|

市场调查报告书

商品编码

1687797

胶带:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Adhesive Tapes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

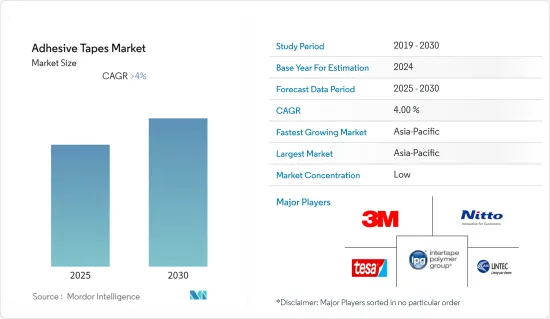

预计预测期内胶带市场的复合年增长率将超过 4%。

预计到今年底,全球胶带市场规模将达到 520.3775 亿平方公尺,预测期内复合年增长率将超过 4%。

新冠疫情影响了胶带市场的价值链。供应链中断和终端用户产业需求疲软对市场产生了负面影响。不过,市场需求可能在 2021 年復苏,并在未来几年大幅成长。

主要亮点

- 短期内,包装产业需求的快速成长以及电动和混合动力车对胶带的持续使用是推动研究市场成长的关键因素。

- 然而,原物料价格波动是预测期内抑制产业成长的关键因素。

- 然而,新兴经济体医疗保健领域的发展可能很快就会为全球市场提供丰厚的成长机会。

- 由于中国和印度等国家胶带消费量最大,预计亚太地区胶带市场在评估期内将出现健康成长。

胶带市场趋势

包装领域占据市场主导地位

- 胶带又称包装胶带,用于密封、封闭、包裹和捆绑。这些包装胶带通常应用于各种储存容器的接缝和接头,以保持货物在容器限制范围内的公差。其他应用包括宅配箱的接缝、密封瓶盖、保护锭剂和食品容器免遭篡改、将形状相似的物品捆绑在一起以及用保护膜或衬里包裹物品。

- 胶带在包装生鲜产品中发挥重要作用。总体而言,预计包装行业的成长将在整个预测期内推动对胶带的需求。

- 根据包装和加工技术研究所 (PMMI) 发布的报告,到 2021 年,全球包装产业规模将成长至 422 亿美元。由于消费者继续依赖隔离期间生产的物品,食品、餐饮和医疗保健行业的需求将增加。

- 同样,印度的包装产业也在快速成长。它是印度经济第五大产业,也是目前印度成长最快的产业之一。随着电子商务的兴起,印度包装产业蓬勃发展,成为成长最强劲的产业之一。根据印度包装协会(IIP)的数据,过去十年印度的包装消费量增加了 200%,从人均每年 4.3 公斤(pppa)增加到人均每年 8.6 公斤(pppa)。

- 此外,在各种包装类型中,软包装市场正在快速成长,这得益于软包装的优势以及相对于其他包装类型更受最终用户偏好。在已开发地区中,北美拥有最大的软包装产业。此外,该地区的人均软包装支出(71.58 美元)在全球最高。欧洲的人均软包装支出也较高(20.73美元),但远低于北美。

- 根据欧洲生物塑胶协会的数据,2021年全球用于软包装和硬包装的生质塑胶产能将分别为66.5万吨和49.2万吨,而2020年分别为55.5万吨和44.3万吨。

- 因此,由于上述因素,包装终端用户产业对胶带的需求可能会在预测期内推动研究市场的成长。

中国将主宰亚太地区

- 在亚太地区,中国占据胶带市场的主导地位,预计在预测期内将继续保持这一地位。

- 近年来,中国汽车产业呈现成长趋势。 OICA 预计,2021 年中国汽车产量(包括乘用车和轻型车)将达到 26,082,220 辆,较 2020 年的 25,225,242 辆增长 3%。中国汽车工业协会进一步预计,由于乘用车市场需求不断成长,汽车产量也将增加。

- 此外,包括Scooter、汽车和巴士等轻型商用车在内的电动车在该国越来越受欢迎。根据中国乘用车市场资讯联席会(CPCA)的数据,2021年销量超过330万辆,较2020年成长169%。

- 中国的健康产业规模位居世界第二,仅次于美国。 2020年医疗保健支出约为人民币7.2兆元(约1.4兆美元),约占国内生产总值)的7%。由于医院数量的增加和医疗支持需求的上升,中国的医疗保健和治疗市场在过去两年中经历了强劲增长。

- 中国是世界上最大的电子设备製造基地。智慧型手机、电视、电线电缆、可携式电脑、游戏系统和其他个人电子设备等电子产品在电子行业中创下了最高成长。

- 根据中国国家统计局的数据,2021年家用电器和家用电器产品产业的销售额将达到9.3464亿元人民币(约1.4484亿美元)。预计收益将以每年2.04%的速度成长,到2025年市场规模将达到1,756.7亿美元。

- 由于上述因素,预计预测期内中国对胶带的需求将会增加。

胶带产业概况

胶带市场高度分散。市场的主要企业包括 3M、日东电工株式会社、Tesa SE-A 拜尔斯道夫公司、LINTEC 公司和 Intertape Polymer Group。 (无特定顺序)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 包装产业需求快速成长

- 电动和混合动力汽车继续使用胶带

- 限制因素

- 原物料价格波动

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 树脂

- 丙烯酸纤维

- 环氧型

- 橡皮

- 有机硅胶

- 聚氨酯

- 科技

- 水性

- 溶剂型

- 热熔胶

- 反应性

- 最终用户产业

- 车

- 卫生保健

- 包装

- 电气和电子

- 消费者/DIY

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- 3M

- Berry Global Inc.

- DuPont

- HB Fuller Company

- Henkel AG & Co. KGaA

- Intertape Polymer Group

- LINTEC Corporation

- Lohmanh GmbH & Co. KG

- NITTO DENKO CORPORATION

- OJI Holdings Corporation

- ORAFOL Europe GmbH

- SEKISUI CHEMICAL CO., LTD

- Shurtape Technologies, LLC

- Sika AG

- Schweitzer-Mauduit International, Inc.

- tesa SE-A Beiersdorf Company

第七章 市场机会与未来趋势

- 新兴经济体的医疗保健发展

The Adhesive Tapes Market is expected to register a CAGR of greater than 4% during the forecast period.

Global Adhesives Tapes Market is estimated to reach 52,037.75 million square meters by the end of this year and is expected to grow with a CAGR of over 4% during the forecast period.

The COVID pandemic impacted value chains in the adhesive tapes market. The disruptions in the supply chain and low demand from end-user industries affected the market negatively. However, the market demand recovered in 2021 and will likely grow significantly in the coming years.

Key Highlights

- Over the short term, rapidly growing demand from the packaging industry and continuous usage of adhesive tapes in electric and hybrid vehicles are significant factors driving the growth of the market studied.

- However, volatility in the prices of raw materials is a key factor anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the development of the medical sector in emerging economies is likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific is estimated to witness healthy growth over the assessment period in the adhesives tapes market due to the most significant consumption from countries such as China and India.

Adhesive Tapes Market Trends

Packaging Segment to Dominate the Market

- Adhesive tapes, also known as packaging tapes, are used for sealing, enclosing, and wrapping or bundling. These packaging tapes are commonly applied to seams and joints of various storage receptacles to maintain a tolerance that keeps cargo within the restraint of the receptacle. Moreover, they are used for sealing box seams in parcel delivery, sealing caps of bottles, tamper-proofing pills, and food containers, bundling similarly shaped items into one larger and enclosing items in a protective film or liner.

- Adhesive tapes play an important role in packaging perishables. Overall, the growing packaging industry is expected to drive the demand for adhesive tapes through the forecast period.

- According to a report published by PMMI, 'The Association for Packaging and Processing Technologies', growth in the global packaging industry will reach USD 42.2 billion by 2021. The food, beverage, and healthcare industries witnessed increasing demand as consumers continued to rely on the items they manufactured during quarantine.

- Similarly, the packaging industry in India is also increasing at a rapid rate. It is the fifth-largest sector in India's economy and is currently one of the fastest and highest-growing sectors in the country. Amid the e-commerce surge, the Indian packaging industry is witnessing steep growth and is one of the strongest growing segments. According to the Indian Institute of Packaging (IIP), packaging consumption in India increased 200% in the past decade, from 4.3 kgs per person per annum (pppa) to 8.6 kgs pppa.

- Moreover, among the different types of packaging, the flexible packaging market is growing at a faster pace, owing to the benefits of flexible packaging and higher end-user preference over other packaging types. Among the developed regions, North America has the largest flexible packaging industry. Moreover, the region has the highest per capita consumption of flexible packaging (USD 71.58) across the world. Europe also has a high per capita consumption of flexible packaging (USD 20.73) however, much lower than the North American region.

- According to the European Bioplastics, the global production capacity of bioplastics for flexible and rigid packaging accounted for 665 kilotons and 492 kilotons, respectively, in 2021, compared to 555 kilotons and 443 kilotons, respectively, in 2020.

- Therefore, owing to the abovementioned factors, the demand for adhesive tapes in the packaging end-user industry is likely to boost the growth of the market studied over the forecast period.

China to Dominate the Asia-Pacific Region

- China dominated the adhesive tapes market in the Asia-Pacific region and is anticipated to continue to do so during the forecast period.

- The automobile industry in China has been witnessing growth trends for the past few years. The OICA recorded the production of automobiles in China to be 26,082,220 units of passenger cars and light vehicles in 2021, which was an increase from 25,225,242 units in 2020, recording a growth of 3%. Moreover, CAAM estimates that the production of automobiles is likely to increase in line with the growing demand from the passenger cars segment.

- Furthermore, electric vehicles, including scooters, passenger cars, and light commercial vehicles like buses, are gaining popularity in the country. According to the China Passenger Car Association (CPCA), the country sold over 3.3 million units in 2021, accounting for an increase of 169% compared to 2020.

- China has the second-largest healthcare industry in the world, after the United States. In 2020, healthcare expenditure was approximately CNY 7.2 trillion (~USD 1.04 trillion), which accounted for about 7% of the country's GDP. China's medical and therapeutical market has witnessed strong growth due to the growing number of hospitals and the increasing demand for medical assistance over the past two years.

- China is the largest base for electronics production in the world. Electronic products, such as smartphones, TVs, wires, cables, portable computing devices, gaming systems, and other personal electronic devices, recorded the highest growth in the electronics segment.

- According to the National Bureau of Statistics in China, the revenue in the consumer electronics and household appliances segment reached CNY 934.64 million (~USD 144.84 million) in 2021. The revenue is expected to show an annual growth rate of 2.04%, resulting in a projected market volume of USD 175,670 million by 2025.

- Owing to the abovementioned factors, the demand for adhesive tapes is expected to increase in China over the forecast period.

Adhesive Tapes Industry Overview

The adhesive tapes market is highly fragmented in nature. The key players in the market include 3M, Nitto Denko Corporation, Tesa SE - A Beiersdorf Company, LINTEC Corporation, and Intertape Polymer Group. (not in any particular order)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Growing Demand from the Packaging Industry

- 4.1.2 Continuous Usage of Adhesive Tapes in Electric and Hybrid Vehicles

- 4.2 Restraints

- 4.2.1 Volatility in Prices of Raw Materials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Epoxy

- 5.1.3 Rubber-based

- 5.1.4 Silicone

- 5.1.5 Polyurethane

- 5.2 Technology

- 5.2.1 Water-based

- 5.2.2 Solvent-based

- 5.2.3 Hot-melt

- 5.2.4 Reactive

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Healthcare

- 5.3.3 Packaging

- 5.3.4 Electrical and Electronics

- 5.3.5 Consumer/DIY

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of the Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Berry Global Inc.

- 6.4.3 DuPont

- 6.4.4 HB Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Intertape Polymer Group

- 6.4.7 LINTEC Corporation

- 6.4.8 Lohmanh GmbH & Co. KG

- 6.4.9 NITTO DENKO CORPORATION

- 6.4.10 OJI Holdings Corporation

- 6.4.11 ORAFOL Europe GmbH

- 6.4.12 SEKISUI CHEMICAL CO., LTD

- 6.4.13 Shurtape Technologies, LLC

- 6.4.14 Sika AG

- 6.4.15 Schweitzer-Mauduit International, Inc.

- 6.4.16 tesa SE - A Beiersdorf Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of the Medical Sector in Emerging Economies