|

市场调查报告书

商品编码

1687816

飞机座椅作动系统:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Aircraft Seat Actuation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

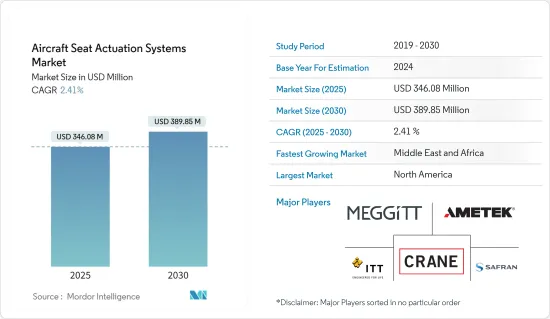

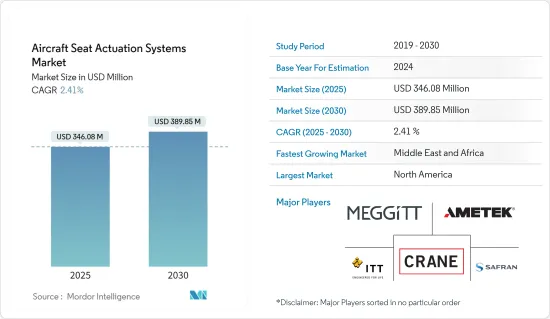

飞机座椅作动系统市场规模预计在 2025 年为 3.4608 亿美元,预计到 2030 年将达到 3.8985 亿美元,预测期内(2025-2030 年)的复合年增长率为 2.41%。

2020年爆发的新冠疫情,对整个航空业造成了严重衝击。结果,一些飞机运营商申请破产,短期内影响了飞机和飞机座椅作动系统的需求。不过,由于2021年的飞机交付较前一年增加,市场已逐渐復苏。军事和通用航空领域也反映了类似的趋势。

随着各国疫苗接种率上升,航空旅行限制正在放宽,航空旅客数量也逐渐增加。客运量的逐步復苏正鼓励航空公司和飞机营运商投资购买新飞机,以实现机队的现代化并扩展到新的目的地。这在预测期内极大地推动了市场成长。

航空公司和飞机营运商将加强对客舱现代化的投资,以增强乘客的飞机体验,座椅製造商也将在座椅设计上进行创新,以提供更高水平的乘客舒适度,预计这些将在未来几年推动飞机座椅作动系统市场的需求。

对积层製造等技术的投资,用于生产薄型面板和其他座椅部件,预计将降低部件的整体重量和製造成本,从而刺激轻量化座椅致动器和马达的发展。

飞机座椅作动系统市场趋势

固定翼飞机市场将在 2021 年占据主要收益占有率

目前,固定翼飞机占据市场主导地位。由于交付和座位数要求比旋翼机更高,预计它将继续占据市场主导地位。由于客运量和航空业务的逐步成长,2021年新飞机交付较2020年有所改善。 2021年,空中巴士交付了611架民航机(2020年为566架),波音交付了340架民航机(2020年为157架),ATR交付了31架(2020年为10架)。民用、商务和私人航空需求的逐步復苏进一步支持了新飞机的采购。

同样,随着供应链问题的消退,军事领域的固定翼飞机交付也在增加。例如,洛克希德·马丁公司交付了142架F-35战斗机(2020年交付123架),达梭航空出口了25架阵风战斗机(2020年交付13架)。预计预测期内飞机交付数量的增加将推动市场成长。此外,透过与航空公司的合作,飞机座椅製造商正在改进其设计以吸引新客户。预计客舱内部和座椅模组方面的创新将在未来几年推动该领域的成长。

预计中东和非洲地区将在预测期内实现最高成长

由于各大航空公司对宽体飞机的需求,以及私人公司和包机业者对大型飞机的需求,预计中东和非洲地区对飞机座椅作动系统市场的需求最高。例如,阿提哈德航空和阿联酋航空订单超过 270 架飞机(截至 2022 年 1 月),包括波音 777X、空中巴士 A350 系列、A380 和波音 787 系列。同样,随着中东地区航空旅行需求的不断增长,该地区的航空公司和飞机运营商正在投资扩大其机持有,以开通该地区的新航线。

同样,该地区恐怖主义的增加也导致这些国家投入大量资金购买军用飞机。 2021 年 8 月,卡达阿联酋空军 (QEAF)接受了首批新一代 F-15 战斗机,由美国和波音公司与海湾国家合作製造。这些飞机是根据该国 2017 年签署的一项订单交付的,该订单要求该国采购 36 架 F-15QA 战斗机,并选择再购买 36 架。预计预测期内埃及、约旦、摩洛哥、阿尔及利亚和以色列空军的类似飞机订单将推动座椅作动系统市场的成长。

飞机座椅作动系统产业概况

飞机座椅作动系统市场是一个高度整合的市场,儘管市场上有许多零件供应商,但只有极少数参与者占据大部分市场份额。飞机座椅作动系统市场的一些知名参与者包括 Safran SA、Meggit PLC、Crane Co.、AMETEK Inc.、ITT Inc. 等。预计需求将保持强劲,不会因军事应用领域的经济衰退或 COVID-19 疫情而出现市场波动。因此,製造商应专注于此领域,以稳定和确保收益来源。亚太地区和中东及非洲地区目前航空业需求旺盛,但目前缺乏足够的基础设施和产品库存来确保快速供应。这使得它们拥有先发优势,同时也使它们能够从全球许多政府作为合约义务一部分的冲销条款中受益,从而扩大在当地绿地领域的影响力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

- 美元汇率

第二章调查方法

第三章执行摘要

- 2018 年至 2027 年全球市场规模及预测

- 2021 年按机制分類的市场占有率

- 2021 年各机型市场占有率

- 2021 年各地区市场占有率

- 市场结构及主要参与企业

第四章 市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 机制

- 线性

- 旋转

- 飞机类型

- 固定翼飞机

- 直升机

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 其他拉丁美洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Lee Air Inc.

- Safran SA

- Astronics Corporation

- Crane Co.

- ITT Inc.

- CEF Industries LLC

- ElectroCraft Inc.

- NOOK Industries Inc.

- Rollon SpA

- Buhler Motor GmbH

- AMETEK Inc.

- Kyntronics

- Meggitt PLC

- OTM Servo Mechanisms Limited

第七章 市场机会与未来趋势

The Aircraft Seat Actuation Systems Market size is estimated at USD 346.08 million in 2025, and is expected to reach USD 389.85 million by 2030, at a CAGR of 2.41% during the forecast period (2025-2030).

The outbreak of the COVID-19 pandemic in 2020 severely impacted the entire aviation industry. It has resulted in several aircraft operators filing for bankruptcy, which affected the demand for aircraft in the short term and aircraft seat actuation systems. However, the market gradually recovered in 2021 due to the increasing aircraft deliveries compared to the previous year. A similar trend has been reflected in the military and general aviation sectors.

With the increasing vaccination in various countries, the air passenger traffic is gradually increasing as the regulations for air travel are alleviating. This gradual recovery in passenger traffic supports the airlines and aircraft operators to invest in the procurement of new aircraft for fleet modernization and destination expansion. This is majorly driving the growth of the market during the forecast period.

Growing investment for cabin modernization by airlines and aircraft operators to enhance passenger experience onboard aircraft and innovation in seat designs by the seat manufacturers for offering a higher level of passenger comfort is anticipated to propel the demand for the aircraft seat actuation systems market in the coming years.

The investments into technologies like additive manufacturing for manufacturing thin down panels and other seat components to reduce the overall weight and cost of manufacturing components are anticipated to promote the development of lightweight seat actuators and motors.

Aircraft Seat Actuation Systems Market Trends

The Fixed-wing Aircraft Segment Accounted for Major Revenue Share in 2021

The fixed-wing aircraft segment currently dominates the market. It is anticipated to continue its dominance over the market due to its higher deliveries and seat requirements than the rotary-wing aircraft. New aircraft deliveries improved in 2021 compared to 2020 due to gradual growth in passenger traffic and airline operations. In 2021, Airbus delivered 611 commercial aircraft (566 deliveries in 2020), Boeing delivered 340 commercial aircraft (157 deliveries in 2020), and ATR delivered 31 aircraft (10 deliveries in 2020). The gradual recovery in demand for commercial aviation and business and private aviation is further propelling the procurement of new aircraft.

Similarly, as the supply chain issues subsided, the fixed-wing aircraft deliveries in the military sector have witnessed growth. For instance, Lockheed Martin delivered 142 F-35 fighter aircraft (compared to 123 deliveries in 2020), and Dassault Aviation exported 25 Rafale fighter jets (compared to 13 deliveries in 2020). The growth in aircraft deliveries is anticipated to propel the market's growth during the forecast period. Also, in collaboration with aircraft operators, the aircraft seat manufacturers are working on enhancing their designs to attract new customers. Such innovation in cabin interiors and seating modules is expected to propel the segment's growth in the coming years.

The Middle-East and Africa Region Expected to Witness Highest Growth During the Forecast Period

The demand for the aircraft seat actuation systems market is anticipated to be highest in the Middle-East and African region due to demand for wide-body aircraft from major airlines and large-size aircraft demand from private and charter companies. For instance, Etihad and Emirates had an order book of more than 270 aircraft (as of January 2022), including Boeing 777X, Airbus A350 family, A380, and Boeing 787 family of aircraft. Similarly, with the growing demand for air travel in the Middle-East region, the airlines and aircraft operators in the region are investing in expanding their aircraft fleet to introduce new aircraft routes in the region.

Similarly, the growth in terrorism in this region has resulted in these countries spending a significant amount on military aircraft procurement. The Qatar Emiri Air Force (QEAF) received its first batch of the new generation F-15 combat aircraft in August 2021, produced by the United States and Boeing, in partnership with the Gulf state. The aircraft was delivered under an order signed by the country in 2017 to procure 36 F-15QA fighter aircraft with an option for an additional 36 aircraft. Similar aircraft orders from Air Forces of Egypt, Jordan, Morocco, Algeria, and Israel are anticipated to accelerate the growth of the seat actuation systems market during the forecast period.

Aircraft Seat Actuation Systems Industry Overview

The market of aircraft seat actuation systems is a highly consolidated market with very few players accounting for the majority share in the market despite the presence of the many component providers in the market. Some prominent players in the aircraft seat actuation systems market are Safran SA, Meggit PLC, Crane Co., AMETEK Inc., and ITT Inc. The demand is expected to remain robust and free from market fluctuations due to the economic downturn and COVID-19 pandemic from the military applications side. Thus manufacturers should focus on this segment to stabilize and secure their revenue sources. The Asia-Pacific and the Middle-East and Africa regions, which are currently experiencing demand in the aviation industry, presently lack adequate infrastructure and inventory of products to supply quickly. Therefore, the companies are expanding their presence in underdeveloped regions locally, as it would provide them the first-mover advantage and will also benefit from offset clauses that are being set forth by many governments globally as part of contract obligations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of Study

- 1.3 Currency Conversion Rates for USD

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Size and Forecast, Global, 2018 - 2027

- 3.2 Market Share by Mechanism, 2021

- 3.3 Market Share by Aircraft Type, 2021

- 3.4 Market Share by Geography, 2021

- 3.5 Structure of the Market and Key Participants

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size and Forecast by Value - USD million, 2018 - 2027)

- 5.1 Mechanism

- 5.1.1 Linear

- 5.1.2 Rotary

- 5.2 Aircraft Type

- 5.2.1 Fixed-wing Aircraft

- 5.2.2 Helicopters

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Egypt

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Lee Air Inc.

- 6.2.2 Safran SA

- 6.2.3 Astronics Corporation

- 6.2.4 Crane Co.

- 6.2.5 ITT Inc.

- 6.2.6 CEF Industries LLC

- 6.2.7 ElectroCraft Inc.

- 6.2.8 NOOK Industries Inc.

- 6.2.9 Rollon SpA

- 6.2.10 Buhler Motor GmbH

- 6.2.11 AMETEK Inc.

- 6.2.12 Kyntronics

- 6.2.13 Meggitt PLC

- 6.2.14 OTM Servo Mechanisms Limited