerSys

- 6.3.5 East Penn Manufacturing Co.

- 6.3.6 C&D Technologies Inc.

- 6.3.7 Amara Raja Batteries Ltd

- 6.3.8 Leoch International Technology Limited

- 6.3.9 Panasonic Corporation