|

市场调查报告书

商品编码

1687902

全球灭菌设备-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Global Sterilization Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

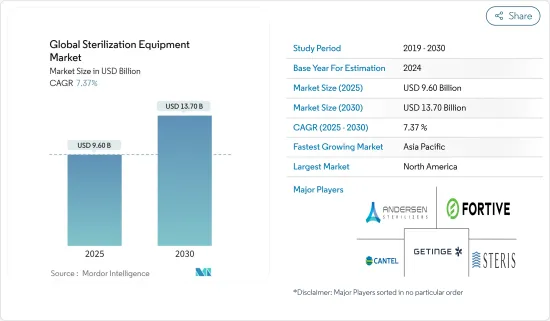

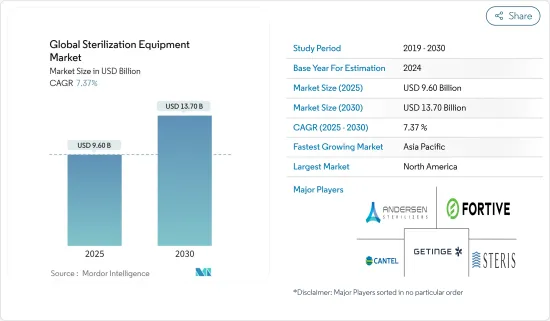

2025年全球灭菌设备市场规模预计为96亿美元,预计到2030年将达到137亿美元,预测期内(2025-2030年)的复合年增长率为7.37%。

COVID-19 疫情改变了医疗保健的重点并对医疗保健管理产生了负面影响。疫情初期,多个国家处于封锁状态。 2020年上半年,与其他国家的贸易暂停和旅行限制的实施导致包括治疗、诊断和手术在内的医疗服务下降。预防医院内传播是COVID-19临床管理的关键。根据2021年8月发表的一项题为《英国新冠疫情第一波期间的院内新冠病毒传播》的研究,英国314家医院中,11.3%的新冠感染患者是在住院后感染的。 2020年5月,这一比例上升至15.8%。因此,疫情影响了医疗机构的感染控制能力,并大大增加了对消毒器的需求。随着新冠肺炎病例的增加,政府机构也努力减轻新冠肺炎的影响。例如,根据美国食品药物管理局(USFDA)2020年3月更新的《产业和食品药物管理局工作人员指南》,应维持灭菌器、消毒设备和空气净化器的供应,以促进灭菌或消毒后的医疗设备的快速週转,并帮助降低因COVID-19疫情期间的公共卫生紧急事件而导致患者和医护人员接触SARS-CoV-Co22的病毒紧急事件。美国食品药物管理局认为,在此次公共卫生紧急事件期间,增加灭菌器、消毒器和空气清净机的供应有助于解决这些紧急的公共卫生问题。

随着世界人口的成长,各种感染疾病的盛行率也迅速增加。许多此类情况需要医疗干预或手术。手术中使用的器械和设备必须消毒。此外,受感染的设备可能导致疾病的交叉传播。根据美国整形外科医师协会《2020 年全国整形外科统计数据》,2020 年美国进行了 2,314,720 例整容手术,而 2019 年进行了 2,678,302 例。此外,2020 年和 2019 年进行的重组手术总数分别为 6,878,486 例和 6,652,591 例。由于这些手术需要无菌器械,预计未来几年市场将显着成长。

这些因素增加了对消毒设备的需求,以防止感染疾病的进一步传播。製药公司进入市场也是市场成长的一个主要因素。然而,这些设备的核准和製造的严格监管标准,以及某些设备中用作化学消毒剂的药剂可能对眼睛和皮肤造成的损害等缺点,正在抑制市场的成长。

灭菌设备市场趋势

高温灭菌设备占据市场主导地位

高温设备是应用最广泛、最可靠的灭菌设备。高温灭菌通常对患者、工作人员和环境无害,并且能有效杀死微生物。它还具有成本效益,因为它可以深入医疗设备,并且成本低于其他消毒设备。这些因素导致了该领域在市场上占据主导地位。高温灭菌设备又细分为蒸气灭菌和干式灭菌。

多种外科手术的兴起推动了手术过程中使用的手术设备的高温灭菌,这可能会促进该领域的成长。根据美国关节置换登记处 2020 年度报告,2012 年至 2019 年期间,美国进行了 1,897,050 例初次和重新置换髋关节和膝关节置换术。此外,2012 年至 2019 年期间,美国共进行了约 995,410 例全膝关节置换术和 625,097 例全髋置换术。

根据美国代谢和减肥手术协会的统计,光是在美国,2019 年就进行了约 256,000 例手术,2018 年约为 252,000 例。这些统计数据显示减肥手术的数量增加,从而推动了整体市场的成长。

此外,该领域的新产品推出可能会推动市场成长。例如,2020年5月,Esco推出了具有高温灭菌功能的Esco CelCulture CO2培养箱(CCL-HHS)。事实证明,它能有效杀死可能污染您的工作空间的抗性真菌、细菌孢子和植物细胞。因此,预计这些因素将在预测期内推动该领域的成长。

北美将经历最快成长

北美灭菌设备市场一直呈现正面成长,预计在预测期内将显着成长。交叉污染和医院内感染风险的增加、外科手术数量的增加、主要市场参与企业的存在以及研发程序的增加预计将推动该地区市场的发展。预计美国将主导北美市场。

根据美国疾病管制与预防中心发布的《2020 年医院获得性感染进展报告执行摘要》 ,美国大约每 31美国患者中就有 1 名患有至少一种医院获得性感染,这凸显了改善美国医疗机构患者照护实践的必要性。因此,该国的医院内感染凸显了适当的卫生和消毒的必要性,包括及时更换医院窗帘。

此外,老年人更容易接受手术,由于免疫力较弱,感染疾病的风险也更高。根据《2019年世界老化报告》,预计到2050年,该国老年人口将从2019年的5,334万增加到8,381.3万,从而增加感染疾病的发生率,并促进市场的成长。

该领域的技术进步也推动着市场的发展。例如,2020年9月,Midmark公司推出了一款新型灭菌器资料记录器,并更新了Midmark M3蒸汽灭菌器,为美国牙科诊所的器械处理带来速度、简单性和合规性。

因此,对医疗设备和其他仪器的需求激增,从而增加了对消毒设备的需求。

灭菌设备产业概况

大多数灭菌设备由全球公司生产。拥有更多研究资金和更好分销系统的市场领导已经确立了自己的市场地位。主要市场参与企业包括 Getinge AB、Fortive Corporation、Anderson Products、Cantel Medical 和 Steris PLC。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 感染风险增加

- 手术数量增加

- 製药和生物技术产业的成长

- 市场限制

- 设备相关高成本

- 接触设备中的化学物质

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 按设备

- 高温灭菌

- 湿式/蒸气灭菌

- 干式灭菌

- 低温灭菌

- 环氧乙烷(ETO)

- 过氧化氢

- 臭氧

- 其他低温灭菌设备

- 无菌过滤

- 电离放射线杀菌

- 电子束灭菌

- 伽玛射线灭菌

- 其他电离放射线杀菌设备

- 高温灭菌

- 按最终用户

- 医院和诊所

- 製药和生物技术公司

- 教育和研究机构

- 食品饮料业

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章竞争格局

- 公司简介

- Fortive Corporation(Advanced Sterilization Products)

- Anderson Products

- Metall Zug Group(Belimed)

- Cantel Medical

- Getinge AB

- Matachana Group

- MMM Group

- STERIS PLC

- Systec GmbH

- Stryker Corporation(TSO3 INC.)

第七章 市场机会与未来趋势

The Global Sterilization Equipment Market size is estimated at USD 9.60 billion in 2025, and is expected to reach USD 13.70 billion by 2030, at a CAGR of 7.37% during the forecast period (2025-2030).

The COVID-19 pandemic has altered healthcare priorities, adversely impacting healthcare management. In the initial days of the pandemic, several countries were in lockdown. They suspended trade with other countries and implemented travel restrictions, leading to a decline in healthcare services such as treatments, diagnosis, and surgical procedures in the first half of 2020. Preventing hospital-acquired infections is a critical aspect of the clinical management of COVID-19, as hospital-acquired infections have been a common feature of such outbreaks. According to the study titled 'Hospital-acquired SARS-CoV-2 infection in the UK's first COVID-19 pandemic wave', published in August 2021, 11.3% of patients with COVID-19 in 314 UK hospitals became infected after hospital admission. This rate increased to 15.8% in May 2020. Thus, the outbreak has impacted the healthcare facilities' ability to manage hospital-acquired infections, significantly increasing the demand for sterilizers. Due to the rising COVID-19 cases, government associations also worked toward reducing the COVID-19 impact. For instance, as per a March 2020 update by the US Food and Drug Administration (USFDA), Guidance for Industry and Food and Drug Administration Staff, it is adequate to maintain the supply of sterilizers, disinfectant devices, and air purifiers that can facilitate the rapid turnaround of sterilized or disinfected medical equipment and help reduce the risk of viral exposure for patients and healthcare providers to SARS-CoV-2 for public health emergency during the COVID-19 pandemic. The USFDA believes that the policy outlined will help address these urgent public health concerns by increasing the availability of sterilizers, disinfectant devices, and air purifiers during this public health emergency.

With the growing global population, the prevalence of various infectious diseases has rapidly increased. Many of these diseases require medical interventions and surgeries. The instruments and devices used in the surgeries need to be sterilized. Moreover, the infected instruments may give rise to the cross-transmission of diseases. According to the National Plastic Surgery Statistics 2020 by the American Society of Plastic Surgeons, 2,314720 cosmetic surgical procedures were performed in the United States in 2020, and 2,678,302 surgeries were performed in 2019. Additionally, the total number of reconstructive procedures performed in 2020 and 2019 were 6,878,486 and 6,652,591, respectively, in the United States. As these surgeries require sterilized instruments, the market is expected to witness significant growth in the coming years.

These factors have given rise to the need for sterilization equipment to prevent the further spread of infectious diseases. The expansion of pharmaceutical companies has also been a major factor in the market's growth. However, stringent regulatory standards for approval, production of these devices, and disadvantages of chemical agents used as chemical sterilants in some equipment, which may cause potential damage to the eyes and skin, have been restraining the market's growth.

Sterilization Equipment Market Trends

High-temperature Sterilization Equipment Dominates the Market

High-temperature equipment is the most widely used and the most dependable sterilization equipment. High-temperature sterilization is usually nontoxic to patients, staff, and the environment and is highly microbicidal. It also penetrates deep into the medical devices and is less costly than other sterilization equipment, thus making it cost-effective. These factors are responsible for the dominance of this segment in the market. High-temperature sterilization equipment is further sub-segmented into steam sterilization and dry sterilization.

The increasing number of several surgical procedures is boosting the high-temperature sterilization of surgical devices used in the process, which may drive the segment's growth. As per the American Joint Replacement Registry's Annual Report 2020, 1,897,050 primary and revision hip and knee arthroplasty procedures were performed between 2012 and 2019 in the United States. About 995,410 total knee arthroplasty and 625,097 total hip arthroplasty were also performed from 2012 to 2019 in the United States.

According to the American Society for Metabolic and Bariatric Surgery Statistics, around 256,000 surgeries and 252,000 surgeries were performed in 2019 and 2018, respectively, in the United States alone. These statistics show an increase in the number of bariatric surgeries, which is driving the growth of the overall market.

Moreover, the launch of new products in the segment may drive the market's growth. For instance, in May 2020, Esco launched Esco CelCulture CO2 Incubator with High Heat Sterilization (CCL-HHS). It has proven effective in killing resistant fungi, bacterial spore, and vegetative cells that may contaminate the workspace. Thus, such factors are expected to boost the segment's growth during the forecast period.

North America to Witness the Fastest Growth

North America experienced positive growth in the sterilization equipment market, and it is estimated to witness significant growth over the forecast period. The increasing risk of cross-contamination and hospital-acquired infections, rising number of surgeries, the presence of major market players, and growth in R&D procedures are expected to drive the market in the region. The United States is expected to dominate the North American market.

According to the '2020 HAI Progress Report Executive Summary' report published by the Centers for Disease Control and Prevention, approximately one in 31 US patients contract at least one hospital-acquired infection, highlighting the need for improvements in patient care practices in the country's healthcare facilities. Thus, hospital-acquired infections in the country are driving the need for proper hygiene maintenance and sterilization, including timely changing of hospital curtains.

In addition, the elderly population is prone to surgeries and is at higher risk of infections due to a weakened immune system. According to the World Ageing Report 2019, the country's elderly population is expected to increase from 53.340 million in 2019 to 83.813 million in 2050, thus increasing the incidence of infectious diseases and contributing to the market's growth.

The technological advancements in the field are also driving the market. For instance, in September 2020, Midmark Corporation launched the new Sterilizer Data Logger and the updated Midmark M3 Steam Sterilizer, bringing speed, simplicity, and compliance to instrument processing in dental practices in the United States.

Hence, there has been a surge in demand for medical devices and other instruments, increasing the demand for sterilization equipment.

Sterilization Equipment Industry Overview

The majority of sterilization equipment is being manufactured by global players. Market leaders with more funds for research and a better distribution system established their positions in the market. Major market players are Getinge AB, Fortive Corporation, Anderson Products, Cantel Medical, and Steris PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Risks of Cross-transmission

- 4.2.2 Increasing Number of Surgical Procedures

- 4.2.3 Growth in Pharmaceutical and Biotechnology Industries

- 4.3 Market Restraints

- 4.3.1 High Cost Associated with the Device

- 4.3.2 Exposure to Chemicals in Equipments

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Equipment

- 5.1.1 High-temperature Sterilization

- 5.1.1.1 Wet/Steam Sterilization

- 5.1.1.2 Dry Sterilization

- 5.1.2 Low-temperature Sterilization

- 5.1.2.1 Ethylene Oxide (ETO)

- 5.1.2.2 Hydrogen Peroxide

- 5.1.2.3 Ozone

- 5.1.2.4 Other Low-temperature Sterilization Equipment

- 5.1.3 Filtration Sterilization

- 5.1.4 Ionizing Radiation Sterilization

- 5.1.4.1 E-beam Radiation Sterilization

- 5.1.4.2 Gamma Sterilization

- 5.1.4.3 Other Ionizing Radiation Sterilization Equipment

- 5.1.1 High-temperature Sterilization

- 5.2 By End User

- 5.2.1 Hospitals and Clinics

- 5.2.2 Pharmaceutical and Biotechnology Companies

- 5.2.3 Education and Research Institutes

- 5.2.4 Food and Beverage Industries

- 5.2.5 Other End Users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Fortive Corporation (Advanced Sterilization Products)

- 6.1.2 Anderson Products

- 6.1.3 Metall Zug Group (Belimed)

- 6.1.4 Cantel Medical

- 6.1.5 Getinge AB

- 6.1.6 Matachana Group

- 6.1.7 MMM Group

- 6.1.8 STERIS PLC

- 6.1.9 Systec GmbH

- 6.1.10 Stryker Corporation (TSO3 INC.)