|

市场调查报告书

商品编码

1687704

计量软体:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Metrology Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

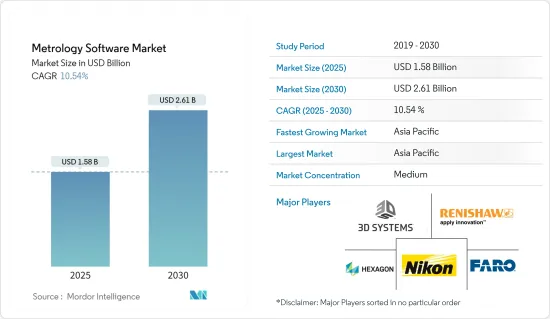

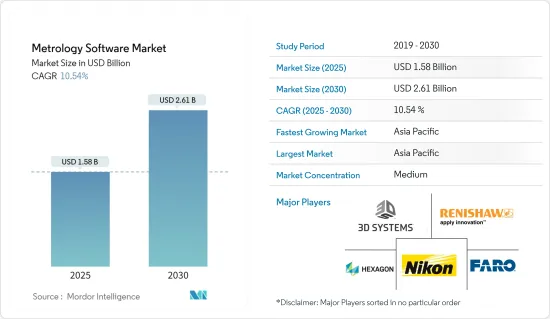

计量软体市场规模预计在 2025 年为 15.8 亿美元,预计到 2030 年将达到 26.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.54%。

主要亮点

- 测量解决方案正在从简单的收集资料的工具转变为能够分析和处理资料。如今,测量是在生产过程中而不是在测量实验室中进行的,这推动了工厂和生产线上以模组化方式使用的计量需求,从而影响了标准测量仪器的需求。

- 使用计量软体检查製造的产品是预计未来五年推动全球计量软体市场成长的关键因素之一。先进的奈米技术、智慧材料、软性电子产品和绿色製造是推动电子製造对计量解决方案需求的主要因素。

- 由于各领域都呈现数位化趋势,计量领域也亟需进行数位化变革。随着世界走向数位转型,各行各业也拥抱转型,使得称重软体市场在预测期内进一步成长。

- 计量软体连接 CAD、ERP、MRP 和 PLM 之间。计量是设计和製造过程中遇到的首要挑战之一。通常需要后 CAD 测量资料来收集缺少的特征资料、创建复杂表面轮廓的几何图形,以及支援製造、工程、工具製造、组装指导和品质检验。

- 计量解决方案有望成为电子製造品质检测活动的重要组成部分。在快速发展的电子製造业中,最终用户正在寻求解决涉及新产品设计和开发的计划。计量软体是旨在实现自动化测量仪器精确操作的应用程式、脚本和程式的集合。该软体不仅可以获得和评估测量资料,而且还透过其用户友好的介面简化了整个过程。此外,它还包括用于彙报和法规遵循的管理工具。

- 半导体製造的统计製程控制可以透过从每天处理的数千片晶圆中仅抽取少量的样本来最大限度地提高产量比率和品质。因此,计量/检测系统的收益成长落后于整体设备的成长。

- 自新冠疫情爆发以来,科技业受到了严重影响。电子产品供应价值链和原材料供应的中断对科技业产生了不利影响。然而,疫情迫使各行各业寻找更安全、更具创新的方式,以平稳有效地运作。计量软体透过产生数位二维和三维模型在製造过程中发挥至关重要的作用,帮助产品设计师和工程师为原型製作建立精确的测量和公差,并且是市场推动力。

测量软体市场趋势

航太航太业大幅成长

- 自飞行诞生以来,技术就以惊人的速度发展,飞机的复杂程度也呈指数级增长。航太航天计量的使用对于这项进步至关重要。预计未来几十年计量的重要性将进一步成长,从而推动计量软体市场的发展。根据国际航空运输协会(IATA)的资料,欧洲占据航空客运量最大的市场占有率,为30.7%,其次是北美,为28.9%。

- 采用复合材料製造的更轻、更有效率、更安全的飞机对于航太生产的持续发展至关重要。复合材料重量轻、强度高、使用寿命长。它的另一个巨大优势是,它可以形成比钢或铝等金属更复杂的形状,需要更少的紧固件和接头。

- 为了製造更轻、更有效率的飞机,使用复合材料零件对于未来的航太製造业至关重要。虽然使用复合材料材料零件的飞机可以降低营运成本,但製造成本通常更高。复合材料更轻、更坚固、更耐用,因此比钢或铝更昂贵,使得称重辅助组装对于保持生产过程的成本效益至关重要。随着复合部件变得越来越普遍,计量作为增值组成部分的重要性越来越受到广泛认可。

- 复合材料的缺点是价格比金属材料贵。但这就是计量学发挥作用的地方,它支援组装过程以开发更具成本效益的生产程序。随着主要民航机製造商越来越多地使用复合材料,计量在航空领域的重要性预计将日益增加。

- 儘管复合材料具有许多优点,但它却难以加工,需要以非常严格的公差进行精密组装。在製造过程中使用计量技术有助于避免代价高昂的错误以及材料废料和返工。由于航太工业要求一级供应商进行 100% 检测,因此各公司必须提供准确度、可重复性和可靠性,以应对最严峻的测量挑战。

- 根据波音的预测,到2042年全球民航机持有预计将增加一倍,未来20年将需要230万名新的航空人员来支持不断增长的民航机并维持航空旅行的长期成长。

亚太地区强劲成长

- 由于亚太地区有多家汽车和航太相关企业,激发了人们对高精度计量解决方案的兴趣,预计该地区将见证计量软体解决方案的最高成长。中国是世界製造地。随着製造过程的精度和复杂性迅速提高,计量软体市场预计将推动这一领域的发展,因为中国现在拥有多家国内外製造工厂。

- 在华为、中国移动的支持下,海尔成功将5G与移动边缘运算结合的创新製造解决方案应用于智慧工厂。这些解决方案将5G边缘运算与製造环境中的人工智慧和机器视觉结合。它们适用于不同的製造场景,可以执行不同的功能。计量软体解决方案可以透过更快地执行品质控制检查来降低製造成本,准确率超过 99%,比没有该功能至少准确率高 10%。预计此类案例将推动该地区的市场成长。

- 各公司已在日本建立各种联盟与合作关係,以进一步加强其测量和检测解决方案并增加其影响力和基本客群。各公司一直在寻求有效的技术,帮助他们完全自动化并增强更具成本效益的视觉检测和测量解决方案,从而显着提高品管并降低生产成本。

- 例如,2023 年 2 月,Hexagon 的製造智慧部门推出了其 Nexus「数位现实平台」。该平台致力于为用户提供计量报告、材料测量和积层製造设计 (DfAM) 工具。其主要功能之一是计量报告应用程序,它充当在 Nexus 安全云环境中无缝连接 Hexagon 和第三方计量资料来源的桥樑。这种整合使公司能够快速存取和分析来自其设备的品管资料,以准确发现趋势并主动解决公差问题。

测量软体产业概况

测量软体市场竞争激烈,许多公司都进入该市场。市场的主要企业正在采用合作、创新和收购等策略来加强其产品供应并获得永续的竞争优势。

例如,AMETEK 旗下专注于可携式3D 测量解决方案和工程服务的业务部门 Creaform 于 2023 年 2 月将 HandySCAN BLACK Elite Limited 引入其 HandySCAN 3D BLACK 系列。 HandySCAN BLACK Elite Limited 专为工业和製造业领域的尺寸测量专业人士设计,是品管、产品开发和其他需要高精度的应用的理想选择。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 加大对製造业流程自动化的推动

- 消费者对高品质产品的需求

- 对智慧有效的资料收集、分析和评估以及强大的资料管理和报告工具的需求日益增长

- 市场限制

- 缺乏认知对市场成长构成挑战

第六章 市场细分

- 按最终用户产业

- 车

- 航太

- 电子製造业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Nikon Metrology NV

- 3D Systems Inc.

- Creaform Inc.(AMETEK Inc.)

- Faro Technologies

- Carl Zeiss AG

- Hexagon AB

- LK Metrology Ltd

- Renishaw PLC

- Perceptron Inc.(Atlas Copco)

- Innovmetric Software Inc.

- Fluke Corporation

- Metrologic Group(Sandvik AB)

- Autodesk Inc.

第八章投资分析

第九章:市场的未来

The Metrology Software Market size is estimated at USD 1.58 billion in 2025, and is expected to reach USD 2.61 billion by 2030, at a CAGR of 10.54% during the forecast period (2025-2030).

Key Highlights

- Metrology solutions are witnessing a shift from merely a tool that gathers or collects data to one capable of data analysis and processing. Measurements are conducted in the production process rather than in measuring rooms, fostering the demand for metrology used in a modularized method in plants and production lines and impacting the demand for standard measuring instruments.

- The use of metrology software to inspect manufactured products is one of the critical factors expected to drive the growth of the global metrology software market in the next five years. Advanced nanotechnology, smart materials, flexible electronics, and green manufacturing are the principal factors driving demand for metrology solutions in electronic manufacturing.

- Due to the ongoing digitalization trend across all sectors, the metrology field has noticed the need to change digitally. As the world shifts toward digital transformation, the industry also embraces the transformation, allowing the metrology software market to grow more during the forecast period.

- Metrology software connects the dots among CAD, ERP, MRP, and PLM. Metrology is one of the first challenges when working down the design/build process. Post-CAD measurement data is often necessary to collect missing feature data, create geometry for complex surface profiles, and support manufacturing, engineering, toolmaking, assembly guidance, and quality verification.

- Metrology solutions are expected to become indispensable to electronic manufacturing quality inspection activities. In the rapidly-growing electronic manufacturing industry, end users aim to undertake projects involving new product designs and development. Metrology Software is a suite of applications, scripts, and programs tailored for precise operations on automated measurement machines. This software not only acquires and evaluates measurement data but also streamlines the entire process with a user-friendly interface. In addition, it includes management tools for reporting and ensuring regulatory compliance.

- Statistical process control for semiconductor manufacturing enables the company to maximize yield and quality by simply sampling a small number of wafers out of thousands processed daily. Thus, revenue growth in metrology/inspection systems lags behind the increase in overall equipment.

- Post COVID-19, there has been a significant impact on the technology sector. Disruptions of an electronic supply-value chain and raw material supply have adversely impacted the technology industry. However, the pandemic compelled industries to find safer and more innovative ways to operate smoothly and effectively. Metrology software plays a pivotal role in the manufacturing process by generating digital 2D and 3D models, aiding product designers and engineers in establishing precise measurements and tolerances for prototyping which is driving the market.

Metrology Software Market Trends

Aerospace Sector to Witness Significant Growth

- Since the dawn of flying, technology has advanced at a breakneck pace, and planes are now vastly more sophisticated. The use of metrology in aerospace has been critical to this progress. Metrology's importance is expected to rise only in the following decades, thus driving the metrology software market. As per data by the International Air Transport Association (IATA), Europe has the maximum air passenger market share with a 30.7% contribution, followed by North America with a 28.9% contribution in air passenger traffic.

- Aircraft that are lighter, more efficient, and safer are made with composite materials, essential to the continued development of aerospace production. Composite materials are light, incredibly robust, and long-lasting. They may also be molded into more intricate shapes than metals like steel and aluminum, which has major benefits, which are companies profit from fewer fasteners and joints, resulting in fewer weak places, and since there are fewer components, assembly time is also minimized.

- To construct lighter, more efficient planes, the usage of composite parts is critical in the future of aerospace manufacturing. While composite-part airplanes have reduced operational costs, their production costs are often higher. Composites are more expensive than steel and aluminum because they are lighter, stronger, and more durable, and metrology-assisted assembly is crucial for keeping the production process cost-effective. As composite parts grow increasingly common, metrology's significance as a value-added component is becoming more widely recognized.

- The disadvantage of composite materials is that they are more expensive than their metallic counterparts. However, metrology comes into play here, supporting the assembly process in developing more cost-effective production procedures. The crucial significance of metrology in aircraft is expected to only grow as the usage of composite materials develops among the significant commercial plane builders.

- Despite its numerous advantages, composite is tough to work with material requiring precise assembly with very tight tolerances. Using metrology in manufacturing helps avoid costly mistakes and scrap or rework material. Also, with the aerospace industry demanding 100% inspection from their Tier-1 suppliers, companies must deliver accuracy, repeatability, and dependability for the most challenging measurement tasks.

- As per the Boeing's forecast, there will be a demand for 2.3 million new aviation personnel over the next 20 years to support the growing commercial fleet and to support the long-term growth in air travel, with the expectation of doubling the global commercial airplane fleet by 2042.

Asia-Pacific to Witness Major Growth

- Due to the presence of various automotive giants and aerospace establishments in the region and their increasing interest in high-accuracy metrology solutions, Asia-Pacific is expected to have the highest growth of metrology software solutions. China is a global manufacturing hub. Since the precision and complexity of manufacturing processes have been increasing rapidly, the metrology software market is expected to boost this area, as China currently has several national and international manufacturing facilities.

- With support from Huawei and China Mobile, Haier has successfully applied innovative manufacturing solutions combining 5G and mobile edge computing in its smart factories. These solutions integrate 5G edge computing with artificial intelligence and machine vision in manufacturing environments. These apply to various manufacturing scenarios where they can perform various functions. The metrology software solutions can save manufacturing costs by rapidly performing QC checks with over 99% accuracy, at least 10% more accurate than without the function. Such instances are expected to drive the market's growth in the region.

- Companies have had various partnerships and collaborations in Japan to enhance their measurement and inspection solutions further and improve their presence and customer base. Various companies have been seeking an effective technology that can help to fully automate and enhance better cost-effective visual inspection and measurement solutions that significantly improve quality control and reduce manufacturing costs.

- For instance, in February 2023, Hexagon's Manufacturing Intelligence division unveiled the Nexus 'digital reality platform.' This platform is tailored to equip users with tools for metrology reporting, materials measurement, and Design for Additive Manufacturing (DfAM). One of its key features, the Metrology Reporting app, acts as a bridge, seamlessly connecting Hexagon and third-party metrology data sources within Nexus' secure cloud environment. This integration empowers companies to swiftly access and analyze quality control data from their equipment, pinpointing trends and proactively addressing tolerance issues.

Metrology Software Industry Overview

The metrology software market is moderately competitive, with many players. The key players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

For instance, Creaform, a business unit of AMETEK specializing in portable 3D measurement solutions and engineering services, introduced the HandySCAN BLACK Elite Limited to its HandySCAN 3D BLACK series in February 2023. The HandySCAN BLACK Elite Limited, tailored for dimensional metrology professionals in industrial and manufacturing sectors, excels in quality control and product development, especially for applications demanding heightened accuracy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Drive Toward Automation of Processes in Manufacturing Industry

- 5.1.2 Demand for High-quality Products from Consumers

- 5.1.3 Increasing Need for Intelligent and Effective Data Acquisition, Analysis, and Evaluation and Powerful Data Management and Reporting Tools

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness to Challenge the Market's Growth

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Automotive

- 6.1.2 Aerospace

- 6.1.3 Electronic Manufacturing

- 6.1.4 Other End-user Verticals

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nikon Metrology NV

- 7.1.2 3D Systems Inc.

- 7.1.3 Creaform Inc. (AMETEK Inc.)

- 7.1.4 Faro Technologies

- 7.1.5 Carl Zeiss AG

- 7.1.6 Hexagon AB

- 7.1.7 LK Metrology Ltd

- 7.1.8 Renishaw PLC

- 7.1.9 Perceptron Inc. (Atlas Copco)

- 7.1.10 Innovmetric Software Inc.

- 7.1.11 Fluke Corporation

- 7.1.12 Metrologic Group (Sandvik AB)

- 7.1.13 Autodesk Inc.