|

市场调查报告书

商品编码

1687714

印度联合收割机:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)India Combine Harvester - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

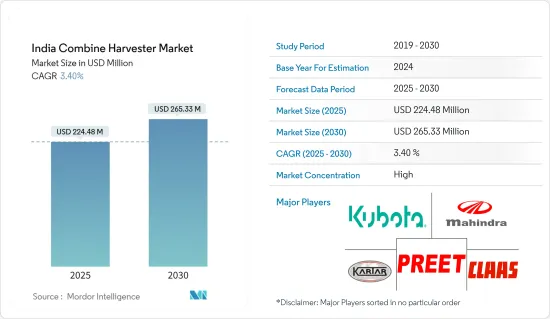

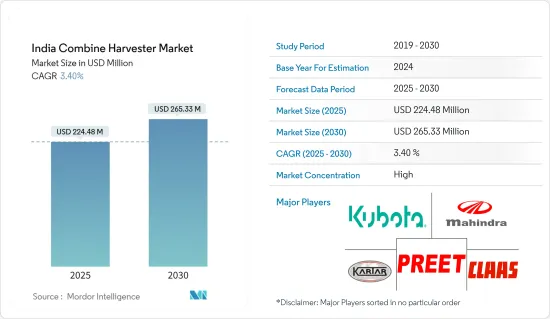

印度联合收割机市场规模预计在 2025 年达到 2.2448 亿美元,预计到 2030 年将达到 2.6533 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.4%。

主要亮点

- 根据印度农业研究理事会(ICAR)的数据,印度主粮、豆类、油籽、粗粮和经济作物(不包括大米和小麦)的收割和脱粒机械化程度接近32%。其中稻米、小麦收割脱粒机械化率已超过60%。这一趋势凸显了联合收割机的日益普及,它简化了收割和脱粒过程,从而有助于扩大市场。

- 此外,在研究期间,各种作物的种植面积增加。例如,根据粮农组织统计资料库 (FAOSTAT) 的统计数据,到 2022 年,印度粗粒种植总面积预计将从 2019 年的 9,510 万公顷增加到 9,960 万公顷。对于联合体来说,这似乎是一个非常大的可能性。

- 在整个研究期间,Preet 987、Mahindra Arjun 605、Kartar 4000、Dasmesh 9100 Self Joint Harvester、New Holland TC5.30、Kubota HARVESTING DC-68G-HK 等知名品牌在该国占有重要地位。印度采用这些联合收割机是由于农业产业严重的劳动力短缺。

- 印度政府对包括机械在内的各种农业投入提供补贴。 2022 年,根据首席部长提出的「萨玛格拉乡村发展计画」(CMSGUY),阿萨姆邦政府旨在促进乡村发展,向阿萨姆邦奇朗区的两家农民生产公司(FPC)提供了联合收割机,补贴率高达 90%。透过补贴使联合收割机机械更容易获得的努力有望增加联合收割机机械的采用率并进一步促进市场成长。

印度联合收割机市场的趋势

农业劳动成本高

农业是大部分人口的主要生计来源。根据《2022-23年印度经济调查》,农业部门僱用了印度近45.76%的劳动力。印度都市化趋势的上升是人口扩张的结果。根据世界银行的资料,2020年至2023年间,都市化从34.9%上升到36.4%。这导致农村家庭迁移到附近的城市,造成该国农业劳动力短缺。例如,根据世界银行的资料,2020年至2022年间,农业就业劳动力从44.3%下降到42.9%。

同样,农业劳动力的短缺也推高了工资,增加了农民的整体生产成本。根据印度政府统计,2022年全印度女性田间(农业)工人的日平均年薪为328.51印度卢比(4美元),与前一年同期比较增长8.32%。同样,对于男性田间(农业)劳动力,据报导 2022 年全印度的日薪为 394.52 印度卢比(4.8 美元),与前一年同期比较增长 8.55%。这导致农场就业人数减少和联合收割机的引进。

该国农业严重依赖体力劳动,农业工人数量的下降对收割等农业工作构成了重大挑战。为了解决这个问题,使用先进的收割机械来有效、有效率地完成这些农业任务正变得越来越流行。

印度粮食种植面积的增加将推动自走式联合收割机的需求

在印度,谷物在饮食中扮演着至关重要的角色,使该国成为这些主食的主要生产国和消费国。随着粮食消费量的增加,扩大耕地面积的必要性也日益增加。这一趋势也从谷类种植面积的不断增加中可以看出。例如,根据粮农组织统计资料库 (FAOSTAT) 的数据,谷物收穫面积将从 2019 年的 9,510 万公顷增加到 2022 年的 9,960 万公顷。考虑到联合收割机,尤其是自走式联合收割机主要用于谷物收割,种植面积的增加将直接刺激对此类设备的需求,从而推动市场成长。

自走式联合收割机配备强劲的发动机,擅长在田间作业,确保高效收割并提高生产力。生产率的提高是该领域扩张的关键驱动力。自走式联合收割机主要用于印度北部、西部和中部收割水稻、小麦和其他季节性作物。此外,大型农场主,特别是在旁遮普邦和哈里亚纳邦等主要稻米和小麦种植区,对这些收割机的有利可图的僱佣行为,导致其他农场对这些收割机的使用量激增。

为了适应种植作物面积不断增加的需要,製造商正在推出专门用于种植作物的联合收割机产品。其中一个例子是马恆达 (Mahindra & Mahindra) 的 Swaraj 部门,该部门于 2021 年 10 月推出了自走式联合收割机「Gen2 8100 EX」。此机型旨在提高水稻种植者的生产力和绩效,并确保大面积区域的最佳粮食产量。

印度联合收割机产业概况

印度联合收割机市场已经巩固。 Claas India、Preet Group、Kubota Corporation、Mahindra &Mahindra Ltd 和 Kartar Agro Industries Private Limited 是主要的市场参与者。公司在产品品质和促销方面竞争,并专注于采取策略性措施来占领主导市场占有率。此外,为了扩大市场占有率并加强我们的研发活动,我们正在与其他公司建立联盟和收购关係,并大力投资新产品的开发。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 需要提高作物产量

- 增加政府支持

- 农业机械化需求

- 市场限制

- 联合收割机高成本

- 所拥有土地小而分散

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 类型

- 自走式联合收割机

- 卡车式联合收割机

- 拖拉机式联合收割机

第六章竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- PREET Group

- John Deere India Pvt. Ltd

- CLAAS India

- Tractors and Farm Equipment(TAFE)Ltd

- Mahindra Tractors

- Kubota Agricultural Machinery India Pvt. Ltd

- Dasmesh Group

- Balkar Combines

- Kartar Agro Industries Pvt. Ltd

- Sonalika Group

第七章 市场机会与未来趋势

The India Combine Harvester Market size is estimated at USD 224.48 million in 2025, and is expected to reach USD 265.33 million by 2030, at a CAGR of 3.4% during the forecast period (2025-2030).

Key Highlights

- Indian Council of Agricultural Research (ICAR), in India, harvesting and threshing operations for major cereals, pulses, oil seeds, millets, and cash crops (excluding rice and wheat) are nearly 32% mechanized. Notably, mechanization levels for harvesting and threshing in rice and wheat exceed 60%. This trend emphasizes the growing adoption of combine harvesters, which streamlines harvesting and threshing, bolstering market expansion.

- Additionally, the area under cultivation of various crops has been rising during the study period. For instance, according to the FAOSTAT Statistics, the total area for cultivating coarse cereals across India increased from 95.1 million hectares in 2019 to 99.6 million hectares in 2022. This seems like a great potential for combine harvesters.

- Throughout the study period, prominent brands such as Preet 987, Mahindra Arjun 605, Kartar 4000, Dasmesh 9100 Self Combine Harvester, New Holland TC5.30, and Kubota HARVESTING DC-68G-HK have established a significant presence in the country. The rising adoption of these combines in India can be largely attributed to a notable shortage of farm labor.

- The Indian government extends subsidies on various agricultural inputs, including machinery. In 2022, under the Chief Minister's Samagra Gramya Unnayan Yojana (CMSGUY) - a scheme by the Assam Government aimed at village development - two farmer-producer companies (FPCs) in Assam's Chirang District were granted combined harvester machinery at a remarkable 90% subsidized rate. Such initiatives, making combined harvester machinery more accessible through subsidies, are poised to amplify their adoption and further fuel market growth.

India Combine Harvester Market Trends

High Cost of Farm Labor

Agriculture is a major source of livelihood for a large group of the population. As per the Indian Economic Survey 2022 -23, the agriculture sector employs nearly 45.76% of the Indian workforce. The rise in urbanization trends observed in the country is a result of the expanding population. According to the World Bank data, the degree of urbanization increased from 34.9% to 36.4% from 2020 to 2023. This resulted in the migration of rural households to the nearby cities, leading to the scarcity of farm labor in the country. For instance, the workforce employed in agriculture dropped from 44.3% to 42.9% from 2020 to 2022, as per the World Bank data.

Likewise, the scarcity of farm labor also increased wage rates, which increased the overall production costs of the farmers. As per the Government of India statistics, the annual average daily wage rate for female field (Agriculture) labor, at all India levels, has reported at ₹ 328.51 (USD 4.0) in 2022, registering an increase of 8.32% over the previous year. Likewise, in the case of male field (agriculture) labor, the daily wage rate at all India levels was reported at ₹ 394.52 (USD 4.8) in 2022, registering an increase of 8.55 percent over the previous year. This resulted in a restrain in employing them in farms, favoring the adoption of combine harvesters by the farmers in the country.

The agricultural industry of the country heavily relies on manual labor, and the decreasing workforce in agriculture has led to major challenges in performing farming operations such as harvesting. As a solution to this problem, the usage of advanced harvesting machinery has become increasingly popular for performing these agricultural operations effectively and efficiently.

Rising Grain Cultivation in India Fuels Demand for Self-Propelled Combine Harvesters

In India, cereals play a pivotal role in the culinary landscape, positioning the nation as a leading producer and consumer of these staples. As the consumption of cereal crops rises, so does the need for expanded cultivation. This trend is evident, with harvested areas for cereals and grains on the upswing. For instance, according to FAOSTAT, the area harvested under cereals increased from 95.1 million hectares in 2019 to 99.6 million hectares in 2022. Given that combines, especially self-propelled ones, are predominantly utilized for cereals, this uptick in cultivation directly boosts the demand for such equipment, propelling the market growth.

Equipped with a robust engine, self-propelled combine harvesters excel in the fields, ensuring efficient harvesting and heightened productivity. This boost in productivity is a key driver for the segment's expansion. Predominantly, these harvesters find their application in Northern, Western, and Central India, catering mainly to rice, wheat, and other seasonal crops. Moreover, the lucrative custom hiring of these harvesters by large farmers, especially in major rice-wheat regions like Punjab and Haryana, has led to a surge in adoption among other farmers.

In response to the expanding areas dedicated to grain crops, manufacturers are rolling out specialized combine harvester products tailored for these crops. A case in point is Swaraj Division, a Mahindra and Mahindra Ltd subsidiary, which unveiled its Gen2 8100 EX self-propelled combine harvester in October 2021. This model aims to enhance productivity and performance for paddy farmers, ensuring optimal grain yield across extensive acreage.

India Combine Harvester Industry Overview

The Indian combined harvester market is consolidated. Claas India, Preet Group, Kubota Corporation, Mahindra & Mahindra Ltd, and Kartar Agro Industries Private Limited are the major market players. Companies compete based on product quality and promotion and focus on strategic initiatives to account for prominent market shares. They are also heavily investing in developing new products while collaborating with and acquiring other companies, which may increase their market shares while strengthening their R&D activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need to Enhance Crop Production

- 4.2.2 Increase In Government Support

- 4.2.3 Demand for Farm Mechanization

- 4.3 Market Restraints

- 4.3.1 High Cost of Combine Harvesters

- 4.3.2 Small and Fragmented Land Holdings

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Self-propelled Combine Harvester

- 5.1.2 Track Combine Harvester

- 5.1.3 Tractor-powered Combine Harvester

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 PREET Group

- 6.3.2 John Deere India Pvt. Ltd

- 6.3.3 CLAAS India

- 6.3.4 Tractors and Farm Equipment (TAFE) Ltd

- 6.3.5 Mahindra Tractors

- 6.3.6 Kubota Agricultural Machinery India Pvt. Ltd

- 6.3.7 Dasmesh Group

- 6.3.8 Balkar Combines

- 6.3.9 Kartar Agro Industries Pvt. Ltd

- 6.3.10 Sonalika Group