|

市场调查报告书

商品编码

1687863

电力电子-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Power Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

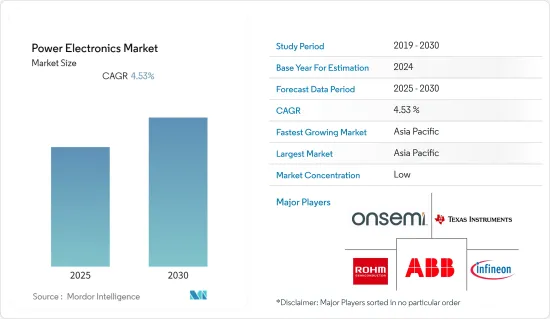

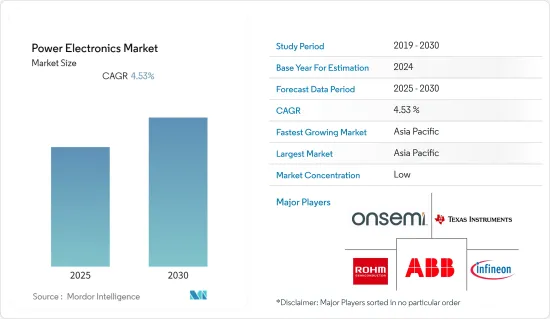

预计电力电子市场在预测期内的复合年增长率将达到 4.53%

关键亮点

- 值得注意的是,电能消耗持续成长,电气应用数量持续增加。预计总能源消耗的 60% 以上将转化为电能供使用,因此必须尽可能有效率地生产、分配和使用电能。此外,新出现的气候变迁也使得寻找未来永续的解决方案成为重点。在这种不断发展的背景下,两种可能在解决未来问题中发挥不可或缺作用的关键技术包括:电力生产从传统化石(和短期)能源来源向再生能源来源的转变,以及在输配电、发电和最终用户应用中使用高效电力电子技术,推动电力电子技术的作用。

- 电力电子产业是一个动态的环境,由于众多趋势而不断变化。电力电子设备和系统遍布整个电力供应链,从发电站到整个电网,因此受到多种因素的影响。以及消耗电力的物品。所有这些都是完全不同的环境,并受到不同事物的影响。

- 降低能源消耗是影响能源产业的主要趋势之一,电力电子已成为根据负载需求精确控制电能从电源到负载流动的关键技术。因此,电力电子负责整个电源基础设施的可靠性和稳定性,从电源、能源传输和分配到电器产品、交通系统以及家庭和办公设备的各种应用。

- 例如,先进的电力电子技术可以将将主电源或电池电压转换为电子设备所需电压所涉及的能量损失减少约 50%。然而,儘管电力电子技术具有巨大的重要性,但即使是最了解情况的公众也需要更多地了解它在现代工业社会中的作用。

- 疫情也加速了物联网的采用,对市场产生了正面影响。例如,全球行动卫星供应商 Inmarsat 最近的一项调查发现,自 COVID-19 疫情爆发以来,采用工业物联网 (IoT) 的公司成熟度迅速提高。

电力电子市场趋势

电子领域对高能量、节能设备的需求不断增长,预计将推动市场成长

- 不断电系统(UPS)、伺服器电源、电源转换器和马达驱动装置等工业设备消耗了全球很大一部分电力。因此,提高工业电源的效率可以大幅降低企业营运成本。随着功率密度的提高和热性能的改善,对高效能电源的需求呈指数级增长。

- 目前,功率半导体最常见的应用之一是不断电系统。它通常用于保护电脑、资料中心、通讯设备和其他电气设备等硬件,这些设备的意外断电可能会导致人身伤害、死亡、重大业务损失或资料中断或遗失。不断电系统通常包含电池和使用 IGBT(绝缘栅双极电晶体)的逆变器。

- 对高效电源的需求正在迅速增长。有几个因素推动了这种扩张。首先是全球越来越意识到高效率、合理利用能源的重要性。控制电力的功率半导体是有助于减少全球二氧化碳排放的关键设备,其应用范围正在扩大,需求也在上升。

- 马达驱动器是每个产业的关键部件。它们用于驱动泵、风扇、输送机、移动推车和电梯,以及产生压缩空气和冷冻。电动装置非常普遍,占工业用电的很大一部分。

- 高效能功率半导体的使用可以设计出有效、可靠的多维机器人。因此,工业机器人的安装量呈上升趋势,市场前景看好。根据国际机器人联合会(IFR)统计,全球安装的机器人数量较前一年强劲回升,成为机器人产业有史以来最好的一年。随着自动化趋势和技术创新的不断推进,各行各业的需求都达到了很高的水准。

预计亚太地区将快速成长

- 亚太地区在去年占据了电子电力市场的主导地位,预计在预测期内将继续占据主导地位并大幅成长。亚太地区家用电子电器、汽车、电讯和工业应用领域的有利机会正在推动市场占有率规模和区域成长。

- 亚太地区目前在全球半导体市场占据主导地位,市场研究显示,在政府措施的进一步支持下,亚太地区预计将继续占据市场主导地位。据 SIA 称,中国大陆、日本、台湾和韩国占全球半导体产量的 75% 左右,越南、泰国、马来西亚和新加坡等其他国家也对该地区的市场主导地位做出了重大贡献。

- 2023年4月举办的PowerUP Asia会议暨展览会展示了电力电子领域的最新技术发展和趋势,包括WBG装置、功率半导体和相关技术。报告指出,随着製造商更加註重电力效率、减少碳排放和「更绿色」能源,电动车(EV)产业的成长、对可再生能源的日益增长的推动、工业自动化趋势以及对家用电子电器日益增长的需求都在推动电力电子产业的成长。

- 电力电子技术在电动车中变得越来越普遍,电动车需要高功率来驱动马达。 MOSFET(金属氧化物场效电晶体)和IGBT等功率元件是动力传动系统系统中的电力电子开关。市场显着成长的原因是印度、中国、日本等多个国家对节能混合动力电动车的需求不断增加,以减轻日益严重的环境污染的影响。

- 例如,中国汽车产业正在崛起,在全球汽车产业中发挥越来越重要的作用。中国是采用电动车最多的国家之一,电动车正变得越来越受欢迎。根据中国乘用车市场资讯联席会的数据,2022年中国电动车和插电式汽车销量为567万辆。政府补贴和高油价导致消费者转换耗油的车款。随着电动车产业的发展,对电力电子产品的需求预计将快速成长。

- 此外,由于交通运输和可再生能源等电力电子应用广泛的领域的发展,日本的电力电子市场正在快速成长。因此,由于对电动车的需求而迅速扩张的日本汽车产业预计将成为该地区电力电子业务机会的主要推动力。

电力电子产业概况

电力电子市场竞争对手之间的竞争非常激烈,预计在预测期内仍将保持这种状态。该市场拥有多家全球知名公司,包括安森美半导体、英飞凌、罗姆和意法半导体。该市场对新参与企业设置了较高的进入门槛,但一些新参与企业正在获得发展动力。

2023 年 5 月,英飞凌推出了采用 XHP 2 封装的 3.3kV MOSFET 的 CoolSiC 牵引功率模组。 FF2,000UXTR33T2M1 和 FF2600UXTR33T2M1 电源模组采用新开发的 3.3kV CoolSiC MOSFET 和英飞凌的 XT 互连技术。本模组采用专为牵引设计的XHP 2包装。

2023年5月,三菱电机公司开发出内置肖特基势垒二极体(SBD)的碳化硅金属氧化物场效电晶体(SiC-MOSFET)的新结构,并将其应用于面向铁路、直流电力系统等大型工业设备的3.3kV全SiC功率模组「FMF800DC-66BEWEW」。

2023 年 1 月,瑞萨电子宣布推出一款新型闸极驱动器 IC,旨在驱动电动车 (EV) 逆变器的 IGBT(绝缘闸极电晶体)和 SiC(碳化硅)MOSFET 等高压功率元件。此外,随着电动车变得越来越便宜,对汽车功率半导体的需求正在迅速增长。该企业透过提供各种产品来满足需求,并不断扩大市场占有率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

- 技术简介

- 发电和储能

- 感测与测量

- 电源管理和分配

- 其他的

第五章市场动态

- 市场驱动因素

- 电子领域对高能量、节能设备的需求不断增加

- 绿色能源发电需求不断成长

- 市场限制

- 积体电路需求不断成长

第六章市场区隔

- 按组件

- 离散的

- 模组

- 按材质

- 硅/锗

- 碳化硅(SiC)

- 氮化镓(GaN)

- 按最终用户产业

- 车

- 消费性电子产品

- 资讯科技/通讯

- 军事和航太

- 工业的

- 能源动力

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- ON Semiconductor Corporation

- ABB Ltd.

- Infineon Technologies AG

- Texas instruments Inc.

- ROHM Co. Ltd

- STMicroelectronics NV

- Renesas electronic corporation

- Vishay Intertechnologies Inc.

- Toshiba Corporation

- Mitsubishi Electric Corporation

8.供应商市场占有率分析

第九章投资分析

第十章:投资分析市场的未来

The Power Electronics Market is expected to register a CAGR of 4.53% during the forecast period.

Key Highlights

- Notably, electrical energy consumption continues to grow, and more applications are being introduced based on electricity. More than 60 percent of total energy consumption is expected to be converted into electricity for use, and electrical energy must be produced, distributed, and used as efficiently as possible. Further, emerging climate change also argues for finding future sustainable solutions. Under such evolving circumstances, two major technologies that are likely to play essential roles in solving parts of those future problems include the change in electrical power production from conventional, fossil (and short-term) based energy sources to renewable energy sources and usage of highly efficient power electronics in power transmission/distribution, power generation, and end-user application, thus driving the role of power electronics.

- The power electronics industry is experiencing a dynamic environment that is constantly changing due to numerous trends. As power electronic devices and systems exist throughout the power supply chain, from the power plant to the entire power grid, the factors that influence them can vary widely. And then to items that consume electricity. All are very different environments and are affected differently.

- Reducing energy consumption is one of the major trends impacting the energy industry, and power electronics are emerging as a key technology to precisely control the flow of electrical energy from the source to the load, depending on the load requirements. Thus, it is responsible for the reliability and stability of the whole power supply infrastructure from the sources, the energy transmission and distribution up to the huge variety of applications in the industry, transportation systems, and home and office appliances.

- For instance, advanced power electronics could realize savings of about 50 percent of the energy losses in converting from mains or battery voltages to those being utilized in electronic equipment. But despite the tremendous importance of power electronics, there needs to be more awareness of the role of power electronics in modern industrial society, even in the well-informed general public.

- The pandemic also accelerated the adoption of IoT, which positively impacted the market. For instance, a recent study by global mobile satellite provider Inmarsat found that the maturity of companies adopting the Industrial Internet of Things (IoT) has increased rapidly since the start of the COVID-19 pandemic.

Power Electronics Market Trends

Rising Demand for High-energy and Power-efficient Devices in the Electronics Segment is Expected to Drive the Market Growth

- Industrial appliances such as uninterruptible power supplies (UPS), server power supplies, power converters, and motor drives consume a significant portion of the world's power. Therefore, any increase in efficiency in industrial power supplies will substantially reduce a company's operating costs. With greater power density and better thermal performance, the demand for high-efficiency power supplies is increasing exponentially.

- Currently, one of the most popular applications for power semiconductors is uninterruptible power supplies. It is typically used to protect hardware such as computers, data centers, communications equipment, and other electrical equipment where an unexpected power failure could result in injury, death, critical business loss, and interruption or loss of data. Uninterruptible power supply systems usually contain batteries and an inverter that uses IGBT (insulated-gate bipolar transistor).

- The need for high-efficiency power sources is growing at a rapid pace. Several causes are fueling this expansion. The first is a growing global awareness of the importance of using energy efficiently and wisely. Power semiconductors for controlling electric power are attracting wider applications and increasing demand as key devices that can help lower a global society's carbon footprint.

- Electric motor drives are one of the key elements in any industry. They drive pumps, fans, and conveyor belts, move hoisting vehicles and elevators, and are used to the same extent to generate compressed air or refrigeration. Owing to their widespread deployment, electric drives account for a significant portion of the power used in the industry.

- Using efficient power semiconductors allows for the design of effective, reliable, and multi-dimensional robots. Thus, increasing the installation of industrial robots creates a positive outlook for the market. According to the International Federation of Robotics (IFR), robot installations worldwide recovered strongly the year before, making it the most successful year ever for the robotics industry. With the continued trend toward automation and continued technological innovation, demand has reached high levels across the industry.

Asia-Pacific Expected to be the Fastest Growing Region

- The Asia-Pacific region dominated the electronic power market in the previous year and is expected to grow considerably and continue dominating over the forecast period. The lucrative opportunities in consumer electronics, automotive, telecom, and industrial applications in the Asia-Pacific region are responsible for the sizeable market share and regional growth.

- The region of Asia-Pacific is anticipated to dominate the market studied because it currently dominates the global semiconductor market, further supported by government policies. According to SIA, China, Japan, Taiwan, and South Korea account for about 75 percent of the world's semiconductor production collectively, and other countries like Vietnam, Thailand, Malaysia, and Singapore also make significant contributions to the region's market dominance.

- In April 2023, the PowerUP Asia conference and exhibition highlighted the most recent technological developments and trends in power electronics, including WBG devices, power semiconductors, and related technologies. It stated that the growing electric vehicle (EV) industry, rising calls for renewable energy adoption, industrial automation trends, and rising consumer electronics demand are all fueling the growth of the power electronics industry as manufacturers focus on power efficiency, carbon reduction, and 'greener' energy.

- Power electronics are becoming increasingly common in EVs, requiring high-power energy to rotate electric motors. Power components like MOSFETs (metal-oxide-semiconductor field-effect transistors) and IGBT are power electronic switches in power train systems. The significant market growth can be attributed to the rising demand for energy-efficient hybrid electric vehicles in several nations, including India, China, Japan, and others, to reduce the effects of rising environmental pollution.

- For instance, China's automotive sector has increased, and the region plays a more significant role in the global auto industry. China is one of the top countries to adopt electric vehicles, which are becoming increasingly popular. In 2022, China sold 5.67 million EVs (electronic vehicles) and plug-ins, according to the China Passenger Car Association, as consumers switched from gas-guzzler models due to government subsidies and high oil prices. With the EV industry, it is anticipated that demand for power electronics will increase quickly.

- In addition, the market for power electronics in Japan is rapidly growing due to developments in several industries, including transportation, renewable energy, and other fields where power electronics have a wide range of applications. As a result, it is anticipated that the Japanese automotive industry, which is expanding quickly due to demand for electric vehicles, will be the primary driver of opportunities for power electronics in the region.

Power Electronics Industry Overview

The intensity of competitive rivalry in the power electronics market is expected to be high and remain unchanged over the forecast period. The market comprises several global and popular players, such as ON Semiconductor, Infineon, ROHM, STMicroelectronics NV, and others. Although the market poses moderately high barriers to entry for new players, several new entrants have gained traction.

In May 2023, Infineon launched CoolSiC power modules using 3.3 kV MOSFETs in the XHP 2 package for traction applications. The FF2000UXTR33T2M1 and FF2600UXTR33T2M1 power modules use newly developed 3.3 kV CoolSiC MOSFETs and Infineon's XT interconnection technology. The modules come in an XHP 2 package specifically tailored for traction applications.

In May 2023, Mitsubishi Electric Corporation developed a new structure for a silicon carbide metal-oxide-semiconductor field-effect transistor (SiC-MOSFET) embedded with a Schottky barrier diode (SBD), which the company has applied in a 3.3 kV full SiC power module, the FMF800DC-66BEW for large industrial equipment such as railways and DC power systems.

In January 2023, Renesas Electronics announced a new gate driver IC designed to drive high-voltage power devices such as IGBTs (insulated gate transistors) and SiC (silicon carbide) MOSFETs for electric vehicle (EV) inverters. Moreover, As electric vehicles become more affordable, demand for automotive power semiconductors is increasing rapidly. The business continually increases its market share by providing various products to meet demand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID -19 impact on the Industry

- 4.4 Technology Snapshot

- 4.4.1 Power Generation and Storage

- 4.4.2 Sensing and Measurement

- 4.4.3 Power Management and Distribution

- 4.4.4 Other Functions

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for High-energy and Power-efficient Devices in the Electronics Segment

- 5.1.2 Demand for Green Energy Power Generation Drives

- 5.2 Market Restraints

- 5.2.1 Rising Demand for Integrated Circuits

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Discrete

- 6.1.2 Module

- 6.2 By Material

- 6.2.1 Silicon/Germanium

- 6.2.2 Silicon Carbide (SiC)

- 6.2.3 Gallium Nitride (GaN)

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Consumer Electronics

- 6.3.3 IT and Telecommunication

- 6.3.4 Military and Aerospace

- 6.3.5 Industrial

- 6.3.6 Energy and Power

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ON Semiconductor Corporation

- 7.1.2 ABB Ltd.

- 7.1.3 Infineon Technologies AG

- 7.1.4 Texas instruments Inc.

- 7.1.5 ROHM Co. Ltd

- 7.1.6 STMicroelectronics NV

- 7.1.7 Renesas electronic corporation

- 7.1.8 Vishay Intertechnologies Inc.

- 7.1.9 Toshiba Corporation

- 7.1.10 Mitsubishi Electric Corporation