|

市场调查报告书

商品编码

1687736

InGaAs 相机 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)InGaAs Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

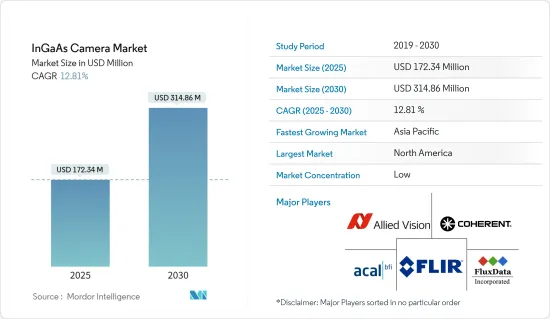

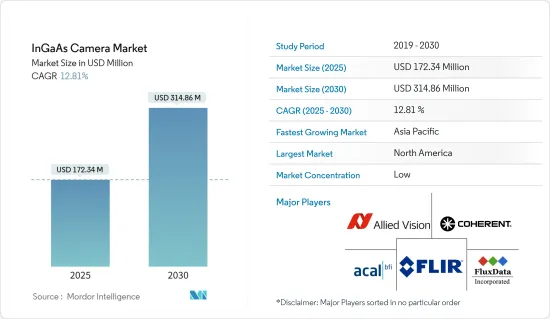

InGaAs 相机市场规模预计在 2025 年达到 1.7234 亿美元,预计到 2030 年将达到 3.1486 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.81%。

越来越多地采用视觉引导机器人系统等自动化解决方案以及越来越多地使用这些摄影机进行污染和缺陷检测是推动研究市场成长的关键因素。

关键亮点

- InGaAs 是一种 III-V 化合物半导体,在近红外线(NIR) 和短波红外线(SWIR) 具有高光敏性。 InGaAs 相机利用此功能用于各种应用,包括即时、线上、无损检测。机器视觉对线扫描 InGaAs 相机的需求不断增加是 InGaAs 相机市场的主要驱动力。

- InGaAs 是一种基于冷却的相机,用于航太、军事、通讯、工业检测、光谱学等。它采用红外线 (IR) 技术,可以在夜间和大气雾霾中看清物体,主要用于军事和国防部队。这些摄影机具有体积小、非製冷、轻量化设计、高品质夜视功能、隐蔽式人眼安全雷射、目标识别和对夜光敏感等性能特点,在国防领域有广泛的应用。

- InGaAs 相机填补了 950-1,700 nm 近红外线波长之间的空白,硅检测器在该波长范围内不再起作用,而 950-1,700 nm 硅检测器在该波长范围内不再具有灵敏度。由于其较低的带隙,InGaAs 在更全面的 NIR 区域具有列出的灵敏度。与 Si-CCD 相比,由于带隙较低,暗电流(由热量产生的讯号)也非常高。因此,科学的 InGaAs FPA 相机需要大量冷却(低至 -85°C)以减少不必要的杂讯源。

- 此外,作为检测器材料,InGaAs 为近红外线(NIR) 工业应用(例如湿度测量、表面膜分布以及聚合物和天然材料分离等分类任务)提供了一种经济实惠的替代方案。这导致技术在工业生产和自动化中的应用不断增加。

- 工业 4.0 加速了机器人等技术的发展,这些技术目前在工业自动化中发挥关键作用,机器人管理着工业中的许多核心业务。 InGaAs 相机的新兴应用包括视觉引导机器人。这些视觉引导机器人由一个红外线成像器可以从箱子中寻找并拾取随机零件,摄影机可以分析每个零件的方向并将其放置在输送机上。

- 此外,机器视觉的使用每年都在增加。在某些地区,机器视觉销售创下历史新高。根据先进自动化协会预测,2022年上半年北美自动侦测和引导机器视觉市场将持续保持正成长,预计全年市场将保持良好的成长动能。因此,预计预测期内此类应用程式对 InGaAs 相机的需求将会上升。

- 然而,InGaAs相机的高成本是阻碍研究市场成长的主要因素之一。此外,各国进出口法规日益严格,也限制了研究市场的发展。

InGaAs相机市场趋势

工业自动化可望占据最大市场占有率

- 推动市场成长的关键因素之一是各种应用对 InGaAs 相机的需求不断增加。此外,工业自动化领域对 InGaAs 相机的使用不断增加也推动了市场的成长。 InGaAs 相机用于热感成像、机器视觉和品管等工业自动化应用,因为它们比其他类型的相机具有更好的性能。

- 机器视觉系统的日益普及预计将推动工业自动化领域对 InGaAs 相机的需求。在机器视觉环境中,摄影系统用于扫描生产线上的产品。相机捕捉影像并将其与预先定义的标准进行比较。

- 此外,机器视觉越来越多地与机器人结合使用,以提高其效率和对企业的整体价值。这种机器人的手柄位置安装了摄影机,以引导它们完成手边的任务。例如,根据IFR 2023报告,预计2022年全球商用机器人保有量将达到约350万台的历史新高,安装价值预计为157亿美元。

- 此外,由于预测期内工业机器人的采用率预计会增加,因此所研究市场中工业领域的需求预计将出现正增长。根据IFR预测,到2024年,每年安装的工业机器人数量预计将达到51.8万台。

- 各行各业都在使用这项技术来实现生产自动化并提高产品的品质和速度。各行各业对高品质侦测和自动化的需求日益增长,这将推动机器视觉的需求,最终促进 InGaAs 相机市场的发展。此外,InGaAs 相机市场参与企业加强研发力度和推出新产品,也大幅推动了 InGaAs 相机市场的发展。

- 例如,2023 年 1 月,Lucid Vision Labs 宣布推出其新的 Triton SWIR IP67 级工业视觉相机,解析度有 1.3MP 和 0.3MP 两种。 Triton SWIR 是一款 GigE PoE 摄影机,配备宽频、高灵敏度 Sony SenSWIR 1.3MP IMX990 和 0.3MP IMX991 InGaAs 感测器,能够以 5 毫米的像素尺寸捕捉可见光和不可见频谱中的影像。

预计北美将占据最大的市场占有率

- 无人机和地面无人车等机器人在军事和国防应用中的使用日益增多,预计将推动北美对 InGaAs 相机的需求。此外,工业领域越来越多地采用自动化和先进技术也推动了该地区研究市场的成长。

- 由于先进製造业伙伴关係等政府计画旨在鼓励企业、学术机构和联邦政府投资尖端自动化技术,机器视觉系统的产量将会增加。预计这将为市场成长创造积极的前景。

- InGaAs 相机广泛应用于军事和防御领域,可穿透烟雾、雾、霾和水蒸气等恶劣条件,因此美国等国家正在增加国防预算和先进设备的支出。例如,美国申请2023财年的国防预算为8,133亿美元,预计此类国防开支将推动市场需求。

- 此外,随着用于硅晶片图案检测等应用的 InGaAs 相机的需求不断增加,半导体产业在北美(主要是美国)的发展势头强劲。预计美国《晶片法案》等有利的政府投资和晶片行业的供应商投资将在预测期内推动对 InGaAs 相机的需求。

- InGaAs 相机为光同调断层扫瞄(OCT) 和光谱等医学影像应用提供高灵敏度和低杂讯。美国、加拿大等国家正在不断投资医疗产业的发展,预计这将推动InGaAs相机在医学影像应用中的使用增加的成长机会。

- 由于北美地区各类终端用户对先进、有效的成像系统的需求稳步增长,预计北美 InGaAs 相机市场在预测期内将经历良好的增长率。此外,由于机器人的广泛使用以及政府在国防和军事工业方面的支出,工业自动化的进步预计将在未来几年推动市场发展。

InGaAs相机行业概览

InGaAs 相机市场竞争非常激烈,既有许多老牌公司,也有许多新参与企业。企业都在努力创新现有产品以满足日益增长的消费者需求,加剧了市场竞争。此外,不断增长的需求正在吸引新参与企业,从而细分市场。主要参与企业包括 Allied Vision Technologies GmbH、Acal BFI Limited Company、Coherent Inc. 和 Flir Systems Inc.。

2022年12月,JAI宣布推出一款新型工业棱镜基线扫描频谱SW-4010Q-MCL,其采用四感测器基准扫描技术,由多个CMOS感测器和一个采用砷化铟红外线(InGaAs)技术的感测器组成,用于从短波红外线(SWIR)光谱收集资料资料。

2022 年 11 月,Allied Vision 宣布推出四款 Goldeye SWIR 相机,配备扩展的 InGaAs 感测器,可高量子效率检测高达 1.9 μm 或 2.2 μm 的波长。整合双级感测器冷却和多种机载影像校正功能是实现特定频谱特征可视化并实现出色影像品质的关键因素。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 技术简介

- 非製冷

- 冷却

- 市场驱动因素

- 机器视觉应用的采用率不断提高

- 军事和国防活动需求不断成长

- 市场问题

- InGaAS相机采购成本高

- 严格的进出口规定

- COVID-19 工业影响评估

第五章市场区隔

- 按应用

- 军事和国防

- 工业自动化

- 监控和安全

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 亚洲

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 东南亚

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司简介

- Allied Vision Technologies GmbH(TKH group)

- Acal BFI Limited Company(Discoverie Group PLC)

- Coherent Inc.

- Flir Systems Inc.

- FluxData Inc.

- Hamamatsu Photonics KK

- Lambda Photometrics Ltd.

- New Imaging Technologies

- Specim Spectral Imaging Ltd.

- Raptor Photonics Ltd.

- Sensors Unlimited(Collins Aerospace Company)

- Teledyne Dalsa Inc.(Teledyne Technologies Incorporated)

- Xenics Inc.

第七章投资分析

第八章 市场机会与未来趋势

The InGaAs Camera Market size is estimated at USD 172.34 million in 2025, and is expected to reach USD 314.86 million by 2030, at a CAGR of 12.81% during the forecast period (2025-2030).

The increasing adoption of automation solutions, such as vision-guided robotic systems, and the increasing use of these cameras for contamination and defect detection are among the significant factors driving the growth of the studied market.

Key Highlights

- InGaAs is an III-V compound semiconductor with high photosensitivity in the near-infrared (NIR) and short-wave infrared (SWIR). The InGaAs camera uses this feature in various applications, including real-time in-line non-destructive inspection. The rise in demand for line scan InGaAs cameras for machine vision applications is a crucial driver of the InGaAs camera market.

- InGaAs are cooling-based cameras used in aerospace, military, telecommunications, industrial inspection, and spectroscopy. It has infrared (IR) technology, which allows for night vision or visibility through atmospheric haze and is primarily used by military and defense forces. Because of their performance characteristics, such as small, uncooled, lightweight design, high-quality night vision, attached covert eye-safe lasers, target recognition, and sensitivity to nightglows, these cameras find many applications in defense.

- InGaAs cameras bridge the gap between NIR wavelengths 950-1700 nm, where silicon detectors no longer work, and 950 - 1700 nm, where silicon detectors are no longer sensitive. Because of its lower bandgap, InGaAs provide sensitivity over a more comprehensive NIR range. When compared to Si-CCDs, the lower bandgap is also responsible for a much higher dark current (thermally generated signal). As a result, scientific InGaAs FPA cameras require intense cooling (down to -85°C) to reduce some unwanted noise sources.

- Moreover, as a detector material, InGaAs provided an affordable alternative for near-infrared (NIR) industrial applications such as humidity measurement, surface film distributions, and sorting tasks such as separating polymers from natural materials. As a result, the use of technology in industrial manufacturing and automation is increasing.

- Industry 4.0 accelerated the development of technologies such as robots, which now play a critical role in industrial automation, with robots managing many core operations in industries. New applications for InGaAs cameras include vision-guided robotics and automated butchering. These vision-guided robots are made up of IR imagers that find and pick random parts from a bin, followed by a camera that analyzes the orientation of each part and places it on a conveyor belt.

- Furthermore, the use of machine vision is increasing year after year. Machine vision sales are at an all-time high in some regions. According to the Association for Advancing Automation, machine vision for automated inspection and guidance continued its positive growth trajectory in North America in the first half of 2022, with favorable market growth predicted throughout the year. This is expected to drive demand for InGaAs cameras in such applications during the forecast period.

- However, the higher cost of InGaAs cameras is one of the major factors impeding the growth of the studied market. Furthermore, a rise in stringent import and export regulations across various countries restrains the development of the studied market.

InGaAs Camera Market Trends

Industrial Automation Expected to Occupy the Largest Market Share

- One of the key factors driving market growth is the increasing demand for InGaAs cameras in various applications. Another factor driving market growth is the increasing use of InGaAs cameras in the industrial automation sector. InGaAs cameras are used in industrial automation applications like thermal imaging, machine vision, and quality control because they outperform other types of cameras.

- The increasing adoption of machine vision systems is expected to drive demand for InGaAs cameras in the industrial automation segment. In a machine vision environment, a camera system is used to scan products on a production line. The camera captures the image and compares it to pre-defined criteria.

- Moreover, machine vision is increasingly being used in conjunction with robots to improve their effectiveness and overall value to the business. These robots have a camera mounted at the hand position that guides them through the task at hand. For example, according to IFR's 2023 report, the global stock of operational robots was to reach a new high of approximately 3.5 million units in 2022. In the meantime, the value of installations reached an estimated USD 15.7 billion.

- Furthermore, with the adoption of industrial robots expected to increase over the forecast period, the studied market is expected to see a positive increase in demand from the industrial segment. The annual installation of industrial robots is expected to reach 518 thousand units by 2024, according to IFR.

- Different industries use this technology to automate production and improve product quality and speed. The growing need for high-quality inspection and automation in various industries drives the demand for machine vision, eventually boosting the InGaAs camera market. Furthermore, increased R&D and the launch of new products by InGaAs camera market players are propelling the InGaAs camera market significantly.

- For instance, in January 2023, Lucid Vision Labs unveiled its brand-new 1.3MP and 0.3MP Triton SWIR IP67-rated industrial vision cameras. The Triton SWIR is a GigE PoE camera with wide-band and high-sensitivity Sony SenSWIR 1.3MP IMX990 and 0.3MP IMX991 InGaAs sensors capable of capturing images in visible and invisible light spectrums and a pixel size of 5m.

North America is Expected to Account for the Largest Market Share

- The rising use of robotics like UAVs and UGVs in military and defense applications is expected to increase demand for InGaAs cameras in North America. Moreover, higher penetration of automation and advanced technologies in the industrial domain favors the growth of the studied market in the region.

- The production of machine vision systems will be increased as a result of government programs like the Advanced Manufacturing Partnership, which aims to encourage businesses, academic institutions, and the federal government to invest in cutting-edge automation technologies. This will create a positive outlook for the market's growth.

- As InGaAs cameras are widely used in the military and defense sector to see through unfavorable conditions such as smoke, fog, haze, and water vapor, countries like the United States have increased their defense budgets and expenditure on advanced equipment. For example, a budget request for national defense of USD 813.3 billion in the United States has been made for the fiscal year 2023. Such defense spending is expected to drive market demand.

- Furthermore, the semiconductor industry, where demand for InGaAs cameras in applications such as silicon wafer pattern inspection is increasing, is gaining traction in the North American region, particularly in the United States. Favorable government investments, such as the US CHIPS Act, and vendor investments in the chip industry are thus expected to drive demand for InGaAs cameras during the forecast period.

- InGaAs cameras provide high sensitivity and low noise in medical imaging applications such as optical coherence tomography (OCT) and spectroscopy. Countries such as the United States, Canada, and others are constantly investing in advancing their medical industries, which is expected to drive growth opportunities in the increasing use of InGaAs cameras in medical imaging applications.

- The InGaAs camera market in North America is anticipated to experience favorable growth rates during the anticipated period due to the steadily increasing demand for advanced and effective imaging systems from various end-users operating in the area. Furthermore, advancements in industrial automation with the widespread adoption of robots and government spending in the defense and military industries are expected to drive the market in the coming years.

InGaAs Camera Industry Overview

The InGaAs camera market is competitive due to the market consisting of many large players as well as new players. Companies are trying to innovate their existing products to cater to increasing consumer demand, making the market competitive. Furthermore, the growing demand attracts new players, making the market fragmented. Some of the major players are Allied Vision Technologies GmbH, Acal BFI Limited Company, Coherent Inc., and Flir Systems Inc., among others.

In December 2022, JAI announced the launch of SW-4010Q-MCL, a new industrial prism-based line scan camera featuring 4-sensor line scan technology consisting of multiple CMOS sensors and a sensor based on indium gallium arsenide (InGaAs) technology to collect image data from the short wave infrared (SWIR) spectrum.

In November 2022, Allied Vision announced the launch of four new Goldeye SWIR camera models equipped with an extended range of InGaAs sensors, capable of detecting wavelengths up to 1.9 μm or 2.2 μm at high quantum efficiencies. The integrated dual-stage sensor cooling and several onboard image correction features are among the key factors to make specific spectral features visible with outstanding image quality.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview?

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.4.1 Uncooled

- 4.4.2 Cooled

- 4.5 Market Drivers

- 4.5.1 Increasing Adoption in Machine Vision Applications

- 4.5.2 Rising Demand in Military and Defense Operations

- 4.6 Market Challenges

- 4.6.1 High Procurement Cost of InGaAS Cameras

- 4.6.2 Stringent Regulation on Export and Import

- 4.7 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Military and Defense

- 5.1.2 Industrial Automation

- 5.1.3 Surveillance and Security

- 5.1.4 Other Applications

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.3 Asia

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Australia and New Zealand

- 5.2.3.5 South East Asia

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Allied Vision Technologies GmbH (TKH group)

- 6.1.2 Acal BFI Limited Company (Discoverie Group PLC)

- 6.1.3 Coherent Inc.

- 6.1.4 Flir Systems Inc.

- 6.1.5 FluxData Inc.

- 6.1.6 Hamamatsu Photonics KK

- 6.1.7 Lambda Photometrics Ltd.

- 6.1.8 New Imaging Technologies

- 6.1.9 Specim Spectral Imaging Ltd.

- 6.1.10 Raptor Photonics Ltd.

- 6.1.11 Sensors Unlimited (Collins Aerospace Company)

- 6.1.12 Teledyne Dalsa Inc. (Teledyne Technologies Incorporated)

- 6.1.13 Xenics Inc.