|

市场调查报告书

商品编码

1687783

北美暖通空调设备:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)North America HVAC Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

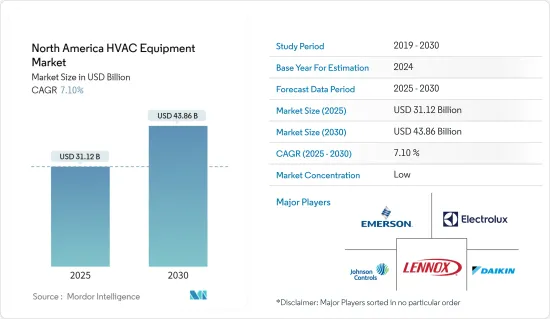

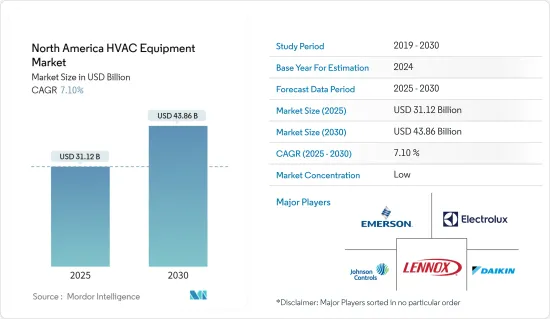

北美 HVAC 设备市场规模预计在 2025 年为 311.2 亿美元,预计到 2030 年将达到 438.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.1%。

可支配收入的增加、建设活动的快速扩张以及天气模式的变化正在推动所研究市场的成长。北美智慧家庭和智慧城市项目的采用正在显着增加,推动了市场的成长。

主要亮点

- 政府以增加预算拨款的形式加大对永续社区发展的支持,可能会促进商业和工业建筑业的持续成长。此外,建设活动的增加、快速的都市化和基础设施改革导致暖通空调机组更换量激增,推动了暖通空调设备市场的发展。

- 北美 HVAC 设备市场的成长受到对智慧系统不断增长的需求以及物联网 (IoT)、工业自动化系统、智慧製造和工业 4.0 的整合的推动。预计市场高于平均水准的成长很大一部分将来自于绿色建设活动的活性化。快速扩张的智慧家庭市场预计将推动 HVAC 系统市场的成长。

- 绿色建筑施工计划将进一步推动该地区暖通空调设备市场的扩张。例如,2022年2月,加拿大绿建筑委员会(CAGBC)宣布,该国在其2021年LEED(能源与环境设计先锋)十大国家和地区年度榜单中名列世界第二,LEED是全球使用的绿色建筑认证计划。由于居住者和能源消耗的认识不断提高,安装符合政府机构标准的空调设备正成为绿色建筑设计的重要标准。

- 然而,根据国际能源总署和美国能源局的数据,大约 25-35% 的电力消耗来自 HVAC 系统。根据同一来源,这部分能源消耗的很大一部分(20%至60%)是由寄生能源使用造成的(用于为加热和冷却运输中使用的风扇和泵提供动力来源的能源)。因此,儘管集中式空调系统比模组化系统更有效率(就单位面积空调空间的消费量而言),但它们仍然会增加能源费用。

- 製造业岗位全面短缺。可悲的是, 冷暖气空调产业也不例外。无论当前的劳动力短缺是否是由于这些因素造成的,它都可能成为阻碍市场成长的因素。

北美暖通空调设备市场趋势

热泵正在快速成长

- 预计热泵将占据很大的市场占有率。由于气候条件、设备便利性、政府税额扣抵和法规等多种因素,北美热泵的使用正在稳步增加。

- 由于人们转向采用节能产品和增加消费者支出的模式转移,美国住宅热泵市场预计将继续保持健康成长。走向脱碳经济的进程将刺激商业环境,并透过立法能源政策和奖励提供支持。随着老化建筑的维修,对灵活性和舒适度的需求可能会成长。这可能会使该行业更加充满活力。

- 热泵分为水源、空气源、地源等类型。空气源热泵(ASHP)吸收电能并从周围空气中提取热量,产生高达 90 摄氏度的热水。它从周围的空气中提取热量,使其变得更冷。因此,对热水和冷空气的需求正在推动空气源热泵的成长。

- 此外,寒冷气候热泵在北美许多地区越来越受欢迎,这推动了该领域的重大创新。寒冷气候热泵已被开发为在低至 -25°C 的条件下有效运行,有些系统在 -18°C 的条件下仍能保持 200% 以上的效率。

- 2022年6月,美国(DOE)宣布,Lennox International成为美国能源局(DOE)住宅寒冷地区热泵技术的首个合作伙伴。

美国占有较大的市场占有率

- 美国是重要的设备市场之一,一直呈现稳定的成长率。建设活动的活性化、高效系统的可用性以及极端天气条件有利于整个设施的系统安装。此外,开利、艾默生电气等主要製造商的存在也为北美市场的未来成长提供了助力。

- 此外,随着物联网 (IoT) 的整合,一些製造商已经开始提供智慧暖气、空调和通风系统,帮助推动整个美国的市场成长。

- 为了确保永续的未来,美国能源局(DOE) 正在大力投资提高全国的能源效率标准。美国能源部希望透过寻找应对环境、能源和核能挑战的科学技术解决方案来确保美国的安全和繁荣。

- 此外,根据美国能源资讯署 (EIA) 的住宅能源消耗调查 (RECS),估计美国居住7,600 万户住宅(占总数的 64%)使用中央空调。约有 1,300 万户家庭(11%)使用热泵进行暖气和冷气。到2023年,在美国销售的所有新住宅空调和空气源热泵系统都必须符合现代能源效率标准,从而刺激暖通空调设备的成长。

- 此外,根据美国人口普查局的数据,2022年6月美国住宅数约为136万套。 2022年6月,美国新建私人住宅数量约155万套。预计在预测期内,这将进一步在该国产生对热泵的大量新需求。

北美暖通空调设备产业概况

北美暖通空调设备市场竞争激烈,大金、开利、伦诺克斯等知名供应商在各自的领域占据主要市场占有率,并拥有完善的分销网络。由于 HVAC 设备行业是最大的市场之一,因此如此众多的主要供应商的存在是永续的,而不会影响市场占有率。然而,供应商之间展开了激烈的竞争,以抢占更大的市场份额,特别是在供暖和製冷领域。

- 2023 年 2 月 - Lennox 推出 Enlight 和 Xion 产品线,增强了其全面的屋顶机组系列。该公司的 Enlight 产品系列旨在最大限度地减少对环境的影响并最大限度地提高效率。

- 2022 年 10 月-开利公司宣布在北美扩大其 AquaEdge19DV 水冷涡轮冷冻的产能。 AquaEdge19DV 的容量高达 1,150 吨,可满足更大的容量需求,例如商业高层建筑和混合用途建筑、大型製造设施和医疗保健设施。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估宏观经济趋势对市场的影响

第五章 市场动态

- 市场驱动因素

- 住宅和非住宅用户增加

- 市场限制

- 暖通空调设备消费量高

第六章 市场细分

- 按设备

- 空调设备

- 加热设备

- 热泵

- 除湿机和加湿器

- 按最终用户

- 住宅

- 产业

- 商业的

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Johnson Controls International PLC

- Daikin Industries Ltd

- Lennox International Inc.

- Electrolux AB

- Emerson Electric Co.

- Carrier Corporation

- Rheem Manufacturing Company Inc.

- Uponor Corp.

- Ingersoll Rand Inc.(Trane Inc.)

- Nortek Global HVAC, LLC

第八章投资分析

第九章:市场的未来

The North America HVAC Equipment Market size is estimated at USD 31.12 billion in 2025, and is expected to reach USD 43.86 billion by 2030, at a CAGR of 7.1% during the forecast period (2025-2030).

Increasing disposable income, rapidly expanding construction activity, and changing weather patterns are driving the growth of the market studied. North America is witnessing a significant increase in the implementation of smart home and smart city programs, driving the market's growth.

Key Highlights

- Growing government support, in the form of higher budget allocations designed to increase sustainable community development, may contribute to the continually growing commercial and industrial construction sectors. Besides, increased construction activities, rapid urbanization, and infrastructural reforms result in an upsurge in HVAC unit replacements, thus driving the HVAC equipment market.

- The growth of the North American HVAC equipment market is driven by an increase in demand for smart systems and the integration of the Internet of Things (IoT), industrial automation systems, smart manufacturing, and industry 4.0. A significant portion of the market's above-average growth is anticipated from the uptick in green building construction activities. The smart home market, which is expanding rapidly, is projected to boost the HVAC system market's growth.

- Green building construction projects further support the empowerment of the HVAC equipment market in the region. For instance, in February 2022, Canada Green Building Council (CAGBC) announced that the country ranked second globally on the annual list of Top 10 Countries and Regions for LEED (Leadership in Energy and Environmental Design), a green building certification program used worldwide, in 2021. Installation of HVAC equipment with standards imposed by the governmental bodies for the rising awareness of occupants' health and energy consumption is becoming a vital criteria in green building designs.

- However, as per IEA and the U.S. Department of Energy, around 25-35% of electricity consumption is due to HVAC systems. According to the same source, a large part (20% - 60%) of this energy consumption is contributed by parasitic energy use (energy used to power fans and pumps used for the transfer of heating and cooling). Thus, centralized HVAC systems have burdened energy bills despite being more efficient (in terms of energy units' consumption per unit area of space conditioned) than unitary systems.

- There is a lack of employment in the whole manufacturing sector. Sadly, there is no exception in the heating and air conditioning industry Whether or not current workforce shortages are caused by these, they will likely be exacerbated might hamper the market gorwth

North America HVAC Equipment Market Trends

Heat Pumps to Witness Significant Growth

- The market share that heat pumps are predicted to command is significant. Due to various factors, including climatic conditions, the convenience provided by the equipment, government tax credit benefits, regulations, etc., the use of heat pumps has steadily increased in the North American region.

- Owing to a paradigm shift toward adopting energy-efficient products and rising consumer spending, the residential heat pump market in the United States would continue to expand steadily. The business environment will be stimulated by the ongoing progress toward a decarbonized economy, which will be supported by legislative energy policies and incentives. As the number of old buildings that are being fixed up goes up, there will be more demand for flexibility and better comfort. This will make the industry more dynamic.

- The heat pumps are been categorized based on types, such as water source, air source, and ground source. The air-source heat pump (ASHP) takes in electricity, extracts heat from the surrounding air, and produces hot water up to 90 degrees Celsius. Due to the extraction of heat from the ambient air, it gets cooler. Thus, the requirement for both hot water and cold air is driving the growth of air-source heat pumps.

- Moreover, Cold climate heat pumps are becoming increasingly popular in many regions across North America, and this has been driving significant innovation in the space. Cold climate heat pumps are developed to work efficiently in conditions down to -25 degrees Celsius, with some systems maintaining an efficiency of over 200% at -18 degrees Celsius.

- In June 2022, the U.S (DOE) announced that Lennox International had became the first partner in the U.S. Department of Energy's (DOE's) Residential Cold Climate Heat Pump Technology has Challenge to develop an next-generation electric heat pump which woyuld that can more effectively heat homes in northern climates relative to current models.

United States Holds Major Market Share

- The United States is one of the essential equipment markets, witnessing a steady growth rate. The growing construction activity, availability of high-efficiency systems, and extreme climatic conditions favour system installation across the facilities. Additionally, the presence of leading manufacturers, such as Carriers, Emerson Electric Co., and others, is complementing the growth of the North American market in the future.

- Additionally, with the Internet of Things (IoT) integration, several manufacturers have initiated smart heating, air conditioning, and ventilation system offers that, in turn, are propelling market growth across the United States.

- To ensure a sustainable future, the U.S. Department of Energy (DOE) is heavily investing in improving energy efficiency standards throughout the country. The DOE wants to make sure that America is safe and doing well by finding science and technology solutions to its environmental, energy, and nuclear problems.

- Moreover, the Energy Information Administration's (EIA) Residential Energy Consumption Survey (RECS) estimates that 76 million primarily occupied US homes (64% of the total) use central air-conditioning equipment. About 13 million households (11%) use heat pumps for heating or cooling. By 2023, all new residential air-conditioning and air-source heat pump systems sold in the United States will require meeting the latest energy efficiency standards, fueling the growth of HVAC equipment.

- Furthermore, according to the US Census Bureau, new home construction in the United States in June 2022 was around 1.36 million. There were approximately 1.55 million new privately owned housing units in the United States in June 2022. This is further expected to create significant new demand for heat pumps in the country over the forecast period.

North America HVAC Equipment Industry Overview

The competitive rivalry in the North American HVAC equipment market is high, as the market studied is home to prominent vendors like Daikin, Carrier, and Lennox that command a major market share in different segments and have access to well-established distribution networks. Owing to the HVAC equipment industry being one of the largest markets, the existence of such a high number of major vendors without compromising on their market shares is sustainable. However, each vendor, especially in the heating and cooling segments, is fiercely competing to gain a larger share of the market studied.

- February 2023 - Lennox enhanced its comprehensive selection of With the introduction of the Enlight and Xion product lines, packaged rooftop units have been introduced. The company's Enlight product family aims to minimize environmental impact and maximize efficiency.

- October 2022 - Carrier Corporation declared that it had increased In North America, the AquaEdge 19DV watercooled Centrifugal chiller offers a range of capacities. The AquaEdge19DV is capable of supplying the customer with up to 1150 tonnes in order to meet their demand for larger capacities, as regards Commercial Highrise and mixed Use Building Applications, Large Manufacturing Establishments or Health Institutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Defnition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 An Assessment of Impact of Macro Economic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Residential and Non-residential Users

- 5.2 Market Restraints

- 5.2.1 High Energy Consumption of HVAC Equipment

6 MARKET SEGMENTATION

- 6.1 By Equipment

- 6.1.1 Air Conditioning Equipment

- 6.1.2 Heating Equipment

- 6.1.3 Heat Pumps

- 6.1.4 Dehumidifiers and Humidifiers

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Industrial

- 6.2.3 Commercial

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Johnson Controls International PLC

- 7.1.2 Daikin Industries Ltd

- 7.1.3 Lennox International Inc.

- 7.1.4 Electrolux AB

- 7.1.5 Emerson Electric Co.

- 7.1.6 Carrier Corporation

- 7.1.7 Rheem Manufacturing Company Inc.

- 7.1.8 Uponor Corp.

- 7.1.9 Ingersoll Rand Inc. (Trane Inc.)

- 7.1.10 Nortek Global HVAC, LLC