|

市场调查报告书

商品编码

1687899

北美锂离子电池:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Lithium-ion Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

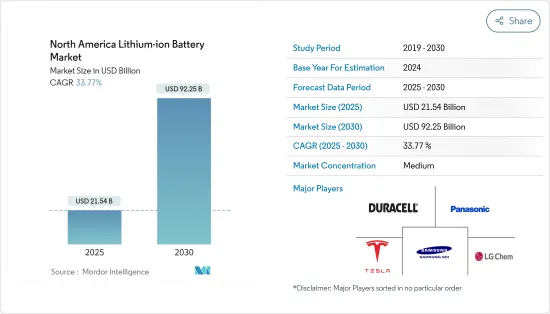

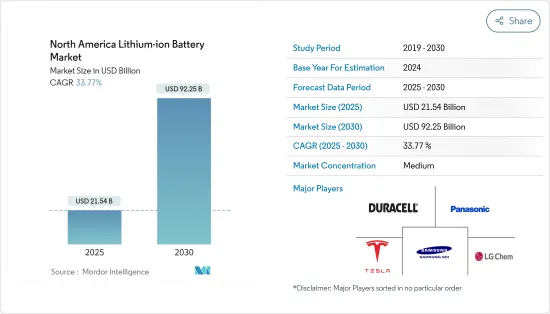

北美锂离子电池市场规模预计在 2025 年为 215.4 亿美元,预计到 2030 年将达到 922.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 33.77%。

关键亮点

- 从中期来看,预计市场将受到电动和混合动力汽车日益普及的推动,这将增加对能源储存系统的需求。

- 然而,原材料供需不匹配预计会在研究期间阻碍市场成长。

- 预计在预测期内,效率和维护需求的改善将为锂离子电池带来巨大的机会。

- 随着政府在预测期内增加对电动车领域的投资,预计美国将占据市场主导地位。这将导致基于电池的能源储存系统的需求增加,主要由锂离子电池主导。

北美锂离子电池市场趋势

汽车电池可望快速成长

- 锂离子电池系统可满足OEM对续航里程和充电时间的要求,进而提高插电式混合动力汽车和电动车的性能。高能量密度、快速充电能力和高放电功率使锂离子电池成为首选技术。锂离子电池在比能量和重量方面比铅基牵引电池更具优势。因此,锂离子电池已成为全混合动力车和电动车最具竞争力的选择。

- 锂离子电池延长了依赖其供电的电动车的使用寿命,并减少了频繁更换电池的需要。锂离子电池被认为比其他电池更环保,因为它们不含铅和镉等有害物质。这使得它成为一个更干净、更安全的选择。此外,锂离子电池提供高功率,这对于需要快速加速和高速行驶的电动车至关重要。

- 此外,锂离子电池的方形电池在电动车电池製造业中越来越受欢迎。这些细胞相当大,比圆柱形细胞大 20 到 100 倍。更大的尺寸使得方形电池能够在相同体积内输出更多电力并储存更多能量。另一方面,圆柱形电池外壳使用的材料较少,限制了其功率输出和能源储存容量。

- 此外,随着电动车销量的增加,预计预测期内汽车领域对锂离子电池的需求将大幅成长。例如,根据国际能源总署的数据,2021年至2022年,美国和加拿大的电动车销量成长了54%以上。

- 此外,通用、福特等美国企业也宣布了2022年电动车产销目标策略。通用的目标是到2025年在北美生产30款电动车,形成100万辆纯电动车(BEV)的产能,到2040年实现碳中和。福特则宣布了这样的目标:到2026年,其销量的三分之一为纯电动车,到2030年,这一比例达到50%,到2030年,欧洲市场所有汽车均为电动车。预计北美地区对锂离子电池的需求将会增加。

- 2023 年 2 月,NanoGraf 宣布了在硅阳极开发方面的最新进展,以提高即将推出的锂离子电池的能量和功率密度。这项突破性技术有效地解决了与硅阳极相关的挑战。

- 因此,预计在预测期内,电动车的日益普及将推动北美锂离子电池市场的发展。

预计美国将主导市场

- 美国是全球电池市场研究和创新的先驱之一。它也是最大的电池消耗国之一,一次电池和二次电池。这是由于电动车的广泛采用、家用电子电器产品的支出以及消费和製造活动的增加。

- 美国拥有完善的锂离子电池製造基础设施,拥有许多电池製造商和专门从事电池技术的研发机构。这些基础设施使美国在生产能力和技术进步方面具有竞争优势。

- 例如,2022年10月,本田宣布计画在美国生产锂离子电池,成为最新一家这样做的汽车公司。透过与 LG Energy Solutions 的合资企业,本田旨在向北美市场供应专为本田和讴歌品牌电动车设计的「袋式」电池。该投资 44 亿美元的工厂的具体位置尚未披露,但预计合资企业将在今年年底前投入运营,但需获得监管核准的批准。预计该计画将于2023年初动工,并预计于2025年底实现先进锂离子电池单元的量产。

- 此外,在政府奖励、环境法规和消费者对更清洁交通的需求的推动下,美国是电动车的庞大市场。电动车的兴起正在推动对锂离子电池的需求,而美国在这一市场上具有优势。

- 新措施要求获得联邦资助的计划在美国生产产品,其中包括2022财年2亿美元的电池技术援助资金。它也适用于能源部先进技术汽车製造贷款计划下贷款机构发放的 170 亿美元。

- 根据国际能源总署 (IEA) 的数据,该国的电动车销量为 99,000 辆,而去年为 63,000 辆,2022 年至 2021 年期间的成长率超过 57%。

- 根据美国能源资讯署的数据,截至 2022 年,大型电池的累积容量约为 22,385.1 兆瓦时 (MWh),比 2021 年增加约 80%。在美国,加州独立系统营运商 (CAISO) 和德克萨斯州电力可靠性委员会 (ERCOT) 负责大部分大型电池容量的新增。 2022 年,CAISO 将拥有 7,561.3 兆瓦时,占 34%,ERCOT 将拥有 1,684.4 兆瓦时,占 7.5%。

- 此外,国内电动车製造商正在进一步努力满足日益增长的需求。预计到 2025 年,美国将有 13 座新的电池超级工厂投入运作。这些超级工厂由福特汽车公司和通用汽车等汽车製造商开发,旨在帮助他们製造和销售电动车。

- 因此,在都市化和消费者支出成长的推动下,北美很可能主导锂离子电池市场。锂离子电池带来的优势预计将推动对技术先进设备和汽车的需求。预计这将导致电池使用量增加。

北美锂离子电池产业概况

北美锂离子电池市场比较分散。市场的主要企业(不分先后顺序)包括特斯拉公司、LG化学有限公司、松下公司、金霸王公司和三星SDI。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 至2029年的市场规模及需求预测(单位:美元)

- 2029年全球锂离子电池价格趋势分析

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 锂离子电池价格下跌

- 电动车日益普及

- 限制因素

- 锂离子电池安全问题

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 应用

- 消费性电子产品

- 车

- 工业电池(动力、固定(电信、UPS、能源储存系统(ESS) 等))

- 其他应用(电动工具、国防、医疗设备等)

- 市场分析:依地区{市场规模及需求预测至2028年(按地区)

- 美国

- 加拿大

- 北美其他地区

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- BYD Company Ltd

- Contemporary Amperex Technology Co. Limited

- EnerSys

- Duracell Inc.

- Clarios(原江森自控国际有限公司)

- LG Chem Ltd.

- Panasonic Corporation

- VARTA AG

- Samsung SDI Co. Ltd.

- Sony Corporation

- Tesla Inc.

第七章 市场机会与未来趋势

- 效率改善和维护需求

简介目录

Product Code: 66743

The North America Lithium-ion Battery Market size is estimated at USD 21.54 billion in 2025, and is expected to reach USD 92.25 billion by 2030, at a CAGR of 33.77% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the market is expected to be driven by the increasing adoption of electric and hybrid vehicles and the increasing demand for energy storage systems.

- On the other hand, the demand-supply mismatch of raw materials is expected to hinder the market growth during the study period.

- Nevertheless, the improvements in efficiency and maintenance requirements are expected to provide significant opportunities for lithium-ion batteries during the forecast period.

- The United States is expected to dominate the market due to the government's increasing investments in electric vehicle segments in the forecast period. It will result in increased demand for battery-based energy storage systems, primarily led by lithium-ion batteries.

North America Lithium-ion Battery Market Trends

Automotive Batteries Expected to be the Fastest-growing Segment

- Lithium-ion battery systems drive the performance of plug-in hybrid and electric vehicles by meeting OEM requirements for driving range and charging time. Their high energy density, fast recharge capability, and high discharge power make lithium-ion batteries the preferred technology. They outperform lead-based traction batteries in terms of specific energy and weight. As a result, lithium-ion batteries are the most competitive option for total hybrid electric vehicles and electric vehicles.

- Lithium-ion batteries offer a longer lifespan for electric vehicles, which rely on these batteries for power, reducing the frequency of battery replacements. Lithium-ion batteries are considered environmentally friendly compared to other batteries as they do not contain toxic materials like lead or cadmium. It makes them a cleaner and safer choice. Additionally, lithium-ion batteries provide a high power output, which is crucial for electric vehicles that require rapid acceleration and high speeds.

- Moreover, within the electric vehicle battery manufacturing industry, there is a growing popularity of lithium-ion battery prismatic cells. These cells are significantly larger, ranging from 20 to 100 times the size of cylindrical cells. This larger size allows prismatic cells to deliver more power and store greater energy within the same volume. Cylindrical cells, on the other hand, use less material for their casing, which can limit their power and energy storage capabilities.

- Additionally, with the growing sales of electric vehicles, the demand for lithium-ion batteries for the automotive segment is expected to increase significantly during the forecasted period. For instance, according to the International Energy Agency, the sales of electric vehicles in the United States and Canada grew by more than 54% between 2021 and 2022.

- Moreover, in 2022, General Motors & Ford, and American companies announced their targeted strategy to manufacture and sell EVs. General Motors declared its target to manufacture 30 EV models and set up a Battery Electric Vehicle (BEV) production capacity of 1 million units in North America by 2025, plus carbon neutrality in 2040. In comparison, Ford declared its target of One-third of sales to be fully electric by 2026 and 50% by 2030, with all-electric sales in Europe by 2030. It will drive the need for lithium-ion batteries in North America.

- In February 2023, NanoGraf's latest advancement in deploying silicon anodes is positioned to enhance the energy and power densities of forthcoming lithium-ion batteries. This breakthrough technology effectively addresses the challenges associated with silicon anodes.

- Therefore, the increasing shift towards electric vehicles is expected to drive the North America Lithium-ion Battery Market during the forecast period.

The United States Expected to Dominate the Market

- The United States is one of the pioneers in research and innovation in the global battery market. The region also remains one of the largest consumers of batteries, i.e., both primary and secondary battery types. It is owing to increased electric vehicle deployment, spending on consumer electronics, and consumer and manufacturing activities.

- The United States includes a well-established manufacturing infrastructure for lithium-ion batteries, a significant number of battery manufacturers, and research and development facilities focused on battery technologies. This infrastructure gives the United States a competitive edge regarding production capacity and technological advancements.

- For instance, in October 2022, Honda announced its plans to manufacture lithium-ion batteries in the United States, making it the latest car company to do so. In a joint venture with LG Energy Solutions, Honda aims to supply the North American market with "pouch type" batteries designed to power electric vehicles under its Honda and Acura brands. While the exact location of the USD 4.4 billion factory is not disclosed, the joint venture is expected to commence by the end of this year, pending regulatory approval. Construction is planned to begin in early 2023 to achieve mass production of advanced lithium-ion battery cells by the end of 2025.

- Moreover, the United States holds a large market for electric vehicles driven by government incentives, environmental regulations, and consumer demand for cleaner transportation options. The increasing adoption of EVs fuels the demand for lithium-ion batteries, giving the United States an advantage in the market.

- The new policies mandate that projects receiving federal support, including the USD 200 million in the agency's 2022 budget to support battery technology, must manufacture their products within the United States. It also applies to the USD 17 billion issued by the lending authority under DOE's Advanced Technology Vehicles Manufacturing Loan Program.

- According to the International Energy Agency, the country's electric vehicle sales were around 990000 compared to 630000, registering a growth rate of more than 57% between 2022 and 2021.

- Moreover, as of 2022, the cumulative large-scale battery storage capacity was around 22,385.1 megawatt-hours (MWh), which was approximately 80% more than in 2021, as per the United States Energy Information Administration. In the United States, the California Independent System Operator (CAISO) and Electric Reliability Council of Texas (ERCOT) include most of the large-scale battery storage capacity additions. In 2022, CAISO had 7561.3 MWh or 34 % share, and ERCOT had 1684.4 MWh capacity or 7.5% share in the country's overall installed capacity.

- Further, the country's EV manufacturers are undertaking further initiatives to cater to the rising demand. Thirteen new battery cell giga-factories are expected to come online in the United States by 2025. These giga-factories are being developed by various automobile manufacturers, like Ford Motor Company and General Motors Company, to support their electric vehicle manufacturing and sales.

- Therefore, the country is likely the dominant player in the North American lithium-ion battery market, supported by increasing urbanization and consumer spending. These are expected to ramp up the demand for technically advanced devices and vehicles due to the benefits provided by the same. Consecutively, this is expected to boost the usage of batteries.

North America Lithium-ion Battery Industry Overview

The North American lithium-ion battery market is semi-fragmented. Some of the key players in the market (in no particular order) include Tesla Inc., LG Chem Ltd, Panasonic Corporation, Duracell Inc., and Samsung SDI Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Global Lithium-ion Battery Price Trend Analysis, till 2029

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Declining Lithium-Ion Battery Prices

- 4.6.1.2 Increasing Adoption Of Electric Vehicles

- 4.6.2 Restraints

- 4.6.2.1 Safety Concerns Related To Lithium-Ion Battery

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Consumer Electronics

- 5.1.2 Automotive

- 5.1.3 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.))

- 5.1.4 Other Applications (Power Tools, Defense, Medical Devices, etc.)

- 5.2 Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 EnerSys

- 6.3.4 Duracell Inc.

- 6.3.5 Clarios (Formerly Johnson Controls International PLC)

- 6.3.6 LG Chem Ltd.

- 6.3.7 Panasonic Corporation

- 6.3.8 VARTA AG

- 6.3.9 Samsung SDI Co. Ltd.

- 6.3.10 Sony Corporation

- 6.3.11 Tesla Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Improvement In Efficiency And Maintenance Requirements

02-2729-4219

+886-2-2729-4219