|

市场调查报告书

商品编码

1687925

工业电脑X光照相术:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Industrial Computed Radiography - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

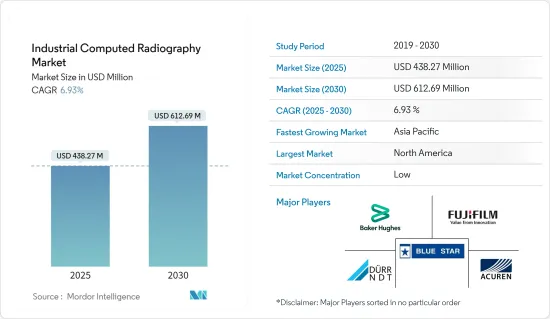

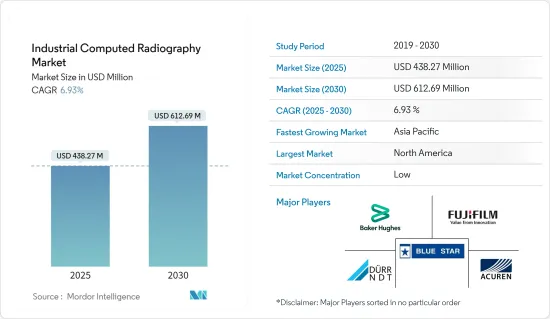

工业电脑X光照相术市场规模预计在 2025 年为 4.3827 亿美元,预计到 2030 年将达到 6.1269 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.93%。

电脑X光照相术技术为您的实验室业务带来了显着的好处,最大程度地减少了消耗品的使用,进一步减少了生成影像所需的时间。预计这些因素将增加市场采用率。

主要亮点

- 与传统 X 光胶片相比,它具有更高的动态范围,可以视觉化和分析精细的细节。此外,它还提供简化的工作流程、为操作员提供安全的工作环境以及环保、无化学製品的製程。

- 各个供应商都改进了数位 X 光扫描仪、磷光体成像板和软体程式。结果是,新产品直接满足了航太和国防、石油和天然气等产业的需求。

- 市面上各种各样的产品都使用圆柱和平板扫描器以及从 14 位元对数到 16 位元线性的软体。最小像素尺寸范围为 12.5-25、25-35、35-70 和 70-100 像素,从而显着提高了固有空间解析度、讯号杂讯比值和灰阶值,以满足许多当前标准。这些对检测材料缺陷的机会有很大影响。

- 目前的 CR 扫描仪和磷光体成像板可以以 12.5 至 25 之间的分辨率进行扫描(相当于射线胶片的 D4/IX50)。这些满足 2% 或更好的X光相片灵敏度的规定灵敏度标准,大大增加了检测到缺陷的可能性。

- 然而,高昂的安装成本和进一步的技术改进可能会扰乱市场。

- 根据印度国家统计局和统计和计划部(MOSPI)发布的2020-21年第一季国内生产总值(GDP)数据,新冠疫情对建设业、製造业和采矿业附加价值毛额的影响分别为-12.6%、-9.4%和-12.4%。因此,这些行业成长放缓预计会在短期内导致市场成长停滞并影响市场成长。

工业电脑X光照相术的市场趋势

无损检测可望推动市场成长

- 电脑X光照相术是工业中用于验证製造的零件和组件的安全性和完整性的一种无损检测 (NDT)。例如,石油和天然气作业需要无损检测来确保所有关键部件均符合运作中。用于输送石油和天然气的管道是需要适当维护和检查的重要零件。因此,工业对无损检测的需求不断增长,也导致电脑X光照相术技术在工业应用中的应用不断增加。

- 此外,随着工业製造和基础设施领域的自动化程度提高,对裂缝、孔隙率、製造故障等缺陷检测的需求显着增加。

- 此外,美国机械工程师学会 (ASME) 和国际标准化组织 (ISO) 等一些政府和区域组织也制定了严格的措施来确保设备安全并监督工程服务测试。因此,各行各业对无损检测的需求日益增加。

- 此外,电脑X光照相术在航太的应用包括检测厚的、复杂几何形状、金属和非金属特征的内部缺陷,以及关键航太零件、结构和组装的品质。此外,对安全标准的日益重视、更短的服务间隔、低排放目标、新材料和新製程是推动航太电脑X射线检测市场的主要因素。

北美可望主导市场

- 由于电脑X光照相术的日益普及和技术进步,北美预计将主导全球电脑X光照相术市场。FUJIFILM和西门子医疗等主要企业也占有重要地位。

- 2021年9月,福特和SK Innovation宣布计划在美国投资114亿美元,创造约11,000个新工作。三家新的 BlueOval SK 电池工厂(两家位于肯塔基州,总合位于田纳西州)将使福特在美国拥有 129 千兆瓦时的年生产能力。

- 2021 年 2 月,总统拜登表示国内半导体製造业是其政府的优先事项。新政府准备解决日益严重的晶片短缺问题,并消除立法者对外包晶片製造使美国更容易受到供应链中断影响的担忧。拜登启动了为期100天的审查计划,旨在透过额外的政府援助和新政策来推动美国晶片公司的发展。

- 此外,北美医疗保健的扩张及其在医疗保健业务中的应用正在推动该地区市场的成长。

工业电脑X光照相术产业概况

在预测期内,市场研究中竞争公司之间的竞争将非常激烈。随着放射线摄影市场的发展,预计供应商和最终用户将转向新技术。因此,现有参与者正在创新其产品以保住市场占有率。此外,许多公司将地域扩张视为获得市场吸引力的途径。

- 2022 年 2 月-加拿大政府宣布对加拿大半导体和光电产业进行重大投资。这项 2.4 亿加元的投资预计将巩固加拿大在光电的全球领先地位,并促进半导体的开发和製造。加拿大拥有100多家从事微晶片研发的国内外半导体公司。在复合半导体、电子机械系统(MEMS)和先进封装等领域拥有 30 多个应用实验室和 5 个商业设施。

- 2021 年 3 月-英特尔将在亚利桑那州开设另外两家製造工厂(晶圆厂)。这项消息发布之际,全球晶片短缺问题正困扰着汽车、电子等多个产业,人们担心美国在半导体製造业方面落后。该代工厂准备生产一系列基于 ARM 技术的晶片,该技术用于移动设备,历史上曾与英特尔青睐的 x86 技术竞争。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

- 研究框架

- 二次调查

- 初步调查

- 资料三角测量与洞察生成

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 减少辐射暴露的需求日益增加

- 无损检测的需求日益增加

- 市场限制

- 安装成本高

第六章 市场细分

- 按应用

- 石油和天然气

- 石油化学和化学品

- 铸件

- 航太和国防

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- Durr Ndt Gmbh & Co. Kg

- Baker Hughes

- Fujifilm Corporation

- Applus Services Sa

- Rigaku Corporation

- Shawcor Ltd

- Bluestar Limited

- Virtual Media Integration

- Acuren

第八章 市场投资

第九章 市场机会与未来趋势

The Industrial Computed Radiography Market size is estimated at USD 438.27 million in 2025, and is expected to reach USD 612.69 million by 2030, at a CAGR of 6.93% during the forecast period (2025-2030).

Computed radiography technology offers enormous advantages for inspection tasks, and the use of consumables is virtually eliminated, further reducing the time to produce an image. These factors are expected to increase market adoption.

Key Highlights

- Minute details are visible and analyzable due to a higher dynamic range than a film in traditional x-ray machines. Further, it provides a simplified workflow, a safer working environment for operators, and a more environmentally-friendly chemical-free process.

- Various computed radiography vendors have improved digital radiography scanners, phosphor imaging plates, and software programs. As a result, new products have been introduced that directly meet the needs of industries such as aerospace and defense, oil and gas, etc.

- Various products on the market use cylinder or flat panel scanners with software ranging from 14-bit logarithmic to 16-bit linear. Minimum pixel sizes range from 12.5-25, 25-35, 35-70, and 70-100 pixels, resulting in significantly increased essential spatial resolution, signal-to-noise ratio values, and grey values to fulfill many of the current standards. These have a substantial impact on the likelihood of detecting faults in materials.

- Current CR scanners and phosphor imaging plates can scan resolutions of 12.5 - 25 (equal to D4/IX50 in radiography film). These fulfill the sensitivity criteria in specifications, such as 2% radiographic sensitivity or greater, and the likelihood of fault identification has increased significantly.

- However, high installation costs and further technological improvements may disrupt the market.

- As per the Gross Domestic Product (GDP) for the Q1 of 2020-21 released by the National Statistical Office and Ministry of Statistic and Program Institute (MOSPI) India, the impact of COVID-19 on the gross value-added of construction, manufacturing, and mining sector accounted for -12.6%, -9.4%, and -12.4%. Thus, the decline in the growth of these industries is expected to stall the market growth for a short period, impacting the market growth.

Industrial Computed Radiography Market Trends

Nondestructive Testing Expected to Drive the Market Growth

- Computed radiography is a sort of non-destructive testing (NDT) used in industrial settings to check the safety and integrity of manufactured components and assemblies. For example, NDT must ensure that all in-service and crucial parts are fit-for-purpose in the oil and gas business. Pipes used to transfer oil or gas are essential components to be well maintained and inspected. Hence, due to the growing demand for NDT in industries, the adoption of computed radiography techniques is also increasing in industrial applications.

- Also, with the increase in automation in the industrial manufacturing and infrastructure sectors, there has been a substantial hike in demand for flaw detection related to cracks, porosity, manufacturing disorders, and so on.

- Moreover, several governmental agencies and regional bodies, like the American Society of Mechanical Engineers (ASME) and the International Organization for Standardization (ISO), have instituted to take stringent measures to ensure the safety of instruments and oversee engineering services testing. Hence, the demand for non-destructive testing is increasing across industries.

- Also, computed radiography applications in aerospace include detecting internal defects in thick and complex shapes, metallic and non-metallic forms, and the quality of critical aerospace components, structures, and assemblies. Further, increasing emphasis on safety standards, decreasing service intervals, low emission targets, and new materials and processes are the major factors driving the computed radiography market in the aerospace segment.

North America Expected to Dominate the Market

- North America is expected to dominate the global computed radiography market due to the increasing adoption of added radiography equipment coupled with technological advancements in the region. Key players like Fujifilm Corporation and Siemens Healthcare also have a strong presence.

- In September 2021, Ford and SK Innovation announced a plan to invest USD11.4 billion and create nearly 11,000 new jobs in the United States. Three new BlueOval SK battery plants, two in Kentucky and one in Tennessee enable 129-gigawatt hours a year of US production capacity for Ford.

- In February 2021, President Joe Biden stated that domestic semiconductor manufacturing is a priority for the country's administration. The new administration is poised to fix growing chip shortages and address lawmakers' concerns that outsourcing chipmaking had made the United States more vulnerable to supply chain disruptions. In an executive action, Biden started began a 100-day review that could boost American chip companies with additional government support and new policies.

- Furthermore, the expansion of healthcare in the North American region and its application in the healthcare business boost the area's market growth.

Industrial Computed Radiography Industry Overview

The intensity of competitive rivalry in the market studied is high during the forecast period. With the technological developments in the radiography market, the vendors and end-users are expected to shift towards the new technology. Hence, the existing players are innovating their products to maintain their market share. Also, many companies view geographical expansion as a path to gaining market traction.

- February 2022 - The Government of Canada announced a significant investment in the Canadian semiconductor and photonics industries. The investment of CAD 240 million is expected to help solidify Canada's role as a global leader in photonics and may bolster the development and manufacturing of semiconductors. Over 100 domestic and international semiconductor companies are working on microchip research and development in Canada. In areas including compound semiconductors, microelectromechanical systems (MEMS), and advanced packaging, it has over 30 applied research laboratories and five commercial facilities.

- March 2021 - Intel committed to two more new fabrication plants, or fabs, in Arizona. The news comes during a global chip shortage that is snarling industries from automobiles to electronics and worries the United States is falling behind in semiconductor manufacturing. The foundry is poised to manufacture a range of chips based on ARM technology used in mobile devices and has historically competed with Intel's favored x86 technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of The Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Increasing Demand for Decreasing the Exposure to Radiation

- 5.1.2 Growing Need for Nondestructive Testing

- 5.2 Market Restraints

- 5.2.1 High Installation Costs

6 MARKET SEGMENTATION

- 6.1 By Applications

- 6.1.1 Oil and Gas

- 6.1.2 Petrochemical and Chemical

- 6.1.3 Foundries

- 6.1.4 Aerospace and Defense

- 6.1.5 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Durr Ndt Gmbh & Co. Kg

- 7.1.2 Baker Hughes

- 7.1.3 Fujifilm Corporation

- 7.1.4 Applus Services Sa

- 7.1.5 Rigaku Corporation

- 7.1.6 Shawcor Ltd

- 7.1.7 Bluestar Limited

- 7.1.8 Virtual Media Integration

- 7.1.9 Acuren