|

市场调查报告书

商品编码

1687759

汽车汽缸套:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Automotive Cylinder Liner - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

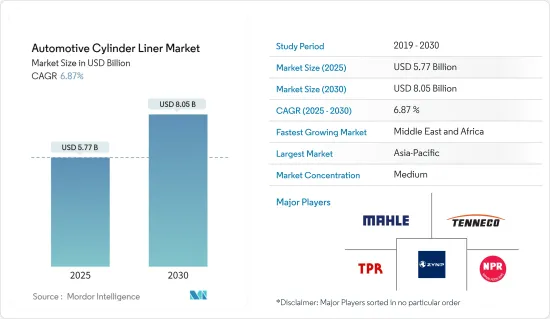

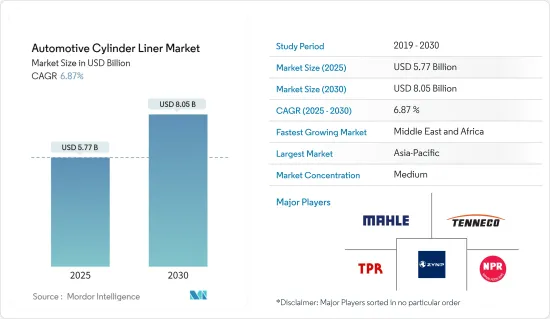

预计 2025 年汽车汽缸套市场规模将达到 57.7 亿美元,到 2030 年将达到 80.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.87%。

商用车销量增加和汽车持有上升是全球汽车产业成长的主要决定因素,进而对汽车汽缸套的需求产生正面影响。商用车的成长主要受到电子商务的扩张和商用车运输使用量的增加的推动。此外,支持汽车工业进步和发展的工业化和基础设施建设不断提高,正在推动商用车市场的成长。

根据国际汽车工业理事会的预测,2022年全球新商用车销售量将达到2,410万辆。

此外,重点地区对氢电商用车的需求不断成长,也促使汽缸套製造商开发先进技术。几家主要企业正在引入氢电动卡车的气缸套技术,以促进市场成长。车辆报废计划以及有关车辆长度和负载容量限制的严格监管规范也有望推动市场成长。

由于印度和中国汽车行业的不断增长的潜力,预计亚太地区将占据汽车气缸套消费的主导地位。包括美国在内的世界许多国家都从中国、日本和其他经济体采购原材料和发动机零件,并在完整的发动机室内组装。随着汽车销售和产量的增加,该地区对汽缸套的需求预计将保持在高位。

汽车汽缸套市场趋势

预测期内乘用车市场将获得发展动力

乘用车是新兴国家最常见的交通途径。由于人均收入的提高,新兴国家的持有数量正在增加,预计这将对汽车气缸套市场产生积极影响。印度等新兴国家正在寻求更好的燃料,例如用于乘用车的乙醇,这可以对市场成长产生积极影响。

例如,2023 年 8 月,Toyota Innova 成为世界上第一款仅靠乙醇运作的弹性燃料汽车。丰田汽车公司预计将成为世界上第一家推出 100% 乙醇燃料汽车的汽车製造商。 2023年8月,印度联邦部长推出了一款基于丰田最受欢迎的乘用车Innova的汽车。 Innova成为全球首款配备 Bharat Phase VI 灵活燃料电动证书的车型。一年前,这家日本汽车製造商推出了使用氢燃料电池的 Mirai。

更严格的排放法规、电动车的日益普及以及内燃机(ICE)汽车对环境的有害影响所导致的石化燃料蕴藏量稀缺可能会对市场成长构成挑战。然而,新兴经济体电动车基础设施和充电设施的发展预计将在预测期内推动内燃机市场的扩张。根据国际汽车工业组织(OICA)预测,2022年全球新车销量将达5,740万辆,较2021与前一年同期比较增1.9%。 2022年南非新车销量较去年与前一年同期比较19.5%,泰国成长10.0%。

都市化的上升和消费者对私人交通途径的偏好的改变预计将推动全球汽车行业的发展,这反过来又将推动先进汽车市场对气缸套的需求。根据世界银行预测,到2022年,印度的都市化将达到36%,而2018年为34%。随着越来越多的消费者迁移到新兴市场的都市区,对个人出行的偏好日益增加,这很可能导致全球整体汽车汽缸套市场的成长。

预测期内,亚太地区将占据最大市场占有率

由于中国和印度汽车产业的扩张,汽缸套产品销售量不断增加,带动了亚太地区汽车汽缸套市场的发展。这两个国家都在刺激汽车销售,对引擎的需求庞大。

印度是该地区主要的汽车出口国之一,从目前的机动性扩张计划来看,预计出口将很快强劲成长。此外,印度政府对汽车产业的大力扶持以及主要汽车製造商在印度市场的存在,帮助印度发展成为领先的汽车出口国之一。 2000年4月至2022年9月,中国汽车产业累计获得直接投资约337.7亿美元。政府预计,到2024年,汽车产业规模将翻倍,达到180亿美元。此外,中国在汽车加工能力和引擎产量方面在亚太地区占据主导地位。

2022年中国汽车销量预计将达到2,680万辆,高于2021年的2,627万辆,与前一年同期比较去年同期成长2.2%。该地区主要发动机製造商和目标商标产品製造商(OEM)的投资、扩张和发展正在增加。预计这将在预测期内减缓对汽缸套的需求。

例如,2022年3月,哈尔滨东安汽车动力股份有限公司宣布2022年投资计划,建造高效增程式引擎生产线,预计包括加工中心、打标机、拧紧机、涂胶机等设备。此计划拟由哈尔滨东安汽车动力股份有限公司下属子公司哈尔滨东安汽车动力有限公司共同开发,总投资7,233万元人民币(1,085万美元)。

因此,随着该地区乘用车和商用车行业的扩张,预计未来几年汽车气缸套市场的需求将迅速增长。然而,各国政府将重点转向电动车可能会成为亚太地区长期产品成长的重大阻碍因素。然而,短期内,汽车电气化的竞争转变对这些政府构成了重大挑战。因此,预计预测期内汽车汽缸套的需求将保持强劲。

汽车汽缸套产业概况

汽车汽缸套市场呈现中度分散态势,有组织和无组织的参与者共同塑造产业格局。汽缸套市场的主要竞争对手包括 Mahle GmBH、Tenneco Inc.、TPR、Nippon Piston Ring 和 ZYNP。领先的製造商正在大力投资汽车汽缸套的研究和开发,以提高盈利和产品效率。

为了降低与原材料采购相关的风险,公司正在采取积极主动的方式并扩大与主要原材料供应商的关係。这项策略成功地确保了生产汽缸套所需原料的稳定、持续供应。

2022年10月:莱茵金属股份公司(莱茵金属与华域汽车系统的合资企业)铸造业务部门赢得一项重要订单,向英国一家知名跑车製造商供应V8引擎缸体。 V8 引擎拥有接近四位数的惊人马力。

2022 年 4 月:丰田北美公司宣布打算在美国四家工厂投资 3.83 亿美元。该投资旨在为混合动力和传统动力传动系统的新型四缸引擎的生产做准备。引擎生产范围包括端到端组装,包括引擎缸盖、衬套和各种其他部件。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 商用车销售量增加

- 其他的

- 市场限制

- 电动车迅速普及

- 其他的

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 依材料类型

- 铸铁

- 防锈的

- 铝

- 钛

- 按燃料

- 汽油

- 柴油引擎

- 按接触点

- 湿式汽缸套

- 干式汽缸套

- 按车型

- 搭乘用车

- 轻型商用车

- 中大型商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Mahle GmbH

- Tenneco Inc.

- GKN Zhongyuan Cylinder Liner Company Limited

- Melling Cylinder Sleeves

- TPR Co. Ltd

- Westwood Cylinder Liners Ltd

- Darton International Inc.

- ZYNP International Corporation

- Laystall Engineering Co. Ltd

- India Pistons Ltd

- Nippon Piston Ring Co. Ltd

- Motordetal

- Kusalava International

- Cooper Corp.

- Yoosung Enterprise Co. Ltd

- Yangzhou Wutingqiao Cylinder Liner Co. Ltd

- Chengdu Galaxy Power Co. Ltd

第七章 市场机会与未来趋势

- 混合衬垫的采用日益增多

The Automotive Cylinder Liner Market size is estimated at USD 5.77 billion in 2025, and is expected to reach USD 8.05 billion by 2030, at a CAGR of 6.87% during the forecast period (2025-2030).

The rising sales of commercial vehicles and increasing vehicle parc globally serve as major determinants for the growth of the automotive industry across the world, which, in turn, is positively impacting the demand for automotive cylinder liners. Commercial vehicle growth is primarily influenced by the expansion of e-commerce and the increasing use of commercial vehicles for transportation. Aside from that, rising industrialization and infrastructure development, which support advancement and development in the automotive industry, are driving market growth for commercial vehicles.

According to the International Organization of Motor Vehicle Manufacturers, the global sales of new commercial vehicles touched 24.1 million units in 2022.

Furthermore, rising demand for hydrogen electric commercial vehicles across major regions is pushing cylinder liner manufacturers to develop advanced technology. Several key players are introducing cylinder liner technology for hydrogen-electric trucks, boosting market growth. Vehicle scrappage programs and stringent regulatory norms for vehicle length and loading limits, among other parameters, are also expected to drive the growth of the market.

Asia-Pacific is expected to dominate the consumption of automotive cylinder liners, owing to the increased potential of the automotive industry in India and China. Many countries across the world, such as the United States, source their raw materials and engine components from China, Japan, and other economies to assemble them under complete engine chambers. With rising automotive sales and production, the region's demand for cylinder liners is expected to remain high.

Automotive Cylinder Liner Market Trends

The Passenger Car Segment of the Market to Gain Traction During the Forecast Period

Passenger cars are the most common form of transport in emerging countries. The number of passenger cars is increasing in developing countries with the rise in per capita income, and such factors are likely to impact the automotive cylinder liner market positively. Emerging countries, such as India, are looking for better fuels, like ethanol, for their passenger cars, which may positively impact the market growth.

For instance, in August 2023, Toyota Innova became the world's first flexible fuel vehicle that can run entirely on ethanol. Toyota Motor is projected to become the first automaker in the world to introduce cars powered by 100% ethanol. In August 2023, the Union Minister of India launched a vehicle based on Toyota's most popular passenger car, Innova. Innova became the first model in the world to feature a Bharat Phase VI vehicle with a flexible fuel electric certificate. The launch came a year after the Japanese auto giant introduced Mirai, which uses hydrogen fuel cells.

Increasing emission regulations, penetration of electric vehicles, and lack of fossil fuel reserves due to the toxic impact of internal combustion engine (ICE) vehicles on the environment could challenge the growth of the market. However, in emerging countries, there needs to be more infrastructure for electric vehicles, and charging facilities are expected to facilitate the expansion of the internal combustion engine market during the forecast period. According to the International Organization of Motor Vehicle Manufacturers (OICA), global new passenger car sales touched 57.4 million in 2022, recording a Y-o-Y growth of 1.9% compared to 2021. Countries such as South Africa and Thailand recorded 19.5% and 10.0% Y-o-Y growth, respectively, in new passenger car sales in 2022 compared to the previous year.

The rising urbanization rate and the shifting preference of consumers toward availing private transportation mediums are anticipated to drive the automotive industry across the world, which, in turn, is expected to drive the demand for the advanced automotive cylinder liner market. According to the World Bank, the urbanization rate in India stood at 36% in 2022, compared to 34% in 2018. As more consumers migrate to urban areas in developing nations, there will be a preference for personal mobility, which, in turn, may lead to the growth of the automotive cylinder liner market across the world.

Asia-Pacific to Hold the Largest Market Share During Forecast Period

The Asia-Pacific automotive cylinder liner market is witnessing elevated sales of cylinder liner products owing to the expanding auto sector of China and India. Both countries are fuelling vehicle sales, generating significant engine demand.

India is one of the major automobile exporters in the region, and strong export growth is expected shortly, seeing its present mobility expansion projects. Furthermore, favorable initiatives by the Indian government to support the automotive industry and the presence of major automakers in its market are assisting in developing the country into one of the major automobile exporters. The automotive industry in the country received a cumulative FDI inflow of approximately USD 33.77 billion between April 2000 and September 2022. The government expects to double the size of the automotive industry to USD 18 billion by 2024. Furthermore, China holds the dominant hand in Asia-Pacific in terms of auto industry throughput and engine production.

In 2022, the total number of vehicles sold in China stood at 26.8 million units, compared to 26.27 million units in 2021, registering a year-on-year growth of 2.2%. The region is witnessing extended investment, expansion, and development, proliferated by key engine manufacturers and original equipment manufacturers (OEMs). This is expected to mitigate the demand for cylinder liners over the forecast period.

For instance, in March 2022, Harbin Dongan Auto Engine Co. Ltd unveiled its investment plan for 2022 for building a production line for high-efficiency extended-range engines, which was expected to involve machining center, marking machines, tightening machines, gluing machines, and other equipment. The project was planned to be jointly maintained by Harbin Dongan Automotive Engine Manufacturing Co. Ltd, the subsidiary of Harbin Dongan Auto Engine, with a total investment of CNY 72.33 million (USD 10.85 million).

Therefore, with the region's expanding passenger car and commercial vehicle industry, the demand for the automotive cylinder liner market will showcase a rapid surge in the coming years. However, shifting the government's focus to promote the adoption of electric vehicles could act as a major deterrent to the growth of these products in the long run in Asia-Pacific. However, a competitive shift toward electrification of vehicle fleets in the short run is a major challenge for these governments. Therefore, the demand for automotive cylinder liners is expected to remain strong during the forecast period.

Automotive Cylinder Liner Industry Overview

The automotive cylinder liner market exhibits moderate fragmentation, with a mix of organized and unorganized players shaping the industry landscape. Among the key contenders in the cylinder liner market, notable players include Mahle GmBH, Tenneco Inc., TPR Co. Ltd, Nippon Piston Ring Co. Ltd, and ZYNP. Significant manufacturers are channeling substantial investments into the research and development of automotive cylinder liners to enhance profitability and product efficiency.

To mitigate the risks associated with raw material procurement, companies have adopted a proactive approach, maintaining extended relationships with their primary raw material suppliers. This strategy has proven successful in ensuring a consistent and uninterrupted supply of materials necessary for cylinder liner production.

October 2022: Rheinmetall AG's Castings business unit, a joint venture between Rheinmetall and HUAYU Automotive Systems Co. Ltd, secured a significant order to supply a V8 engine block to a renowned English sports car manufacturer. Notably, the V8 engines boast an impressive horsepower output, approaching four figures.

April 2022: Toyota Motor North America disclosed its intention to invest USD 383 million in four US-based plants. This investment is aimed at preparing to produce a new four-cylinder engine variant tailored for hybrid and conventional powertrains. The scope of engine production encompasses end-to-end assembly, encompassing engine heads, liners, and various other components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Sales of Commercial Vehicles

- 4.1.2 Others

- 4.2 Market Restraints

- 4.2.1 Rapid Adoption of Electric Vehicles

- 4.2.2 Others

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Material Type

- 5.1.1 Cast Iron

- 5.1.2 Stainless Steel

- 5.1.3 Aluminum

- 5.1.4 Titanium

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.3 By Contact

- 5.3.1 Wet Cylinder Liner

- 5.3.2 Dry Cylinder Liner

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commerical Vehicles

- 5.4.3 Medium and Heavy-duty Commercial Vehicles

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of Latin America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Mahle GmbH

- 6.2.2 Tenneco Inc.

- 6.2.3 GKN Zhongyuan Cylinder Liner Company Limited

- 6.2.4 Melling Cylinder Sleeves

- 6.2.5 TPR Co. Ltd

- 6.2.6 Westwood Cylinder Liners Ltd

- 6.2.7 Darton International Inc.

- 6.2.8 ZYNP International Corporation

- 6.2.9 Laystall Engineering Co. Ltd

- 6.2.10 India Pistons Ltd

- 6.2.11 Nippon Piston Ring Co. Ltd

- 6.2.12 Motordetal

- 6.2.13 Kusalava International

- 6.2.14 Cooper Corp.

- 6.2.15 Yoosung Enterprise Co. Ltd

- 6.2.16 Yangzhou Wutingqiao Cylinder Liner Co. Ltd

- 6.2.17 Chengdu Galaxy Power Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Adoption of Hybrid Liners