|

市场调查报告书

商品编码

1687840

空调市场:全球市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Air Conditioner - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

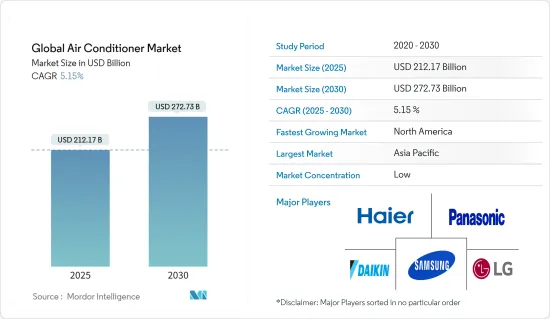

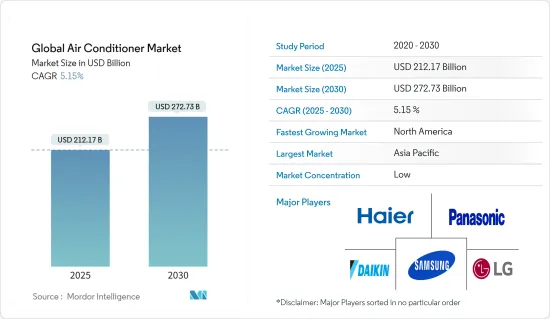

2025 年全球空调市场规模预估为 2,121.7 亿美元,预计到 2030 年将达到 2,727.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.15%。

根据行业分析报告,全球气温和湿度不断上升,以及人们越来越意识到空调是一种实用品而非偏好,预计将推动空调业务的大幅成长。预计在预测期内,由于配备空气净化系统和逆变器的空调等先进空调的采用,空调市场占有率将会成长。

全球供应链和市场需求,包括空调市场占有率,都受到了新冠肺炎疫情的影响。中国在空调市场中扮演关键角色。然而,它却向许多国家出口生产製成品所需的一系列投入品。中国工厂的停产迫使其他美国和欧洲空调製造商暂停最终产品的生产。市场供需失衡状况加剧。

推动智慧空调市场发展的主要的市场成长要素是能够将传统遥控空调转变为智慧型装置的智慧型装置的日益普及。随着商场、办公室和工业项目开发审批率的提高,预计箱型冷气将温和增长,而住宅标准的提高也将推动室内空调的需求。

空调市场趋势

全球空调需求不断成长

市场资料证实,全球空调需求的成长是由多种因素共同推动的。由于气候变迁和城市热岛效应导致的全球气温上升,对空调的需求也随之增加,以维持舒适的室内环境,尤其是在炎热的夏天。快速的都市化,特别是新兴经济体的城市化,导致都市区普遍存在高温现象,进一步增加了住宅、商业和机构建筑对空调的需求。人们对空调的舒适性和健康益处的了解不断增加,包括改善室内空气品质、湿度控制和缓解与热相关的健康状况,这推动了住宅和商业建筑对空调系统的需求。

根据市场分析,由于企业优先考虑员工舒适度、生产力和设备冷却,办公大楼、零售空间、医疗设施、资料中心和製造工厂对空调的需求不断增加,从而推动了市场成长。政府为提高能源效率和减少温室气体排放的倡议,透过法规、奖励和能源效率标准鼓励采用节能空调系统,从而推动全球产业需求。

亚太地区主导空调市场

快速的都市化、气温升高、可支配收入增加以及对舒适解决方案的需求不断增长都是推动亚太地区成为全球领先市场之一的因素。该地区人口稠密的国家包括中国、印度、印尼和日本,使其成为空调系统的主要目标市场。这些国家的人口成长和都市化正在推动住宅、商业和教育领域对空调系统的需求。气候变迁导致气温上升,推动了该地区对空调解决方案的需求。东南亚和南亚国家气候炎热潮湿,对提供舒适冷却的空调系统的需求日益增长。

市场成长得益于空调系统的技术进步,包括变频技术、智慧连接功能和节能设计。这些进步提高了能源效率,降低了营业成本并增强了用户体验,从而提高了采用率。例如,大金、三菱电机和Panasonic等公司提供采用变频技术和智慧功能的先进空调系统,吸引了亚太地区的消费者。为了鼓励采用节能模式,亚太地区许多国家正在推出能源效率标准和空调系统标籤计画。例如,印度政府推出了节能建筑规范(ECBC)和能源效率局(BEE)星级评定计划,以推广节能空调系统。

空调市场概况

根据行业概况,全球空调市场竞争激烈,众多参与者遍布全球。竞争格局的特点是成熟的跨国公司和区域参与者,每家公司都试图透过技术创新、能源效率、产品特性和定价策略来实现产品差异化。主要公司包括海尔集团、DAIKIN INDUSTRIES、LG电子、三星电子、Panasonic。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况

- 市场驱动因素

- 气温升高和气候变迁

- 逆变器技术、智慧功能和互联功能等技术创新

- 市场限制

- 能耗高

- 初始和维护成本高

- 市场机会

- 节能空调系统的需求

- 将空调系统与物联网集成

- 价值链分析

- 产业吸引力波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 洞察产业技术进步

- COVID-19 市场影响

第五章 市场区隔

- 按类型

- 窗型空调

- 分离式/多分离式空调

- 套装空调

- 可变冷媒流量 (VRF)

- 中央空调

- 其他的

- 依技术分类

- 逆变器

- 非逆变器

- 按最终用户

- 住宅

- 商业的

- 按分销管道

- 多品牌专卖店

- 专卖店

- 网路商店

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Haier Group

- Daikin Industries

- LG Electronics

- Samsung Electronics

- Panasonic Corporation

- Mitsubishi Electric Corporation

- Carrier

- Hitachi Ltd.

- Whirlpool Corporation

- Toshiba Corporation*

第七章 市场机会与未来趋势

第八章 免责声明及发布者

The Global Air Conditioner Market size is estimated at USD 212.17 billion in 2025, and is expected to reach USD 272.73 billion by 2030, at a CAGR of 5.15% during the forecast period (2025-2030).

This industry analysis report indicates that the rising global temperatures and humidity levels and the growing recognition of air conditioners as a utility rather than luxury goods are predicted to drive significant growth in the air conditioning (AC) business. Driven by the introduction of sophisticated air conditioners, including models equipped with air purification systems and inverters, the AC market share is anticipating growth in the forecast period.

The worldwide supply chain and market demand including the market share of air conditioners were affected by the COVID-19 outbreak. China plays a significant role in the air conditioner market. Still, it also exports a variety of input supplies, which are needed to make finished items, to a wide range of nations. Due to the closure of their operations in China, other American and European air conditioning manufacturers have been forced to stop producing final goods temporarily. As a result, the market's imbalance between supply and demand widened.

The primary market growth factor driving the smart air conditioner market is the growing adoption of smart devices that can transform traditional remote-controlled air conditioners into smart devices. While packaged air conditioners are expected to expand at a moderate rate due to rising permit rates for the development of malls, offices, and industries, the demand for room air conditioners is being driven by improvements in housing standards.

Air Conditioner Market Trends

Growing Demand for Air Conditioners Globally

Market data confirms that the growing demand for air conditioners worldwide is propelled by a convergence of factors. Increasing global temperatures, attributed to climate change and urban heat island effects, are driving the need for air conditioning to maintain comfortable indoor environments, especially during hot summer months. Rapid urbanization, particularly in emerging economies, is leading to higher population densities in urban areas where heat retention is common, further increasing the demand for air conditioning in residential, commercial, and institutional buildings. The demand for air conditioning systems in both residential and commercial settings is being driven by the increased knowledge of the comfort and health benefits of air conditioning, including enhanced indoor air quality, humidity management, and relief from heat-related health conditions.

The market analysis indicates that the increasing demand for air conditioning in office buildings, retail spaces, healthcare facilities, data centers, and manufacturing plants is driving market growth as businesses prioritize employee comfort, productivity, and equipment cooling. Government initiatives that aim to improve energy efficiency and reduce greenhouse gas emissions are encouraging the adoption of energy-efficient air conditioning systems through regulations, incentives, and energy efficiency standards, thereby driving the global industry demand.

Asia-Pacific Dominating the Air Conditioner Market

Factors such as rapid urbanization, rise in temperatures, increase in disposable income, and increased demand for comfort solutions are driving Asia-Pacific to be one of the major markets worldwide. The region comprises some of the most densely populated countries, including China, India, Indonesia, and Japan, represents a significant target market for air conditioning systems. Increased population growth and urbanization in these countries have led to an increase in demand for air conditioning systems in the residential, business, and educational sectors. Rising temperatures, exacerbated by climate change, are driving the region's need for air conditioning solutions. Southeast and South Asian countries experience scorching and humid climates, leading to higher demand for air conditioning systems to provide comfortable cooling.

The market growth is driven by technological advances in air conditioning systems, such as inverter technology, intelligent and connected features, and energy-efficient designs. These advancements improve energy efficiency, reduce operating costs, and enhance user experience, leading to higher adoption rates. For example, companies like Daikin, Mitsubishi Electric, and Panasonic offer advanced air conditioning systems with inverter technology and smart features that appeal to consumers in Asia-Pacific. In order to encourage the adoption of energy-efficient models, a number of countries in Asia-Pacific have introduced Energy Efficiency Standards and Air Conditioning System Labelling Programmes. For example, the Indian government has introduced the Energy Conservation Building Code (ECBC) and the Bureau of Energy Efficiency (BEE) star rating program to promote energy-efficient air conditioning systems.

Air Conditioner Market Overview

The industry profile shows that the global market for air conditioners is highly competitive with many players competing around the world. The competitive landscape is characterized by both established multinational corporations and regional players, each striving to differentiate their products through innovation, energy efficiency, product features, and pricing strategies. The largest companies include Haier Group, Daikin Industries, LG Electronics, Samsung Electronics, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Temperatures and Climate Change

- 4.2.2 Technological Innovations such as Inverter Technology, Smart and Connected Features

- 4.3 Market Restraints

- 4.3.1 High Energy Consumption

- 4.3.2 High Initial and Maintenance Costs

- 4.4 Market Opportunities

- 4.4.1 Demand for Energy-Efficient Air Conditioning Systems

- 4.4.2 Integration of Air Conditioning Systems with loT

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Window AC

- 5.1.2 Split and Multi-Split AC

- 5.1.3 Packaged AC

- 5.1.4 Variable Refrigerant Flow (VRF)

- 5.1.5 Central AC

- 5.1.6 Others

- 5.2 By Technology

- 5.2.1 Inverter

- 5.2.2 Non-Inverter

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Distribution Channel

- 5.4.1 Multi-Brand stores

- 5.4.2 Exclusive Stores

- 5.4.3 Online Stores

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Italy

- 5.5.2.6 Spain

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Haier Group

- 6.2.2 Daikin Industries

- 6.2.3 LG Electronics

- 6.2.4 Samsung Electronics

- 6.2.5 Panasonic Corporation

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.7 Carrier

- 6.2.8 Hitachi Ltd.

- 6.2.9 Whirlpool Corporation

- 6.2.10 Toshiba Corporation*