|

市场调查报告书

商品编码

1687941

资产追踪:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asset Tracking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

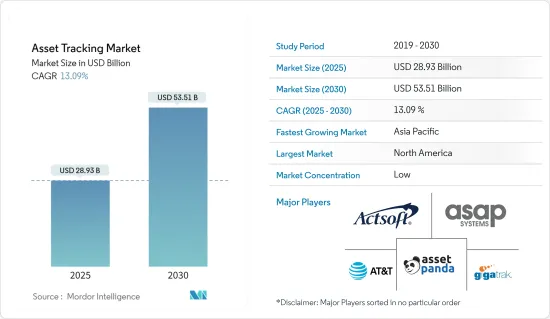

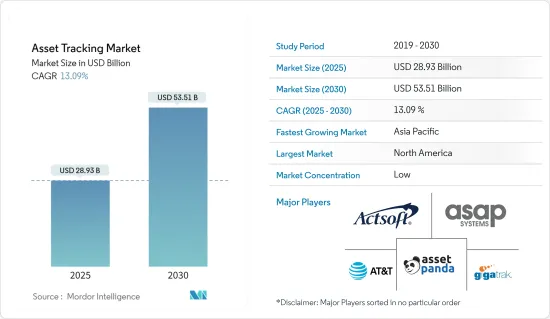

资产追踪市场规模预计在 2025 年为 289.3 亿美元,预计到 2030 年将达到 535.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.09%。

关键亮点

- 在当前製造环境和办公空间快速数位化的市场形势下,资产管理和追踪解决方案对于实现更高的业务效率至关重要。资产追踪技术以硬体形式部署,例如 GPS、RFID、BLE、QR 码和/或用于内部部署和云端部署的软体。

- 物联网技术的最新进展使得运输和物流、製造、食品和饮料以及其他领域的最终用户能够使用经济高效的资产追踪硬体。例如,在医疗保健领域,医院和其他医疗机构需要密切监视高价值医疗设备的状况,以防止盗窃并确保持续使用。医院追踪系统可以即时监控物资和设备。它为患者提供所需的护理,并有可能显着提高患者照护的标准。

- 工业 4.0 帮助工业领域数位化的早期采用者节省了新计画的时间和资源。资产追踪是数位化中最有益和最必要的方面。行动应用工具和云端基础的资产追踪和监控大大减少了定位和追踪资产所需的时间和精力。透过持续的即时定位和状况追踪以及物品评估,这些系统正在提高施工现场的效率。企业领导者需要具有适合大规模现场和业务的物联网技术功能的强大资产监控解决方案,因此他们青睐提供云端解决方案的解决方案供应商。

- 疫情过后,由于物联网在各个终端用户产业的渗透率不断提高,以及对有效追踪和管理资产的需求不断增长,市场正在经历显着增长。此外,资产追踪技术的硬体和软体都取得了重大技术进步,对疫情后资产追踪市场的成长产生了积极影响。

- 儘管高昂的初始成本限制了市场的成长,但第三方物流参与企业透过增值追踪服务不断增长的需求以及物联网设备在资产追踪中的日益普及,刺激了市场的成长。基于物联网的资产追踪正在获得发展动力,因为它利用感测器和连接的设备来远端监控和追踪资产的地理位置和移动。物联网技术也为企业(尤其是工业、运输和物流服务领域的企业)提供了巨大的成长机会,以监控资产、提高效率并实施新的经营模式。

资产追踪市场趋势

製造业成为最大的终端用户产业

- 随着工业4.0和智慧工厂的普及,製造业需要采用先进的数位技术来改善生产流程。资产追踪在各行各业被广泛采用,以追踪和监控资产的位置和状态。

- 资产监控技术广泛应用于製造工厂,以监控原材料、在製品和成品的移动和储存。即时追踪资料简化了供应链操作并最大限度地减少了缺货。

- 物联网和低功耗蓝牙 (BLE) 等先进的资产追踪技术在製造业中正在迅速普及。 BLE 标籤具有多种尺寸、形式和功能,使製造商可以轻鬆开始他们的第一个使用案例。无论是零件还是设备,资产追踪都融合了物联网 (IoT) 的进步,使用薄标籤可以在整个工厂或院子里自动追踪。这种利用物联网的先进资产追踪解决方案有望丰富製造业的资产追踪解决方案并促进市场成长。

- 同时监控多个工厂位置并获取有关流程、操作和库存的即时资讯的需求预计将推动製造业资产追踪的成长。利用物联网和工业IoT的创新资产追踪解决方案有望丰富资产追踪解决方案。物联网连接性的不断增强导致对物联网资产追踪设备的需求增加。

- 例如,根据Telenor IoT的数据,目前已部署约140亿台连网物联网设备,数量超过智慧型手机、平板电脑、个人电脑和固定电话等非物联网连接设备。预计到 2025 年,这一数字将成长到 300 亿台。这些设备在远端监控、定位和管理资产方面发挥着至关重要的作用,能够提高各行业的效率、增强安全性并优化利用率。不断扩大的物联网生态系统正在促进此类追踪设备的采用,以便更好地即时管理和监控资产。

- 预计在预测期内,向智慧工厂、工业 4.0 和製造业数位化的日益转变将为市场成长带来光明的未来。

北美占最大市场占有率

- 由于美国和加拿大等国家先进技术的采用率很高,预计北美将在资产追踪市场占据主要市场占有率。

- 加拿大和美国面临类似的供应链物流挑战,包括边境和主要港口附近的公路和铁路瓶颈。因严重天气灾害、劳动力短缺、安全中断和材料短缺而导致的工作停工凸显了裁员和规划的必要性。

- 美国和加拿大食品和饮料行业的显着增长以及先进技术的采用促进了市场增长率。食品和饮料产业对美国经济至关重要。该行业包括农业、製造业、零售业和食品服务业,约占该国 GDP 的 5% 和就业机会的 10%。根据美国经济发展委员会的报告,食品和饮料业约有 27,000 家企业,僱用了约 150 万人。

- 加拿大也将推出一个独立的供应链工作小组,与企业领导者、员工和产业专家进行磋商,为物流供应链问题提案短期和长期解决方案。通用致力于解决供应链物流挑战是加拿大和美国在运输物流长期合作的基础。此次合作的范围包括共同管理五大湖圣劳伦斯航道系统,以及实施智慧交通系统,使商用车辆能够获取即时边境延误资讯。

- 随着主要企业致力于创新资产追踪解决方案,该地区的医疗保健领域也持续成长。例如,2024 年 2 月,Geotab Inc. 推出了 Geotab GO Anywhere 资产追踪器。此硬体解决方案旨在改善企业管理和监控各行各业资产的方式,包括运输、航运、供应链、采矿、建筑和政府。

- 此类策略合作伙伴关係和产品发布旨在为物流、製造、食品和饮料等各个行业提供满足当前需求和技术的解决方案,提高采用率,并最终提高该地区的成长率。

资产追踪市场概览

资产追踪市场竞争激烈,涌现许多大型供应商和新的市场供应商。解决方案供应商正在大力投资多项研发活动,以改善现有的资产追踪解决方案并推出整合最新技术发展的新解决方案。公司将全球扩张视为占领最大市场份额的途径。市场的主要企业包括 Asset Panda LLC、ActSoft Inc.、Touma Incorporated(ASAP Systems)、AT&T Inc. 和 GigaTrak(P&T Solutions Inc.)。

- 2024 年 3 月:汇丰资产管理公司推出印度科技 Ucits ETF。该 ETF 旨在为投资者提供投资技术主导印度公司的广泛全球管道。该报告涵盖了广泛的行业,并介绍了深入参与数位技术、通讯和软体的公司。

- 2024 年 1 月:BioConnect 收购了领先的 RFID 库存和资产管理软体供应商 Silent Partner Technologies Inc.。透过此次收购,BioConnect 扩展了其尖端的可信任安全平台,以建造尖端的云端基础的智慧保险箱、储物柜、橱柜、房间和车辆,实现智慧「保管链」和任何关键资产的安全保障。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 价值链分析

- 评估宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 透过增值追踪服务增加第三方物流营运商的需求

- 物联网设备在资产追踪中的应用日益增多

- 市场限制

- 资产追踪软体的初始成本高

第六章市场区隔

- 按组件

- 硬体

- 软体

- 依实施类型

- 在云端

- 本地

- 按最终用户产业

- 运输和物流

- 航空

- 医疗保健

- 製造业

- 饮食

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

7. 消费者资产追踪市场

- 消费者资产追踪市场概览

- 按类型追踪消费者资产

- 家庭和儿童追踪

- 宠物追踪

- 消费者车辆追踪

- 其他消费者资产追踪类型

第八章竞争格局

- 公司简介

- Actsoft Inc.

- Touma Incorporated(ASAP Systems)

- Asset Panda

- AT & T Inc.

- GigaTrak(P& T Solutions Inc.)

- OnAsset Intelligence Inc.

- Fleet Complete

- Oracle Corporation

- Spireon Inc.

- Trimble Inc.

- Zebra Technologies Corporation

- Verizon Communications Inc.

- Ubisense Limited

- TIVE

第九章投资分析

第十章 市场机会与未来趋势

The Asset Tracking Market size is estimated at USD 28.93 billion in 2025, and is expected to reach USD 53.51 billion by 2030, at a CAGR of 13.09% during the forecast period (2025-2030).

Key Highlights

- Asset management and tracking solutions are essential to achieve greater operational efficiencies in the current market scenario of rapid digitalization in manufacturing environments and office spaces. The asset tracking technology is deployed as hardware, including GPS, RFID, BLE, QR codes, and software for on-premises and cloud deployment.

- Recent advancements in IoT technology have enabled several end users, such as transportation and logistics, manufacturing, and food and beverage, to acquire economical and efficient asset-tracking hardware. For instance, in the healthcare segment, hospitals and other healthcare facilities must closely monitor the status of medical equipment due to its high cost to deter theft and ensure ongoing accessibility. The hospital tracking system enables real-time monitoring of supplies and equipment. It may give patients the care they need and significantly raise the standard of patient care.

- Industry 4.0 has aided early digitalization adopters in the industrial segment by saving time and resources on new projects. Asset tracking is the most beneficial and necessary aspect of this digitization. Mobile application tools and cloud-based asset tracking and monitoring significantly reduce the time and effort required to find and track assets. With continuous, real-time location and condition tracking and commodity evaluation, these systems improve efficiency at building sites. Corporate leaders prefer solution providers that offer cloud solutions as they require a robust asset monitoring solution with the proper IoT technology ability for large sites and operations.

- Post-pandemic, the market is witnessing considerable growth driven by the proliferation of IoT in various end-user industries, coupled with the growing demand to track and manage assets effectively. In addition, the market has witnessed substantial technological advancements in hardware and software in asset-tracking technology, positively impacting the growth of the asset-tracking market post-pandemic.

- Although the high initial costs are restraining the market growth, it is stimulated by the rising demand from third-party logistics players through value-added tracking services and the growing adoption of IoT devices for asset tracking. IoT-based asset tracking is gaining substantial traction as it leverages sensors and connected devices to remotely monitor and track an asset's geo position and movements. Also, IoT technology offers significant growth opportunities for monitoring assets, achieving efficiency gains, and implementing new business models for companies, notably in the industrial, transport, and logistics services.

Asset Tracking Market Trends

Manufacturing to be the Largest End-user Industry

- With the growing popularity of Industry 4.0 and smart factories, it has become necessary for manufacturing sectors to adopt advanced digital technologies to improve manufacturing processes. Industries widely adopt asset tracking to track and monitor asset location and status.

- Asset monitoring technologies are widely used in manufacturing facilities to monitor the movement and storage of raw materials, work-in-progress, and finished goods. Due to real-time tracking data, the supply chain's operations are streamlined, and stockouts are minimized.

- Advanced asset tracking technology, such as IoT and Bluetooth Low Energy (BLE), is rapidly gaining traction in the manufacturing industry. BLE tags come in many sizes, shapes, and capabilities, making it easy for manufacturers to tackle that first use case. Whether parts or equipment, asset tracking incorporates internet of things (IoT) advancements with thin tags that may be automatically tracked throughout the factory or yard. These advanced asset-tracking solutions with IoT are expected to enrich the asset-tracking solutions in the manufacturing sector, thus increasing the market's growth.

- The need to monitor multiple plant locations simultaneously to get real-time information about the process, operations, and inventory is expected to boost the growth of asset tracking in the manufacturing sector. Innovative asset-tracking solutions with IoT and Industrial IoT are anticipated to enrich the asset-tracking solutions. The growing IoT connectivity is leading to increasing demand for IoT asset-tracking devices.

- For instance, according to Telenor IoT, there are approximately 14 billion connected IoT devices in deployment, which exceeds the number of non-IoT connected devices, such as smartphones, tablets, PCs, and fixed-line telephones. This number is expected to grow to 30 billion in 2025. These devices play a crucial role in monitoring, locating, and managing assets remotely, which can enhance efficiency, improve security, and optimize utilization across various industries. The expanding IoT ecosystem is driving the adoption of such tracking devices to better manage and monitor assets in real-time.

- The growing shift toward smart factories, Industry 4.0, and digitization of the manufacturing sector is expected to provide a promising future for the market's growth during the forecast period.

North America Holds Largest Market Share

- North America is expected to account for a significant market share of the asset tracking market, owing to the high adoption rate of advanced technologies in countries across the United States and Canada.

- Canada and the United States have suffered similar supply chain logistics challenges, such as road and rail bottlenecks near borders and key ports. Significant weather disasters, worker shortages, security interruptions, and work stoppages due to material scarcity have underscored the necessity of redundancy and planning.

- The significant growth in the food and beverage segment in the United States and Canada and the adoption of advanced technologies contribute to the market's growth rate. The food and beverage segment is vital to the US economy. The industry accounts for around 5% of the nation's GDP and 10% of employment, including agriculture, manufacturing, retail, and foodservice. The US Committee for Economic Development reports that the food and beverage segment includes nearly 27,000 businesses and employs around 1.5 million people.

- Canada is also setting up its independent Supply Chain Task Force to confer with business leaders, employees, and industry experts to develop recommendations for both immediate and long-term solutions to logistical supply chain issues. Their shared determination to address supply chain logistics issues supports long-standing cooperation in transport logistics between Canada and the United States. This partnership ranges from joint management of the Great Lakes St. Lawrence Seaway System to implementing intelligent transportation systems, which allow commercial vehicles access to real-time border delay information.

- As the healthcare segment in the region is also witnessing incremental growth, the key players are innovating asset-tacking solutions. For instance, in February 2024, Geotab Inc. launched the Geotab GO Anywhere asset tracker. This hardware solution is designed to improve how companies manage and monitor their assets across various industries, such as transportation, shipping and supply chain, mining, construction, and government.

- These strategic collaborations and product launches aim to provide various industries, such as logistics, manufacturing, and food and beverages, with solutions that meet the current demand and technologies, boost the adoption rate, and consequently result in a growth rate in the region.

Asset Tracking Market Overview

The asset tracking market is highly competitive, with many significant vendors and the emergence of new market vendors. Solution providers are heavily investing in multiple R&D activities to improve existing asset-tracking solutions and launch new solutions by integrating the latest technological developments. Companies view global expansion as a path to attracting maximum market share. Some of the key players in the market are Asset Panda LLC, ActSoft Inc., Touma Incorporated (ASAP Systems), AT&T Inc., and GigaTrak (P&T Solutions Inc.).

- March 2024: HSBC Asset Management launched the India Tech Ucits ETF. This ETF aims to give investors global access to a broad spectrum of technology-driven Indian enterprises. It encompasses a variety of sectors, showcasing companies deeply entrenched in digital technology, communication, and software-related activities.

- January 2024: BioConnect acquired Silent Partner Technologies Inc., a leading RFID Inventory and asset management software provider. This acquisition will help BioConnect expand its leading Trusted Security Platform to create the most advanced cloud-based smart safes, lockers, cabinets, rooms, and vehicles for the intelligent "chain of custody" and security assurance for any critical asset.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from Third-party Logistics Players through Value-add Tracking Services

- 5.1.2 Increasing Adoption of IoT Devices for Asset Tracking

- 5.2 Market Restraints

- 5.2.1 High Initial Cost of Asset Tracking Software

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 By Deployment Type

- 6.2.1 On-cloud

- 6.2.2 On-premise

- 6.3 By End-user Industry

- 6.3.1 Transportation and Logistics

- 6.3.2 Aviation

- 6.3.3 Healthcare

- 6.3.4 Manufacturing

- 6.3.5 Food and Beverages

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 CONSUMER ASSET TRACKING MARKET

- 7.1 Consumer Asset Tracking Market Overview

- 7.2 By Consumer Asset Tracking Type

- 7.2.1 Family and Child Tracking

- 7.2.2 Pet Tracking

- 7.2.3 Consumer Vehicle Tracking

- 7.2.4 Other Consumer Asset Tracking Types

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Actsoft Inc.

- 8.1.2 Touma Incorporated (ASAP Systems)

- 8.1.3 Asset Panda

- 8.1.4 AT & T Inc.

- 8.1.5 GigaTrak (P&T Solutions Inc.)

- 8.1.6 OnAsset Intelligence Inc.

- 8.1.7 Fleet Complete

- 8.1.8 Oracle Corporation

- 8.1.9 Spireon Inc.

- 8.1.10 Trimble Inc.

- 8.1.11 Zebra Technologies Corporation

- 8.1.12 Verizon Communications Inc.

- 8.1.13 Ubisense Limited

- 8.1.14 TIVE