|

市场调查报告书

商品编码

1687811

资料中心浸入式冷却-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Data Center Immersion Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

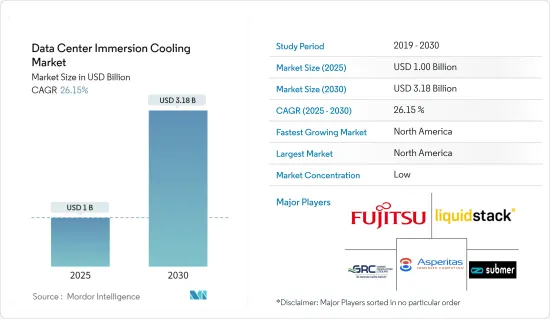

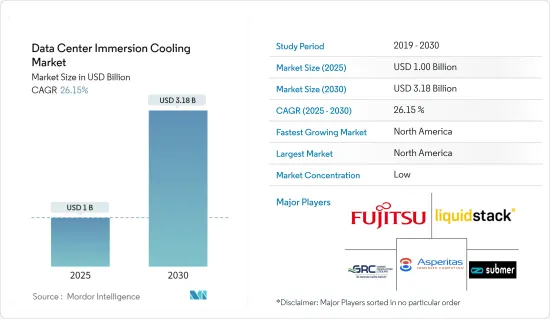

资料中心浸入式冷却市场规模预计在 2025 年为 10 亿美元,预计到 2030 年将达到 31.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 26.15%。

为了满足对该技术日益增长的需求,Supermicro 和富士通等公司提供了多个支援浸入式冷却的伺服器产品线。一些硬体製造商已经开始发布韧体和/或 BIOS 更新,以告知伺服器在基于浸入式冷却的安装中不需要风扇,这在很大程度上表明该行业已准备好向硬体冷却技术迈进。

主要亮点

- 资料中心不断增加的碳排放也是一个主要问题,这导致人们更多地采用浸入式冷却等先进的液体冷却技术。浸入式冷却市场知名合成冷却剂供应商 3M 最近的一项研究表明,采用传统空气冷却技术的资料中心所需电力的 38% 用于冷却电子元件。

- 印度和中国等新兴经济体的 IT 结构发展预计将推动对资料中心的需求。由于云端模型的采用日益广泛,对资料中心的需求预计会增加,云端模型为 IT 产业提供了成本和营运优势。

- 根据NTT有限公司的一项调查,超过一半的受访者表示,云端模式将为其组织的运作方式带来最大的转变。因此,预计资料中心对冷却的需求将会增加,从而导致根据最终用户的偏好实施液体冷却方法。

- Uptime 最近的年度调查发现,20kW 以上机架的部署正在减少。与前一年同期比较,大多数受访者使用 10-19kW 范围内的最高密度机架。随着机架密度增加到 20-25kW 以上,直接液体冷却变得更加经济和有效。

- 对于大型企业而言,从长远来看,比起在较低温度下运行超大规模设施,更频繁地更换故障伺服器可能成本更低。然而,随着对更大运算能力的需求导致资料中心中 GPU 的整合度增加,大型企业必须转向有效的冷却技术。

- 新冠疫情给多个经济体的各个领域带来了额外的压力。这导致人们的注意力转向数位经济。中国顶级云端处理供应商阿里云正在投资数十亿美元建设下一代资料中心,以支援「后疫情世界」的数位转型需求。

- 由于新冠疫情带来的远程办公和其他虚拟活动的增加,资料中心的能源消耗进一步增加。这就是对永续冷却技术的需求不断增加的原因。

资料中心浸入式冷却的市场趋势

边缘运算将大幅成长

- 在预测期内,企业预计将见证处理大量 IP 流量的 IP 连接移动和机器对机器 (M2M) 设备的快速采用。线上提供者对更快的 Wi-Fi 服务和应用传输的需求预计将会成长。一些 M2M 设备(例如自动驾驶汽车)需要与本地处理资源进行即时通讯以确保安全。

- 边缘资料中心的部署将使许多新兴技术受益,包括第五代(5G)网路、物联网和工业物联网设备、虚拟实境和增强智慧、人工智慧和机器学习、资料分析、自动驾驶汽车以及视讯串流和监控。

- 5G 无线基础设施的出现正在推动资料中心营运商选择与提供更低延迟和更高弹性的网路配合的边缘运算基础设施。多接入边缘运算(MEC)有助于网路服务与使用者更加紧密地联繫在一起。

- 因此,由于全球范围内采用 5G 技术、自动驾驶汽车和智慧城市日益增长的趋势等诸多因素,对高效边缘资料中心的需求预计将会增长。根据英特尔预测,2024 年全球自动驾驶汽车註册量占比为 0.49%,预计到 2030 年将达到 12%。

- 然而,大规模边缘运算部署的一个关键要求是低营运成本。对于边缘部署,浸入式冷却可显着节省能源。液体冷却解决方案的可靠性和非接触功能满足了增加维护间隔平均时间和延长干预间隔的需求,以便可行地操作和管理安装在远端位置的设备。

- 人工智慧 (AI) 是许多企业数位转型的一部分,预计将对资料中心管理、生产力和基础设施产生重大影响。全球资料中心建设产业也蓬勃发展,云端运算的日益普及为巨量资料和物联网投资带来了新的机会,从而推动了超大型资料中心的兴起。

- 人工智慧和巨量资料分析需要很高的冷却能力,许多浸没式和冷却供应商正在与OEM合作以改善他们的服务。为了获得竞争优势,公司需要策略性地、创造性利用IT基础设施。浸入式冷却有效降低了功耗,同时保持了 AI 应用等密集工作负载的效能。

北美占据主要市场占有率

- 资料中心投资者正在投资直接晶片冷却和浸入式解决方案。随着 5G 网路在世界各地兴起,边缘资料中心的重要性日益凸显,美国是该技术的早期采用者之一。在美国,包括EdgePresence、EdgeMicro、American Towers在内的多家营运商已经开始投资边缘资料中心。

- 根据Cisco的报告,美国的行动资料流程量资料大幅成长,从 2017 年的每月 1.26 Exabyte成长到 2022 年的每月 7.75 Exabyte。爱立信公司预计,到 2030 年,这笔资料流量将再次成长两倍。因此,分散式云端实用化,有可能提供实现这种规模连接所需的低延迟和高频宽。

- 美国的网路使用量急剧增加。该国是最大的资料中心营运市场,并且由于最终用户资料消费的增加而持续扩大。物联网 (IoT) 的兴起正在推动美国超大型资料中心市场的发展,从而催生更多能够支援商业用户和消费者产生的Exabyte资料的设施。

- Switch 已与戴尔和联邦快递合作在美国部署边缘资料中心设施。主机託管服务供应商 DataBank 已向美国边缘资料中心供应商 EdgePresence 投资 3,000 万美元,以将客户工作负载託管在边缘中心,从而减少服务延迟。

- 据全球选址咨询提供者(经济奖励、企业房地产服务和空气冷却系统)Site 位置 Group 称,该地区的经济冷却能力已达到最大值。随着越来越多的资料中心希望将机架容量最大化,液体冷却正成为更可行的解决方案。

资料中心浸入式冷却市场概述

市场竞争激烈,预计在预测期内将更加激烈。富士通有限公司、Green Revolution Cooling Inc.、Submer Technologies SL、Liquid Stack Inc. 和 Asperitas Company 等主要企业正在采取合作、协作和收购等策略来加强产品系列确保永续的竞争优势。

- 2023 年 11 月 - LiquidStack 推出了一系列新型通用冷却液分配装置 (CDU),可设定为适应大多数市售的直接晶片 (DTC) 解决方案。 Liquid Stack 的通用 CDU 系列适用于 AI、HPC 和高阶云端运算应用,可提供 800kW 至 1.5MW 的散热量,专为 DTC 设计。

- 2023 年 10 月—英特尔与 Samar 合作在单相浸没技术方面建立坚实的基础,并在强制对流散热器 (FCHS) 封装形式上取得突破。 FCHS 彻底改变了资料中心的冷却方式,减少了热设计功率 (TDP) 大于 1000W 的晶片全面捕获和散发热量所需的组件数量和成本。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争程度

- 替代品的威胁

- COVID-19 产业影响评估

- 产业供应链分析

- 氟化液体供应商/製造商

- 浸入式冷却浴设备供应商

- 资料中心供应商

第五章市场动态

- 市场驱动因素

- 超大规模资料中心的兴起

- 解决高密度功耗问题

- 市场限制

- 资金投入大

第六章 技术简介

- 资料中心冷却的演变

- 能耗和计算密度指标及关键考量因素

- 流体、处理器、GPU、机架和基础设施供应商的细分

第七章市场区隔

- 按类型

- 单相浸入式冷却系统

- 两相浸入式冷却系统

- 按冷却剂

- 矿物油

- 去离子水

- 氟碳流体

- 合成液体

- 按应用

- 高效能运算

- 边缘运算

- 人工智慧

- 加密货币挖矿

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第八章竞争格局

- 公司简介

- Fujitsu Limited

- Green Revolution Cooling Inc.

- Submer Technologies SL

- Liquid Stack Inc.

- Asperitas Company

- LiquidCool Solutions

- Midas Green Technologies

- Iceotope Technologies Ltd

- Wiwynn Corporation

- DCX Ltd

第九章投资分析

第十章:市场的未来

The Data Center Immersion Cooling Market size is estimated at USD 1.00 billion in 2025, and is expected to reach USD 3.18 billion by 2030, at a CAGR of 26.15% during the forecast period (2025-2030).

Owing to the increasing demand for this technology, companies such as Supermicro and Fujitsu offer several server lines ready for immersion cooling. Several hardware manufacturers are launching firmware and BIOS updates to inform servers that fans are not required in immersion-cooling-based installations, primarily indicating the industry's readiness to shift to hardware cooling technologies.

Key Highlights

- The increasing carbon footprint of the data centers is another major issue leading to the increased adoption of advanced liquid cooling technology, such as immersion cooling. In a recent study conducted by company 3M, a prominent synthetic coolant provider in the immersion cooling market, it was identified that 38% of the electricity needed in data centers equipped with traditional air-based cooling technologies is utilized to cool the electronic components.

- The developments in the IT structure in emerging economies, such as India and China, are expected to boost the demand for data centers favorably. The demand for data centers is anticipated to increase due to the increasing adoption of the cloud model, which has cost and operational benefits for the IT industry.

- According to an NTT Ltd study, over half of the respondents stated that the cloud model would have the most transformational impact on their organization's business operations. Therefore, the demand for the cooling of data centers is anticipated to increase, leading to the execution of liquid cooling methods based on end-user preferences.

- Uptime launched its recent annual survey, which found that racks consisting of 20 kW and advanced are decreasingly deployed. On a time-over-year base, most respondents highlighted their highest density rack usage in the 10-19 kW range. Direct liquid cooling becomes more economical and effective when rack densities higher than 20- 25 kW are preferred.

- For large enterprises, replacing failed servers more constantly than usual may be less expensive over time than operating a hyperscale facility at lower temperatures. Still, with the growing integration of GPUs in data centers urged by the need for better computing power, large enterprises must move toward an effective cooling technology.

- The outbreak of COVID-19 posed further stress on multiple economies across various sectors. This shifted the focus toward a digital economy. China's top cloud computing provider, Alibaba Cloud, invests billions in building next-generation data centers to support digital transformation needs in a"post-pandemic world."

- Data center energy usage has been compounded due to increased teleworking and other virtual activities brought on by the COVID-19 pandemic. Thus, developments using sustainable cooling technologies are on the rise.

Data Center Immersion Cooling Market Trends

Edge Computing to Witness Major Growth

- In the forecast period, organizations are expected to witness rapid growth in IP-connected mobile and machine-to-machine (M2M) devices, which handle significant amounts of IP traffic. The demand for faster Wi-Fi service and application delivery from online providers is expected to rise. Some M2M devices, such as autonomous vehicles, require real-time communications with local processing resources to ensure safety.

- The deployment of edge data centers benefits many new technologies, including fifth-generation (5G) networks, IoT and IIoT devices, virtual and augmented reality, artificial intelligence and machine learning, data analytics, autonomous vehicles, and video streaming and surveillance.

- The emergence of 5G wireless infrastructure has urged data center operators to opt for edge computing infrastructure to work with networks offering lower latency and higher resiliency. Multi-access edge computing (MEC) aids network services in connecting to users closely.

- Hence, the demand for efficient edge data centers is expected to be augmented by many factors, including the introduction of 5G technology worldwide and the growing trend of autonomous or self-driving vehicles and smart cities. According to Intel, the projected global autonomous vehicle registration share in 2024 is 0.49%; by 2030, the registration share is expected to reach 12%.

- However, a key requirement of large-scale edge computing roll-outs will be low operating costs. In edge deployments, immersive liquid cooling provides dramatic energy-saving benefits. The reliability and no-touch features of liquid cooling solutions will match the need for extended mean time to maintenance and longer intervention intervals for viable operation and management of remotely located equipment.

- Artificial intelligence (AI), a part of the digital transformation for many enterprises, is anticipated to impact data center management, productivity, and infrastructure significantly. The global data center construction industry is also booming, as increasing cloud adoption fuels new opportunities in big data and IoT investment, leading to more hyper-scale data centers.

- AI and big data analytics require a high cooling power, encouraging many liquid immersion and cooling vendors to partner with OEMs to improve their offerings. Enterprises must leverage their IT infrastructure strategically and creatively to gain a competitive advantage. Immersion cooling effectively reduces power consumption while maintaining performance across high-density workloads like AI applications.

North America to Hold Significant Market Share

- The data center investors are investing in direct-to-chip cooling and liquid immersion solutions. The emergence of 5G networks worldwide facilitates the importance of edge data centers, and the United States is among the earliest adopters of the technology. Many operators in the United States, such as EdgePresence, EdgeMicro, and American Towers, have started investing in these centers.

- The mobile data traffic in the United States increased considerably over the years, from 1.26 exabytes per month of data traffic in 2017 to 7.75 exabytes per month of data traffic by 2022, as reported by Cisco Systems. According to Ericsson, this data traffic is expected to triple further by 2030. Thus, the distributed cloud that may secure the low latency and high bandwidth required to easily connect at such a scale is coming into action.

- The United States is witnessing a substantial increase in internet usage. The country is the largest data center operations market, and it continues to expand due to the higher data consumption by end users. The popularity of the Internet of Things (IoT) is driving the US hyper-scale data center market, leading to additional facilities that can support exabytes of data generated by business users and consumers.

- Switch partnered with Dell and FedEx to deploy edge data center facilities in the United States. DataBank, a colocation service provider, invested USD 30 million in EdgePresence, an edge data center provider in the United States, to collocate their customer workloads to edge centers to reduce latency in their services.

- According to the Site Selection Group, a global location advisory provider, economic incentive, corporate real estate services, and air-cooled systems, it reached its maximum economic cooling capability in the region. As more data centers aim to pack racks to capacity, liquid cooling becomes a more viable solution.

Data Center Immersion Cooling Market Overview

The market studied reflects high competitiveness and is expected to intensify further during the forecast period. Key players, including Fujitsu Limited, Green Revolution Cooling Inc., Submer Technologies SL, Liquid Stack Inc., and Asperitas Company, employ strategies like partnerships, collaborations, and acquisitions to fortify their product portfolios and secure sustainable competitive advantages.

- November 2023 - Liquid Stack announced its new range of universal coolant distribution units (CDUs), which can be configured to support the most commercially available direct-to-chip (DTC) solutions. Suitable for AI, HPC, and advanced cloud computing applications, LiquidStack's universal CDU range delivers 800 kW to 1.5 MW of heat rejection and is designed specifically for DTC.

- October 2023 - Intel and Submer collaborated in establishing a formidable foundation for single-phase immersion technology, which has achieved a groundbreaking advancement in the form of the Forced Convection Heat Sink (FCHS) package. Set to revolutionize data center cooling, the FCHS reduces the quantity and cost of components required for comprehensive heat capture and the dissipation of chips with thermal design power (TDP) exceeding 1000 W.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Degree of Competition

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of the Impact of COVID-19 on the Industry

- 4.4 Industry Supply Chain Analysis

- 4.5 Fluorine-based Liquid Suppliers/Manufacturers

- 4.6 Immersion Cooling Bath Equipment Vendors

- 4.7 Data Center Vendors

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Number of Hyper-scale Data Centers

- 5.1.2 Dealing with High-density Power Consumption

- 5.2 Market Restraint

- 5.2.1 High Investment with Greater Capital Expenditure

6 TECHNOLOGY SNAPSHOT

- 6.1 Evolution of Data Center Cooling

- 6.2 Energy Consumption and Computing Density Metrics, and Key Considerations

- 6.3 Teardown of Fluid, Processor, GPUs, Racks, and Infrastructure Providers

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Single-Phase Immersion Cooling System

- 7.1.2 Two-Phase Immersion Cooling System

- 7.2 By Cooling Fluid

- 7.2.1 Mineral Oil

- 7.2.2 Deionized Water

- 7.2.3 Fluorocarbon-Based Fluids

- 7.2.4 Synthetic Fluids

- 7.3 By Application

- 7.3.1 High-Performance Computing

- 7.3.2 Edge Computing

- 7.3.3 Artificial Intelligence

- 7.3.4 Cryptocurrency Mining

- 7.3.5 Other Applications

- 7.4 By Geography

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia

- 7.4.4 Australia and New Zealand

- 7.4.5 Latin America

- 7.4.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Fujitsu Limited

- 8.1.2 Green Revolution Cooling Inc.

- 8.1.3 Submer Technologies SL

- 8.1.4 Liquid Stack Inc.

- 8.1.5 Asperitas Company

- 8.1.6 LiquidCool Solutions

- 8.1.7 Midas Green Technologies

- 8.1.8 Iceotope Technologies Ltd

- 8.1.9 Wiwynn Corporation

- 8.1.10 DCX Ltd