|

市场调查报告书

商品编码

1910516

不沾涂层:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Non-stick Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

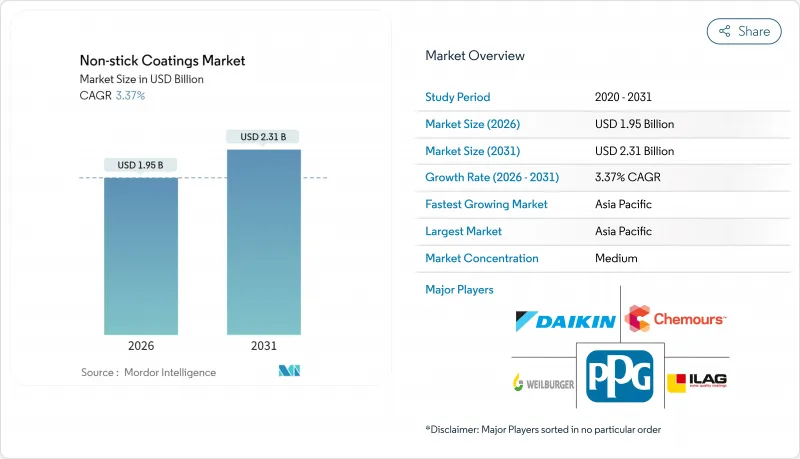

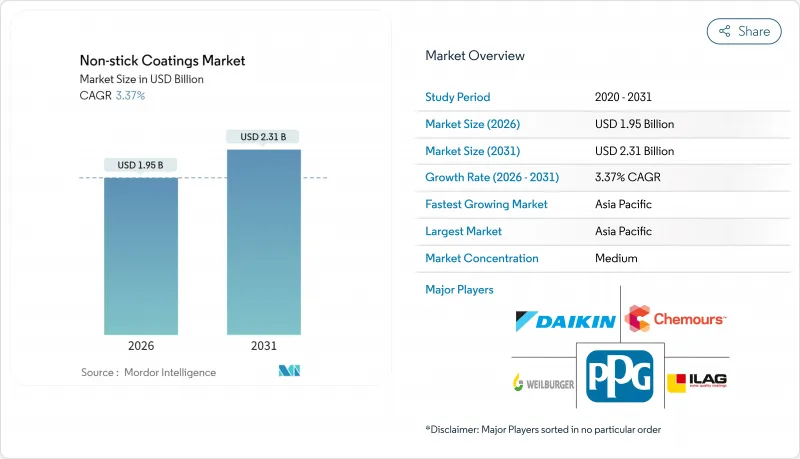

预计不沾涂料市场将从 2025 年的 18.9 亿美元成长到 2026 年的 19.5 亿美元,到 2031 年将达到 23.1 亿美元,2026 年至 2031 年的复合年增长率为 3.37%。

这一增长反映了炊具、食品加工和先进电子行业稳定的市场需求,以及向无 PFAS 化学品的持续转型。儘管氟化钙价格波动对供应链的影响仍然令人担忧,但拥有多元化原料组合的製造商仍具备竞争优势。产品创新重点在于开发符合监管要求且不影响释放性能的陶瓷和混合体系,亚太地区的强劲势头支撑着销售成长,儘管北美和欧洲的销售有所放缓。製造业自动化程度的提高以及家庭中低油烹饪方式的持续偏好,将支撑工业和消费领域的长期消费。

全球不沾涂料市场趋势及洞察

家庭对不沾锅的需求不断增长

都市区和快节奏的生活持续推动消费者对用油量少、清洁方便的厨具的偏好。厨具品牌越来越多地在广告中强调其产品表面不含PFOA的认证,零售商也积极推广这些声明以建立消费者信任。在中国和东南亚,中高级产品凭藉电商折扣缩短了更换週期,主导了线上销售管道。大型製造商正抓住这一趋势,推出耐磨性堪比PTFE的多层陶瓷涂层。对于进口产品而言,符合FDA 21 CFR 175.300及欧盟同等法规的认证已成为关键的行销要素。随着可支配收入的成长和整体厨房的普及,不沾涂层市场已拥有稳定的消费群,并朝着更高端化的产品线发展。

应用于工业机械和食品加工领域

烘焙用品、包装辊和工业搅拌机的製造商指定使用先进涂层,以满足卫生标准并减少停机时间。 PPG 于 2024 年 9 月在马来西亚投资,新增五条生产线,专门生产用于烤盘和能源组件的水性及溶剂型涂层系统。设备整合商青睐光滑、易于清洁且能承受腐蚀性清洗循环和热衝击的表面,从而降低大型工厂的卫生成本。在石油和天然气阀门领域,低摩擦氟聚合物薄膜可降低扭矩并防止在酸性气体环境中腐蚀。政府法规要求更严格的食品安全审核,这间接刺激了对合规表面的需求,使向全球提供技术支援的供应商受益。工业组件较长的更换週期确保了涂层的持续采购,从而支撑了该领域的价格稳定。

加强 PFAS 法规的影响

强制揭露和对现有 PFAS 的彻底禁令正在造成即时的生产缺口。 3M 公司 2023 年 PFAS销售量下降了 20%,并计划在 2025 年底前逐步停止所有含氟化学品的生产。因此,该公司累计了8 亿美元的税前资产减损费用。科慕公司在多个司法管辖区面临诉讼,这阻碍了其对新的 PTFE 生产能力的资本投资,并延迟了高纯度等级产品的供应。下游混配商被迫承担因配方重新设计和重新认证 NSF 和 EFSA 食品接触标准而增加的合规成本。小规模涂料代工公司正努力资金筹措,用于安装修订后的《清洁空气法》法规要求的新型烤箱和烟气捕集系统。预计这些干扰因素将导致不沾黏涂料市场在短期内需求下降,直到替代化学品得到更广泛的供应。

细分市场分析

到2025年,含氟聚合物将占据不沾涂层市场41.32%的份额,这充分证明了其卓越的热稳定性和脱模耐久性。儘管监管日益严格,但以美元计价,含氟聚合物市场的成长速度仍高于其他同类化学品。不含PFOA的PTFE产品,由于与现有应用设备具有良好的兼容性,目前占据了復购量的主导地位。大金和科慕正利用这一市场需求,提供专为静电喷涂设计的低VOC分散体和粉末级产品。同时,陶瓷涂层不受PFAS法规的约束,且深受注重健康的消费者青睐,预计到2031年将以3.62%的复合年增长率快速成长。商业应用采用溶胶-凝胶工艺,并以奈米氧化锆或二氧化钛增强,以降低脆性。硅酮涂层则占据了烘焙用具和医疗设备等较为狭窄的细分市场,在这些市场中,柔软性和生物相容性比极致的脱模性能更为重要。混合有机-无机材料目前市场份额较小,但兼具抗污染性和抗衝击性,预计从 2028 年开始将导致市场份额的重组。

专用于半导体载体的第二代含氟聚合物价格居高不下,使供应商免受炊具市场週期性波动的影响。同时,3M的产能优化导致大量供应中断,迫使下游复合材料供应商必须从多个管道采购关键等级的材料。亚洲的二级复合材料供应商正透过与寻求稳定涂层生产线的家电OEM厂商签订多年供货协议来争取市场份额。随着终端买家对永续性声明的审核,ISO 14001认证已成为一项重要的资格,促使供应商投资于废热和溶剂回收。整体而言,监管压力和特定应用性能之间的相互作用,维持了该领域两极化的成长轨迹:陶瓷材料加速成长,而含氟聚合物则继续巩固其现有的工业地位。

区域分析

预计到2025年,亚太地区将占全球营收的49.62%,复合年增长率达3.53%,进一步巩固其在不沾涂层市场的主导地位。中国浙江和广东丛集的产能扩张正在缩短炊具OEM厂商的前置作业时间,而税收优惠政策则吸引了越南和印尼等国投资建设新的喷涂生产线。印度的都市区中产阶级青睐透过限时抢购平台销售的高端煎锅,而随着印度标准局(BIS)标准的实施,预计对进口聚四氟乙烯(PTFE)的监管审查力度将加大。日本在先进机器人和半导体设备需求的推动下,继续进口高纯度涂层,抵消了家用产品更换週期放缓的影响。

北美地区按以金额为准排名第二,但面临最具挑战性的 PFAS 法规。各州的禁令正在加速陶瓷研发,美国涂料製造商正投资于废气捕集和销毁系统,以获得美国环保署 (EPA) 的核准。在墨西哥,美国State Electric 品牌的近岸外包效应正在推动当地对炉灶烤架和烤盘用粉末涂料的需求。欧洲在 REACH 法规的指导下继续逐步淘汰长链 PFAS,德国推广水性分散剂,法国则透过绿色经济津贴支持溶胶-凝胶技术新兴企业。东欧工厂正在将炊具组装业务集中起来,并采用在地采购的涂料以降低运输成本。

中东和非洲地区正涌现出小规模但充满活力的机会。当地蓬勃发展的旅馆业正在推动商用厨房设备的升级换代。南美洲的家禽和糖果甜点加工商正在采用符合美国食品药物管理局(FDA)标准的薄膜以应对出口审核,而巴西的本地化涂层业务也在不断扩张。这种地理多元化有助于供应商减轻单一监管或宏观经济衝击的影响,但红海贸易路线的物流中断情况值得密切关注。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 家用不沾锅需求不断成长

- 应用于工业机械和食品加工领域

- 监管主导的向无PFOA陶瓷过渡

- 用于电子和医疗设备

- 水性低VOC氟树脂分散液

- 市场限制

- 加强 PFAS 法规

- 微塑胶引发的健康问题

- 萤石供应价格飙升

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- 氟树脂

- 陶瓷製品

- 硅酮

- 其他类型

- 透过使用

- 炊具

- 食品加工

- 布料和地毯

- 医疗保健

- 电气和电子设备

- 工业机械

- 车

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 土耳其

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率/排名分析

- 公司简介

- 3M

- AGC Chemicals

- Cavero Coatings

- DAIKIN INDUSTRIES, Ltd.

- Endura Coatings

- ILAG-Industrielack AG

- Metal Coatings

- Metallic Bonds Ltd

- PPG Industries, Inc.

- Rhenotherm Kunststoffbeschichtungs GmbH

- Showa Denko KK

- Solvay

- The Chemours Company

- Weilburger

- Zhejiang Pfluon Technology Co., Ltd

第七章 市场机会与未来展望

The Non-stick Coatings Market is expected to grow from USD 1.89 billion in 2025 to USD 1.95 billion in 2026 and is forecast to reach USD 2.31 billion by 2031 at 3.37% CAGR over 2026-2031.

This expansion reflects steady demand from cookware, food-processing, and advanced electronics alongside the ongoing shift toward PFAS-free chemistries. Supply chains remain vulnerable to fluctuations in fluorspar costs, yet producers with diversified raw-material portfolios hold a competitive edge. Product innovation centers on ceramic and hybrid systems that meet regulatory mandates without compromising release performance, while regional momentum in the Asia-Pacific sustains volume growth despite moderating sales in North America and Europe. Rising automation in manufacturing and sustained household preference for low-oil cooking sustain long-term consumption across industrial and consumer verticals.

Global Non-stick Coatings Market Trends and Insights

Rising Household Demand for Non-Stick Cookware

Urban living patterns and increasingly busy lifestyles have sustained consumer preference for cookware that minimizes oil use and simplifies cleaning. Kitchenware brands are increasingly advertising certifications that guarantee PFOA-free surfaces, and retailers are highlighting such labels to build trust. Mid-tier and premium products now dominate online sales channels in China and Southeast Asia, where e-commerce discounts shorten replacement cycles. Large-scale producers capitalize on this shift by launching multi-layer ceramic finishes that rival PTFE in abrasion resistance. Certification to FDA 21 CFR 175.300 and equivalent EU frameworks has become a core marketing feature for imported offerings. With disposable incomes rising and modular kitchens proliferating, the non-stick coatings market enjoys a stable consumer base that absorbs upgraded product lines.

Industrial Machinery and Food-Processing Uptake

Manufacturers of bakeware, packaging rollers, and industrial mixers specify advanced coatings to meet hygiene mandates and reduce downtime. PPG's September 2024 investment in Malaysia added five production lines dedicated to waterborne and solvent-borne systems tailored for bakery trays and energy components. Equipment integrators favor smooth, easy-clean surfaces that endure caustic wash cycles and thermal shocks, which lowers sanitation costs across large plants. In oil and gas valves, low-friction fluoropolymer films cut torque and prevent corrosion under sour-gas conditions. Governments that legislate stricter food-safety audits indirectly stimulate demand for compliant surfaces, benefiting suppliers with global technical support. The long replacement interval for industrial parts locks in recurrent coating purchases and underpins price stability across this segment.

PFAS Regulatory Clamp-Down

Mandatory disclosure and outright bans on legacy PFAS generate immediate production gaps. 3M recorded a 20% decline in PFAS volumes during 2023 and will exit all fluorochemical manufacturing by the end of 2025, booking a USD 800 million pre-tax charge tied to asset write-downs. Chemours faces multi-jurisdictional litigation that diverts capital away from new PTFE capacity, slowing the supply of high-purity grades. Downstream blenders absorb higher compliance costs as they redesign formulations and requalify them under NSF and EFSA food-contact standards. Small contract coaters struggle to fund new ovens and fume-capture systems required under evolving Clean Air Act rules. Collectively, these disruptions reduce short-term volumes in the non-stick coatings market until alternative chemistries are scaled.

Other drivers and restraints analyzed in the detailed report include:

- Regulation-Driven Shift to PFOA-Free Ceramics

- Electronics and Medical Device Adoption

- Fluorspar-Supply Price Shocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fluoropolymers held 41.32% non-stick coatings market share in 2025, underscoring their supremacy in thermal stability and release longevity. The non-stick coatings market size for fluoropolymers outstripped USD-denominated growth in rival chemistries even as regulatory headwinds intensified. PTFE variants free of PFOA now dominate reorder volumes, thanks to their proven compatibility with existing application equipment. Daikin and Chemours capitalize on this reliance by offering low-VOC dispersions and powder grades engineered for electrostatic spray. In contrast, ceramic finishes post the fastest 3.62% CAGR to 2031 because they bypass PFAS scrutiny and appeal to health-conscious consumers. Commercial roll-outs employ sol-gel routes reinforced with nano-zirconia or titania to curb brittleness. Silicone coatings occupy a narrower niche serving bakeware and medical devices, where flexibility and biocompatibility trump extreme release. Although hybrid organic-inorganic systems currently account for a small slice of the market, they promise a convergence of stain resistance and impact toughness that could realign market shares after 2028.

Second-generation fluoropolymers purpose-built for semiconductor carriers maintain premium pricing, cushioning suppliers from cookware cyclicality. Conversely, capacity rationalization by 3M removes a sizeable volume and prompts downstream formulators to dual-source critical grades. Tier-two Asian compounds secure share gains by signing multi-year supply deals with appliance OEMs seeking stable coating lines. ISO 14001 certification emerges as a credential when end buyers audit sustainability claims, nudging suppliers to invest in waste-heat recovery and solvent capture. Overall, the interplay of regulatory pressure and application-centric performance sustains a dual-speed trajectory in this segment, with ceramics accelerating yet fluoropolymers defending entrenched industrial roles.

The Non-Stick Coatings Market Report is Segmented by Type (Fluoropolymer, Ceramic, Silicone, and Other Types), by Application (Cookware, Food Processing, Fabrics and Carpets, Medical, Electrical and Electronics, Industry Machinery, Automotive, and Other Applications), and by Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 49.62% of 2025 revenue and is projected to advance at a 3.53% CAGR, reinforcing its primacy in the non-stick coatings market. Capacity additions in China's Zhejiang and Guangdong clusters shorten lead times for cookware OEMs, while tax incentives draw new spray-line investments to Vietnam and Indonesia. India's urban middle class is embracing premium pans sold via flash-sale portals, although regulatory oversight on imported PTFE will tighten under pending BIS standards. Japan leverages advanced robotics and semiconductor equipment demand to sustain high-purity coating imports, offsetting slower household replacement cycles.

North America ranks second by value but confronts the most disruptive PFAS legislation. State-level bans accelerate ceramic R&D, and US coaters invest in capture-destroy exhaust systems to secure EPA approvals. Mexico benefits from near-shoring by US appliance brands, lifting regional powder demand for stovetop grates and bakeware sheets. Europe continues to migrate away from long-chain PFAS under REACH, with Germany championing water-based dispersions and France encouraging sol-gel start-ups through green economy grants. Eastern European plants attract cookware assembly operations that source coatings locally to sidestep shipping costs.

Smaller yet dynamic opportunities emerge in the Middle East and Africa, where hospitality expansion spurs commercial-kitchen upgrades. South American processors of poultry and confectionery adopt FDA-compliant films to meet export audits, driving localized toll-coating ventures in Brazil. Geographic diversification thus cushions suppliers from any single regulatory or macro-economic shock, although logistics disruptions in the Red Sea trade lane remain a watchpoint.

- 3M

- AGC Chemicals

- Cavero Coatings

- DAIKIN INDUSTRIES, Ltd.

- Endura Coatings

- ILAG - Industrielack AG

- Metal Coatings

- Metallic Bonds Ltd

- PPG Industries, Inc.

- Rhenotherm Kunststoffbeschichtungs GmbH

- Showa Denko K.K.

- Solvay

- The Chemours Company

- Weilburger

- Zhejiang Pfluon Technology Co., Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising household demand for non-stick cookware

- 4.2.2 Industrial machinery and food-processing uptake

- 4.2.3 Regulation-driven shift to PFOA-free ceramics

- 4.2.4 Electronics and medical device adoption

- 4.2.5 Water-based low-VOC fluoropolymer dispersions

- 4.3 Market Restraints

- 4.3.1 PFAS regulatory clamp-down

- 4.3.2 Micro-plastic health perception

- 4.3.3 Fluorspar-supply price shocks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Fluoropolymer

- 5.1.2 Ceramic

- 5.1.3 Silicone

- 5.1.4 Other Types

- 5.2 By Application

- 5.2.1 Cookware

- 5.2.2 Food Processing

- 5.2.3 Fabrics and Carpets

- 5.2.4 Medical

- 5.2.5 Electrical and Electronics

- 5.2.6 Industry Machinery

- 5.2.7 Automotive

- 5.2.8 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic

- 5.3.3.7 Russia

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Turkey

- 5.3.5.3 UAE

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 AGC Chemicals

- 6.4.3 Cavero Coatings

- 6.4.4 DAIKIN INDUSTRIES, Ltd.

- 6.4.5 Endura Coatings

- 6.4.6 ILAG - Industrielack AG

- 6.4.7 Metal Coatings

- 6.4.8 Metallic Bonds Ltd

- 6.4.9 PPG Industries, Inc.

- 6.4.10 Rhenotherm Kunststoffbeschichtungs GmbH

- 6.4.11 Showa Denko K.K.

- 6.4.12 Solvay

- 6.4.13 The Chemours Company

- 6.4.14 Weilburger

- 6.4.15 Zhejiang Pfluon Technology Co., Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space and Unmet-need Assessment