|

市场调查报告书

商品编码

1687762

休閒车租赁:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Recreational Vehicle Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

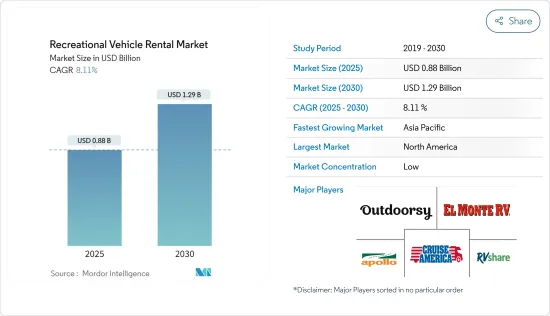

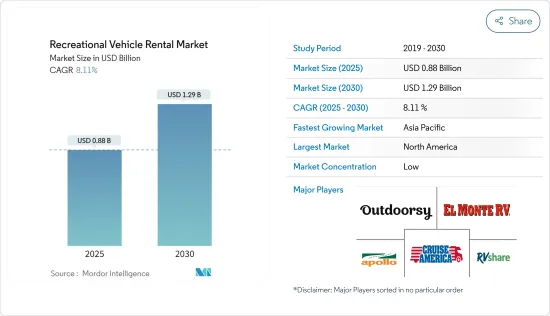

休閒车租赁市场规模预计在 2025 年达到 8.8 亿美元,预计到 2030 年将达到 12.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.11%。

由于越来越多的年轻人和老年人选择房车旅游,休閒车(RV)租赁市场预计将经历显着增长。此外,旅游业的发展和休閒车露营的日益普及正在推动全球对房车租赁服务的需求。

购买房车的成本可能相当高,这就是为什么北美、欧洲和亚太地区的许多人都选择房车租赁服务来消除与购买、保险和维护车辆相关的成本。房车租赁服务的便利性以及全球范围内房车租赁服务供应商数量的不断增加,吸引了那些预算有限且不想投资购买新房车的客户。

新的房车租赁流程也随着时代的变迁而变得越来越简单。房车租赁公司提供丰厚的优惠来吸引顾客。随着每年都有新的技术先进的车型进入市场,并提供线上和线下预订方式,客户拥有充足的选择。每次新旅行,您都可以乘坐配备其他设施的不同型号的房车。每家公司都客製了他们的预订服务,以方便房车旅行者预订。

房车租赁市场趋势

按产品类型划分,电动房车是最大的细分市场

随着旅行和旅游业在世界各地越来越受欢迎,人们正在寻求独特而冒险的体验。对体验式、沉浸式旅行体验的渴望推动了对机动房车租赁的需求。许多国家缺乏可用的露营地也促进了电动房车市场的萎缩。

此外,全球范围内,尤其是欧洲国家,旅居车的需求正在强劲成长。日益增长的富裕程度和休閒车停车位的广泛普及正在推动休閒车在北美和欧洲的普及。 2022 年,欧洲将占据全球大篷车和旅居车市场的巨大份额,因为欧洲的旅居车销售将超过北美。

自疫情爆发以来,许多人计划度假,同时出于安全考虑避免乘坐公共交通工具,导致休閒车的需求激增。在新冠疫情期间,欧洲多家房车租赁公司的预订量大幅增加。

此外,近年来,B级和C级旅居车因其优势而需求增加。例如,近年来,美国参加夏令营的人数不断增加。 2023年,美国露营者的数量将超过5,700万,高于2022年的约5,500万。

此外,各国政府正在投资基础设施建设以吸引旅游业,这可能会对预测期内电动房车租赁的成长产生正面影响。例如,2022年6月,西班牙政府核准从欧盟下一代资金中拨款总计1.1亿欧元,用于增强巴利阿里群岛、休达和梅利利亚等多个地区的旅游竞争力。

所有这些因素结合起来可能会在预测期内推动对电动房车的需求。

预测期内亚太地区将经历快速成长

预计北美市场占有率,而亚太地区预计将在预测期内以最快的速度成长。中国、印度、日本和东南亚国家等经济体的可支配收入不断提高,中阶人口不断增长,推动了人们对休閒和户外体验的兴趣。

2019年,中国旅游业收入成长11.7%,达到约5.7兆元(7,960亿美元)。这一增长发生在新冠疫情爆发之前。 2022年,中国旅游收入预计将达到约2兆元(2,800亿美元)。值得注意的是,2020 年、2021 年和 2022 年的大部分收入来自国内旅游,因为自 2020 年 2 月以来,严格的旅游限制对入境旅游产生了重大影响。

此外,亚太地区基础设施建设和道路网络改善也使前往各种目的地更加便捷,包括适合房车旅行的偏远地区和风景优美的地区。在印度,政府推出的「Swadesh Darshan」计画等旨在发展旅游基础设施和促进国内旅游的倡议就是支持旅游业的基础设施建设的典型例子。

此外,该地区房车租赁公司和平台的增加以及创新租赁模式和服务的采用也促进了市场的成长。

房车(RV)租赁业概览

市场分散,许多国际和国内公司在世界各地开展业务。然而,该行业正在整合,少数参与者占据了大部分市场。

市场上的主要企业包括 Outdoorsy Inc.、Indie Campers 和 McRent Europe。房车旅游租赁市场也正在迎来地区和全球层面的新进业者。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 旅游业的成长推动了市场需求

- 市场限制

- 房车租赁维修成本高

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 按租赁公司类型

- 私人业主

- 车队营运商

- 按预订类型

- 线下预订

- 线上预订

- 依产品类型

- 电动房车

- A级旅居车

- B级旅居车

- C级旅居车

- 露营者

- 拖曳式房车

- 第五轮拖车

- 旅行拖车

- 卡车露营车

- 运动型多用途拖车

- 电动房车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Apollo Tourism & Leisure Ltd(ATL)

- McRent

- El Monte RV

- RV Share

- Cruise America

- Just Go Motorhome Hire

- Outdoorsy, Inc.

- Indie Campers

- RoadSurfer GmbH

- MotorVana(Ideamerge LLC)

第七章 市场机会与未来趋势

- 对永续、环保汽车的需求不断增长,创造了成长机会

The Recreational Vehicle Rental Market size is estimated at USD 0.88 billion in 2025, and is expected to reach USD 1.29 billion by 2030, at a CAGR of 8.11% during the forecast period (2025-2030).

The recreational vehicle rental market is expected to witness significant growth due to an increase in the population of young and old opting for RV touring. Moreover, the development of the tourism industry and the growing popularity of recreational vehicle camping are driving the demand for RV rental services around the globe.

RVs are significantly expensive to purchase, so a large population across North America, Europe, and Asia-Pacific is opting for RV rental services, eliminating the cost associated with vehicle purchase, insurance, and maintenance. The ease of accessing RV rental services and the increase in the number of RV rental service providers across the globe are attracting customers who have budget constraints and are unwilling to invest in purchasing new RVs.

The process of renting a new RV has become simpler over time. RV rentals offer lucrative deals to attract customers. Customers have many options, with new technologically advanced models arriving on the market every year using both online and offline modes of booking. Every new trip can be in a different RV model with other amenities. Companies are customizing their booking services to make it easy for RV customers.

Recreational Vehicle (RV) Rental Market Trends

Motorized RVs are the Largest Segment by Product Type

With travel and tourism gaining popularity across the globe, people are seeking unique and adventurous experiences. The desire for experiential and immersive travel experiences has increased demand for motorized RV rental. The shortage of available campgrounds in many countries has also contributed to the market for motorized RVs.

Further, motorhomes are witnessing significant growth in demand worldwide, especially in European countries. The increasing number of HNWIs and the availability of widespread parking areas for RVs are driving their adoption in North America and Europe. In 2022, Europe accounted for a significant share of the global caravan and motorhome market due to more motorhomes sold than North America.

The demand for recreational vehicles has boomed after the outbreak of the pandemic, as most people started planning their holidays while avoiding public transportation due to safety precautions. Several RV rental companies across Europe witnessed significant booking growth during the COVID-19 pandemic.

Moreover, over the past few years, the demand for Class B and Class C motorhomes has increased owing to their advantages. For instance, the population of the United States participating in camping has seen an upward trajectory over the last few years. In 2023, the number of users opting for camping in the United States stood at over 57 million, compared to around 55 million in 2022.

Additionally, various countries' governments are investing in infrastructure development to attract tourism, which will positively impact motorized RV rental growth during the forecast period. For example, in June 2022, the Spanish government authorized a total expenditure of EUR 110 million from Next Generation EU funding to strengthen tourist competitiveness in numerous territories, including the Balearic Islands, Ceuta, and Melilla.

All these factors combined will positively boost the demand for motorized RVs during the forecast period.

Asia-Pacific Will be the Fastest Growing Region During the Forecast Period

While North America holds the largest recreational vehicle rental market share, Asia-Pacific is expected to be the fastest-growing region during the forecast period. Increasing disposable income and a growing middle-class population across economies like China, India, Japan, and Southeast Asian nations show greater interest in leisure and outdoor experiences.

In 2019, the Chinese tourism industry witnessed an 11.7% surge in revenue, reaching approximately CNY 5.7 trillion (~USD 796 billion). This growth occurred just before the onset of the COVID-19 pandemic. In 2022, the revenue from tourism in China reached around CNY 2 trillion (~USD 280 billion). Notably, most of this revenue during 2020, 2021, and 2022 was generated by domestic tourism, as strict travel restrictions have significantly impacted inbound tourism since February 2020.

Additionally, infrastructure development and road network improvements across APAC have enhanced accessibility to various tourist destinations, including remote and scenic locations that could be best explored through RVs. In India, the government's initiatives, such as the Swadesh Darshan scheme for developing tourist infrastructure and promoting domestic tourism, are the best examples of infrastructural development supporting tourism.

Moreover, the increasing availability of RV rental companies and platforms in the region and the introduction of innovative rental models and services contribute to the market's growth.

Recreational Vehicle (RV) Rental Industry Overview

The market is fragmented with numerous international and domestic companies operating across the globe. However, the industry is on the verge of consolidation, with few players capturing most of the market.

Some of the key players operating in the market include Outdoorsy Inc., Indie Campers, and McRent Europe. The RV tourism rental market is also witnessing an inflow of new entrants both at the regional and global levels.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased Travel and Tourism to Fuel Market Demand

- 4.2 Market Restraints

- 4.2.1 High Maintenance cost of RV Rental Fleets

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value in USD Million)

- 5.1 Rental Supplier Type

- 5.1.1 Private/Individual Owners

- 5.1.2 Fleet Operators

- 5.2 Booking Type

- 5.2.1 Offline Booking

- 5.2.2 Online Booking

- 5.3 Product Type

- 5.3.1 Motorized RVs

- 5.3.1.1 Class A Motorhomes

- 5.3.1.2 Class B Motorhomes

- 5.3.1.3 Class C Motorhomes

- 5.3.1.4 Campervans

- 5.3.2 Towable RVs

- 5.3.2.1 Fifth-Wheel Trailers

- 5.3.2.2 Travel Trailers

- 5.3.2.3 Truck Campers

- 5.3.2.4 Sports Utility Trailers

- 5.3.1 Motorized RVs

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Apollo Tourism & Leisure Ltd (ATL)

- 6.2.2 McRent

- 6.2.3 El Monte RV

- 6.2.4 RV Share

- 6.2.5 Cruise America

- 6.2.6 Just Go Motorhome Hire

- 6.2.7 Outdoorsy, Inc.

- 6.2.8 Indie Campers

- 6.2.9 RoadSurfer GmbH

- 6.2.10 MotorVana (Ideamerge LLC)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Sustainable and Eco-Friendly vehicles Presents Ample Growth Opportunities