|

市场调查报告书

商品编码

1687721

液体硅胶橡胶(LSR):市场占有率分析、产业趋势和成长预测(2025-2030)Liquid Silicone Rubber (LSR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

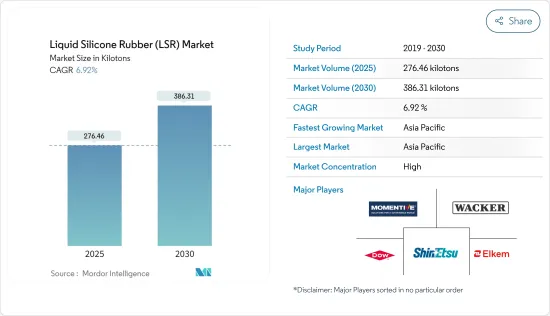

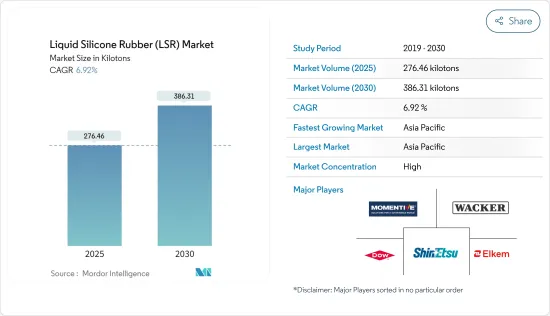

预计 2025 年液体硅胶橡胶市场规模为 276.46 千吨,到 2030 年将达到 386.31 千吨,预测期内(2025-2030 年)的复合年增长率为 6.92%。

2020 年,市场受到新冠疫情的负面影响,停工、维持社交距离和贸易制裁导致全球供应链网路严重中断。不过,预计2022年市场将达到疫情前的水平,并持续稳定成长。

主要亮点

- 医疗保健和婴儿护理行业对 LSR 的需求不断增长预计将推动市场成长。

- 然而,预计液体合成橡胶产品的高成本将在未来几年阻碍市场成长。

- 此外,电子产业采用率的提高以及汽车零件製造业使用率的上升将为未来几年的市场带来机会。

- 由于印度、日本和中国等国家的消费量高,亚太地区在预测期内可能呈现最高的复合年增长率。

液体硅胶橡胶市场趋势

医疗保健和医疗设备预计将成为成长最快的市场

- 医疗设备是液体硅胶橡胶市场的主要终端用户之一。液体硅胶橡胶因其纯度、耐化学性和物理性、柔韧性和灭菌性能而在医疗设备业中需求量很大。

- 在医疗保健和医疗设备领域,LSR 具有传统橡胶材料所不具备的特性,大大扩展了其在各种一次性和可重复使用医疗设备医疗设备和消耗品生产中的用途。

- 据Astra Zeneca称,预计2024年北美的医药销售额将达到6,330亿美元,其次是欧盟(不包括英国),为2,870亿美元,东南亚和东亚约2,320亿美元。

- 近几十年来,由于更加重视研发,美国製药业经历了显着成长。美国口中有超过 15% 年龄超过 65 岁,预计到 2023 年这数字还会上升。

- 在欧洲,德国占据医疗保健市场的最大份额。预计该国每年在健康方面的支出(不包括健身和保健)将超过 3,750 亿欧元(3,951.8 亿美元)。

- 北美五个最重要的医疗保健建筑建设项目于 2022 年开始:盖恩斯维尔医院扩建、西亨德森医院、雪松山医院、史密斯堡仁慈医院扩建和曼卡托梅奥诊所健康计划扩建。此类计划可能会对医疗设备和其他医疗治疗产生大量需求,从而逐渐增加对 LSR 的需求。

- 因此,预计液体硅胶橡胶市场在预测期内将会成长。

亚太地区占市场主导地位

- 预计亚太地区将见证液体硅胶橡胶 (LSR) 市场最高的复合年增长率。由于中国和印度等最大消费国的存在,该地区对液体硅胶橡胶的需求正在大幅增加。

- 人口成长、慢性病流行以及重大技术进步正在推动该地区对医疗保健和医疗设备产业的需求,进一步促进液体硅胶橡胶市场的发展。

- 中国製药业是世界上最大的製药业之一。该国参与学名药、治疗药物、原料药和草药的生产。预计到2023年将成长至1,618亿美元,占全球市场的30%。

- 根据Astra Zeneca年度报告,预计到2025年,印度将成为全球医药市场成长率最高的国家,达到10.9%。

- 此外,2020 年医疗设备生产连结奖励(PLI) 计画和医疗园区的建立等政府计画正在刺激需求。例如,2022年8月,印度医药部核准了2021财年至2025财年的「医疗设备园区促进」计划,总贷款额40亿印度卢比(4,897万美元)。该计划为每个医疗设备园区提供的最高资助为 10 亿印度卢比(1,224 万美元)。

- 此外,液体硅胶橡胶也用于婴儿护理行业。该行业在奶瓶分配器奶嘴和安抚奶嘴等产品中使用 LSR。

- 该地区婴儿护理市场的成长受到政府为满足 LSR 的高需求而采取的多项措施的推动。例如,2021年至2025年,中国国家卫生健康委员会发布了新的儿童健康行动计划,这将影响婴儿护理产品的销售。

- 液体合成橡胶也用于电子工业。该地区对电子产品的需求主要来自中国、印度和日本。根据日本电子情报技术产业协会(JEITA)预测,到2023年,日本电子和IT企业在亚太地区的产值预计将达到40.7599兆日圆(约3,121.5亿美元),与前一年同期比较成长3%。

- 因此,由于上述原因,预计亚太地区将在预测期内占据市场主导地位。

液体硅胶橡胶产业概况

液体硅胶橡胶市场部分整合,主要企业占据主要市场份额(销售额)。调查涉及的市场主要企业(排名不分先后)包括陶氏化学、瓦克化学股份公司、工业、迈图高新材料和埃肯公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 医疗保健产业需求增加

- 婴儿护理行业需求增加

- 限制因素

- 液体硅胶橡胶製品高成本

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 类型

- 食品级液体硅橡胶

- 工业级 LSR

- 医疗级 LSR

- 最终用户产业

- 医疗保健和医疗设备

- 车

- 电气和电子

- 消费品

- 美容与个人护理

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Avantor Inc.

- Dow

- DuPont

- Elkem Asa

- Jiangsu Tianchen New Material Co. Ltd

- Momentive Performance Materials Inc.

- Rico Group GmbH(simtec Silicone Parts LLC)

- Shin-etsu Chemical Co. Ltd

- Stockwell Elastomerics Inc.

- Trelleborg Group

- Wacker Chemie AG

- Wynca Tinyo Silicone Co. Ltd

第七章 市场机会与未来趋势

- 在电子领域的应用不断扩大

- 扩大汽车零件製造的应用

The Liquid Silicone Rubber Market size is estimated at 276.46 kilotons in 2025, and is expected to reach 386.31 kilotons by 2030, at a CAGR of 6.92% during the forecast period (2025-2030).

The market was negatively impacted by the COVID-19 pandemic in 2020, as lockdowns, social distances, and trade sanctions triggered massive disruptions to global supply chain networks. However, the market reached pre-pandemic levels in 2022, and it is expected to grow steadily in the future.

Key Highlights

- The increasing demand for LSR from the healthcare and baby care industries is expected to drive the growth of the market.

- On the other hand, the high costs associated with the products made from a liquid synthetic rubber material are expected to hinder market growth in the coming years.

- Furthermore, increasing adoption in the electronics sector and growing usage in automotive components manufacturing act as opportunities for the market in the coming years.

- Asia-Pacific is likely to witness the highest CAGR during the forecast period due to high consumption from countries such as India, Japan, and China.

Liquid Silicone Rubber Market Trends

Healthcare and Medical Devices is Expected to be the Fastest Growing Market

- Medical devices are one of the major end-users of the liquid silicone rubber market. The demand for liquid silicone rubber is rising in the medical devices industry due to its purity, chemical and physical resistance, flexibility, and sterilization properties.

- In healthcare and medical devices, the use of LSR has significantly expanded in the production of a broad range of disposable and reusable medical devices and supplies as it offers properties that are not obtainable with traditional rubber materials.

- According to AstraZeneca, the projected pharmaceutical sales in 2024 are expected to be USD 633 billion for North America holding the major share, followed by the European Union (excluding the United Kingdom) with USD 287 billion, and Southeast and East Asia expected to register sales of around USD 232 billion.

- The pharmaceutical sector in the United States has achieved considerable gains in recent decades due to a stronger emphasis on research and development, which is further fueled by the expanding and aging population in the United States. More than 15% of the US population is over the age of 65, and this figure is predicted to climb by 2023.

- In Europe, Germany holds the largest share of the healthcare market. The annual expenditure on health in the country is expected to be more than EUR 375 billion (USD 395.18 billion), excluding fitness and wellness.

- In 2022, the five most significant healthcare building construction projects were initiated in North America, Gainesville Hospital Expansion, West Henderson Hospital, Cedar Hill Hospital, Mercy Hospital Fort Smith Expansion, and Mankato Mayo Clinic Health Complex Expansion. Such projects are likely to create massive demand for medical devices and other healthcare treatments, gradually increasing the demand for LSR.

- Therefore, owing to all the aforementioned factors, the market for liquid silicone rubber is expected to grow during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is expected to register the highest CAGR in the liquid silicone rubber (LSR) market. The demand for liquid silicone rubber in the region is growing significantly due to the presence of the largest consuming countries, such as China and India.

- The growing population, greater prevalence of chronic diseases, and significant technological innovations have driven the demand for the healthcare and medical device industry in the region, which further boosts the market for liquid silicone rubber.

- The pharmaceutical industry in China is one of the largest in the world. The country is involved in the production of generics, therapeutic medicines, active pharmaceutical ingredients, and traditional Chinese medicine. By 2023, it is projected to grow to USD 161.8 billion and occupy 30% of the global market.

- As per the annual report of AstraZeneca, India is expected to record the highest growth rates in the pharmaceutical market till 2025, accounting for 10.9%.

- Moreover, government programs such as the "Production Linked Incentive (PLI) Scheme for Medical Devices 2020" and the establishment of medical parks have boosted the demand. For instance, in August 2022, the Department of Pharmaceuticals approved the "Promotion of Medical Device Parks" program from FY21 to FY25, with a total financial commitment of INR 400 crore (USD 48.97 million). The program's maximum assistance is INR 100 crore (USD 12.24 million) for each Medical Device Park.

- Furthermore, liquid silicone rubber is also used in the baby care industry. This industry involves the usage of LSR in the products such as nipples of bottle dispensers, pacifiers, and others.

- Several government initiatives are driving the growth of the baby care market in the region, which caters to the high demand for LSR. For instance, from 2021 to 2025, the National Health Commission of China (NHC) released a new action plan for improving child health, which impacted the sales of baby care products.

- Liquid synthetic rubber is also used in the electronics industry. The demand for electronics products in the region majorly comes from China, India, and Japan. As per the Japan Electronics and Information Technology Industries Association (JEITA), the Asia Pacific production by Japanese Electronics and IT Companies is likely to reach JPY 40,759.9 billion (~USD 312.15 billion) by 2023, witnessing a growth rate of 3% year-on-year.

- Hence, for the above-mentioned reasons, Asia-Pacific is anticipated to dominate the market during the forecast period.

Liquid Silicone Rubber Industry Overview

The liquid silicone rubber market is partially consolidated in nature, with the top five players accounting for a major share (in terms of revenues generated) of the market studied. Some of the major players in the market studied (not in any particular order) include Dow, Wacker Chemie AG, Shin-Etsu Chemical Co. Ltd, Momentive Performance Materials, and Elkem ASA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Healthcare Industry

- 4.1.2 Rising Demand from the Baby Care Industry

- 4.2 Restraints

- 4.2.1 High Cost of Liquid Silicone Rubber Products

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Food Grade LSR

- 5.1.2 Industrial Grade LSR

- 5.1.3 Medical Grade LSR

- 5.2 End-user Industry

- 5.2.1 Healthcare and Medical Devices

- 5.2.2 Automotive

- 5.2.3 Electrical and Electronics

- 5.2.4 Consumer Goods

- 5.2.5 Beauty and Personal Care

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avantor Inc.

- 6.4.2 Dow

- 6.4.3 DuPont

- 6.4.4 Elkem Asa

- 6.4.5 Jiangsu Tianchen New Material Co. Ltd

- 6.4.6 Momentive Performance Materials Inc.

- 6.4.7 Rico Group GmbH (simtec Silicone Parts LLC )

- 6.4.8 Shin-etsu Chemical Co. Ltd

- 6.4.9 Stockwell Elastomerics Inc.

- 6.4.10 Trelleborg Group

- 6.4.11 Wacker Chemie AG

- 6.4.12 Wynca Tinyo Silicone Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Adoption in the Electronics Sector

- 7.2 Growing Usage in Automotive Components Manufacturing