|

市场调查报告书

商品编码

1687810

自动拖拉机:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Autonomous Tractors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

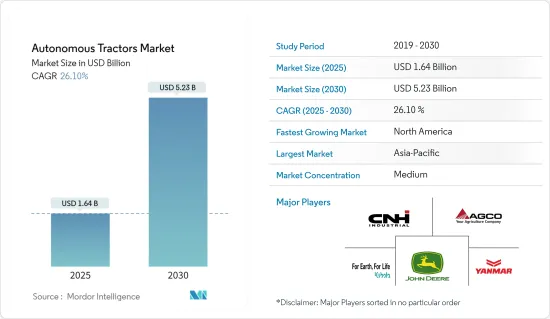

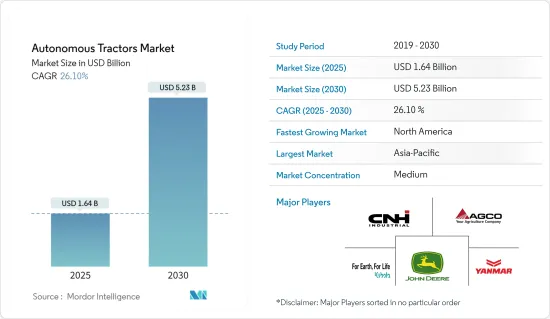

预计 2025 年自动拖拉机市场规模为 16.4 亿美元,到 2030 年将达到 52.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 26.1%。

主要亮点

- 农业劳动成本的上升,导致农业劳动力减少。农民越来越多地采用农业机械化来取代体力劳动,提供更具成本效益、更容易取得且更有效率的耕作方式。拖拉机是农业机械的主要动力来源。预计这将促进长期市场成长。

- 半自动自动化系统在合理的距离内足够独立地运行,以便农民在出现任何问题时能够进行干预,因此比全自动设备更可行。由于农业车辆配备操作员,这种半自动系统无需采用昂贵的传感器或复杂的传感器融合演算法就能轻鬆确保安全,因此对于农民来说,尤其是在新兴国家,它是最经济实惠的选择。

自动驾驶拖拉机的市场趋势

农业劳动力短缺和耕地面积减少

- 农业劳动力的减少,导致农业劳动力价格的上涨。从简单的供需经济学角度来看,农业劳动成本与一个国家从事农业的总人口比例直接相关,这会影响农业拖拉机市场。

- 平均而言,新兴经济体的人口中农业依赖程度较高。然而,由于每年大量人口迁入都市区,这一比例正在下降。根据世界银行资料库,农业就业占总就业人数的比重从2014年的29.43%大幅下降到2019年的26.75%。

- 技术辅助农业需要熟练劳动力,而熟练劳动力严重短缺,因此农民正在考虑当前的挑战并采用高产量自动拖拉机等技术。这种状况是推动市场向前发展的主要因素之一。

- 根据印度食品和农业理事会(ICFA)估计,到2050年,印度从事农业的人口比例将下降25.7%。农业需要技术纯熟劳工,而熟练劳动力严重短缺,因此农民正在考虑当前的挑战,并采用自动拖拉机等生产率更高的技术。这种状况是推动市场向前发展的主要因素之一。

北美预计将成为成长最快的市场

- 北美将在 2022 年占据最大的市场占有率,并且在预测期内(2023-2028 年)市场成长也将快速推进。农民可支配收入高、训练有素的农业劳动力短缺以及技术进步预计将成为未来推动北美自动拖拉机市场扩张的主要原因。

- 由于北美是已开发地区,农场通常规模较大,顾客忠诚度较高。美国对高功率拖拉机的需求开始成长。美国是北美最大的自动拖拉机市场。

- 政府对精密农业等永续生产技术的支持,以及物联网 (IoT)、人工智慧 (AI) 和机器学习 (ML) 的融合,正在推动对自动化技术的需求。因此,美国拖拉机市场在预测期内可能会经历显着增长。

- 此外,加拿大农民也对采用自动拖拉机表现出兴趣。因此,这对未来几年的市场成长来说是一个好兆头。

自动驾驶拖拉机产业概况

自动驾驶拖拉机市场相当巩固。我们专注于全球创新和新产品的推出。由于该市场才刚起步,因此它被认为是一个整合的市场,少数几家公司占据着大部分市场占有率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 马力

- 小于30马力

- 31马力至100马力

- 超过100马力

- 自动化

- 全自动

- 半自动

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 西班牙

- 法国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 非洲其他地区

- 北美洲

第六章 竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- AGCO

- John Deere

- Mahindra and Mahindra Ltd

- Autonomous Tractor Corporation

- CNH Industrial

- Kubota Corporation

- Dutch Power Company

- Yanmar Co. Ltd

- Zimeno Inc.(DBA Monarch Tractor)

- AutoNext Automation

第七章 市场机会与未来趋势

The Autonomous Tractors Market size is estimated at USD 1.64 billion in 2025, and is expected to reach USD 5.23 billion by 2030, at a CAGR of 26.1% during the forecast period (2025-2030).

Key Highlights

- Agricultural labor is decreasing due to the cost of farm labor rising. Farmers are increasingly adopting agricultural mechanization as a substitute for manual labor and offering more cost-effective, easily available, and efficient agricultural operations. Tractors are the primary source of power for driving agricultural machinery. This is observed to contribute to market growth over the long term.

- The semi-autonomous systems operate independently enough within reasonable distances that the farmer can intervene if any problems occur, and therefore, they are more viable than fully autonomous equipment. Because of the operator's presence in agricultural vehicles, the safety of such a semi-autonomous system can be easily ensured without the incorporation of costly sensors and complicated sensor fusion algorithms, making them the most feasible for farmers to purchase, especially in developing countries.

Autonomous Tractors Market Trends

Shortage of Farm Labor and Declining Arable Land

- Due to decreasing agricultural labor, the prices of farm labor are rising. The cost of farm labor directly relates to the percentage of a country's total population employed in agriculture, considering simple demand-supply economics, thereby affecting the agricultural tractors market.

- On average, developing economies have larger percentages of the population dependent on agriculture. However, the percentages have decreased as many people migrate yearly to urban areas. According to the World Bank's database, agricultural employment out of total employment fell drastically from 29.43% in 2014 to 26.75% in 2019 globally.

- As technologically assisted agriculture needs skilled labor, of which there is an acute shortage, farmers are adopting technologies such as autonomous tractors that can be productive, considering the current challenge. This scenario is one of the major factors that drive the market forward.

- According to the Indian Council of Food and Agriculture (ICFA), the percentage of agriculture workers in India is estimated to decline by 25.7% in 2050. As agriculture needs skilled laborers with an acute shortage of availability, farmers are adopting technologies such as autonomous tractors that can be productive, considering the current challenge. This scenario is one of the major factors that drive the market forward.

North America Projected to be Fastest-Growing Market

- North America accounted for the largest market share in 2022 while also rapidly advancing in the market growth over the forecast period(2023-2028). The higher disposable incomes of farmers, lack of trained farm labor, and well-developed technology are expected to be the primary reasons for the future expansion of the North American autonomous tractors market.

- Since North America is a developed region, farms are usually large, and customer loyalty is high. The demand for high-powered tractors in the US is starting to gain traction. The US is the largest market for autonomous tractors in the North American region.

- The government's support for sustainable production techniques, such as precision farming, involving the integration of the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) is boosting the demand for automated technologies. Therefore, this may result in the significant growth of the autonomous tractors market in the US during the forecast period.

- Further, Canadian farmers are also showing interest in adopting autonomous tractors as they would save time and decrease operating costs. Therefore, this may indicate a positive sign for market growth over the coming years.

Autonomous Tractors Industry Overview

The autonomous tractors market is fairly consolidated. The major players in this market are focused on innovation and launching new products globally. Since the market's inception is very recent, it is considered a consolidated market with a few players holding most of the market share. The top players in the market are Deere and Co, CNH Industrial, AGCO Corporation, Kubota, and Yanmar. The companies were involved in various strategic activities such as product innovations, expansions, partnerships, and mergers and acquisitions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Horsepower

- 5.1.1 Up to 30 HP

- 5.1.2 31 HP to 100 HP

- 5.1.3 Above 100 HP

- 5.2 Automation

- 5.2.1 Fully Automated

- 5.2.2 Semi-automated

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Russia

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AGCO

- 6.3.2 John Deere

- 6.3.3 Mahindra and Mahindra Ltd

- 6.3.4 Autonomous Tractor Corporation

- 6.3.5 CNH Industrial

- 6.3.6 Kubota Corporation

- 6.3.7 Dutch Power Company

- 6.3.8 Yanmar Co. Ltd

- 6.3.9 Zimeno Inc. (DBA Monarch Tractor)

- 6.3.10 AutoNext Automation