|

市场调查报告书

商品编码

1687772

基油:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Base Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

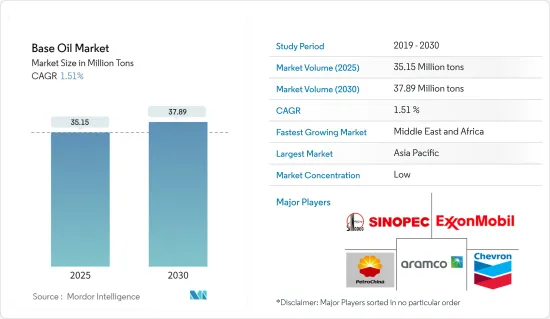

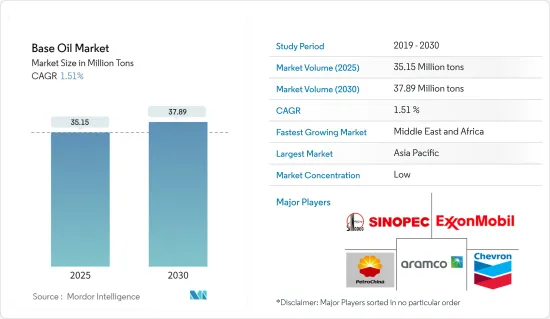

预计 2025 年基油市场规模为 3,515 万吨,2030 年将达到 3,789 万吨,预测期内(2025-2030 年)的复合年增长率为 1.51%。

受新冠疫情影响,2020年基油需求大幅下降。该病毒导致汽车业和其他各行业(航空、工业等)的产量下降。机油、齿轮油、润滑脂和金属加工油消费量的减少影响了基油市场。然而,由于汽车製造和其他行业生产活动的活性化,基油市场在 2021 年和 2022 年有所復苏。

主要亮点

- 在预计预测期内,亚太地区的快速工业化、液压油和工业齿轮油等基油油的工业用途的探索以及汽车产量和销量的增加将推动市场成长。

- 另一方面,由于对低黏度基础基油的偏好导致对 I 类基础基油的需求下降,预计将在预测期内阻碍市场成长。

- 然而,可再生基油和基油回收利用领域的技术创新有望提供市场机会。

- 由于中国、印度和日本等国家的需求庞大,预计亚太地区将占据市场主导地位。

基油市场趋势

机油领域占据市场主导地位

- 由于汽车、电力、重型机械、金属加工、化学品等各行业对引擎油的需求不断增长,机油领域占据了基油市场的主导地位。

- 机油广泛用于润滑内燃机。机油一般含有约7-10%的添加化学物质,其余为基油。

- 在使用各种基油和添加剂配製引擎油时,氧化稳定性、沉积物预防、磨损和腐蚀保护等性能都是考虑的重要因素。高燃油经济性机油由于其防止漏油和减少消费量的特性,近年来越来越受欢迎。

- 此外,各种投资和商业实践的发展正在增加对机油的需求,这可能会促进基油市场的发展。例如,2023 年 4 月,Brakes India 宣布透过其 Revia 品牌进军润滑油领域。凭藉这一新品牌,该公司将进军机油领域,满足乘用车和商用车市场的需求。

- 此外,2023 年 3 月,埃克森美孚宣布将投资约 90 亿印度卢比(1.1 亿美元),在马哈拉施特拉邦工业发展公司位于赖加德的伊桑贝工业区建立润滑油製造厂。新厂的成品润滑油年产能为159,000千公升,预计2025年开始商业营运。

- 此外,2023 年 2 月,壳牌公司宣布推出乘用车机油产品组合 Shell Helix SP HX8 0W-20。根据该公司介绍,该产品是一种全合成、符合 BS VI 标准的引擎油,专为涡轮增压缸内喷油(TGDI) 引擎设计,可防止有害的低速预点火器(LSPI)。该公司还声称将提高车辆的燃油效率,同时减少排放气体并改变引擎设计。

- 预计汽车产业对机油的需求将推动基油市场的发展。根据OICA预测,2023年全球汽车销售量将达到9,272万辆,而2022年为8,287万辆。

- 因此,预计上述因素将在预测期内影响引擎油领域基油的成长。

亚太地区占市场主导地位

- 预计亚太地区将主导全球市场。中国、印度、日本和韩国等国家各领域的润滑油消费量不断增加,推动了该地区基油使用量的上升。

- 根据国际贸易局发布的资料,中国对汽车润滑油的需求预计将在 2026 年达到 51.9 亿公升,2021 年至 2026 年的复合年增长率为 5.41%。预计这将推动该国的基油需求。

- 同样,国家统计局发布的资料显示,2024年3月中国工业增加与前一年同期比较增4.5%。 2023年9月至12月,製造业、公共产业和采矿业的营运放缓限制了整体工业生产的与前一年同期比较成长。

- 在印度,汽车保有量的强劲成长(2023 年汽车销量年增 12%)和工业活动的活性化(2024 年 2 月年增率为 5.7%)预计将在预测期内推动与前一年同期比较基油需求。

- 此外,在日本,各大润滑油厂商都依赖长期供应合约来满足该国对基油的需求。例如,出光兴产于2023年10月签署了一份谅解备忘录,以确保长期稳定采购第三类基油。

- 因此,预计上述因素将在预测期内对亚太地区的基油市场产生重大影响。

基油产业概览

基油市场本质上是分散的。主要参与者(不分先后顺序)包括埃克森美孚公司、沙乌地阿拉伯石油公司(Aramco)、中国石油天然气股份有限公司、雪佛龙公司和中国石油化学集团公司(SINOPEC)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 亚太地区快速工业化

- 汽车产销量不断成长

- 限制因素

- 一级基油需求下降

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按类型

- 第一组

- 第二组

- 第三组

- 第四组

- 其他(第五类和生物基基油)

- 按应用

- 机油

- 变速箱/齿轮油

- 金属加工油

- 油压

- 润滑脂

- 其他(加工油、透平油、压缩机油、循环油等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 印尼

- 越南

- 泰国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 埃及

- 卡达

- 奈及利亚

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- ADNOC(Abu Dhabi National Oil Company)

- Chevron Corporation

- China Petrochemical Corporation(SINOPEC)

- CNOOC Limited

- Exxon Mobil Corporation

- Formosa Petrochemical Corporation

- Gazprom Neft PJSC

- GS Caltex Corporation

- Indian Oil Corporation Ltd

- LUKOIL

- Nynas AB

- Petrobras

- PetroChina

- PETRONAS Lubricants International

- Philips 66 Company

- Repsol

- Saudi Arabian Oil Co.(ARAMCO)

- Sepahan Oil Company

- Shandong Qingyuan Group Co. Ltd

- Shell PLC

- SK Innovation Co. Ltd

- Total Energies

第七章 市场机会与未来趋势

- 可再生基油油的创新

- 基油油回收

The Base Oil Market size is estimated at 35.15 million tons in 2025, and is expected to reach 37.89 million tons by 2030, at a CAGR of 1.51% during the forecast period (2025-2030).

The demand for base oil decreased significantly in 2020 due to the outbreak of COVID-19. The virus caused production to decline in the automotive industry and various other industrial units (aviation, industrial, etc.). The reduction in the consumption of engine oil, gear oil, greases, and metalworking fluid affected the base oil market. However, in 2021 and 2022, the base oil market recovered as car manufacturing and production activities across other industries ramped up.

Key Highlights

- Rapid industrialization in Asia-Pacific, considering the industrial application of base oil such as hydraulic fluid and industrial gear oil, and growing automotive production and sales are expected to drive the market's growth during the forecast period.

- On the flip side, the declining demand for group I base oils due to the preference for lighter viscosity base oils is likely to hamper the market's growth over the forecast period.

- Nevertheless, innovations in the field of renewable base oils and recycling of base oils are anticipated to provide opportunities for the market studied.

- Asia-Pacific is expected to dominate the market owing to significant demand from countries such as China, India, and Japan.

Base Oil Market Trends

The Engine Oil Segment to Dominate the Market

- The engine oil segment dominates the base oil market due to the growing demand for engine oil from various industries such as automotive, power, heavy equipment, metalworking, and chemicals.

- Engine oils are widely used to lubricate internal combustion engines. They generally contain about 7% to 10% additive chemicals, with the rest as base oil.

- Properties like oxidation stability, deposit control, and wear and corrosion protection are the key factors taken into consideration when forming engine oils using different base oils and additives. High-mileage engine oils are in demand lately, owing to the properties that help prevent oil leaks and reduce oil consumption.

- Additionally, various investments and developments in business practices are enhancing the demand for engine oil, which may boost the market for base oil. For instance, in April 2023, Brakes India announced it would enter the lubricants segment through the Revia brand. With its new brand, the company is diversifying into the engine oil space, catering to both passenger car and commercial vehicle segments.

- Furthermore, in March 2023, Exxon Mobil Corporation announced the investment of nearly INR 900 crore (USD 110 million) to build a lubricant manufacturing plant at the Maharashtra Industrial Development Corporation's Isambe Industrial Area in Raigad. The new plant is expected to produce 159,000 kiloliters of finished lubricants per year, with commercial startup expected by 2025.

- In addition, in February 2023, Shell PLC announced the launch of its passenger car motor oil portfolio, Shell Helix SP HX8 0W-20. According to the company, the product is a fully synthetic, BS VI-compliant engine oil designed for turbocharged petrol direct injection (TGDI) engines to protect against damaging low-speed pre-ignition (LSPI). The company also claims to aid a vehicle's fuel economy while reducing emissions and changes in engine design.

- The demand for engine oil from the automotive sector is expected to enhance the base oil market. According to OICA, global motor vehicle sales amounted to 92.72 million in 2023 compared to 82.87 million in 2022.

- Hence, the aforementioned factors are expected to influence the growth of base oil in the engine oil segment over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the global market. With the growing consumption of lubricants from various sectors in countries like China, India, Japan, and South Korea, the usage of base oil is increasing in the region.

- According to the data published by the International Trade Administration, China's demand for automotive lubricants is expected to reach 5.19 billion liters in 2026, registering a CAGR of 5.41% during the 2021-26 period. It is expected to drive the demand for base oils in the country.

- Similarly, according to the data published by the National Bureau of Statistics, China's industrial output grew by 4.5% year-on-year in March 2024. The slowdown of operations in the manufacturing, utilities, and mining sectors from September 2023 to December 2023 restricted the overall Y-o-Y growth of industrial output.

- In India, strong growth in vehicle population (12% Y-o-Y growth in vehicle sales in 2023) and increasing industrial activity (5.7% on an annual basis in February 2024) are expected to drive the demand for base oils during the forecast period.

- Additionally, in Japan, various large-scale lubricant manufacturers are relying on long-term supply contracts to meet the domestic base oil demand. For instance, in October 2023, Idemitsu Kosan Co. Ltd signed an MoU to secure a long-term stable procurement of group III base oil.

- As a result, the above-mentioned factors are projected to substantially influence the base oil market in Asia-Pacific during the forecast period.

Base Oil Industry Overview

The base oil market is fragmented in nature. The major players (not in any particular order) include Exxon Mobil Corporation, Saudi Arabian Oil Co. (Aramco), PetroChina, Chevron Corporation, and China Petrochemical Corporation (SINOPEC).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapid Industrialization in Asia-Pacific

- 4.1.2 Growing Automotive Production and Sales

- 4.2 Restraints

- 4.2.1 Declining Demand for Group I Base Oils

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Group I

- 5.1.2 Group II

- 5.1.3 Group III

- 5.1.4 Group IV

- 5.1.5 Other Types (Group V and Bio-based Base Oils)

- 5.2 Application

- 5.2.1 Engine Oils

- 5.2.2 Transmission and Gear Oils

- 5.2.3 Metalworking Fluids

- 5.2.4 Hydraulic Fluids

- 5.2.5 Greases

- 5.2.6 Other Applications (Process Oils, Turbine Oil, Compressor Oil, Circulating Oils, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malayisa

- 5.3.1.6 Indonesia

- 5.3.1.7 Vietnam

- 5.3.1.8 Thailand

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 Nigeria

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADNOC (Abu Dhabi National Oil Company)

- 6.4.2 Chevron Corporation

- 6.4.3 China Petrochemical Corporation (SINOPEC)

- 6.4.4 CNOOC Limited

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 Formosa Petrochemical Corporation

- 6.4.7 Gazprom Neft PJSC

- 6.4.8 GS Caltex Corporation

- 6.4.9 Indian Oil Corporation Ltd

- 6.4.10 LUKOIL

- 6.4.11 Nynas AB

- 6.4.12 Petrobras

- 6.4.13 PetroChina

- 6.4.14 PETRONAS Lubricants International

- 6.4.15 Philips 66 Company

- 6.4.16 Repsol

- 6.4.17 Saudi Arabian Oil Co. (ARAMCO)

- 6.4.18 Sepahan Oil Company

- 6.4.19 Shandong Qingyuan Group Co. Ltd

- 6.4.20 Shell PLC

- 6.4.21 SK Innovation Co. Ltd

- 6.4.22 Total Energies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in the Field of Renewable Base Oils

- 7.2 Recycling of Base Oils