|

市场调查报告书

商品编码

1687756

驱虫剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Insect Repellent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

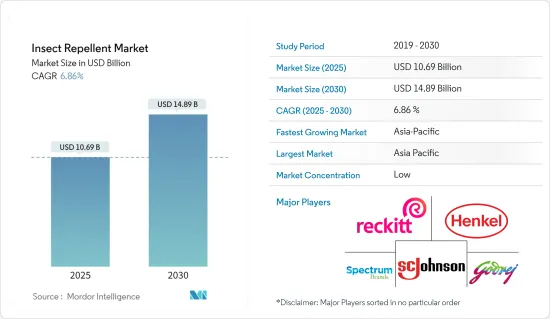

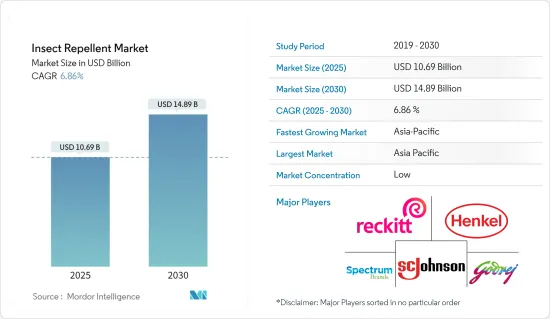

驱虫剂市场规模预计在 2025 年为 106.9 亿美元,预计到 2030 年将达到 148.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.86%。

预计预测期内,登革热、疟疾、基孔肯雅病、兹卡病毒和黄热病等疾病威胁的加剧将增加对驱虫剂的需求。政府加强疾病控制力度、人们健康意识增强以及驱虫产品价格合理是推动全球驱虫剂需求的主要因素。此外,驱虫剂的价格分布广泛,使得许多消费者更容易获得和负担得起。采用天然成分驱虫剂的人数正在增加。越来越多的消费者开始使用这类驱虫剂,以避免皮疹和过敏等问题。

製造商推出了各种产品来减少驱虫剂中避蚊胺的有害影响,预计这将在预测期内显着促进驱虫剂市场的成长。例如,2023年7月,Flora-scent Organics推出了一款创新驱蚊香。根据该公司介绍,这些香棒是由天然有机植物油混合物製成的,这种植物油以驱虫特性而闻名,但不含香茅油。随着这些化学驱虫剂造成的健康危害增加,消费者的偏好开始转向草药驱虫剂。现在,世界已开发地区的人们已经开始使用以印度楝为基础的喷雾剂、乳霜、油、香茅油、桦树皮和其他植物成分。该市场的主要企业包括 Dabur International、Reckitt Benckiser Group PLC、Godrej Consumer Products Limited、SC Johnson &Son Inc.、Jyothy Laboratories、Spectrum Brand Holdings Inc. 和 Genesis Group。市场上的公司正在采用新产品发布、协议、合作伙伴关係和收购等策略来在市场上站稳脚跟。

驱虫剂市场趋势

产品创新激增推动市场

驱虫剂产品的创新源于对更有效、更持久、更易于使用的解决方案的需求,以及对更安全、更环保的选择日益增长的需求。因此,製造商不断改进驱虫剂配方,以提高功效和安全性。这包括开发新的活性成分,如派卡瑞丁、IR3535和柠檬桉油(OLE),以及优化现有成分,如避蚊胺和Permethrin。例如,2023 年 5 月,消费品创新者 Grand Tongo 宣布推出 Town & Jungle Protection 驱虫喷雾。该品牌声称,新系列推出了一种以避蚊胺为基础的驱虫剂,可以取代避蚊胺并驱赶虫子。此外,该品牌表示,派卡瑞丁是一种温和、不油腻、几乎无味的活性成分,对于那些寻求有效防护而又不想有传统避蚊胺驱虫剂弊端的人来说,它是理想的选择。

此外,消费者对天然和植物来源的驱虫剂的需求日益增长,因为它们是合成化学品的更安全、更环保的替代品。采用植物抽取物、精油和草药配製的创新产品可以有效防虫,同时吸引环保意识的消费者。为了应对这种情况,製造商正在开发使用生物分解性成分和永续采购产品以减少对环境影响的驱虫剂。例如,庄臣旗下公司 STEM 于 2022 年 6 月推出了创新的新型虫害防治产品系列,包括 STEM Bug Spray 和 STEM Bug 擦拭巾。据该品牌声明,STEM 驱虫喷雾采用特殊配製的精油混合物製成,可驱蚊。此外,STEM驱虫擦拭巾采用植物来源活性成分,适合儿童(6个月及以上)驱蚊。这种多功能性使这些擦拭巾成为个人使用或露营的理想选择,可提供全面的驱虫功效。

亚太地区对驱虫剂的需求不断增加

中国是亚太地区人口最多的国家,其消费者的可支配收入较高,意识不断增强,生活水准不断提高,导致驱虫剂的使用率增加。所有这些因素结合起来会提高产品销售。此外,苍蝇、白蚁、臭虫、蚂蚁和蟑螂等家居昆虫在中国也很常见。喷雾剂、蒸发器、粉笔和粉末等易于使用的驱蚊剂的使用,导致这些产品在中国家庭中的销售量激增。

在印度,随着健康意识和兴趣的不断增强,以及家庭收入的提高和驱虫产品的普及,驱虫剂正逐渐进入家庭。此外,各种广告宣传、政府措施和新产品创新也在推动市场研究。例如,2023年5月,利洁时家用驱虫品牌Mortein与DENTSU CREATIVE India合作,在印度巴雷利发起了一项抗击疟疾的新倡议「Suraksha Ka Teeka」。发起这项宣传计画的目的是教育消费者透过使用「teeka」的日常做法来预防媒介传播感染疾病。

此外,印度推出的「清洁印度」运动等各种项目提高了人们对卫生和清洁的重视,进一步促进了市场的成长。例如,蚊媒疟疾的发生率已大大降低。卷状驱虫剂是该地区最受欢迎的产品,因为它们具有成本效益并且在所有零售通路均有销售。便利商店等线下通路在亚太国家农村地区颇受欢迎。

驱虫剂产业概况

由于全球和地区参与者众多,驱虫剂市场高度停滞且竞争激烈。市场的主要参与者包括 Spectrum Brands Inc.、Henkel AG &Co.KGaA、Reckitt Benckiser Group PLC、SC Johnson &Son Inc.、Godrej Group 等。 Godrej Consumer Products 是市场领导者,拥有广泛的产品系列、全球影响力和持续的动力。在研究期间,该公司专注于产品创新,开发了四种创新产品并扩大产品系列和全球影响力。另一家市场领导(SC Johnson & Son) 在所研究的市场中也享受着销售量的增长,这得益于消费者对包括所有产品类型(如避蚊胺产品以及天然和有机驱虫剂)在内的更广泛产品的偏好日益增长。因此,为了进一步巩固市场地位,该公司正在大力投资扩大其旗舰产品的生产规模。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 产品创新激增

- 政府倡议不断增加、市场主体大力推动

- 市场限制

- 使用驱虫剂的安全问题

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 产品类型

- 身体驱虫剂(乳霜、乳液、油)

- 其他驱虫剂

- 线圈

- 液体蒸发器

- 喷雾/气雾剂

- 饵

- 其他驱虫剂

- 销售管道

- 线下零售店

- 网路零售商

- 类别

- 天然驱虫剂

- 传统驱虫剂

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 西班牙

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 主要企业策略

- 市场占有率分析

- 公司简介

- Spectrum Brands Holdings Inc.

- Henkel AG & Co. KGaA

- Newell Brands Inc.

- Enesis Group

- SC Johnson & Son Inc.

- Quantum Health

- Reckitt Benckiser Group PLC

- Jyothy Labs Limited

- Dabur India Ltd

- Sawyer Products Inc.

- Kao Corporation

第七章 市场机会与未来趋势

The Insect Repellent Market size is estimated at USD 10.69 billion in 2025, and is expected to reach USD 14.89 billion by 2030, at a CAGR of 6.86% during the forecast period (2025-2030).

The growing threat of diseases, such as dengue, malaria, chikungunya, Zika virus, and yellow fever, is expected to boost the demand for insect repellents during the forecast period. Government initiatives being increasingly undertaken for disease control, rising health awareness among people, and the affordable costs of these products are among the major factors propelling the demand for insect repellents across the world. Also, the wide range of insect repellents in different price ranges has made them more easily accessible and affordable for a large consumer base. There has been a rise in the adoption of insect repellents based on natural ingredients. The adoption of such insect repellents is increasing among consumers to avoid problems such as skin rashes and allergies, among others.

Manufacturers are coming up with various products that are reducing the harmful effects of repellents due to the content of DEET in them, which, in turn, is anticipated to boost the insect repellent market's growth significantly during the forecast period. For instance, in July 2023, Flora-scent Organics launched an innovative mosquito-repellent incense stick. As per the company, it is an all-natural product made using a blend of organic plant oils that are well-known for their insect-repellent qualities, but it contains no citronella. With the growing incidences of health hazards caused by such chemical-based insect repellents, consumer preferences have begun to switch toward herbal-based insect repellents. Presently, people in developed regions worldwide have started using neem-based sprays, creams, oils, citronella oil, birch tree bark, and other plant-based ingredients. Key players in the market include Dabur International, Reckitt Benckiser Group PLC, Godrej Consumer Products Limited, SC Johnson & Son Inc., Jyothy Laboratories, Spectrum Brand Holdings Inc., and Genesis Group. The players operating in the market have been adopting strategies, such as new product launches, agreements, collaborations, and acquisitions, to gain a stronger foothold in the market.

Insect Repellent Market Trends

Surge in Product Innovations Propelling the Market

Product innovation in insect repellents has been driven by the need for more effective, long-lasting, and user-friendly solutions, as well as increasing demand for safer and more environmentally friendly options. As a result, manufacturers are continually refining and improving the formulation of insect repellents to enhance their efficacy and safety. This includes the development of new active ingredients, such as picaridin, IR3535, and oil of lemon eucalyptus (OLE), as well as the optimization of existing ingredients like DEET and permethrin. For instance, in May 2023, Grand Tongo, an innovator in consumer products, unveiled the launch of Town & Jungle Protection insect repellent. As per the brand's claim, this new collection featured a DEET alternative, a picaridin-based insect repellent that repels bugs. In addition, the brand stated that picaridin is an active ingredient that is gentle on the skin, non-greasy, and virtually odorless, making it an ideal choice for those who want effective protection without the drawbacks associated with traditional DEET-based repellents.

Furthermore, there is growing consumer demand for insect repellents made from natural and plant-based ingredients, perceived as safer and more environmentally friendly alternatives to synthetic chemicals. Innovations in botanical extracts, essential oils, and herbal formulations offer effective protection against insects while appealing to eco-conscious consumers. In response, manufacturers are developing insect repellents with reduced environmental impact, using biodegradable ingredients and sustainable sourcing practices. For instance, in June 2022, STEM, owned by S.C. Johnson, introduced an innovative new line of pest control products, including STEM Bug Repellent Spray and STEM Bug Repellent Wipes. According to the brand's statement, the STEM Bug Repellent Spray is crafted with an essential oil blend specifically formulated to deter mosquitoes. Furthermore, the brand affirms that the STEM Bug Repellent Wipes utilize plant-derived active components and are suitable for children (aged six months and above) to fend off mosquitoes. This versatility makes these wipes ideal for personal use or use in camping settings, offering comprehensive protection against insects.

Increased Demand for Insect Repellents from Asia-Pacific

China represents the largest market for insect repellents among Asia-Pacific countries as it is the most populous regional country, and its consumers have high disposable incomes, growing awareness, and improved living standards, which, along with the affordable pricing of repellents, has increased their penetration among household goods. All these factors cumulatively augment the sales of the product. Moreover, household insects like flies, termites, bed bugs, ants, and cockroaches are very common in China. The use of insect repellants in usable forms like sprays, vaporizers, chalks, and powders has proliferated sales of these products in Chinese homes.

In India, people's growing awareness and rising health concerns, along with increased household incomes and affordable product pricing, have improved insect repellents' penetration in homes. Furthermore, various ad campaigns, government initiatives, and innovations in new products have been driving the market studied. For instance, in May 2023, Mortein, Reckitt's household insect-repellent brand, and DENTSU CREATIVE India collaborated to launch their new initiative, 'Suraksha Ka Teeka,' against malaria in Bareilly, India. The awareness program was launched to leverage the everyday habit of applying 'teeka' to educate consumers on protection from vector-borne diseases.

The launch of various programs like Swacch Bharat Abhiyaan in India has also increased the importance of hygiene and cleanliness among people, which further improved market growth. For instance, the incidences of malaria caused by mosquitoes have reduced significantly. Insect repellents in the coil form are the most popular products in the region because they are cost-effective and available across all retail channels. Among the rural areas of the Asia-Pacific countries, offline distribution channels such as convenience stores are more popular.

Insect Repellent Industry Overview

The insect repellent market is highly stagnant and competitive, with the presence of various global and regional players. The major players operating in the market include Spectrum Brands Inc., Henkel AG & Co. KGaA, Reckitt Benckiser Group PLC, S.C. Johnson & Son Inc., and Godrej Group. Its extensive product portfolio, global presence, and continuous activities have made Godrej Consumer Products a market leader. During the study period, the company's major focus remained on product innovations, and it developed four innovative products to extend its product portfolio and global presence. SC Johnson & Son, another market leader, is also enjoying higher sales volumes in the market studied, supported by growing consumer inclination toward its wider range of products, which includes all product types, including DEET products and natural and organic insect repellents. Accordingly, to further strengthen its position in the market, the company has been extensively investing to scale up the production of its core products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Surge in Product Innovation

- 4.1.2 Increasing Government Initiatives and Extensive Promotions by Market Players

- 4.2 Market Restraints

- 4.2.1 Safety Concerns Associated with the Usage of Insect Repellents

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Body Work Insect Repellents (Cream/Lotion and Oil)

- 5.1.2 Other Insect Repellents

- 5.1.2.1 Coil

- 5.1.2.2 Liquid Vaporizer

- 5.1.2.3 Spray/Aerosol

- 5.1.2.4 Bait

- 5.1.2.5 Other Insect Repellents

- 5.2 Distribution Channel

- 5.2.1 Offline Retail Stores

- 5.2.2 Online Retail Stores

- 5.3 Category

- 5.3.1 Natural Insect Repellent

- 5.3.2 Conventional Insect Repellent

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 Spain

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Spectrum Brands Holdings Inc.

- 6.3.2 Henkel AG & Co. KGaA

- 6.3.3 Newell Brands Inc.

- 6.3.4 Enesis Group

- 6.3.5 S.C. Johnson & Son Inc.

- 6.3.6 Quantum Health

- 6.3.7 Reckitt Benckiser Group PLC

- 6.3.8 Jyothy Labs Limited

- 6.3.9 Dabur India Ltd

- 6.3.10 Sawyer Products Inc.

- 6.3.11 Kao Corporation