|

市场调查报告书

商品编码

1687934

印度金属加工:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)India Metal Fabrication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

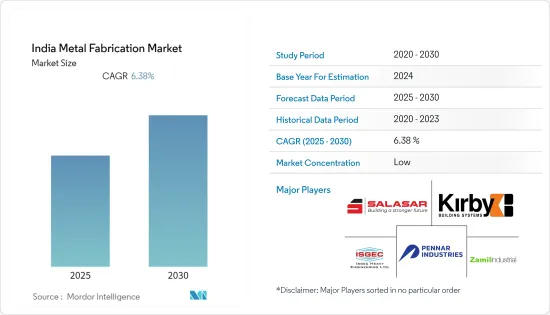

预计印度金属加工市场在预测期内的复合年增长率将达到 6.38%

关键亮点

- 随着印度经济的成长和市场的发展,印度的金属製造市场正在蓬勃发展。随着政府雄心勃勃的基础设施发展计划,印度对金属製品的需求预计将进一步增加。

- 全国各地有许多钢铁加工企业。其中大部分位于孟买和加尔各答,其余位于清奈。印度的钢铁工业高度分散。众多中小企业在钢材加工市场经营。 JSW Steel 是印度最大的钢铁加工商,其次是塔塔钢铁和 SAIL。

- 印度钢铁加工市场进入门槛低,竞争激烈。钢铁製造商面临国内外参与企业的竞争。它还面临来自其他行业的竞争,例如铝和混凝土,它们可以在某些应用中取代钢铁。

- 目前印度钢骨製造市场的规模约为 120 亿印度卢比(1,448 万美元),并且以 15-20% 的成长率扩张。钢骨製造市场的成长主要归因于印度不断增长的基础设施开发和建设活动。印度有5000多家钢铁加工企业,其中大部分是中小型企业。该行业僱用了 1,000 多名员工,并且与钢铁业有着紧密的后向联繫。

- 为了在这个竞争激烈的市场中生存和发展,钢铁製造商提供满足客户需求的创新产品和服务。此外,为了保持成本竞争力,我们必须采用高效率的製造流程并投资于最新技术。

- 印度各行业对商品和服务的需求不断增长,全球製造商纷纷在中国和印度等国家设立低成本工厂,实现生产多元化,预计将推动印度製造业的发展,并刺激金属製造业的发展,助力该国的基础设施计划。

- 预计在预测期内,金属和製造业的扩张、汽车和航太领域的成长以及研发支出的增加将推动印度金属加工市场的发展。由于政府的支持政策,金属加工产业也不断发展。

印度金属加工市场趋势

製造业塑造市场

- 预计印度金属加工产业将受到多个产业对商品和服务需求不断增长以及全球製造公司寻求透过在中国和印度等国家建立低成本工厂实现生产多元化的推动。预计到2025年,印度製造业规模将成长1兆美元,是目前的六倍。印度製造业的成长可能会导致该国製造设施的增加,从而增加市场需求。

- 在优先产业成长和有利的大战略的推动下,印度製造业正在向新的地区和市场领域扩张。凭藉熟练劳动力和低人事费用的优势,製造业也受益于活性化的资本投资和併购併购,从而提高了製造业产出并增加了出口贡献。

- 印度大规模电子製造业的 PLI 计划已公布。该计划的目标是吸引对行动电话製造和特定电子元件(包括组装、测试、标记和包装(ATMP))的大规模投资。印度电子系统设计与製造 (ESDM) 产业得到了「印度製造」、「数位印度」和「创业印度」等多项措施的支持,以促进印度电子系统设计和製造业的发展。

印度基础建设活动推动市场

- 印度预计到2047年将成为已开发国家。但要实现这一目标,我们需要发展基础设施。基础设施是适应气候并支持经济成长的城市生活、工作和居住的基础。为此,政府在2024年预算中将GDP的3.3%拨给基础建设领域,特别关注交通运输和物流。

- 其中,公路和高速公路占比最大,其次是铁路和城市公共交通。政府在交通运输领域设定了雄心勃勃的目标,包括到 2025 年建成 2,000 公里的国家公路网,到 2030 年将机场数量增加到 220 个。

- 2030年,将开闢23条水道,开发35个多式联运物流园区(MMLP)。基础建设相关部会和机构的总预算从上年度(FY23)的约3.7亿印度卢比增加到FY24的约5亿印度卢比。

- 交通运输部门正准备应对永续性的挑战,私部门也准备利用有利的政策环境来刺激基础设施投资。公私合作模式在私营部门参与基础设施建设方面发挥关键作用,尤其是在印度各地的机场、港口、高速公路和物流园区的建设。

- 印度要实现2025年成为5兆美元经济体的目标,除了中央和各邦透过各种计画提供支持外,还需要公私合作的强力推动。因此,印度的基础设施发展活动可能会对金属加工产业产生重大影响。高速公路、桥樑、铁路、机场、港口和城市发展等基础建设计划对各种金属製品和结构的需求日益增长。

印度金属加工产业概况

印度金属製造市场较为分散,由众多中小企业和 EPC 企业组成。受调查市场中的大多数大型製造商主要是 EPC 公司,为结构钢製造和製程设备加工服务提供端到端解决方案。在结构钢领域,市场上的製造商正专注于透过预製建筑扩大产品系列为客户提供工程解决方案。

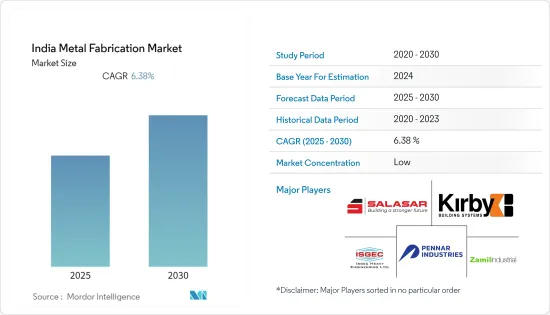

建筑业的成长和对预製建筑的偏好预计将进一步加剧市场竞争。 Salasar Techno Engineering Ltd、Kirby Building Systems、Zamil Industrial Investment Co.、Pennar Group 和 ISGEC Heavy Engineering Ltd 是印度金属製造市场的一些领先企业。其他主要企业包括 Godrej Process Equipment、TEMA India、Larsen & Toubro Ltd、Diamond Group、Novatech Projects (India) Private Limited、SKV Engineering India Pvt.Ltd 和 Karamtara Engineering Pvt.Ltd。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 金属製品需求的不断增长推动了市场

- 市场驱动的技术进步

- 市场限制

- 原物料价格波动是市场的一个限制因素

- 技术纯熟劳工短缺是市场的一个限制因素

- 市场机会

- 航太业的扩张推动市场

- 电动车日益普及

- 印度金属加工市场的技术进步

- 印度金属加工市场的政府法规和关键倡议

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链分析

- COVID-19对市场的影响

第五章市场区隔

- 按最终用户产业

- 製造业

- 电力和公共产业

- 建造

- 石油和天然气

- 其他的

- 按材质

- 钢

- 铝

- 其他的

- 按服务类型

- 铸件

- 锻造

- 加工

- 焊接和管材

- 其他的

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Salasar Techno Engineering Ltd

- Kirby Building Systems

- Zamil Industrial Investment Co.

- Pennar Group

- ISGEC Heavy Engineering Ltd

- Godrej Process Equipment

- TEMA India

- Larsen & Toubro Ltd

- Diamond Group

- Novatech Projects (India) Private Limited

- SKV Engineering India Pvt. LTD

- Karamtara Engineering Pvt. Ltd*

- 其他公司

第七章:市场的未来

第 8 章 附录

The India Metal Fabrication Market is expected to register a CAGR of 6.38% during the forecast period.

Key Highlights

- The Indian metal fabrication market is growing at a fast pace as the country's economic growth and infrastructure development are on the rise. The demand for metal-fabricated products in India is expected to increase further due to the government's ambitious plans for infrastructure development.

- There are many steel fabricators across the country. Most of them are located in Mumbai and Kolkata, while the rest are located in Chennai. The steel fabricators industry in India is highly fragmented. Many SMEs are operating in the steel fabricators market. JSW Steel is the largest steel fabricator in India, followed by Tata Steel and SAIL.

- In the Indian steel fabrication market, the entry barriers are low, and the competition is very high. Steel fabricators face a lot of competition from both domestic and foreign players. In addition, they also face competition from other industries like aluminum and concrete, which can replace steel in some applications.

- The Indian steel fabrication market is currently valued at around INR 1,200 crore (USD 14.48 million) and is expanding at a growth rate of 15% to 20%. The growth of the steel fabrication market is largely attributed to the growth of infrastructure development and construction activity in India. In India, there are more than 5,000 steel fabricators, the majority of which are SMEs. The industry employs more than 1 lakh people and has a strong backward-link relationship with the steel sector.

- In order to survive and succeed in this competitive market, steel fabricators are providing innovative products and services to meet the needs of customers. Furthermore, they must adopt efficient manufacturing processes and invest in modern technology in order to stay cost-competitive.

- The rising demand for goods and services across various sectors in India, along with the global manufacturing companies' focus on diversifying their production by setting up low-cost plants in countries like China and India, is expected to drive the Indian manufacturing sector, fueling the metal fabrication sector in the country for infrastructure projects.

- During the forecast period, the expanding metal and manufacturing industries, expanding automotive and aerospace sectors, and rising R&D expenditures are expected to drive the Indian market for metal fabrication. The metal fabrication industry is also growing because of government policies that aid the industry.

India Metal Fabrication Market Trends

Manufacturing Sector is Shaping the Market

- The Indian metal fabrication sector is expected to be driven by the rising demand for goods and services in many sectors, as well as global manufacturing companies' aim to diversify their production by setting up low-cost plants in countries like China and India. The Indian manufacturing sector is expected to register six times more growth than its current value by 2025, to USD 1 trillion. This growth in the manufacturing sector in India is likely to lead to more manufacturing facilities in the country, which is expected to increase demand in the market studied.

- Driven by growth in priority industries and favorable mega-strategies, the Indian manufacturing industry has expanded into new regions and market segments. Building on the advantages of a skilled labor force and low labor costs, the manufacturing industry is also benefitting from higher capital expenditure and increased mergers and acquisitions (M&A) activity, resulting in an increase in manufacturing output and, hence, an increase in export contribution.

- PLI scheme for large-scale electronics manufacturing in India has been notified. The aim of the scheme is to bring in large investments in mobile phone manufacturing as well as specified electronic components, including assembly, testing, marking, and packaging (ATMP). The ESDM industry in India has been supported by several initiatives, such as Make in India, Digital India, and Startup India, which have boosted the electronics system design and manufacturing industry in India.

Infrastructure Development Activities in India are Boosting the Market

- India is expected to become a developed country by 2047. However, it will do so by improving its infrastructure. Infrastructure is the foundation for living, working, and living in cities that are resilient to climate change and conducive to economic growth. To this end, the government has allocated 3.3 % of GDP in the budget year 2024 to the infrastructure sector, with a particular emphasis on transport and logistics.

- Roads and highways account for the largest share, followed by railways and urban public transport. The government has set ambitious objectives in the transport sector, such as the development of a 2-lakh-km national highway network by 2025 and increasing the number of airports to 220 by 2030.

- Twenty-three waterways will be operationalized by 2030, and 35 multi-modal logistics parks (MMLP) will be developed. The total budget of infrastructure-related Ministries increased from around INR 3.7 lakh crore in the year-earlier year (FY23) to around INR 5 lakh crore in FY24.

- The transport sector is preparing to face sustainability challenges, and the private sector is well-positioned to take advantage of the favorable policy environment to catalyze infrastructure investments. PPPs have played a crucial role in the private sector's involvement across infrastructure domains, particularly in the development of airports and ports, highways, and logistics parks across India.

- India needs a strong push from PPPs in addition to central government and state support across various schemes to reach its goal of a USD 5 trillion economy by 2025. Thus, infrastructure development activities in India can indeed have a significant impact on the metal fabrication industry. As infrastructure projects such as highways, bridges, railways, airports, ports, and urban development projects are undertaken, there is a heightened demand for various metal-fabricated products and structures.

India Metal Fabrication Industry Overview

The Indian metal fabrication market is fragmented, with the presence of many small- and medium-sized companies and EPC companies. Most large fabricators in the market studied are primarily EPC companies, which handle end-to-end solutions for structural steel fabrication and process equipment fabrication services. In structural steel, fabricators in the market are focusing on expanding their product portfolios through prefabricated buildings and providing engineering solutions to their clients.

The growing construction sector and the preference for pre-engineered buildings are expected to further increase competition within the market studied. Salasar Techno Engineering Ltd, Kirby Building Systems, Zamil Industrial Investment Co., Pennar Group, and ISGEC Heavy Engineering Ltd are some of the leading players in the Indian metal fabrication market. Some other major players in the market are Godrej Process Equipment, TEMA India, Larsen & Toubro Ltd, Diamond Group, Novatech Projects (India) Private Limited, SKV Engineering India Pvt. Ltd, and Karamtara Engineering Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS & DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Fabricated Metal Products Driving the Market

- 4.2.2 Technological Advancements Driving the Market

- 4.3 Market Restraints

- 4.3.1 Fluctuating Raw Materials Prices Hindering the Market

- 4.3.2 Lack of Skilled Labor Hindering the Market

- 4.4 Market Opportunities

- 4.4.1 Expansion of Aerospace Industry Driving the Market

- 4.4.2 Rising Adoption of EVs

- 4.5 Technological Advancements in the Indian Metal Fabrication Market

- 4.6 Government Regulations and Key Initiatives in the Indian Metal Fabrication Market

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Value Chain Analysis

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By End-user Industry

- 5.1.1 Manufacturing

- 5.1.2 Power and Utilities

- 5.1.3 Construction

- 5.1.4 Oil and Gas

- 5.1.5 Other End-user Industries

- 5.2 By Material Type

- 5.2.1 Steel

- 5.2.2 Aluminum

- 5.2.3 Other Material Types

- 5.3 By Service Type

- 5.3.1 Casting

- 5.3.2 Forging

- 5.3.3 Machining

- 5.3.4 Welding and Tubing

- 5.3.5 Other Services

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Salasar Techno Engineering Ltd

- 6.2.2 Kirby Building Systems

- 6.2.3 Zamil Industrial Investment Co.

- 6.2.4 Pennar Group

- 6.2.5 ISGEC Heavy Engineering Ltd

- 6.2.6 Godrej Process Equipment

- 6.2.7 TEMA India

- 6.2.8 Larsen & Toubro Ltd

- 6.2.9 Diamond Group

- 6.2.10 Novatech Projects (India) Private Limited

- 6.2.11 SKV Engineering India Pvt. LTD

- 6.2.12 Karamtara Engineering Pvt. Ltd*

- 6.3 Other Companies