|

市场调查报告书

商品编码

1687858

美国物业管理:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)US Property Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

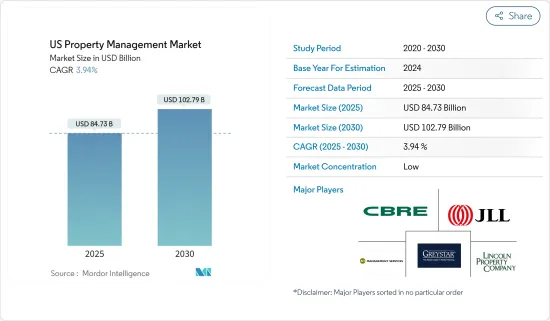

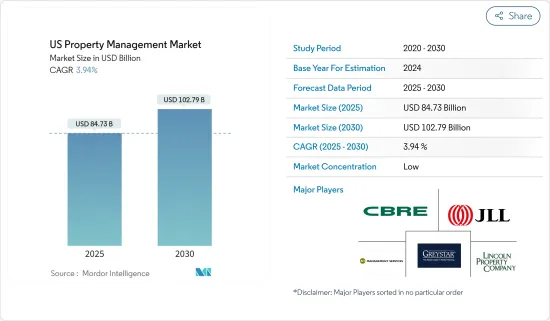

美国物业管理市场规模预计在 2025 年为 847.3 亿美元,预计到 2030 年将达到 1027.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.94%。

美国正经历快速发展,新基础设施和新技术不断涌现,逐渐提升该地区的整体经济统计数据。在一系列令人兴奋的产品发布以及支援管理和统计技术的推动下,该公司正在经历惊人的成长。

物业管理行业是美国发展最快的行业之一。随着美国各大城市新建公寓大楼的数量不断增加,对有效的物业管理解决方案的需求也日益增长。

对于那些希望在不断变化的房地产市场中保持敏捷并保持竞争优势的物业管理公司来说,SaaS 模式正迅速成为策略必需品。此外,职场流动性的变化为美国房地产专业人士带来了巨大的成长机会。 2023年美国将有296,477家物业管理企业,比2022年成长2.1%。美国物业管理业属于劳力密集产业,对劳动力的依赖密集型高于对资本的依赖程度。美国物业管理业最大的业务成本占收入的比例是薪资(42.9%)、物料成本(2.7%)、租金和水电费(2.7%)。

美国物业管理市场的趋势

住宅需求支撑市场

儘管存在经济不确定性、通货膨胀和利率上升,但大多数州的住宅仍在继续上涨。住宅涨幅最大的州是亚利桑那州、缅因州、康乃狄克州和新罕布夏州。 2023年第二季度,加州、华盛顿州和科罗拉多等八个州和哥伦比亚特区的房价出现下跌。

在加州,住宅中位数明显高于新房屋和二手住宅的平均售价。加州是美国最热门的住宅市场之一。

物业管理软体公司 RealPage 预测,2024 年将有 671,953 套公寓竣工,为 1974 年以来最多的一年。

2023年,美国公寓供应量预计将激增,达到1987年以来的最高水平,新建公寓数量将超过439,000套。供应量的增加为租屋者提供了更多选择,并显着减缓了租金成长,导致许多市场的公寓租金全面下降。

随着住宅领域需求的增加,物业管理的需求也随之增加。管理所有这些业务涉及大量的行政工作。这就是为什么物业经理使用软体来管理所有这些任务。

智慧家庭需求推动市场

物联网技术和智慧型设备的应用预计将在房地产业务的各个方面变得更加广泛。在房地产行业,对物联网的需求不断增加,以改善客户服务。

软体供应商开始整合软体和技术,以改善物业与其管理者、业主、投资者和其他人之间的沟通。例如,总部位于德克萨斯州的开发商 Capstone Partners 与物联网解决方案供应商 IOTAS 合作,为其租户创建互联的智慧家庭环境。因此,智慧家庭的日益普及可能会推动物业管理软体解决方案的发展。

所有连接设备、平台和家用电子电器产品产生的大量资料可用于提高软体功能。此外,透过资料分析,物联网的采用有望帮助业主了解连接设备的效能,并采取适当的措施为租户提供更好的服务。根据江森自控建筑效率小组调查,70% 的受访者认为物联网的采用将增加对预测和诊断趋势的软体的需求。

美国物业管理产业概况

美国物业管理市场的领导者正致力于透过获取收益管理、付款服务、通讯解决方案、设施管理、租赁管理等方面的知识来提高其软体能力和产品适用性。这种方法帮助该公司扩大了在美国的业务范围。

此次收购将重点关注伙伴关係和协作,以帮助主要相关人员提供新产品和新体验。此外,现有产品系列的开发和成长正在帮助供应商提高其市场地位。市场的主要企业包括 Greystar Real Estate Partners、JLL、林肯房地产公司和 CBRE。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 商业领域需求的不断增长正在推动市场

- 消费者可支配收入的增加推动了市场

- 市场限制

- 经济不确定性阻碍市场

- 市场机会

- 快速的公寓开发推动市场

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- PESTLE分析

- COVID-19 疫情对市场的影响

第五章市场区隔

- 最终用户

- 商业的

- 住宅

- 服务

- 行销

- 财产评估

- 租户服务

- 维护

- 其他的

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Greystar Real Estate Partners

- Lincoln Property Company

- CBRE Group

- Jones Lang LaSalle Incorporated

- CoStar Group Inc.

- Pinnacle Property Management

- Equity Residential

- FPI Management

- AvalonBay Communities

- WinnCompanies*

- 其他公司

第七章:市场的未来

第 8 章 附录

The US Property Management Market size is estimated at USD 84.73 billion in 2025, and is expected to reach USD 102.79 billion by 2030, at a CAGR of 3.94% during the forecast period (2025-2030).

The United States is rapidly progressing with newer infrastructures and technologies frequently developed, which also gradually boosts the overall economic statistics in this part of the world. Businesses are overwhelmingly growing with many stimulating product launches and supportive management and statistical techniques.

The property management industry is one of the fastest-growing industries in the United States. With the increasing number of new apartments being built in major cities across the United States, there is an increasing need for effective real estate management solutions.

SaaS models are becoming a strategic necessity for property management companies that want to stay ahead of the competition and stay agile in the ever-changing real estate environment. In addition, the changing landscape of workplace mobility presents a huge growth opportunity for real estate professionals in the United States. There were 296,477 property management businesses in the United States as of 2023, an increase of 2.1% from 2022. The US property management industry is labor intensive, which means businesses are more reliant on labor than capital. The highest costs for business in the US property management industry as a percentage of revenue are wages (42.9%), purchases (2.7%), and rent and utilities (2.7%).

US Property Management Market Trends

Demand from the Residential Sector is Supporting the Market

House prices continued to increase in most states despite economic uncertainty, inflation, and rising interest rates. The strongest home appreciation was in the state of Arizona, as well as in Maine, Connecticut, and New Hampshire. In Q2 of 2023, prices decreased in eight states and in the District of Columbia, including California, Washington, and Colorado.

In California, the median home value was significantly above the average sales price for both new and existing homes. California is one of the most sought-after housing markets in the United States.

Property management software company RealPage predicts that the number of apartment units completed in 2024 will be 671,953, which is the highest number since 1974.

The apartment supply in the United States exploded in 2023, reaching its highest level since 1987, with over 439,000 new units being built. This increase in supply has provided renters with more options and significantly slowed rent growth, resulting in outright apartment rent decreases in many markets.

As the demand in the residential segment increased, there was also a simultaneous demand for property management. Managing all these tasks comes with a lot of paperwork. That's the reason property managers are using software to manage all these tasks.

Demand for Smart Homes is Driving the Market

Implementing IoT technology and smart devices is expected to witness an increase in penetration in various aspects of the real estate business. The need for IoT is continuously increasing in the real estate business in order to improve customer serviceability.

Software providers have begun to integrate technology with software to improve communication between the property and its administrators, owners, investors, and others. For example, Capstone Partners, a Texas-based developer, teamed with IOTAS, an IoT solution provider, to create a linked smart home environment for tenants. As a result, the increasing penetration of smart homes is likely to drive property management software solutions.

The massive amount of data created by all linked devices, platforms, and appliances may be used to improve software functions. Furthermore, with data analysis, the adoption of IoT is projected to assist property owners in recognizing connected device performance and taking appropriate action to deliver better services to renters. According to Johnson Controls' building efficiency panel poll, 70% of respondents feel that introducing IoT to anticipate and diagnose trends will fuel demand for the software.

US Property Management Industry Overview

Leading players in the US property management market focus on obtaining knowledge in revenue management, payment services, communication solutions, facility management, and lease management to improve their software capabilities and product applicability. This technique assists organizations in increasing their corporate footprint in the United States.

Along with the acquisition, a significant emphasis on partnership and cooperation assists major stakeholders in providing new goods and experiences. Furthermore, the development and growth of the existing product range are assisting suppliers in improving their market position. Some of the major players in the market are Greystar Real Estate Partners, JLL, Lincoln Property Company, and CBRE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand from the Commercial Segment is Driving the Market

- 4.2.2 Increasing Disposable Income of Consumers is Driving the market

- 4.3 Market Restraints

- 4.3.1 Economic Uncertainties are Restraining the Market

- 4.4 Market Opportunities

- 4.4.1 Rapid Development of Apartments is Driving the Market

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 PESTLE Analysis

- 4.8 Impact of the COVID-19 pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 End User

- 5.1.1 Commercial

- 5.1.2 Residential

- 5.2 Service

- 5.2.1 Marketing

- 5.2.2 Property Evaluation

- 5.2.3 Tenant Services

- 5.2.4 Maintenance

- 5.2.5 Other Services

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Greystar Real Estate Partners

- 6.2.2 Lincoln Property Company

- 6.2.3 CBRE Group

- 6.2.4 Jones Lang LaSalle Incorporated

- 6.2.5 CoStar Group Inc.

- 6.2.6 Pinnacle Property Management

- 6.2.7 Equity Residential

- 6.2.8 FPI Management

- 6.2.9 AvalonBay Communities

- 6.2.10 WinnCompanies*

- 6.3 Other Companies