|

市场调查报告书

商品编码

1687760

美国汽车服务:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)US Automotive Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

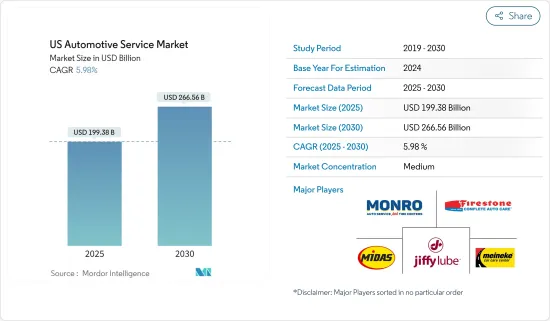

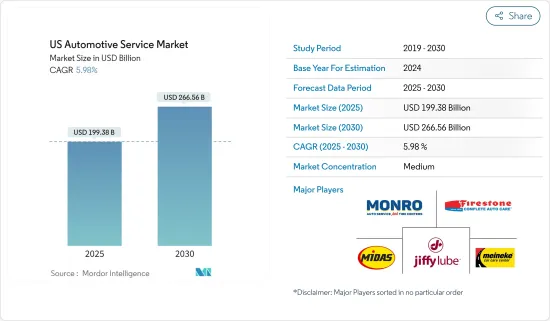

预计 2025 年美国汽车服务市场规模为 1,993.8 亿美元,到 2030 年将达到 2,665.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.98%。

2020年,新冠疫情迫使约95%的汽车相关企业暂停营运。然而,与世界其他地区相比,美国的封锁时间仅为几週。该国汽车需求量大,汽车工业蓬勃发展。道路运输车辆及零件零售业已从新冠疫情中迅速復苏,收益超过 1.5 兆美元。同时,全球汽车晶片短缺给产业带来了挑战,自2020年4月以来,月度库存销售比持续下降。

从长远来看,汽车服务公司越来越多地使用基于人工智慧的车检技术进行车辆检查,以拓宽客户群。例如,2022年2月,美国科技公司Scope Technology与微软云端运算服务Azure合作,开发基于AI的车辆侦测技术。这次目视检查只需不到五分钟,并可降低 50% 的成本。

车队的年龄可能是行业成长的一个积极因素,因为老车需要更频繁的维护和更换零件。此外,随着每年行驶里程的增加,共用出行需求的不断增长是计程车和共用汽车年度维护支出增加的主要原因之一。

电动车的日益普及预计将对市场成长产生重大影响。电动车的迅速普及可以归功于政府为改善环境品质以减少对原油的依赖而采取的措施和支持。总体而言,电动车的维修和保养成本预计将比内燃机汽车低约 40%。

这些机构通常设有各种维修站,为各种车辆提供维修和保养服务,包括掀背车、轿车、MPV、SUV 和两轮车。降低管理费用对降低整体服务费用有很大帮助。有效的沟通和独立的机制可以改善客户关係并培养客户的善意。满足多种汽车品牌的需求和零件的便利供应进一步刺激了市场需求。

汽车修理局 (BAR) 是消费者事务部 (DCA) 的一个部门,透过对汽车修理行业进行有效监督并管理机动车排放气体和安全计划来保护加州人民。

美国汽车服务市场趋势

商用车需求不断成长推动市场

自景气衰退以来,商用车销量逐年成长,但美国消费者的偏好正转向既能运载货物又能载客的皮卡车。

例如,2021 年商用车销量约为 1,200 万辆,低于 2020 年报告的约 1,150 万辆。用于货运和客运的机动车辆都属于此类别。

商用车辆(例如中型和大型卡车)的行驶远距。因此需要经常进行维护。此外,由于它们在相对较短的时间内行驶远距,因此零件的维护和更换週期也更加频繁。

例如,一项研究发现,今年美国轻型车(VIO)的平均使用车龄为12.2年,比去年增加了近两个月。

美国车龄连续五年增加。虽然汽车持有已经回升,去年增加了350万辆,但今年车龄再次创历史新高。

据汽车保养委员会执行董事称,由于车龄超过 11.5 年,老旧汽车更容易出现故障和服务问题。

- 汽车保养委员会敦促老旧车辆驾驶员采取预防性维护计划,以减少道路上发生故障的可能性,并使车辆更有效率、更经济地运行。

引擎油、煞车油、变速箱油、空气滤清器和煞车皮等常见零件磨损很快。大多数车主在保固期过后都会向售后车库和研讨会寻求服务。

此外,大多数商用车都配备柴油发动机,与汽油发动机车辆相比,柴油发动机需要更多的维护。为了净化柴油,使用单一过滤器或初级过滤器和次级过滤器的组合。这些过滤器应根据车辆的品牌和类型定期更换。预计这将在预测期内推动市场发展。

随着电动车时代的到来,大多数物流公司都致力于在其车队中增加商用电动车来运送货物。

- 例如,2022 年 7 月,亚马逊和 Rivian 宣布,他们计划在 2022 年底在 100 多个城市部署数千辆客自订电动送货车,到 2030 年增加到 10 万辆。

- 沃尔玛公司已从通用汽车旗下的 BrightDrop 子公司预订了 5,000 辆电动货车,用于 2022 年 1 月,以支持该零售商不断扩大的电子商务配送业务。

由于上述因素,预计美国汽车服务市场在预测期内将继续成长。

汽车维修保养中心增加

预计2021年第四季美国汽车维修保养中心数量将达到近239,100个,与前一年同期比较增加2%。 2010 年第四季至 2021 年间,该产业新增了 17,700 多家机构。

汽车维修

- 美国道路上的车辆数量正在增长,最近的估计表明,美国道路上车辆的平均使用年限每年都在增加。

- 这些发展显示汽车维修产业还有扩展空间。预计未来几年汽车维修业的收益将会成长。

一项研究显示,今年美国轻型车辆(VIO)的平均运作年限为12.2年,比去年增加了近两个月。

- 美国车龄连续五年增加。虽然汽车持有已经回升,去年增加了350万辆,但今年车龄再次创历史新高。

据汽车保养委员会执行董事称,由于车龄超过 11.5 年,老旧汽车更容易出现故障和服务问题。

- 汽车保养委员会敦促老款汽车驾驶对其车辆实施预防性维护计划,以减少道路上发生故障的可能性,并使汽车更有效率、更经济地运行。

美国汽车服务市场较为分散,市场参与者众多。为了获得竞争优势,各公司纷纷建立合资企业、联盟并推出采用先进技术的新产品。

- 例如,我们宣布收购 RepairSmith,这是一家提供汽车维修和保养全方位服务的行动解决方案公司,总部位于加州洛杉矶,并在美国南部和西部拥有大型营运基地。

美国汽车服务业概况

美国汽车服务市场较为分散,Firestone Complete Auto Care、Jiffy Lube International, Inc.、Meineke Car Care Centers, LLC.、Midas International, LLC.、MONRO, INC.、Safelite Group等占较大市场份额。公司正在建立合资企业、联盟并推出采用先进技术的新产品,以获得竞争优势。

- 例如,2022 年 4 月,特斯拉公司提案在佛罗里达州圣彼得堡建造一座 10 万平方英尺的工厂。新的特斯拉中心将负责该地区的销售、服务和交付。新的特斯拉工厂将建在一块占地 4.21 英亩的土地上,该土地上还设有一个 100,000 平方英尺的凯恩斯家具组织中心。

- 2022 年 7 月 FullSpeed Automotive® 是美国最大的汽车售后维修设施特许专利经营之一,也是领先品牌 Grease Monkey® 和 SpeeDee Oil Change & Auto Service® 的母公司,该公司正在透过收购策略加速其成长,旨在到 2023 年底实现 1,000 家单位的扩张目标。

- 2021 年 3 月,Monro, Inc. 签署最终协议,收购 Mountain View Tire &Service, Inc.。收购 30 家加州门市将使预计年销售额增加 4,500 万美元。

- 2021 年 1 月,Jiffy Lube International, Inc. 继续致力于扩大其业务范围,在北美建立了 2,081 多个特许经营服务中心。在美国开设了 45 家新的 Jiffy Lube International, Inc. 服务中心。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 按车辆类型

- 搭乘用车

- 商用车

- 按服务类型

- 机械的

- 外观和结构

- 电气和电子

- 依设备类型

- 胎

- 床单

- 电池

- 其他的

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Firestone Complete Auto Care

- Jiffy Lube International, Inc.

- Meineke Car Care Centers, LLC.

- Midas International, LLC

- Monro Inc.

- Safelite Group

- Walmart Inc.

- Pep Boys

第七章 市场机会与未来趋势

The US Automotive Service Market size is estimated at USD 199.38 billion in 2025, and is expected to reach USD 266.56 billion by 2030, at a CAGR of 5.98% during the forecast period (2025-2030).

The COVID-19 pandemic compelled about 95% of all automotive-related companies to put their workforces on hold during the lockdowns in the year 2020. However, the United States witnessed a lockdown for only a few weeks compared to other countries worldwide. The country's high motor vehicle demand fuels an active automotive industry. The road vehicle and parts retail trade has quickly recovered from the COVID-19 pandemic, generating over USD 1.5 trillion in revenue. The global automotive chip shortage, on the other hand, poses a challenge to the industry, and the monthly inventory-to-sales ratio has been falling since April 2020.

Over the long term, automotive service companies are increasingly using artificial intelligence-based automated vehicle inspection technology for vehicle inspection to widen their customer base. For instance, In February 2022, Scope Technology, a US-based tech firm, collaborated with Microsoft's Azure cloud computation to develop AI-automated vehicle inspection technology. This visual inspection takes less than 5 minutes and saves 50% on costs.

The increasing age of vehicles will benefit industry growth because older vehicles require more frequent maintenance and replacement parts. Furthermore, increasing demand for shared mobility is one of the key factors increasing yearly maintenance spending on cabs or shared vehicles owing to a higher yearly distance driven.

The increasing penetration of electric vehicles will have a significant impact on market growth. The rapid adoption of electric vehicles can be attributed to government initiatives and support for improving environmental quality to reduce reliance on crude oil. Overall, battery electric vehicle repair and maintenance costs are expected to be around 40% lower than ICE vehicle costs.

The establishments typically include a variety of service bays to provide repair and maintenance services for a wide range of vehicles, including hatchbacks, sedans, MPVs, and SUVs, as well as two-wheelers. Lowering overhead costs contributes significantly to lowering overall service charges. Effective communication and independent mechanics improve customer relationships and foster customer goodwill. The ability to serve multiple vehicle brands and the easier availability of spare parts are driving market demand even higher.

The Bureau of Automotive Repair (BAR), a division of the Department of Consumer Affairs (DCA), protects Californians by effectively supervising the automotive repair industry and administering vehicle emissions reduction and safety programs.

US Automotive Service Market Trends

Growing Demand for Commercial Vehicles Likely to Drive the Market

Although commercial vehicle sales have been rising year after year since the post-recession period, there is a shift in consumer preference in the United States toward pick-up trucks capable of transporting both cargo and passengers. For instance,

Approximately 12 million commercial vehicles were sold in 2021, up from approximately 11.5 million units reported in 2020. Motor vehicles used for transporting goods or paying passengers are included in this category.

Commercial vehicles, such as medium and heavy-duty trucks, typically travel longer distances than passenger vehicles. As a result, they are frequently in need of maintenance. Their part and component maintenance and replacement cycle are also more frequent due to the large distances traveled in a relatively short period. For instance,

According to a study, the average age of light vehicles in operation (VIO) in the United States increased to 12.2 years this year, up nearly two months from the previous year.

The average vehicle age in the United States has risen for the fifth year in a row. This year's average age is another all-time high, even as the vehicle fleets recovered, increasing by 3.5 million units in the previous year.

According to the executive director of the Car Care Council, with an average vehicle age of more than 11.5 years, the likelihood of a breakdown or service issue on an older vehicle is much higher.

- The Car Care Council strongly advises drivers of older vehicles to implement a preventative maintenance plan for their vehicle in order to reduce the likelihood of a roadside breakdown and to help their vehicle run more efficiently and economically.

Engine oils, brake and transmission fluids, air filters, brake pads, and other common components deplete more quickly. Most vehicle owners seek the services of aftermarket garages or workshops after the warranty period has expired.

Furthermore, because most commercial vehicles are diesel-powered, they require more maintenance than their gasoline-powered counterparts. To purify diesel, a single filter or a combination of primary and secondary filters is used. These filters must be replaced on a regular basis, depending on the vehicle's build and variant. This is expected to drive the market over the forecast period.

As the electric vehicle era has started, most logistic companies focus on adding commercial electric vehicles to their fleet to deliver goods. For instance,

- In July 2022, Amazon and Rivian intended to deploy thousands of custom electric delivery vehicles in over 100 cities by the end of 2022, increasing to 100,000 by 2030.

- In January 2022, Walmart Inc. reserved 5,000 electric vans from General Motors' BrightDrop subsidiary to support the retailer's expanding e-commerce delivery operations.

Based on the aforementioned factor, the United States automotive service market's growth is expected to continue during the forecast period.

Growing Number of Auto Repair and Maintenance Centers

There will be nearly 239,100 auto repair and maintenance centers in the United States in the fourth quarter of 2021, a 2% increase from the previous year. The industry added over 17,700 establishments between the fourth quarter of 2010 and 2021.

Automobile maintenance:

- The number of vehicles on the road in the United States has mostly increased, and recent estimates indicate that the average age of vehicles on American roads is increasing year after year.

- These developments suggest that the automotive repair industry has room for expansion. The revenue generated by the automotive repair industry is expected to grow in the coming years.

According to a study, the average age of light vehicles in operation (VIO) in the United States increased to 12.2 years this year, up nearly two months from the previous year.

- The average vehicle age in the United States has risen for the fifth year in a row. This year's average age is another all-time high, even as the vehicle fleets recovered, increasing by 3.5 million units in the previous year.

According to the executive director of the Car Care Council, with an average vehicle age of more than 11.5 years, the likelihood of a breakdown or service issue on an older vehicle is much higher.

- The Car Care Council strongly advises drivers of older vehicles to implement a preventative maintenance plan for their vehicle in order to reduce the likelihood of a roadside breakdown and to help their vehicle run more efficiently and economically.

The automotive service market in the United States is fragmented, with numerous market players. Companies are either forming joint ventures, forming partnerships, or launching new products with advanced technology in order to gain a competitive advantage. For Instance-

- In December 2022, AutoNation Inc., one of America's largest automotive retailers, announced the acquisition of RepairSmith, a full-service mobile solution for automotive repair and maintenance headquartered in Los Angeles, CA, with a significant operational footprint in southern and western United States.

US Automotive Service Industry Overview

The United States automotive service market is fragmented with market players, such as Firestone Complete Auto Care, Jiffy Lube International, Inc., Meineke Car Care Centers, LLC., Midas International, LLC, MONRO, INC., and Safelite Group, who hold the most significant shares. Companies are making joint ventures, and partnerships, and launching new products with advanced technology to have the edge over their competitors. For instance,

- In April 2022, Tesla, Inc. proposed constructing a 100,000-square-foot facility in St. Pete, Florida. The new Tesla center will handle sales, service, and deliveries in the area. The new Tesla facility will be built on a 4.21-acre plot that houses a 100,000-square-foot Kanes Furniture liquidation center.

- In July 2022, FullSpeed Automotive(R), one of the nation's largest franchisors and operators of automotive aftermarket repair facilities and the parent company of flagship brands Grease Monkey(R) and SpeeDee Oil Change & Auto Service(R), is accelerating growth with an acquisition strategy aimed at achieving its 1,000-unit expansion goal by the end of 2023.

- In Mar 2021- Monro, Inc. signed a definitive agreement to acquire mountain view tire & Service, Inc. Acquisition of 30 California-based stores, adding USD 45 million in expected annualized sales, expanding its presence in an attractive western region with a total of 116 stores.

- In January 2021, Jiffy Lube International, Inc. continued its focus on expanding its footprint by establishing more than 2,081 franchisee-owned service centers across North America. 45 new Jiffy Lube International, Inc. service centers were opened in the United States.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Driver

- 4.2 Market Restraint

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size Value in USD Million)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Service Type

- 5.2.1 Mechanical

- 5.2.2 Exterior and Structural

- 5.2.3 Electrical and Electronics

- 5.3 By Equipment Type

- 5.3.1 Tires

- 5.3.2 Seats

- 5.3.3 Batteries

- 5.3.4 Other Equipment Types

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Firestone Complete Auto Care

- 6.2.2 Jiffy Lube International, Inc.

- 6.2.3 Meineke Car Care Centers, LLC.

- 6.2.4 Midas International, LLC

- 6.2.5 Monro Inc.

- 6.2.6 Safelite Group

- 6.2.7 Walmart Inc.

- 6.2.8 Pep Boys