|

市场调查报告书

商品编码

1687900

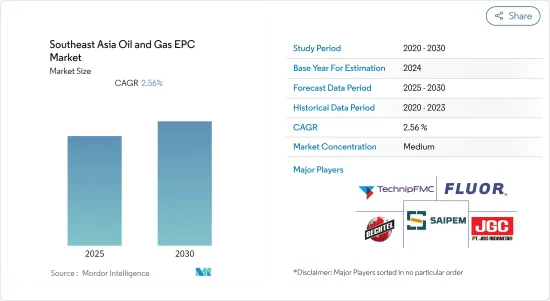

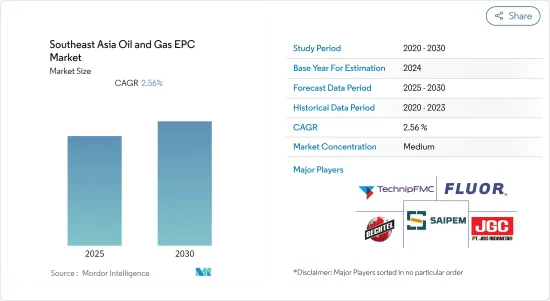

东南亚石油和天然气 EPC—市场占有率分析、产业趋势和成长预测(2025-2030 年)Southeast Asia Oil and Gas EPC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

东南亚石油和天然气 EPC 市场预计在预测期内实现 2.56% 的复合年增长率

关键亮点

- 预计下游领域将在 2021 年占据东南亚石油和天然气 EPC 市场的最大份额。该领域正在对现有的炼油厂和石化综合体进行重大升级。

- 汶莱、越南、缅甸等国的石油天然气产业在上游、中游、下游三个环节都有巨大潜力。这对东南亚石油和天然气EPC市场来说可能是一个良机。

- 由于新建炼油厂数量众多,预计2021年东南亚油气EPC市场将以印尼为主。

东南亚油气EPC市场趋势

下游产业主导市场

- 由于化工、石化和运输等产业对精製产品的需求不断增加,东南亚的精製产业正经历显着成长。亚洲开发银行预测,2030年,该地区累积人口将成长约13%,受新冠疫情影响,该地区的成长预测维持不变,到2022年将略微下降至7%和5.3%。

- 根据《英国石油公司2021年世界能源统计年鑑》,新加坡的精製能力最大,为151.4万桶/日,其次是泰国、印尼、马来西亚、越南等东南亚国家。除越南外,该地区的精製产能在过去五年中并未显着扩张,为 EPC 市场相关人员创造的机会极少。

- 然而,随着石油产品需求的增加以及各国努力实现自给自足足以满足需求,预计未来几年该地区的下游基础设施将大幅增加。印尼、马来西亚、汶莱、新加坡、泰国、越南和菲律宾等国均正在製定扩建现有炼油厂或建造新炼油厂的计画。

- 过去二十年,马来西亚大力投资精製业务,使其在长期依赖新加坡炼油厂后,得以在国内满足大部分石油产品需求。此外,马来西亚已在 Kerteh、Gebeng 和 Pasir Gudang Tanjung Langsat 建立了三个主要石化联合企业 (IPC)。

- 雪佛龙旗下的加德士、埃克森美孚和壳牌等许多国际公司已在新加坡能源领域投入大量资金,其中包括许多石化和精製资产。截至 2019 年 5 月,埃克森美孚在该国的资产价值为 180 亿美元,该国是其下游和化学业务的亚太中心。

- 此外,有迹象表明,汶莱和越南等经济体将迎来下游领域大量 EPC 合约的涌入。在汶莱,几个大型下游石油和天然气计划将于未来几年投入运营,其中包括 Pulau Muara Besar 炼油和石化综合体第二期工程,该项目的合约已于 2020 年 8 月签署。

- 因此,东南亚油气EPC市场预计将由下游产业主导。

印尼占市场主导地位

- 截至2020年,印尼已探明石油蕴藏量为24亿桶,已探明天然气蕴藏量为44.2兆立方英尺。同时,印尼的地理特征也十分多样化。该地质盆地由60个沉积盆地组成,其中14个盆地产有石油和天然气。该国丰富的石油和天然气蕴藏量可能会活性化探勘和生产活动,从而在预测期内刺激 EPC 业务。

- 近期,印尼上游石油产业已无法满足国内精製产能。此外,该国对成品精製的需求超过了国内精製能力。这些因素显示需要发展上游和下游产业。

- 2020年,印尼政府授予了95个开发合约区,而2019年为92个开发合约区。

- 2020 年,SKK Migas 在 Jambi Merang KKP 完成了最长的二维地震探勘。占碑美朗合约区勘测于 2019 年 11 月开始,总长 31,908 公里,最终采集于 2020 年 8 月完成。研究涵盖印尼 128 个盆地中的 35 个盆地,包括 6 个生产盆地、7 个发现盆地、5 个勘探盆地和 17 个其他盆地,这些盆地是新的或未勘探的盆地。

- 此外,中游产业的EPC市场也预计将大幅成长。大量精製和石化厂的建设和升级计划正在刺激对石油运输基础设施的需求,预计这将在预测期内推动石油管线EPC 市场的发展。

- 印尼政府也宣布计划在2018年至2025年期间将精製能力提高一倍,达到每天220万桶。由于这些计划,主要炼油厂和石化厂的建设和升级计划正在筹备中。

- 因此,鑑于上述情况,预计印尼将在预测期内主导东南亚石油和天然气 EPC 市场。

东南亚油气EPC产业概况

东南亚油气EPC市场区隔程度适中。市场的主要企业包括 TechnipFMC PLC、Fluor Corporation、Bechtel Corporation、Saipem SpA 和 PT.JGC Indonesia。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2027 年市场规模与需求预测

- 近期趋势和发展

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 部门

- 上游

- 中游

- 下游

- 地区

- 印尼

- 马来西亚

- 泰国

- 其他东南亚地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- TechnipFMC PLC

- Saipem SpA

- Bechtel Corporation

- Fluor Corporation

- John Wood Group PLC

- Petrofac Limited

- PT Barata Indonesia(Persero)

- PT Meindo Elang Indah

- PT Indika Energy Tbk

- PT Rekayasa Industri

- PT. JGC Indonesia

- Sinopec Engineering(Group)Co. Ltd

- PT Krakatau Engineering

- Samsung Engineering Co. Ltd

第七章 市场机会与未来趋势

简介目录

Product Code: 66745

The Southeast Asia Oil and Gas EPC Market is expected to register a CAGR of 2.56% during the forecast period.

Key Highlights

- The downstream segment is estimated to account for the largest share in the Southeast Asian oil and gas EPC market in 2021. The segment has been undergoing major upgrades in the existing refineries and petrochemical complexes.

- Countries such as Brunei, Vietnam, and Myanmar have enormous potential for the oil and gas industry across all three sectors, namely, upstream, midstream, and downstream. This is likely to act as an opportunity for the Southeast Asian oil and gas EPC market.

- Indonesia is expected to dominate the Southeast Asian oil and gas EPC market in 2021, owing to a large number of new refineries being constructed.

Southeast Asia Oil and Gas EPC Market Trends

The Downstream Sector to Dominate the Market

- Southeast Asia's refining sector is witnessing significant growth on account of the increasing demand for refined products from industries such as chemical, petrochemical, and transport. The cumulative population in the region is expected to grow by approximately 13% by 2030, and according to the Asian Development Bank, the region's growth forecast remains unchanged due to the COVID-19 pandemic, which is slightly down to 7% and 5.3% in 2022.

- According to the BP Statistical Review of World Energy 2021, Singapore had the largest refining capacity of 1,514 thousand barrels daily, followed by Thailand, Indonesia, Malaysia, Vietnam, and other Southeast Asian countries. The refining capacity in the region has not witnessed any notable expansion in the past five years, apart from Vietnam, which has previously led to very minimal opportunities for the EPC market players.

- However, with the growing demand for petroleum products and countries working towards being self-reliant to meet the demand, the downstream infrastructure in the region is expected to increase significantly in the coming years. Indonesia, Malaysia, Brunei, Singapore, Thailand, Vietnam, the Philippines, etc., have formulated plans for either expanding the current refineries or constructing new ones.

- Malaysia invested heavily in refining activities during the last two decades, and it can now meet most of its demand for petroleum products domestically after relying on refineries in Singapore for many years. Furthermore, three major integrated petrochemical complexes (IPCs) were established in Kerteh, Gebeng, and Pasir Gudang-Tanjung Langsat in Malaysia.

- Many international firms, such as Chevron's Caltex, ExxonMobil, and Shell PLC, have made significant investments in Singapore's energy sector, including many petrochemical and refining assets. As of May 2019, ExxonMobil had assets worth USD 18 billion in the country, which serves as the Asia-Pacific hub for the company's downstream and chemical businesses.

- Moreover, economies such as Brunei and Vietnam are on the cusp of witnessing the inflow of several EPC contracts in the downstream sector. In Brunei, several large downstream oil and gas projects are expected to commence operations in the coming years, such as Phase 2 of the Pulau Muara Besar Refinery & Petrochemical Complex, for which contracts were let out in August 2020.

- Therefore, owing to the above points, the downstream sector is expected to dominate the Southeast Asia oil and gas EPC market.

Indonesia to Dominate the Market

- As of 2020, Indonesia's proven oil reserves stood at 2.4 billion barrels, and the proven gas reserves stood at 44.2 trillion cubic feet. Along with this, it has a diverse geographical profile. The geological basins comprise 60 sedimentary basins, including 36 in Western Indonesia that have already been thoroughly explored, out of which 14 produce oil and gas. Substantial oil and gas reserves increase the country's exploration and production activities, which is likely to stimulate the EPC operations during the forecast timelines.

- In the recent past, the upstream industry of Indonesia failed to meet even the domestic refining capacity. Also, the country's demand for refined products exceeds domestic refining capacity. These factors indicate the need for the development of the upstream and downstream sectors.

- In 2020, the Indonesian government granted 95 exploitation contract areas compared to what it granted in 2019 (92 exploitation contract areas).

- In 2020, SKK Migas finished the longest 2D Seismic Survey in Jambi Merang KKP. The Jambi Merang Contract Area survey was started with a length of 31,908 km in November 2019, and its last acquisition was completed in August 2020. The survey covered 35 basins from 128 basins in Indonesia, consisting of six producing basins, seven discovery basins, five explored basins, and 17 other basins constituting new or unexplored basins that have never been explored.

- Besides, the EPC market for the midstream industry is also expected to register significant growth. With a large number of construction and upgradation projects for refining and petrochemical plants, the demand for the oil transportation infrastructure is growing, which, in turn, is expected to drive the EPC market for oil pipelines during the forecast period.

- Also, the Indonesian government announced its plans to double the refining capacity during 2018-2025, and it is aiming to reach 2.2 million barrels per day. As a result of these plans, major refinery and petrochemical plant construction and upgradation projects are upcoming and are in the pipeline.

- Therefore, owing to the above points, Indonesia is expected to dominate the Southeast Asia oil and gas EPC market during the forecast period.

Southeast Asia Oil and Gas EPC Industry Overview

The Southeast Asia oil and gas EPC market is moderately fragmented. The major companies in the market are TechnipFMC PLC, Fluor Corporation, Bechtel Corporation, Saipem SpA, and PT. JGC Indonesia, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, until 2027

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

- 5.2 Geography

- 5.2.1 Indonesia

- 5.2.2 Malaysia

- 5.2.3 Thailand

- 5.2.4 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 TechnipFMC PLC

- 6.3.2 Saipem SpA

- 6.3.3 Bechtel Corporation

- 6.3.4 Fluor Corporation

- 6.3.5 John Wood Group PLC

- 6.3.6 Petrofac Limited

- 6.3.7 PT Barata Indonesia (Persero)

- 6.3.8 PT Meindo Elang Indah

- 6.3.9 PT Indika Energy Tbk

- 6.3.10 PT Rekayasa Industri

- 6.3.11 PT. JGC Indonesia

- 6.3.12 Sinopec Engineering (Group) Co. Ltd

- 6.3.13 P.T. Krakatau Engineering

- 6.3.14 Samsung Engineering Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219