|

市场调查报告书

商品编码

1687809

硫代硫酸钠-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Sodium Thiosulphate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

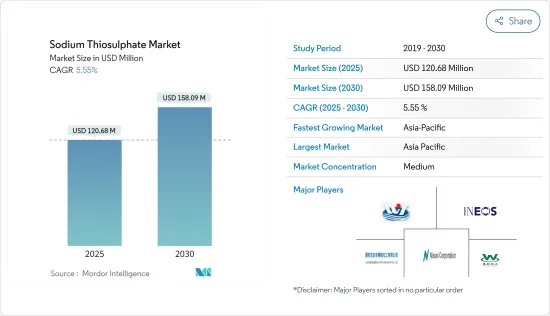

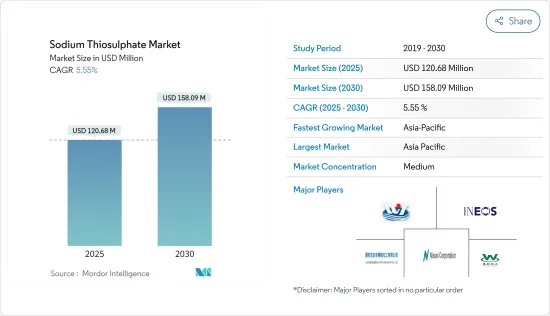

预计 2025 年硫代硫酸钠市场规模为 1.2068 亿美元,到 2030 年将达到 1.5809 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.55%。

由于供应链和市场中断,COVID-19 疫情影响了硫代硫酸钠市场。不过,市场在 2021-2022 年有所復苏。

主要亮点

- 短期内,扩大黄金浸出应用和增加在製药领域的应用是刺激市场需求的一些驱动因素。

- 另一方面,对静脉注射副作用的担忧预计会阻碍市场成长。

- 硫代硫酸钠在医疗产业的新兴用途可能会在未来几年为市场创造机会。

- 预计亚太地区将主导市场,并可能在预测期内呈现最高的复合年增长率。

硫代硫酸钠市场趋势

水疗用途日益广泛

- 硫代硫酸钠可用作游泳池、水族馆和水处理厂的脱氯剂,用于处理沉淀的反冲洗水,然后再将其排入河流和溪流。硫代硫酸钠是一种还原剂或抗氧化剂,可以中和自由基。

- 硫代硫酸钠液体用于透过电解工作的压舱水处理系统,并使用次氯酸钠作为消毒剂。它充当中和剂,在压舱水排放大海之前去除其中的氯。

- 硫代硫酸钠可以去除氯和氟化物,改善饮用水的品质。硫代硫酸钠结晶还可以提供硫,中和水和身体中的氯和氟化物,帮助身体排毒。

- 向家庭供应纯净水是每个政府的主要要求之一。人口成长和水需求增加导致饮用水短缺日益严重,这是推动全球水处理应用对硫代硫酸钠需求增加的一个主要问题。

- 能源、环境和水资源委员会(CEEW)与2030水资源集团计划改善印度的污水管理,并增加对水处理化学品製造商的私人投资,以建造污水处理厂和原材料。

- 所有这些因素都可能推动预测期内全球硫代硫酸钠市场的成长。

亚太地区可望主导市场

- 预计预测期内亚太地区将主导硫代硫酸钠市场。中国、印度、日本和东协国家等国家对水处理的需求不断增长预计将推动市场成长。

- 硫代硫酸钠广泛用于金的萃取。中国是世界上最大的黄金生产国。根据世界黄金协会统计,2021年中国黄金产量为332吨,约占全球总产量的9.3%。

- 2021 年 12 月,环境服务公司中国光大水务订单中国山东省济南国际医学科学中心污水处理计划价值 3.195 亿元(约 4,951 万美元)。该公司将主要为济南医疗中心区内的太平河、梅里、峨眉地区提供市政污水处理服务。该计划特许经营期为30年,其中建设期1年。

- 在印度,根据 2021 年 10 月启动的「清洁印度运动(城市)2.0」计划,已向各邦/中央直辖区拨款 15,883 亿印度卢比(约合 21.4818 亿美元),用于污水或水资源管理,包括 STP 和 FSTP(粪便污泥处理厂)。

- 此外,印度政府在2022年联邦预算中宣布了6,000亿印度卢比(约8,115亿美元)的预算,为每个家庭提供饮用水,这将推动该国对硫代硫酸钠的需求。

- 由于这些因素,预计该地区的硫代硫酸钠市场在预测期内将稳定成长。

硫代硫酸钠产业概况

硫代硫酸钠市场部分分散。市场主要企业包括英力士、溧阳庆丰炼化、长沙伟创化工、海门五洋化工、日精株式会社(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 扩大黄金浸出应用

- 在製药领域的应用日益广泛

- 限制因素

- 对静脉注射硫代硫酸钠副作用的担忧

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按应用

- 医疗的

- 照片编辑

- 黄金提取

- 水处理

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 合併、收购、合资、合作和协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Ampak Chemicals Inc.

- Changsha Weichuang Chemical Co. Ltd

- Esseco SRL

- Fennec Pharmaceuticals

- Haimen Wuyang Chemical Industry Co. Ltd

- Ineos

- Lakshmi Chemical Industries

- Liyang Qingfeng Fine Chemical Co. Ltd

- Nilkanth Organics

- Nissei Corporation

- Sankyo Kasei Co. Ltd

第七章 市场机会与未来趋势

- 硫代硫酸钠在医疗产业的新兴用途

The Sodium Thiosulphate Market size is estimated at USD 120.68 million in 2025, and is expected to reach USD 158.09 million by 2030, at a CAGR of 5.55% during the forecast period (2025-2030).

The COVID-19 pandemic affected the sodium thiosulphate market because of supply chain and market disruption. However, the market rebounded back in 2021-2022.

Key Highlights

- Over the short term, the growing use of gold leaching and increasing usage in pharmaceutical applications are some driving factors stimulating the market demand.

- On the flip side, concerns about the side effects of intravenous administration are expected to hinder the market growth.

- The emerging use of sodium thiosulphate in the medical industry is likely to create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market and is likely to witness the highest CAGR during the forecast period.

Sodium Thiosulphate Market Trends

Increasing Usage in Water Treatment

- Sodium thiosulfate can be used as a dichlorination agent for swimming pools, aquariums, and water treatment plants to treat settled backwash water before releasing it into rivers. Sodium thiosulfate is a reducing agent or antioxidant, neutralizing free radicals.

- Sodium thiosulphate liquid is used in ballast water treatment systems that work through electrolysis and use sodium hypochlorite as a disinfectant. It works as a neutralizing agent, de-chlorinating the ballast water before discharging it into the sea.

- Sodium thiosulphate promotes the quality of drinking water by removing chlorine or fluorine. Also, sodium thiosulfate crystallin promotes the body's detoxification by providing sulfur to neutralize chlorine and fluorine in water or the body.

- The supply of pure water to households is one of the chief requirements for all governments. The rising scarcity of potable water, coupled with the growing population and increasing water demand, is the primary concern driving the demand for sodium thiosulphate for water treatment applications worldwide.

- With the 2030 Water Resources Group, the Council on Energy, Environment & Water (CEEW) plans to improve wastewater management in India and increase private investments in water treatment chemicals manufacturing companies to build wastewater treatment facilities and raw materials.

- Owing to all these factors, the sodium thiosulphate market may grow globally during the forecast period.

Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region is estimated to dominate the sodium thiosulphate market during the forecast period. Increasing demand for the water treatment sector in countries like China, India, Japan, and ASEAN is expected to drive market growth.

- Sodium thiosulphate is widely used for gold extraction. China is the largest producer of gold globally. According to the World Gold Council, in 2021, China produced 332 metric tons of gold, accounting for around 9.3% of total global production.

- In December 2021, environmental services company China Everbright Water bagged a wastewater treatment project at the Ji'nan International Center for Medical Sciences in Shandong, China, worth CNY 319.5 million (~USD 49.51 million). The company is expected to mainly provide wastewater treatment services for the municipal wastewater generated in the Taipinghe, Meili, and Emei areas within the Ji'nan Medical Centre area. The project has a concession period of 30 years, including a one-year construction period.

- In India, under the Swachh Bharat Mission (Urban) 2.0, launched in October 2021, INR 15,883 crore (~USD 2,148.18 million) was allocated to states/UTs for wastewater or used water management, including STPs and FSTPs (fecal sludge treatment plants).

- Furthermore, in the Union Budget 2022, the Government of India announced a package of INR 60 lakh crore (~USD 8,11,500 million) to provide drinkable water to every household, thus, boosting the demand for sodium thiosulphate in the country.

- Due to all such factors, the market for sodium thiosulphate in the region is expected to have steady growth during the forecast period.

Sodium Thiosulphate Industry Overview

The sodium thiosulphate market is partially fragmented. Some of the major players in the market include INEOS, Liyang Qingfeng Fine chemical Co. Ltd, Changsha Weichuang Chemical Co. Ltd, Haimen Wuyang Chemical Industry Co. Ltd, and Nissei Corporation, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Use in the Gold Leaching

- 4.1.2 Increasing Use in Pharmaceutical Applications

- 4.2 Restraints

- 4.2.1 Concerns Regarding Side Effects of the Intravenous Sodium Thiosulphate Administration

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Application

- 5.1.1 Medical

- 5.1.2 Photographic Processing

- 5.1.3 Gold Extraction

- 5.1.4 Water Treatment

- 5.1.5 Other Applications

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, And Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted By Major Players

- 6.4 Company Profiles

- 6.4.1 Ampak Chemicals Inc.

- 6.4.2 Changsha Weichuang Chemical Co. Ltd

- 6.4.3 Esseco SRL

- 6.4.4 Fennec Pharmaceuticals

- 6.4.5 Haimen Wuyang Chemical Industry Co. Ltd

- 6.4.6 Ineos

- 6.4.7 Lakshmi Chemical Industries

- 6.4.8 Liyang Qingfeng Fine Chemical Co. Ltd

- 6.4.9 Nilkanth Organics

- 6.4.10 Nissei Corporation

- 6.4.11 Sankyo Kasei Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Use of Sodium Thiosulphate in the Medical Industry