|

市场调查报告书

商品编码

1687932

光纤测试设备 (FOTE):市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Fiber Optic Test Equipment (FOTE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

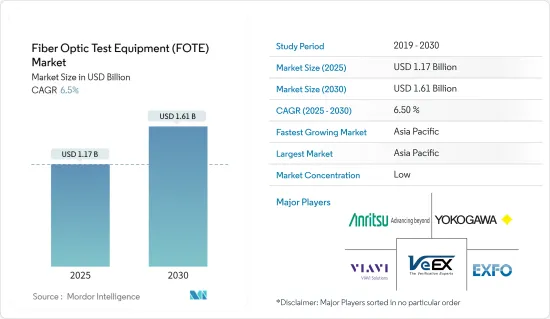

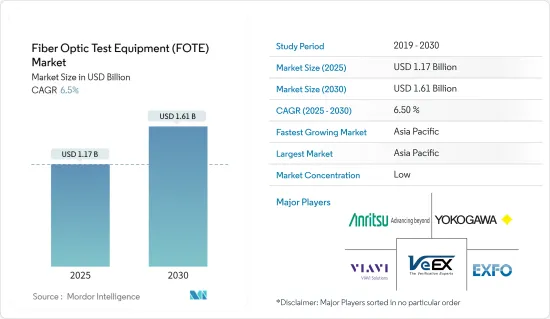

光纤测试仪器市场规模预计在 2025 年将达到 11.7 亿美元,预计到 2030 年将达到 16.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.5%。

光纤测试设备透过光纤电缆检测讯号遗失或变化。当讯号通过光纤传输时,讯号遗失是不可避免的。由于输出讯号和输入讯号之间的耦合,可能会发生一些传输损失。光纤测试设备 (FOTE) 对于表征和测量光的物理特性(光纤网路的关键特性)非常有用。

主要亮点

- 随着线上交易和虚拟会议的增加,企业需要 5G 和光纤电缆来保持竞争力。这些电缆是许多工业应用的经济高效、方便且简单的解决方案,包括照明和装饰、资料传输、手术和机器检查。在家工作和混合劳动力的增加推动了美国和欧洲对 FTTH 的需求,进一步刺激了研究市场的发展。

- 5G基地台建置需要大量优质光缆。超密度网路(UDN)的发展导致光纤电缆的需求激增。 5G过渡所需的光纤电缆总量将是4G基础设施的两倍以上。其他变化也将需要大量的光纤线路。

- 此外,光纤电缆主要用于医疗保健、生物医学研究和显微镜检查。在内视镜检查中,与非侵入性手术一样,光纤通讯至关重要。此手术使用小型明亮的光线照亮体内的手术部位,从而减少切口数量并缩小切口尺寸。光纤电缆也可用作成像工具、光导和手术雷射。

- 光纤测试仪器市场预计将随着光纤电缆网路的增加而成长。为了确保服务成功,即时操作的需求不断增加,需要持续测试频宽和插入损耗。由于这种需求,光纤测量仪器市场预计将大幅成长。

- 各种资料中心供应商都在不断投资新的资料中心,以满足对资料永不满足的需求。根据印度国家软体和服务公司协会(NASSCOM)预测,到2025年,印度资料中心市场的投资额将达到46亿美元。无论是进入市场还是经营,成本效益都是印度资料中心相较于成熟市场的最大优势。目前,资料中心主要位于孟买、班加罗尔、清奈、德里(NCR)、海得拉巴和普纳。加尔各答、喀拉拉邦和艾哈默德巴德被计划作为未来的资料中心所在地。资料中心市场不断增长的投资正在推动印度对光纤测试设备的需求。

光纤测试设备 (FOTE) 市场趋势

通讯业务显着成长

- 光纤连接彻底改变了通讯领域。该公司在资料网路领域也占有重要地位。如今,透过光纤电缆进行的光纤通讯使得建立相当远距的通讯线路成为可能。光纤通讯由于传输量和介质损耗水平明显较低,因此可以实现更快的资料通讯。由于这些优势,光纤通讯系统被广泛应用于从关键通讯基础设施到乙太网路系统、宽频分布和通用资料网路。

- 新兴大都市对于连接和网路存取的需求不断增长,积极推动了市场成长。对更高互联网速度和更好连接性的日益增长的需求最终需要强大而高效的光纤测试设备,光学技术可以满足这一需求,从而积极推动市场成长。

- 5G连接的迫切性和光纤网路的快速扩张也推动了光纤测试仪器市场的发展。例如,爱立信预计未来几年将快速成长,到 2028 年 5G 用户数预计将达到约 47 亿。

- 此外,随着供应商寻求将高速网路直接引入家庭和企业,光纤到户的部署也变得越来越普遍。光纤测试设备对于确保这些最后一哩连接的品质和可靠性至关重要。

亚太地区实现强劲成长

- 由于拥有庞大的光纤电缆生态系统,预计中国仍将是亚太地区光纤测试仪器的主要市场之一。例如,该国拥有多元化的光纤电缆製造商基础。此外,各国政府正在见证数位基础设施投资的显着成长,由于光纤电缆构成数位基础设施的核心,这为研究市场创造了机会。

- 中国的技术援助努力还包括「一带一路」倡议,这是一项国际基础设施大型企划,旨在透过与 60 多个国家达成的基础设施协议,将全球经济重新定位到北京。预计「一带一路」倡议最重要的元素是「数位丝路」(DSR)。中国将打造从巴基斯坦到非洲和欧洲的数位丝绸之路。在华为等公司的主导下,数位丝路计画致力于透过光纤电缆和5G通讯等不断发展的技术连接全球经济,改变我们的世界和网路。

- 日本凭藉其完善的光纤网路生态系统,其光纤测试设备市场具有强劲的成长潜力。此外,随着数位技术的普及改变了频宽需求,对更高网路频宽的需求不断增长也推动了日本光纤电缆市场的发展。例如,根据政府最近的一项促进数位化的政策,政府的目标是到 2028 年将高速光纤网路扩展到约 99.9% 的家庭。

- 政府还计划在 2030 年将下一代 5G 无线网路的覆盖范围扩大到 99% 的人口,并在 2025 财年末完成环绕日本的海底电缆铺设。因此,在预测期内,这种趋势可能会为所研究的市场带来充足的机会。

光纤测试设备 (FOTE) 市场概览

由于市场参与者之间的激烈竞争,光纤测试设备市场变得分散。这些公司也投入大量资金为客户提供特定应用的现场测量、监控和维护的广泛技术。此外,EXFO Inc.、安立公司、VIAVI Solutions Inc.、VeEX Inc. 和横河电机等公司也不断投资于策略伙伴关係、收购和产品开发,以占领更多的市场占有率。各公司最新动态如下:

- 2024 年 3 月,VIAVI Solutions 达成协议,向 Spirent 提出现金收购要约,但须获得 Spirent 董事会的一致核准。这种竞标称为「收购」。思博伦正在实施这项策略,将其产品扩展到现有网路中,增加经常性收益来源,并在产品系列中提供附加价值服务和解决方案。

- 2024年2月,韩国无线电频率协会(RAPA)与日本安立公司(Anritsu)于2月22日在安立总部签署了MoU。该谅解备忘录概述了双方在下一代通讯标准5G和6G方面的合作。该谅解备忘录概述了RAPA与安立公司进行多方面合作以推进B5G/6G技术的计划,包括建立测试环境以检验B5G/6G技术的候选频段FR3(7 GHz至24 GHz)和亚太赫兹(100 GHz以上),以及从PoC阶段开始的技术合作。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 的副作用和其他宏观经济因素将如何影响市场

第五章 市场动态

- 市场驱动因素

- 5G/LTE 网路普及率和固定宽频用户数成长

- 电力和公用事业管理、安全和通讯越来越多地采用光纤网路

- 市场限制

- 测试仪和光纤测量仪器高成本

- 缺乏意识和技术知识

第六章 市场细分

- 依设备类型

- 光源

- 光功率损耗仪

- 光时域反射仪

- 频谱仪

- 远端光纤测试系统

- 其他设备

- 按最终用户应用

- 通讯

- 资料中心

- 产业

- 其他最终用户应用程式

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- EXFO Inc.

- Anritsu Corporation

- VIAVI Solutions Inc.

- VeEX Inc.

- Yokogawa Electric Corporation

- Kingfisher International

- AFL Global

- Fluke Networks

- Pelorus Technologies Pvt. Ltd

- Deviser Instruments

- Terahertz Technologies Inc.(Trends Networks)

- AMS Technologies Ag

第八章投资分析

第九章:市场的未来

The Fiber Optic Test Equipment Market size is estimated at USD 1.17 billion in 2025, and is expected to reach USD 1.61 billion by 2030, at a CAGR of 6.5% during the forecast period (2025-2030).

Fiber optic test equipment detects signal loss or changes through a fiber optic cable. When a signal is delivered across optical fibers, signal loss is unavoidable. As a result of the coupling of output and input signals, there may be some transmission losses. Fiber Optic Test Equipment (FOTE) is extremely useful for characterizing and measuring the physical properties of light, which is a critical feature of fiber optic networks.

Key Highlights

- With growing online transactions and virtual meetings, companies need 5G and optic fiber cable to stay competitive. These cables are cost-effective, convenient, and easy solutions for many industrial applications, such as lighting and decorations, data transmission, surgeries, and mechanical inspections. The growing work-from-home or hybrid work model drives the demand for FTTH across the United States and Europe, further driving the studied market.

- Fiber optic cables of high quality and quantity are required to build 5G base stations. The development of UDN, or ultra-dense networks, has sparked a surge in demand for fiber optic cables. The total number of fiber optic cables required for the 5G transition is more than double that of the 4G infrastructure. Other changes will necessitate a large number of Fiber optic lines.

- Moreover, Fiber optic cables are primarily employed in medicine, biomedical research, and microscopy. Optical communication is essential in endoscopy, as it is in non-invasive surgery. A small bright light is utilized in this procedure to light up the operation area inside the human body, allowing the number and size of incisions to be reduced. Fiber optic cable is also utilized as an imaging tool, a light guide, and a laser for surgical assistance.

- The fiber optic test equipment market is predicted to increase in response to the growing number of fiber cable networks. To deliver successful services, the increased need for real-time operations necessitates continual testing of bandwidth and insertion loss. As a result of this need, the fiber optic test equipment market is predicted to grow significantly.

- Various data center vendors are consistently investing in new data centers in line with the insatiable need for data. According to the National Association of Software and Service Companies (NASSCOM), India's data center market investment is expected to reach USD 4.6 billion in 2025. India's higher cost efficiency in both development and operation is its most significant advantage compared to more mature markets. Currently, India's data centers are primarily located in Mumbai, Bengaluru, Chennai, Delhi (NCR), Hyderabad, and Pune. Calcutta, Kerala, and Ahmedabad are the upcoming data center hubs. These growing data center market investments drive the demand for fiber optic test equipment in India.

Fiber Optic Test Equipment (FOTE) Market Trends

Telecommunications to Witness Significant Growth

- Fiber optic connections have transformed the telecommunications sector. It has also established a strong presence in the data networking field. Optical communications through fiber optic cable have enabled telecommunications lines to be established over considerably greater distances. With the significantly lower transmission and medium loss levels, fiber optical communications have enabled far higher data speeds to be accommodated. As a result of these advantages, Fiber optic communications systems are widely used for applications ranging from significant telecommunications infrastructure to Ethernet systems, broadband distribution, and general data networking.

- Growing demand for connectivity and internet access among the rising metropolitan cities positively drives the market's growth. The growing need for higher internet speed and better connectivity eventually requires strong and efficient fiber optic test equipment, which optical technology fulfills, thereby positively driving the market's growth.

- The market for fiber optic test equipment is also driven by the emergency of 5G connectivity and the rapid expansion of fiber optic networks. For instance, According to Ericsson, rapid growth is expected over the coming years, with the number of 5G subscriptions forecast to reach almost 4.7 billion by 2028

- Additionally, fiber-to-the-home deployments are becoming more common as providers seek to deliver high-speed internet directly to homes and businesses. Fiber test equipment is essential for ensuring the quality and reliability of these last-mile connections.

Asia Pacific to Register Major Growth

- China is anticipated to remain among the major markets for fiber optic test equipment in the Asia Pacific region, owing to the presence of a large ecosystem for optical fiber cables. For instance, the country has a diversified base of fiber optical cable manufacturers. Furthermore, the government is also witnessing a notable growth in digital infrastructure investment, creating opportunities in the market studied as optical fiber cables form the core of digital infrastructure.

- China's technological outreach also incorporates its international infrastructure mega-project, the Belt and Road Initiative (BRI), which aims to reorient the global economy toward Beijing through infrastructure deals with over 60 countries. BRI's most consequential component is expected to be the Digital Silk Road (DSR). China builds the Digital Silk Road from Pakistan to Africa and Europe. Directed by companies like Huawei, the DSR seeks to connect the global economy through evolving technologies transforming global networks, such as fiber-optic cables and 5G-supported communications.

- Japan holds significant growth potential for the fiber optic test equipment market as the country houses an established ecosystem for fiber optic networks. Furthermore, the growing demand for increased network bandwidth is also driving the Japanese optical fiber cable market with the proliferation of digital technologies that shift the bandwidth requirements. For instance, according to the recent government policy promoting digitization, the government aims to expand the high-speed fiber-optic networks to about 99.9% of households by 2028.

- Furthermore, the government aims to expand the coverage of next-generation 5G wireless networks to 99% of the population by 2030 and complete seabed cables surrounding Japan by the end of fiscal year 2025. Hence, such trends will drive ample opportunities in the market studied during the forecast period.

Fiber Optic Test Equipment (FOTE) Market Overview

The fiber optics test equipment market is fragmented due to the high competitive rivalry among the market players. Also, these companies are extensively investing in offering customers a wide range of technologies for application-specific field measurement, monitoring, and maintenance. Moreover, companies such as EXFO Inc., Anritsu Corporation, VIAVI Solutions Inc., VeEX Inc.Yokogawa Electric Corporation continuously invest in strategic partnerships, acquisitions, and product development to gain more market share. Some of the recent actions by the companies are listed below.

- In March 2024, VIAVI Solutions entered into an agreement on terms of a cash tender for Spirent, subject to the unanimous approval of Spirent's Board. The tender is known as the 'Acquisition'. Spirent is implementing this strategy to expand its products into live networks, grow recurring revenue streams, and deliver value-added services and solutions across its product portfolio.

- In February 2024, Korea's Radio Frequency Association (RAPA) and Japan's Anritsu Corp. (Anritsu) signed an MoU on February 22, 2024, at Anritsu's Headquarters. The MoU outlines their collaboration on B5G and 6G, the next generation of communication standards. The MoU outlines RAPA's plan to collaborate with Anritsu in multiple areas to promote the development of B5G / 6G technologies, including setting up a test environment to validate candidate frequency bands for the B5G / B6G technologies, namely FR3 (7GHz to 24GHz) and sub-THz (100GHz and above) and technical cooperation from the PoC stage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Penetration of 5G/LTE Networks and Fixed Broadband Subscription

- 5.1.2 Growing Adoption of fiber optic networks for power and utility management, Security, and Communication

- 5.2 Market Restraints

- 5.2.1 High Cost of Testers and Fiber Optic Test Equipment

- 5.2.2 Lack of Awareness and Technical Knowledge

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Optical Light Sources

- 6.1.2 Optical Power and Loss Meters

- 6.1.3 Optical Time Domain Reflectometer

- 6.1.4 Optical Spectrum Analyzers

- 6.1.5 Remote Fiber Test System

- 6.1.6 Other Equipment Types

- 6.2 By End-user Application

- 6.2.1 Telecommunications

- 6.2.2 Data Centers

- 6.2.3 Industries

- 6.2.4 Other End-user Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.5.3 Mexico

- 6.3.6 Middle East and Africa

- 6.3.6.1 United Arab Emirates

- 6.3.6.2 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 EXFO Inc.

- 7.1.2 Anritsu Corporation

- 7.1.3 VIAVI Solutions Inc.

- 7.1.4 VeEX Inc.

- 7.1.5 Yokogawa Electric Corporation

- 7.1.6 Kingfisher International

- 7.1.7 AFL Global

- 7.1.8 Fluke Networks

- 7.1.9 Pelorus Technologies Pvt. Ltd

- 7.1.10 Deviser Instruments

- 7.1.11 Terahertz Technologies Inc. (Trends Networks)

- 7.1.12 AMS Technologies Ag