|

市场调查报告书

商品编码

1687824

气体感测器、检测器和分析仪器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Gas Sensor, Detector And Analyzer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

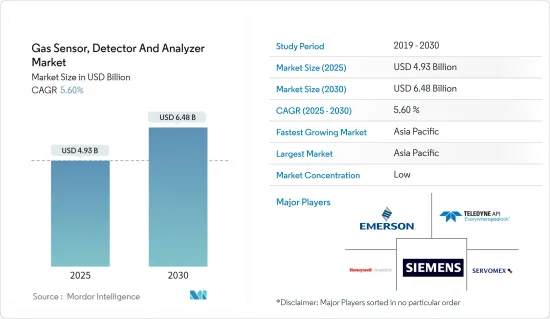

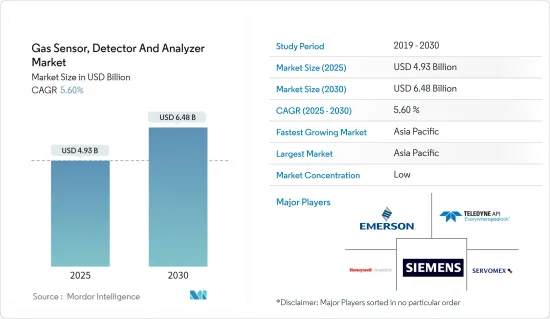

气体感测器、检测器和分析仪的市场规模预计在 2025 年为 49.3 亿美元,预计到 2030 年将达到 64.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.6%。

气体感测器是一种化学感测器,可以测量附近成分气体的浓度。这些感测器采用多种技术来量化介质中的气体的精确量。气体检测仪利用其他技术来测量并显示空气中特定气体的浓度。气体探测器的特点在于它们可以在环境中探测到的气体类型。气体分析仪应用于多个终端用户产业所使用的安全设备中,以确保足够的职场安全。

主要亮点

- 页岩气和緻密油的发现不断增加,推动了全球对气体分析仪的需求。政府立法和职业安全与健康法规的执行也要求在某些工业环境中使用气体分析仪。社会对气体洩漏和废气危害的认识不断提高,也促进了气体分析仪的普及。製造商正在将气体分析仪与行动电话和其他无线设备集成,以提供即时监控、远端控制和资料备份。

- 气体洩漏和其他意外污染可能造成爆炸后果、人身伤害和火灾危险。在密闭空间内,多种危险气体会取代氧气,甚至使附近的工人窒息。这些后果危害员工、设备和财产的安全。

- 手持式气体侦测工具透过监测固定和移动使用者的呼吸区域来确保工人的安全。在许多可能存在气体危险的情况下,这些设备极为重要。空气中氧气、可燃物和有毒气体的监测对于确保每个人的安全至关重要。手持式气体侦测仪内建警报器,可提醒人员密闭空间和其他应用的潜在危险情况。当警报响起时,大型易读的 LCD 显示器会辨识危险气体或气体浓度。

- 近年来,由于技术进步,气体感测器和探测器的製造成本一直在稳步上升。虽然市场现有企业能够适应这些变化,但新参与企业和中阶製造商面临相当大的挑战。

- 由于COVID-19疫情爆发,受访市场中的多个终端用户产业受到了营运减少、工厂暂时关闭等影响。例如,在可再生能源产业,全球供应链是一个主要问题,生产大幅放缓,导致对新测量系统和感测器的支出减少。在天然气加工中,硫化氢 (H2S) 和二氧化碳 (CO2) 的检测和监测至关重要,因此对气体分析仪的需求很大。

气体感测器、检测器和分析仪的市场趋势

石油和天然气产业预计将占据主要市场占有率

- 在石油和天然气工业中,保护压力管道免受腐蚀和洩漏以最大限度地减少停机时间是一项关键责任。根据NACE(美国腐蚀工程师协会)的研究,石油和天然气生产行业每年的腐蚀总成本约为13.72亿美元。

- 气体样本中是否存在氧气决定了加压管道系统中是否有洩漏。持续的、未被发现的洩漏会使情况变得更糟,影响管道的运作流动效率。此外,当管道系统内存在硫化氢 (H2S) 和二氧化碳 (CO2) 等气体时,它们会与氧气反应并结合,形成腐蚀性、破坏性混合物,从内到外劣化管道壁。

- 降低这些高成本是工业界采用气体分析仪作为预防措施的驱动力之一。气体分析仪透过有效检测此类气体的存在,有助于监测洩漏,从而延长管道系统的使用寿命。石油和天然气产业正在朝向可调谐二极体雷射 (TDL) 技术发展,因为 TDL 技术的高解析度可以实现可靠、准确的检测,同时避免传统分析仪的常见干扰。

- 根据国际能源总署 (IEA) 2022 年 6 月发布的公告,预计 2022 年全球净精製能力将增加 100 万桶/日,2023 年将再增加 160 万桶/日。这一趋势预计将进一步增加市场需求,因为炼油厂气分析仪通常用于表征原油精製过程中产生的气体。

- 国际能源总署表示,预计 2021 年全球天然气供应量将成长 4.1%,部分原因是新冠疫情后的市场復苏。在天然气加工中,硫化氢 (H2S) 和二氧化碳 (CO2) 的检测和监测至关重要,因此对气体分析仪的需求很大。

- 该行业有许多正在进行和即将进行的计划,涉及巨额投资以扩大生产。例如,西通道输送2023计划将在现有的25,000公里NGTL系统中增加约40公里的新天然气管道,并将天然气运往加拿大各地和美国市场。预计此类计划将在预测期内继续进行,从而推动对气体分析仪的需求。

亚太地区预计将占据主要市场占有率

- 预计石油和天然气、钢铁、电力、化学和石化行业新工厂的投资增加以及国际安全标准和实践的采用将影响市场的成长。亚太地区是近年来唯一一个石油和天然气产能成长的地区。该地区已开设约四家新炼油厂,为全球原油产量增加近 75 万桶/日。

- 该地区的工业发展正在推动气体分析仪的成长,因为它可用于製程监控、提高石油和天然气工业的安全性、效率和品质等应用。因此,该地区的炼油厂正在其工厂安装气体分析仪。

- 预计预测期内亚太地区将成为全球气体感测器市场成长最快的地区之一。这是由于政府法规越来越严格以及环保意识提升宣传活动持续进行。此外,根据印度基础设施基金会 (IBEF) 的数据,根据 2019-25 年国家基础设施规划,在预计总资本支出 111 亿印度卢比(1.4 兆美元)中,能源产业计划占最高(24%)。

- 由于政府的严格监管,该地区近年来也出现了强劲成长。此外,政府对智慧城市计划的投资激增可能为智慧感测器设备创造巨大的潜力,并推动该地区气体感测器市场的成长。

- 亚太地区各国快速工业化是推动气体检测市场成长的主要因素之一。火力发电厂、煤矿、海绵铁、钢铁、铁合金、石油和化学品等高污染产业会产生烟雾、烟气和有毒气体排放。气体检测仪通常用于检测可燃性气体、易燃和有毒气体,以确保工业操作安全。

气体感测器、检测器和分析仪器产业概况

气体感测器、检测器和分析仪市场分散,全球有许多参与者。目前,一些知名公司正在开发以检测器为中心的应用产品。分析仪部门有广泛的应用,包括临床测试、环境排放控制、爆炸物检测、农产品储存和运输以及职场危害监测。市场参与者正在采用伙伴关係、合併、扩张、创新、投资和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2022 年 12 月 - 仕富梅集团有限公司 (Spectris PLC) 在韩国开设新的服务中心,将服务扩展到亚洲市场。该服务中心在龙仁正式揭牌,为半导体、石油和天然气、发电和钢铁行业的工业过程和排放客户提供宝贵的建议和帮助。

- 2022 年 8 月 - 艾默生宣布将在苏格兰开设一个气体分析解决方案中心,以帮助工厂实现永续性目标。该中心拥有10多种不同的感测技术,能够测量60多种不同的气体成分。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 评估新冠肺炎对产业的影响

第五章 市场动态

- 市场驱动因素

- 提高对工作场所事故的安全意识

- 手持设备的兴起

- 市场限制

- 高成本,产品缺乏差异化

第六章 市场细分

- 气体分析仪

- 科技

- 电化学公式

- 顺磁性

- 锆石

- 无损红外线

- 最终用户产业

- 石油和天然气

- 化工和石化

- 用水和污水

- 药品

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 科技

- 气体感测器

- 类型

- 毒性

- 电化学

- 半导体

- 光电离

- 易燃

- 催化剂

- 红外线的

- 最终用户产业

- 石油和天然气

- 化工和石化

- 用水和污水

- 金属与矿业

- 公共产业

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 类型

- 气体探测器

- 通讯类型

- 有线

- 无线的

- 探测器类型

- 固定的

- 可携式的

- 最终用户产业

- 石油和天然气

- 化工和石化

- 用水和污水

- 金属与矿业

- 公共产业

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 通讯类型

第七章 竞争格局

- 公司简介

- Emerson Electric Company

- Teledyne API

- Siemens AG

- Servomex Group Limited(Spectris PLC)

- Honeywell Analytics Inc.

- Draegerwerk AG & Co KGaA

- Industrial Scientific Corporation

- MSA Safety Incorporated

- Crowncon Detection Instruments Limited

- Yokogawa Electric Corporation

- Control Instruments Corporation

- Membrapor AG

- Senseir AB

- Eaton Corporation PLC

- GfG Gas Detection UK Ltd

- Figaro Engineering Inc.

- Robert Bosch GmbH

- Thermofisher Scientific Inc.

- Detector Electronics Corporation

- Alphasense Limited

- California Analytical Instruments

- Testo SE & Co. KGaA

- Trolex Ltd

- Bacharach Inc.

- MKS Instruments Inc.

- RKI Instruments Inc.

- Horiba Ltd

- SGX Sensortech Limited(Amphenol Limited)

- Afriso-Euro-Index GmbH

- General Electric Company

- NGK Spark Plugs USA Inc.

- Delphi Technologies(BorgWarner Inc.)

- Denso Corporation

- 供应商市场占有率分析

第八章投资分析

第九章市场机会与未来成长

The Gas Sensor, Detector And Analyzer Market size is estimated at USD 4.93 billion in 2025, and is expected to reach USD 6.48 billion by 2030, at a CAGR of 5.6% during the forecast period (2025-2030).

Gas sensors are chemical sensors that can measure the concentration of a constituent gas in its vicinity. These sensors embrace different techniques for quantifying a medium's exact amount of gas. A gas detector measures and indicates the concentration of certain gases in the air via other technologies. These are characterized by the type of gases they can detect in the environment. Gas analyzers find applications across safety instruments used in multiple end-user industries to maintain adequate safety in the workplace.

Key Highlights

- The global demand for gas analyzers has been boosted by an increase in shale gas and tight oil discoveries since these resources are utilized to stop corrosion in the infrastructure of natural gas pipelines. The use of gas analyzers has also been enforced in several industrial settings by government law and the enforcement of occupational health and safety rules. The growing public consciousness of the dangers of gas leaks and emissions contributed to the increased adoption of gas analyzers. Manufacturers are integrating gas analyzers with mobile phones and other wireless devices to offer real-time monitoring, remote control, and data backup.

- Gas leaks and other unintentional contamination can result in explosive consequences, physical harm, and fire risk. In confined spaces, numerous hazardous gases can even asphyxiate workers in the vicinity by displacing oxygen, which results in death. These outcomes jeopardize employee safety and the safety of equipment and property.

- Handheld gas detection tools keep personnel safe by monitoring a user's breathing zone while stationary and moving. These devices are critical in many situations where gas risks may exist. It is essential to monitor the air for oxygen, combustibles, and poisonous gases to ensure the safety of all people. Handheld gas detectors include built-in sirens that alert workers to potentially hazardous situations within an application, such as a confined space. When an alert is triggered, a large, easy-to-read LCD verifies the concentration of dangerous gas or gases.

- The production costs for gas sensors and detectors have steadily risen due to recent technological changes. While the market incumbents have been able to adapt to these changes, new entrants and mid-range manufacturers face considerable challenges.

- With the onset of COVID-19, multiple end-user industries in the market studied have been affected by reduced operations, temporary factory closures, etc. For instance, in the renewable energy industry, significant concerns revolve around global supply chains, which are considerably slowing down production, thus, aiming at reduced spending for new measurement systems and sensors. The detection and monitoring of hydrogen sulfide (H2S) and carbon dioxide (CO2) is pertinent in natural gas processing, creating significant demand for gas analyzers.

Gas Sensor, Detector, and Analyzer Market Trends

Oil and Gas Industry Segment is Expected to Hold Significant Market Share

- In the oil and gas industry, protecting a pressurized pipeline from corrosion and leaks and minimizing downtime are a few of the crucial responsibilities of the industry. As per a NACE (National Association of Corrosion Engineers) study, the total annual cost of corrosion in the oil and gas production industry is around USD 1.372 billion.

- The presence of oxygen in the gas sample determines a leak in the pressurized pipeline system. The continuous and undetected leak may worsen the situation while impacting on operational flow efficiency of the pipeline. Moreover, the presence of gases, such as hydrogen sulfide (H2S) and carbon dioxide (CO2), in the pipeline system reacting with oxygen can combine and form a corrosive and destructive mixture that can deteriorate the pipeline wall inside out.

- Mitigating such expensive costs is one of the drivers for adopting gas analyzers for preventive actions in the industry. Gas analyzer helps monitor leaks to extend the life of pipeline systems by effectively detecting the presence of such gases. The oil and gas industry is moving toward the TDL technique (tunable diode laser), which enables the reliability of detecting with precision because of its high-resolution TDL technique and avoids common interferences with traditional analyzers.

- As per the International Energy Agency's (IEA) June 2022, net global refining capacity is expected to expand by 1.0 million b/d in 2022 and by an additional 1.6 million b/d in 2023. With refinery gas analyzers commonly used to characterize gases produced during crude oil refining, such trends are expected to increase the market demand further.

- According to IEA, global natural gas supply increased by an estimated 4.1% globally in 2021, partly supported by the market recovery post the COVID-19 pandemic. The detection and monitoring of hydrogen sulfide (H2S) and carbon dioxide (CO2) is pertinent in natural gas processing, creating significant demand for gas analyzers.

- There are many ongoing and upcoming projects in the industry, with massive investments toward expanding production. For instance, the West Path Delivery 2023 project is expected to add about 40 km of new natural gas pipeline to the existing 25,000-km NGTL system, which ships gas across Canada and to the U.S. markets. Such projects are expected to continue during the forecast period, which will fuel the demand for gas analyzers.

Asia Pacific is Expected to Hold Significant Market Share

- Increased investments in new plants in oil and gas, steel, power, chemical, and petrochemicals and the rising adoption of international safety standards and practices are expected to influence market growth. Asia Pacific is the only region to register an oil and gas capacity growth in recent years. About four new refineries were added in the area, which has added nearly 750,000 barrels per day to global crude oil production.

- The development of industries in the region is driving the growth of gas analyzers, owing to their use in the oil and gas industry, such as monitoring processes, increased safety, enhanced efficiency, and quality. Hence, the refineries in the region are deploying gas analyzers in the plants.

- During the forecast period, Asia Pacific is anticipated to be one of the fastest-growing global gas sensors market regions. This is due to a rise in strict governmental regulations and ongoing environmental awareness campaigns. Further, according to IBEF, as per the National Infrastructure Pipeline 2019-25, energy sector projects accounted for the highest share (24%) out of the total expected capital expenditure of INR 111 lakh crore (USD 1.4 trillion).

- Also, the strict government regulations have recently shown significant growth in this region. Moreover, the surge in the government's investments in smart city projects creates a significant potential for smart sensor devices, likely to impel regional Gas Sensors Market growth.

- Rapid industrialization across the different countries in the Asia Pacific region is one of the primary factors driving the growth of the gas detectors market. Smoke, fumes, and toxic gas emissions occur due to highly polluting industries such as thermal power plants, coal mines, sponge iron, steel and ferroalloys, petroleum, and chemicals. Gas detectors are commonly used to detect combustible, flammable, and toxic gases and ensure safe industrial operations.

Gas Sensor, Detector, and Analyzer Industry Overview

The gas analyzer, sensor, and detector market is fragmented due to the presence of many players worldwide. Currently, some prominent companies are developing products with applications centering on the detector. The analyzer segment has applications across clinical assaying, environmental emission control, explosive detection, agricultural storage, shipping, and workplace hazard monitoring. Players in the market are adopting strategies such as partnerships, mergers, expansion, innovation, investment, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2022 - Servomex Group Limited (Spectris PLC) extended its offerings to the Asian market by opening a new service center in Korea. As the service center is officially unveiled at Yongin, customers from the semiconductor industry, as well as the industrial process and emissions for oil and gas, power generation, and steel industry, can access invaluable advice and assistance.

- August 2022 - Emerson has announced opening a gas analysis solutions center in Scotland to help plants meet sustainability goals. The center has access to more than ten different sensing technologies that can measure more than 60 other gas components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 An Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Safety Awareness Regarding Occupational Hazards

- 5.1.2 Proliferation of Handheld Devices

- 5.2 Market Restraints

- 5.2.1 High Costs and Lack of Product Differentiation

6 MARKET SEGMENTATION

- 6.1 Gas Analyzers

- 6.1.1 Technology

- 6.1.1.1 Electrochemical

- 6.1.1.2 Paramagnetic

- 6.1.1.3 Zirconia

- 6.1.1.4 Non-disruptive IR

- 6.1.2 End-user Industry

- 6.1.2.1 Oil and Gas

- 6.1.2.2 Chemicals and Petrochemicals

- 6.1.2.3 Water and Wastewater

- 6.1.2.4 Pharmaceuticals

- 6.1.2.5 Other End-user Industries

- 6.1.3 Geography

- 6.1.3.1 North America

- 6.1.3.2 Europe

- 6.1.3.3 Asia-Pacific

- 6.1.3.4 Latin America

- 6.1.3.5 Middle-East and Africa

- 6.1.1 Technology

- 6.2 Gas Sensor

- 6.2.1 Type

- 6.2.1.1 Toxic

- 6.2.1.1.1 Electrochemical

- 6.2.1.1.2 Semiconductor

- 6.2.1.1.3 Photoionization

- 6.2.1.2 Combustible

- 6.2.1.2.1 Catalytic

- 6.2.1.2.2 Infrared

- 6.2.2 End-user Industry

- 6.2.2.1 Oil and Gas

- 6.2.2.2 Chemicals and Petrochemicals

- 6.2.2.3 Water and Wastewater

- 6.2.2.4 Metal and Mining

- 6.2.2.5 Utilities

- 6.2.2.6 Other End-user Industries

- 6.2.3 Geography

- 6.2.3.1 North America

- 6.2.3.2 Europe

- 6.2.3.3 Asia-Pacific

- 6.2.3.4 Latin America

- 6.2.3.5 Middle-East and Africa

- 6.2.1 Type

- 6.3 Gas Detectors

- 6.3.1 Communication Type

- 6.3.1.1 Wired

- 6.3.1.2 Wireless

- 6.3.2 Type of Detector

- 6.3.2.1 Fixed

- 6.3.2.2 Portable

- 6.3.3 End-user Industry

- 6.3.3.1 Oil and Gas

- 6.3.3.2 Chemicals and Petrochemicals

- 6.3.3.3 Water and Wastewater

- 6.3.3.4 Metal and Mining

- 6.3.3.5 Utilities

- 6.3.3.6 Other End-user Industries

- 6.3.4 Geography

- 6.3.4.1 North America

- 6.3.4.2 Europe

- 6.3.4.3 Asia-Pacific

- 6.3.4.4 Latin America

- 6.3.4.5 Middle-East and Africa

- 6.3.1 Communication Type

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Company

- 7.1.2 Teledyne API

- 7.1.3 Siemens AG

- 7.1.4 Servomex Group Limited (Spectris PLC)

- 7.1.5 Honeywell Analytics Inc.

- 7.1.6 Draegerwerk AG & Co KGaA

- 7.1.7 Industrial Scientific Corporation

- 7.1.8 MSA Safety Incorporated

- 7.1.9 Crowncon Detection Instruments Limited

- 7.1.10 Yokogawa Electric Corporation

- 7.1.11 Control Instruments Corporation

- 7.1.12 Membrapor AG

- 7.1.13 Senseir AB

- 7.1.14 Eaton Corporation PLC

- 7.1.15 GfG Gas Detection UK Ltd

- 7.1.16 Figaro Engineering Inc.

- 7.1.17 Robert Bosch GmbH

- 7.1.18 Thermofisher Scientific Inc.

- 7.1.19 Detector Electronics Corporation

- 7.1.20 Alphasense Limited

- 7.1.21 California Analytical Instruments

- 7.1.22 Testo SE & Co. KGaA

- 7.1.23 Trolex Ltd

- 7.1.24 Bacharach Inc.

- 7.1.25 MKS Instruments Inc.

- 7.1.26 RKI Instruments Inc.

- 7.1.27 Horiba Ltd

- 7.1.28 SGX Sensortech Limited (Amphenol Limited)

- 7.1.29 Afriso-Euro-Index GmbH

- 7.1.30 General Electric Company

- 7.1.31 NGK Spark Plugs USA Inc.

- 7.1.32 Delphi Technologies (BorgWarner Inc.)

- 7.1.33 Denso Corporation

- 7.2 Vendor Market Share Analysis