|

市场调查报告书

商品编码

1687806

自动液体处理器:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Automated Liquid Handlers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

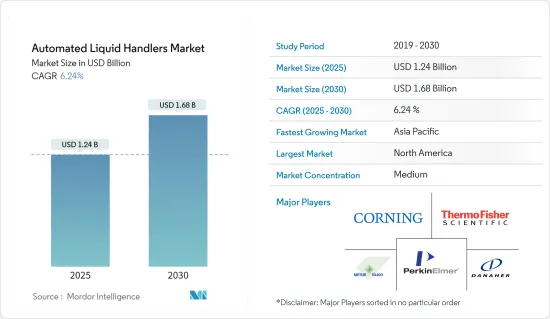

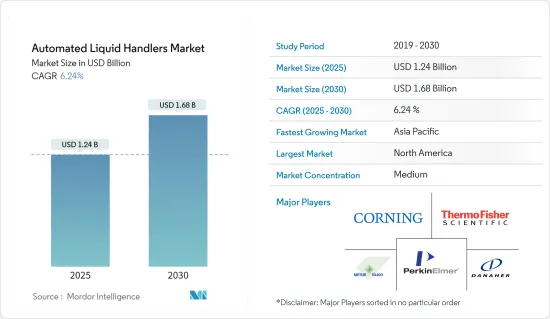

自动化液体处理器市场规模预计在 2025 年为 12.4 亿美元,预计到 2030 年将达到 16.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.24%。

由于 COVID-19 疫情爆发,全球诊断实验室的测试、追踪和追踪要求增加,导致自动化液体处理市场的需求大幅增加。特别是随着与疫情相关的样本涌入增加,实验室需要更强的能力来每天检测数千个样本。

主要亮点

- 自动化系统的灵活性和适应性使得自动化液体处理设备在实验室自动化中得到广泛的应用。高效率的死体积分配缩短了处理时间并降低了样品污染的机会。液体处理器还能够分配纳升量,使其可用于分配任务。

- 市面上有各种各样的自动化液体处理系统。这些是用于移液的空气或液体填充系统,结合了固定和/或抛弃式吸头。具有液体检测系统的自动化平台可记录抽吸动作,适用于少量生物分析样本。

- 此外,世界各地(尤其是美国)临床试验和临床前试验的迅速扩张对样本分析的速度提出了要求。临床研究机器持续运作,需要大量劳动力来确保正常运作。此外,现有疾病的快速传播和新疾病的发现也推动了对早期治疗和诊断的需求。预计这将增加临床诊断的应用并刺激自动液体处理器的采用。

- 此外,2021 年 1 月,SPT Labtech 收购了 Apricot Designs。透过此次收购,SPT 旨在扩大其液体处理技术范围,作为结构生物学、药物发现、样本管理、基因组学、生物库和低温电子显微镜自动化解决方案的一部分。预计此类发展将进一步促进市场发展。

- 对快速週转时间 (TAT)、高吞吐量、减少人为错误和降低营运成本的需求不断增加是推动采用自动化液体处理器的一些关键因素。液体处理器通常用于生物化学和化学实验室。自动化液体处理机器人可帮助实验室转移样本和其他液体。液体处理器使用软体控制器和整合系统来客製化批量转移的处理程序。

- 此外,2021年6月,德国默克公司宣布计划在法国投资1.75亿欧元。吉伦特实验室将投资约 5,000 万欧元,计画将产量提高三倍,专门研究治疗癌症的生物技术药物。

- 此外,自动容量分配器等先进的液体处理技术允许使用者在较小的体积范围内处理更多种类的液体,从高黏度到高挥发性。贝克曼库尔特推出了一系列适用于基因组、细胞、蛋白质和其他工作流程的可扩展液体处理解决方案。新发布的 Biomek 4000 自动液体处理器有助于标准化您的日常移液程序,保持样品品质并产生可重复的可靠结果。

自动化液体处理器市场趋势

临床诊断显着成长

- 医学实验室的自动化是一个日益增长的趋势,包括临床化学、血液学和分子生物学等研究和诊断实验室。模组化实验室自动化广泛应用于临床诊断的各种应用,包括样品製备、分发、筛检和存檔。此外,美国美国卫生研究院(NIH)对临床研究的资助逐年增加,这是市场的主要动力。

- 临床诊断已被证明对感染疾病和慢性病的治疗有益。根据世界卫生组织估计,心血管疾病、癌症、呼吸道疾病等慢性疾病每年导致全球约3,800万人死亡,占全球死亡总数的62%。

- 此外,根据美国国立卫生研究院的数据,预计2022年临床研究支出将达到约183.2亿美国,这有望成为未来市场成长的驱动力。

- 根据美国心臟协会统计,每天约有2,300名美国人死于心血管疾病,平均每38秒就有一人死亡。

- 据主要企业罗氏控股称,临床诊断在疾病的预防、检测和管理中发挥关键作用。临床诊断仅占医疗保健支出的 2%,但却影响约三分之二的临床决策。自动化临床诊断是一个巨大的挑战,因为它需要持续的、高品质的客户服务。这对于获得可靠的测试结果和确保患者安全至关重要。

- 此外,2022 年 5 月,印度商务和工业部的资料显示,2021-22 财年,印度医院和诊断中心产业的外国直接投资 (FDI) 资本注入增长了 39%,总资本注入额达到约 6.975 亿美元。

北美占最大市场占有率

- 北美自动化液体处理解决方案供应商不断创新,以整合最多的临床设备。此外,根据基金会-Keybridge设备与软体投资动量监测,美国临床设备投资在2021年第二季以0.7%的年化速度成长,2021年8月与去年同期相比成长了19%。

- 此外,美国面临临床实验室技术人员和实验室人员短缺的问题,预计将在全国范围内率先实现检测自动化。美国劳工统计局预测,未来几年临床实验室技术人员的短缺将超过 15 万名,而退休潮将使许多合格的工人退出劳动力市场,从而加剧短缺情况。每年约有 5,000 名美国临床实验室科学家进入劳动市场,不到每年满足日益增长的服务需求所需的约 12,000 名科学家的一半。

- 预计研发领域的发展将推动全国许多公共机构加强实验室能力,从而增加对实验室自动化设备的需求。例如,位于马里兰州弗雷德里克市德特里克堡的美国感染疾病医学研究所(USAMRIID)正在进行最后的试运行。该建筑计划于 2021 年投入使用。这座占地 835,000 平方英尺的建筑预计将成为美国生物防御研究计画的主要设施。

- 此外,由于美国政府和美国食品药物管理局(FDA)实施的严格监管,诊断市场的需求不断增长,以及由于该地区心血管和神经系统疾病等各种疾病的增加,对药物发现和研究实验室的重视程度不断提高,刺激了药物发现和临床诊断领域的需求。

- 该地区新实验室基础设施的建设正在加速进行。例如,2021年4月,领先的高端分析测量技术供应商耶拿分析仪器公司宣布在Endress+Hauser园区开设应用实验室。该实验室旨在为美国内部客户支援和演示提供一个集中地点。实验室将提供演示,展示耶拿分析仪器在液体处理和自动化、化学分析和生命科学领域的精确度和准确度。

- 新软体创新解决方案和扩展的趋势已经转化为区域自动化液体处理市场的需求,从而主导北美和全球市场。

自动化液体处理器产业概览

自动化液体处理市场较为分散,只有少数知名公司,而新加入的新兴企业和伙伴关係的创新正在增加市场上的新竞争对手。赛默飞世尔科技、珀金埃尔默、贝克曼库尔特和康宁是该市场的主要参与者。产品创新、合作和收购是扩大市场占有率的关键发展。

- 2022 年 2 月 - 生命科学实验室自动化专家 SPT Labtech 在波士顿举行的 SLAS 2022 国际会议和展览会上推出了四合一自动化液体处理平台 apricot DC1。本次示范将介绍一种紧凑型自动移液器,以帮助实验室简化日常应用中的手动和半手动移液过程。

- 2021 年 1 月-QIAGEN NV 宣布在全球推出 QIAcube Connect MDx,这是一个灵活的自动化样本处理平台,可供美国、加拿大、欧盟和其他全球市场的分子诊断实验室使用。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 实验室自动化系统的灵活性和适应性

- 市场限制

- 中小型组织的采用率下降

第六章市场区隔

- 按应用

- 药物研发

- 癌症和基因组研究

- 生物技术

- 其他用途

- 按行业

- 合约研究组织

- 製药和生物技术

- 学术和研究机构

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Thermo Fisher Scientific

- Perkin Elmer Inc.

- Danaher Corporation(Beckman Coulter Inc.)

- Formulatrix Inc.

- Mettler-Toledo International Inc.

- Agilent Technologies Inc.

- Hamilton Company

- Becton Dickinson and Company

- Synchron Lab Automation

- Tecan Group Ltd

- Aurora Biomed Inc.

- Eppendorf AG

- Analytik Jena AG(Endress+Hauser Group Services AG)

- Hudson Robotics Inc.

第八章投资分析

第九章:市场的未来

The Automated Liquid Handlers Market size is estimated at USD 1.24 billion in 2025, and is expected to reach USD 1.68 billion by 2030, at a CAGR of 6.24% during the forecast period (2025-2030).

With the outbreak of COVID-19, the automated liquid handler market witnessed a significant increase in demand due to the increasing requirement for testing, tracing, and tracking in diagnostic labs globally. As the volume of incoming samples, especially related to the pandemic situation, laboratories need many capabilities to test up to thousands of samples daily.

Key Highlights

- Automation systems' flexibility and adaptability made automated liquid handlers' equipment widely used in lab automation. They reduce processing time and the possibility of sample contamination by dispensing dead volumes efficiently. Liquid handlers can work with volumes as small as nanoliters, making them helpful in dispensing operations.

- There is a wide range of automated liquid handling systems on the market. They are air-based or liquid-filled systems for pipetting with either/or a combination of fixed and disposable tips. Automation platforms with liquid detection systems record aspiration action and assist when bioanalytical sample volumes are low.

- Furthermore, the rapid expansion of several clinical and pre-clinical studies worldwide, particularly in the United States, has created a need for speed in sample analysis. The machines in clinical studies run continuously and require a large workforce to ensure proper operation. Furthermore, the rapid spread of existing diseases and the discovery of new diseases raises the demand for early treatments and diagnoses. This is expected to boost the rate of clinical diagnostic application, fueling the adoption of automated liquid handlers.

- Furthermore, in January 2021, SPT Labtech acquired Apricot Designs. Through this purchase, SPT aimed to extend its range of liquid handling technologies as part of its collection of automation resolutions for structural biology, drug discovery, sample managing, genomics, biobanking, and cryo-electron microscopy. Such developments are anticipated to further drive the market growth.

- The increasing need for faster turn-around times (TAT), higher throughput, reduced human errors, and lower operational costs are some of the major factors driving the adoption of automated liquid handlers. Liquid handlers are typically employed in biochemical and chemical laboratories. Automatic liquid handling robots aid in the dispensing of samples and other liquids in laboratories. Liquid handlers use a software controller and an integrated system to customize handling procedures for large transfer volumes.

- Further, in June 2021, the German laboratory Merck announced its plan to invest EUR 175 million in France. About EUR 50 million was invested in the Gironde laboratory, which planned to triple its production, specializing in drugs derived from biotechnologies to treat cancer.

- Furthermore, advanced liquid handling technologies, such as automatic positive displacement pipetting systems, allow users to handle highly viscous to highly volatile liquids in lower volume ranges and with a broader range of liquid types. Beckman Coulter has introduced a new line of scalable liquid handling solutions for genomic, cellular, protein, and other workflows. The newly released Biomek 4000 Automated Liquid Handler aids in standardizing daily pipetting routines, preserving sample quality, and generating repeatable and reliable results.

Automated Liquid Handlers Market Trends

Clinical Diagnostics to Witness Significant Growth

- Automation in medical laboratories has been witnessing an increasing trend, including research and diagnostic laboratories, such as clinical chemistry, hematology, and molecular biology. Modular laboratory automation is widely employed in clinical diagnostics for various applications that include sample preparation, distribution, screening, and archiving. Further, year to year, growth in funding provided by NIH (National Institutes of Health) in clinical research is significantly driving the market.

- Clinical diagnostics have been proven beneficial in treating infectious and chronic disease conditions. World health organization (WHO) estimates that chronic disease conditions, like cardiovascular diseases, cancer, and respiratory diseases, are responsible for about 38 million people every year, accounting for 62% of all deaths worldwide.

- Moreover, according to the National Institutes of Health, clinical research funding in 2022 is expected to be around 18.32 billion US dollars, which is expected to drive market growth in the future.

- Statistics from American Heart Association indicate that about 2,300 Americans die of cardiovascular diseases each day, an average of 1 death every 38 seconds, thus indicating the need to treat them and find a solution via clinical diagnostics research.

- According to Roche Holding AG, a leading pharmaceutical company, clinical diagnostics play a crucial role in disease prevention, detection, and management. Though they account for just 2% of healthcare spending, they influence roughly two-thirds of clinical decision-making. Implementation of automation for clinical diagnostics is quite challenging as the processes need continuous, high-quality customer service. This is very important to obtain reliable test results and to provide patient safety.

- Further, in May 2022, according to data from the Ministry of Commerce and Industry, the hospitals and diagnostic centers sector in India experienced a 39% increase in Foreign Direct Investment (FDI) fund infusion during the fiscal year 2021-22, with fund infusion totaling approximately USD 697.5 million, this is expected to provide positive boost to the market growth.

North America Accounts For Largest Market Share

- Automated liquid handling solution providers in North America continuously innovate to integrate a maximum number of clinical equipment. Further, according to the Foundation-Keybridge Equipment & Software Investment Momentum Monitor, US investment in clinical equipment increased at a 0.7% annualized rate in Q2 2021 and was up 19% year over year in August 2021.

- Besides, the United States faces a shortfall in laboratory scientists and lab personnel, which is expected to spearhead lab automation across the country. The Department of Labor and Statistics predicts a future shortage of more than 150,000 clinical laboratory scientists exacerbated by a wave of retirements that would see much-qualified personnel leave the workforce over the coming years. Around 5,000 American lab professionals enter the labor pool each year, less than half of the approximately 12,000 workers a year necessary to meet the rising demand for their services.

- Due to the developments in the field of R&D, many public institutions are expected to enhance their laboratory capabilities across the country, boosting the demand for lab automation equipment. For instance, final commissioning is underway at the U.S. Army Medical Research Institute of Infectious Diseases (USAMRIID) in Fort Detrick in Frederick, Maryland. The building is anticipated to be open for occupancy in 2021. This 835,000-square-foot building is expected to serve as the lead facility for the U.S. Biological Defense Research Program.

- Furthermore, strict regulations imposed by the U.S. government and the FDA, along with the growing demand in the diagnostic market with the increasing emphasis on drug discovery and research laboratories owing to the rising presence of various diseases such as cardiovascular diseases and neurological diseases in the region, fueled the demand of drug discovery and clinical diagnostics sector.

- New lab infrastructure setup has been accelerated in the region. For instance, in April 2021, Analytik Jena, a leading provider of high-end analytical measuring technology, announced the opening of its applications lab within the Endress+Hauser campus. The lab aimed to offer a centralized location in the United States for in-house customer support and demonstrations. This lab is set to provide demos to showcase the precision and accuracy of Analytik Jena instruments in liquid handling and automation, chemical analysis, and life science groups.

- The trend towards new software innovation solutions and expansion has translated the demand for automated liquid handlers market in the region, leading to dominating the North American and the global markets.

Automated Liquid Handlers Industry Overview

The Automated Liquid Handlers Market is moderately fragmented due to the presence of a few prominent players, and newly added startups and partnership innovations are increasing new rivalry in the market. Thermo Fisher Scientific, Perkin Elmer Inc., Beckman Coulter Inc., Corning Inc., and others are key market players. Product innovation, partnerships, and acquisition are vital developments to increase their market share.

- February 2022 - SPT Labtech, a laboratory automation specialist for life sciences, debuted the apricot DC1, a 4-in-1 automated liquid handling platform, at the SLAS 2022 International Conference and Exhibition in Boston. The launch introduces a compact automatic pipettor to help laboratories streamline daily manual or semi-manual pipetting processes across applications.

- Match 2021 - QIAGEN N.V. announced the global launch of the QIAcube Connect MDx, a flexible platform for automated sample processing available to molecular diagnostic laboratories in the U.S. and Canada, the European Union, and other markets worldwide.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Flexibility and Adaptability of Lab Automation Systems

- 5.2 Market Restraints

- 5.2.1 Slower Adoption Rates in Small- and Medium-sized Organizations

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Drug Discovery

- 6.1.2 Cancer and Genomic Research

- 6.1.3 Biotechnology

- 6.1.4 Other Applications

- 6.2 By End-user Vertical

- 6.2.1 Contract Research Organizations

- 6.2.2 Pharmaceutical and Biotechnology

- 6.2.3 Academic and Research Institutes

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thermo Fisher Scientific

- 7.1.2 Perkin Elmer Inc.

- 7.1.3 Danaher Corporation (Beckman Coulter Inc.)

- 7.1.4 Formulatrix Inc.

- 7.1.5 Mettler-Toledo International Inc.

- 7.1.6 Agilent Technologies Inc.

- 7.1.7 Hamilton Company

- 7.1.8 Becton Dickinson and Company

- 7.1.9 Synchron Lab Automation

- 7.1.10 Tecan Group Ltd

- 7.1.11 Aurora Biomed Inc.

- 7.1.12 Eppendorf AG

- 7.1.13 Analytik Jena AG (Endress+Hauser Group Services AG)

- 7.1.14 Hudson Robotics Inc.