|

市场调查报告书

商品编码

1687827

选择性雷射烧结:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Selective Laser Sintering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

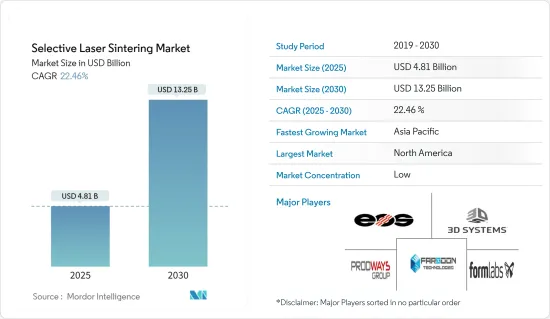

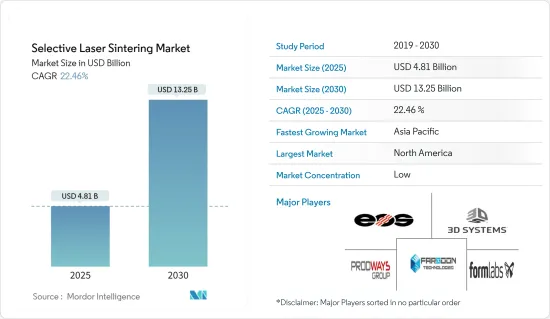

选择性雷射烧结市场规模预计在 2025 年为 48.1 亿美元,预计到 2030 年将达到 132.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 22.46%。

选择性雷射烧结 (SLS) 是一种积层製造(AM) 技术,其是将高功率雷射光束照射到粉末材料床(通常是尼龙或聚酰胺)上以烧结所需物体层的过程。一旦该层完成,物体就会被一层新的粉末覆盖,然后再烧结另一层。

主要亮点

- 由于已开发国家拥有研发设施,预计 SLS 设备市场的需求将持续成长。用于製造原型模型和零件的非金属粉末的随时可用推动了雷射烧结印表机的采用。雷射烧结印表机在列印金属零件时也是最精确的。

- 选择性雷射烧结 (SLS) 被认为是最受欢迎的技术之一,因为它比印刷应用中使用的其他技术具有多种优势,预计在预测期内将出现强劲增长。

- SLS利用尼龙粉末作为原料来替代光固化成形法中使用的感光树脂。世界各地的公司和研究机构都在使用这种材料和技术来解决树脂在阳光下变脆等问题。此外,SLS 已被证明是成本和材料友好的,因为它在列印后不需要专门的支撑结构。此外,SLS 生产的零件耐用且性能与功能性零件和原型一样好。

- SLS 也可广泛应用于航太、国防和汽车等各个垂直领域。随着航太发展模式转移,越来越多的国家准备发射人造卫星,对 SLS 列印的需求预计会成长。

- 各航太公司正在采用这项技术来促进高效生产。例如,在航太航太领域,美国国家航空暨太空总署和私人公司正在努力製造零件更少的火箭引擎(或者,在 Relativity Space 的案例中,是整个火箭)。这是 3D 列印的关键功能,也是减少製造时间和成本的一种方法。该部件是使用选择性雷射烧结以及金属粉末(例如,可承受高温的 Inconel 铜高温合金粉末)的铺设和熔化逐层构建的。 SLS 技术具有多种优势:例如,只需几天时间就可以将多个部件列印成一个统一的部件。如果火箭在测试期间发生故障,可以对 3D 建模软体进行更改以建立新火箭并快速设定另一次测试。

- 此外,2021 年 12 月,积层製造零件製造商 Primaeaam Solutions Pvt Ltd 在印度清奈开设了新的积层製造客户体验中心和医疗保健创新孵化中心。该中心占地 10,000 平方英尺,将使该公司成为领先的增材製造服务机构,拥有电子束熔化 (EBM)、选择性雷射光固化成形法(SLM)、熔融熔融沉积建模(FDM)、立体光刻 (SLA)、多喷射熔合 (MJF) 和主要企业纤维长丝製造 (CFF) 等技术。

- COVID-19 疫情为世界各地的大、中、小型企业带来了经济混乱。这是因为製造业很大一部分涉及工厂车间工作,人们在车间密切接触以提高生产力。

选择性雷射烧结 (SLS) 市场趋势

航太和国防工业预计将占据主要市场占有率

- 航太业是大多数当代科技的早期采用者。飞机和引擎製造商都依赖 3D 列印技术来开发轻量化零件以提高效率。

- 几十年来,美国国家航空暨太空总署(NASA) 一直使用 3D 列印技术进行原型製作、製造功能零件,最近还用于为月球和火星建造施工系统。

- 贝尔德事隆公司是首批尝试积层製造的航太公司之一。 SLS 的最初用途是快速製作模具和实验部件的原型。然而,随着积层製造业的发展,该公司意识到自己需要成熟。自公司开始积层製造之旅以来,贝尔德事隆仅使用 SLS 技术就已经生产了遍布其产品的 550 多个零件。虽然生产的零件大部分都是实验性的,但值得注意的是,在 550 个零件中,有超过 200 个是用于生产用途的。

- 此外,GKN Aerospace 于 2022 年 7 月在其位于英国的全球技术中心安装了 RenAM 500 Flex,扩大了其金属积层製造机器的范围。 RenAM 500Q Flex 是一款四雷射增材製造机,预计将优化航太应用的积层製造。

- 此外,根据美国人口普查局的数据,到 2024 年,美国航太产品和零件製造收益预计将达到约 2,644 亿美元。此外,到 2024 年,加拿大航太产品和零件製造销售额预计将达到约 193 亿美元。这些发展预计将积极推动市场成长。

- 根据斯德哥尔摩国际和平研究所(SIPRI)统计,2021年美国位居世界军费最高国家榜首,军费开支达8,010亿美元,占全球军事支出2.1兆美元的38%。

预计北美将占据主要市场占有率

- 北美是许多开发、采用和投资增材製造的公司的所在地。该地区对原型製作的需求正在增长,这极大地推动了该地区市场的发展。此外,北美对 SLS 的需求受到各行业对研发和测试日益重视的推动。

- 根据加拿大统计局的数据,加拿大企业计划在 2021 年投入 219 亿美元用于内部工业研发,并预计在 2022 年投入 224 亿美元。预计研发支出的成长将推动北美选择性雷射烧结市场的发展。

- 该地区的公司正在建立策略联盟,为更广泛的客户提供解决方案。例如,2022年5月,美国Essentium Inc.与蓝色雷射解决方案供应商Nuburu合作开发基于蓝色雷射的金属增材製造平台。

- 预计该成果将使製造商能够製造出具有高解析度和快速吞吐量的生产级金属零件。此外,作为协议的一部分,Nuburu 将授权其积层製造应用专利。

- 3D 列印等新技术的日益普及也有望推动该地区 SLS 市场的发展。例如,根据世界经济论坛预测,到2022年,47%接受调查的美国公司预计将使用3D列印技术。

选择性雷射烧结 (SLS) 产业概览

选择性雷射烧结市场主要由全球营运的现有企业和少数在整合的市场空间中争夺关注的区域性企业组成。 3D Systems Inc.、EOS GmbH Electro Optical Systems、Ricoh Company Ltd. 和 Fathom Manufacturing 等多家在该领域拥有丰富专业知识的公司的存在预计将进一步加剧竞争对手之间的竞争。

- 2022 年 6 月 - 3D Systems 和 EMS GRILTECH 宣布建立策略合作伙伴关係,以加强积层製造材料的开发。两家公司推出了 Duraform PAx Natural,这是一种新型尼龙共聚物,专为商用选择性雷射烧结 (SLS) 印表机而设计。

- 2021 年 11 月-赢创工业股份公司宣布提供更广泛的 RESOMER PrintPowder 聚合物,以实现个人化植入式医疗设备的 3D 列印。这种新型粉末可在全球范围内用于选择性雷射烧结 (SLS) 3D 列印。新型粉末具有多种可自订的机械性能和劣化速率,使其能够用于更复杂和客製化的医疗设备,包括各种整形外科、牙科和软组织应用。

- 2021 年 2 月 - 3D Systems 宣布其位于南卡罗来纳州罗克希尔的工厂的扩建计划,为其现有的总部园区增加 100,000 平方英尺的面积。透过此次扩张,公司将整合材料製造、品质和物流业务,并建造和扩大材料开发实验室,从而提高业务效率,加快解决方案开发并缩短产品上市时间。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

- 3D列印技术分析(FDM、SLA、SLS;材料与技术的定性分析;桌上型工业SLS与传统工业SLS列印机的比较)

第五章市场动态

- 市场驱动因素

- 缩短最终产品的上市时间

- 加强各地区政府工作

- 市场挑战

- 额外的资本支出和量产限制

第六章市场区隔

- 按材质

- 金属

- 塑胶

- 按零件

- 硬体

- 软体

- 服务

- 按最终用户产业

- 车

- 航太与国防

- 卫生保健

- 电子产品

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章竞争格局

- 公司简介

- 3D Systems Inc.

- EOS GmbH Electro Optical Systems

- Farsoon Technologies

- Prodways Group

- Formlabs Inc.

- Ricoh Company Ltd

- Concept Laser GmbH(General Electric)

- Renishaw PLC

- Sinterit Sp. Zoo

- Sintratec AG

- Sharebot SRL

- Red Rock SLS

第八章投资分析

第九章:市场的未来

The Selective Laser Sintering Market size is estimated at USD 4.81 billion in 2025, and is expected to reach USD 13.25 billion by 2030, at a CAGR of 22.46% during the forecast period (2025-2030).

Selective Laser Sintering (SLS), an additive manufacturing (AM) technique, is a process in which a high-powered laser beam is aimed into powdered material (typically nylon or polyamide) bed to sinter a layer of the desired object. Following the completion of that layer, the object is covered with a new layer of powder, and another layer is sintered.

Key Highlights

- The market for SLS equipment is anticipated to be driven by the rising demand from developed countries, owing to the presence of research and development facilities in the countries. The adoption of laser sintering printers has increased due to the ease of availability of non-metal powders to create prototype models and parts. Also, laser sintering printers are the most precise when printing metal parts.

- Selective Laser Sintering (SLS) has been identified as one of the most-preferred technology and is expected to witness robust growth during the forecast period, owing to its various benefits over other technologies used for printing applications.

- SLS utilizes nylon powder as raw material as a substitute for the photosensitive resin used in Stereolithography. Companies and research organizations across the globe have been identified to take advantage of this material and technology to tackle concerns, such as the brittle nature of the resin when exposed to sunlight. In addition, SLS has also been proven to be cost and material friendly, as it does not require any dedicated support structure post-printing. In addition, SLS provides enhanced durability and can perform as well as either functional parts or prototypes.

- SLS further finds a wide array of applications across various verticals, such as aerospace, defense, and automotive, among others. With space exploration witnessing a paradigm shift, the demand for SLS printing is expected to mount, with an increasing number of countries gearing up to launch satellites.

- Various aerospace companies are adopting the technology to foster efficient production. For instance, in the space flight branch of aerospace, NASA and private companies are working to build rocket engines (and even entire rockets in the case of Relativity Space) with fewer parts, which is a crucial capability of 3D printing and a way to reduce production time and costs. Using selective laser sintering and the laying down and melting of metal powder (for example, Inconel copper super alloy power that can withstand high temperatures), parts are built up layer by layer. The SLS technique offers several benefits, like multiple parts can be printed as one unified part in just days; the rocket's weight can be reduced with fewer nuts, bolts, and welds. If the rocket proves faulty during a test, changes can be made to the 3D modeling software for a new rocket, and another test can be quickly set up.

- Further, in December 2021, Primaeam Solutions Pvt Ltd, an additive parts manufacturing company, inaugurated its new Additive Manufacturing Customer Experience Centre, Innovation & Incubation Centre for Healthcare, in Chennai, India. The 10,000 sq. ft. center would allow the company to develop its position as a prominent player in the additive manufacturing service bureau with technologies such as Electron Beam Melting (EBM), Selective Laser Sintering (SLM), Fused Deposition Modelling (FDM), Stereolithography (SLA), Multi Jet Fusion (MJF), and Continuous Filament Fabrication with Fiber reinforcement (CFF).

- The COVID-19 pandemic outbreak has created economic turmoil for small, medium, and large-scale industries worldwide. Adding to the woes, country-wise lockdown inflicted by the governments across the globe (to minimize the spread of the virus) has further resulted in industries taking a hit and disruption in supply chain and manufacturing operations across the world, as a large part of manufacturing includes work on the factory floor, where people are in close contact as they collaborate to boost the productivity.

Selective Laser Sintering (SLS) Market Trends

Aerospace and Defense Industry is Expected to Hold Significant Market Share

- The aerospace industry has an early rate of adoption of most of the technologies in the current generation. Both aircraft and engine manufacturers have been relying on 3D printing technology in order to develop lightweight parts to gain efficiency.

- 3D printing has been used by the National Aeronautics and Space Administration (NASA) for decades for the purposes of prototyping and creating functional parts and, most recently, for building construction systems for the Moon and Mars.

- Bell Textron Inc. was one of the first aerospace companies to experiment with additive manufacturing. The first use of SLS was for quick prototypes of tooling and experimental parts. However, as the additive manufacturing industry progressed, the company understood the need to allow the additive manufacturing industry to mature. Since the start of additive efforts, Bell Textron has produced over 550 parts widely spread among its products with just SLS. While a majority of parts produced are experimental, it is to be noted that over 200 of those 550 parts are for production purposes.

- Moreover, in July 2022, GKN Aerospace expanded its range of metal additive manufacturing machines at the company's global technology center in the United Kingdom by installing RenAM 500 Flex. The RenAM 500Q Flex is a four-laser Additive Manufacturing machine that is expected to optimize Additive Manufacturing for aerospace applications.

- Furthermore, according to the US Census Bureau, it is expected that the revenue of aerospace products and parts manufacturing in the United States will amount to about USD 264.4 billion by 2024. Moreover, It is likely that the revenue of aerospace products and parts manufacturing in Canada will amount to approximately USD 19.3 billion by 2024. Such developments would drive the market's growth positively.

- According to Stockholm International Peace Research Institute (SIPRI), the United States led the ranking of countries with maximum military spending in 2021, with 801 USD billion dedicated to the military, which was 38 percent of the global military expenditure of USD 2.1 trillion.

North America is Expected to Hold Major Market Share

- North America is home to many companies developing, adopting, or investing in additive manufacturing. There has been a growth in the demand for prototyping in the region which has been majorly driving the market in the region. Further, the demand for SLS in North America is driven by a higher focus on research and development and increased testing in various industries.

- According to Statistics Canada, Canadian businesses intend to spend USD 21.9 billion on in-house industrial research and development in 2021, while USD 22.4 billion is expected to be spent in 2022. Such growth in research and development is expected to push the market for Selective Laser Sintering in North America.

- Companies in the region are doing strategic collaborations to provide their solutions to a broader customer base. For instance, in May 2022, Essentium Inc, a US-based company, partnered with Nuburu, a blue laser solution provider, to develop a blue laser-based metal Additive Manufacturing platform.

- The resulting machine is hoped to enable manufacturers to create production-grade metal parts with high resolution and fast throughput. Further, as a part of the contract, Nuburu will license its additive manufacturing application patents.

- The increase in the usage of new technologies, such as 3D printing, is also expected to drive the market of SLS in the region. For instance, according to World Economic Forum, it is expected that by 2022, 47% of the surveyed companies in the United States will use 3D printing technology.

Selective Laser Sintering (SLS) Industry Overview

The Selective Laser Sintering Market majorly comprises incumbents operating globally, along with a few regional players vying for attention in a consolidated market space. The presence of several players, such as 3D Systems Inc., EOS GmbH Electro Optical Systems, Ricoh Company Ltd., and Fathom Manufacturing, among others with considerable expertise in the field, is expected to intensify the competitive rivalry further.

- June 2022 - 3D Systems and EMS GRILTECH announced the strategic partnership to enhance additive manufacturing materials development. Both companies will introduce a novel nylon copolymer - DuraForm PAx Natural- designed to be used with any commercially-available selective laser sintering (SLS) printer.

- November 2021 - Evonik Industries AG announced that it offers a broader range of RESOMER PrintPowder polymers to enable the 3D printing of personalized implantable medical devices. The new powders are available globally for 3D printing through selective laser sintering (SLS). Due to a broader range of customizable mechanical properties and degradation rates, the new powders could be used for more complex and tailored medical devices, including diverse orthopedic, dental, or soft tissue applications.

- February 2021 - 3D Systems announced the expansion plan of its Rock Hill, South Carolina, location, adding 100,000 square feet to its existing headquarters campus. This expansion will enable the company to consolidate its materials manufacturing, quality, and logistics operations, with new and expanded materials development laboratories to improve operational efficiencies, accelerate solution development, and reduce time to market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

- 4.4 Analysis of 3D Printing Technologies (FDM, SLA, SLS; Qualitative Analysis on Materials and Technologies; Benchtop Industrial SLS Vs Traditional Industrial SLS Printers)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Reduced Time for the End Product to Reach the Market

- 5.1.2 Increased Government Initiatives Across Various Regions

- 5.2 Market Challenges

- 5.2.1 Additional Capital Expenditure and Restrictions in Mass Production

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Metal

- 6.1.2 Plastic

- 6.2 By Component

- 6.2.1 Hardware

- 6.2.2 Software

- 6.2.3 Services

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Aerospace and Defense

- 6.3.3 Healthcare

- 6.3.4 Electronics

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 3D Systems Inc.

- 7.1.2 EOS GmbH Electro Optical Systems

- 7.1.3 Farsoon Technologies

- 7.1.4 Prodways Group

- 7.1.5 Formlabs Inc.

- 7.1.6 Ricoh Company Ltd

- 7.1.7 Concept Laser GmbH (General Electric)

- 7.1.8 Renishaw PLC

- 7.1.9 Sinterit Sp. Zoo

- 7.1.10 Sintratec AG

- 7.1.11 Sharebot SRL

- 7.1.12 Red Rock SLS