|

市场调查报告书

商品编码

1689685

美国汽车零件售后市场:市场占有率分析、行业趋势和成长预测(2025-2030 年)United States Aftermarket Automotive Parts & Components - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

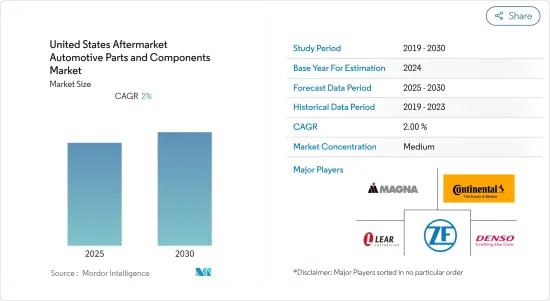

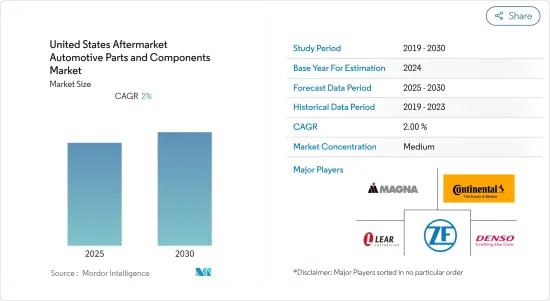

预计预测期内美国汽车售后零件市场复合年增长率将达到 2%。

由于世界各地政府封锁和旅行限制导致多处製造业停产,COVID-19 疫情对美国汽车售后市场的影响十分严重。整个汽车产业供应链中断,影响了市场上汽车零件的生产。

不过,由于汽车零件製造需求与汽车製造商的业绩直接相关,且汽车製造商是工业产品的最大购买者,因此预计市场将稳定成长。原厂替换零件的优势是推动美国汽车售后市场成长的关键因素之一。电子商务平台上汽车零件供应量的不断增加是美国售后市场的主要趋势之一。

3D列印在汽车售后市场中的兴起以及对混合动力汽车和全电动汽车的需求不断增长可能会在预测期内进一步推动市场成长。此外,二手车销量的成长可能为美国售后汽车零件市场的主要企业创造大量机会。

美国汽车售后零件市场趋势

汽车售后零件线上销售成长

由于人们的线上活动增加,预计美国售后汽车零件市场将出现乐观的成长。技术进步和物流的快速改进使製造商能够更快地交付优质产品,进一步推动市场成长。由于疫情持续,电子商务活动的成长速度将高于预期。

儘管全球受到新冠疫情的影响,但2020年汽车售后市场再次展现韧性,表现优于预期。 2021年,业界强劲復苏。预计 2021 年美国轻型汽车售后整体销售额将成长约 11.2%,达到 3,250 亿美元。一般而言,线上零件销售额的年增长率通常在 16% 左右,但在 2021 年,冠状病毒大流行导致电子商务活动激增至 30%。这包括替换零件、售后零件和配件。因此,在预测期内,疫情为市场的主要企业创造了有利的机会。

汽车零件的网路购物正在兴起。随着汽车技术的变化,越来越多的混合动力汽车汽车和电动车进入市场,推动了美国售后汽车零件市场的成长。此外,行动购物正在兴起,亚马逊和 eBay 等线上平台可能会对美国售后汽车零件线上市场产生影响。

电动车销量成长可能会影响市场

电动车市场逐年成长,影响汽车产业的成长。预计到2021年,美国插电式电动车年销量将超过17.21万辆,这意味着满足该市场需求的零件需求量很大。此外,美国是北美最大的插电式混合动力汽车製造国。中国也是此类汽车的最大市场,凯迪拉克、GMC、特斯拉和克莱斯勒等製造商都引领市场。

随着汽车产业不断向电动车转型,过去几年美国插电式电动车的销售量有所成长。传统动力传动系统车有 2,000 多个零件,而电动车的零件则少得多。例如,特斯拉透露,其动力传动系统只有 17 个运动部件,包括两个马达。由于动力传动系统是电动车的心臟,预计汽车零件製造商将从製造相关零件开始。此外,在美国汽车零件製造业就业的 59 万名员工中,估计有近 15 万名从事内燃机 (ICE) 製造业。

由于公司将其中一部分资金分配给製造电动车零件,预计这一数字在预测期内将发生变化。电源逆变器、DC-DC转换器、电池及相关组件、马达控制单元(MCU)等是公司为维持市场相关性而将长期生产的其他一些重要组件。儘管售后市场对电动车相关零配件的采用最初会比较缓慢,但随着产业正在经历模式转移,预计未来几年将大幅回升。

美国汽车售后零件产业概况

由于存在大型一级和二级零件製造商以及大量无组织的参与企业,美国售后汽车零件市场既不整合也不分散。每家公司都专注于行销自己的产品,并与当地经销商合作以增加市场占有率。该市场的主要企业包括麦格纳国际公司、大陆集团、采埃孚股份公司、电装公司和李尔公司。参与企业正在与其他主要企业合作以获取市场占有率。例如,2022 年 3 月,Meritor, Inc. 宣布与 ConMet 达成合作协议,根据该协议,Meritor, Inc. 将开发客自订拖车悬吊、煞车和轮胎空气喷射系统,并与 ConMet 的 PreSet Plus eHub 配合使用,以实现零排放冷冻拖车的生产。为了提供这种电动拖车解决方案,Meritor 正在重新设计拖车悬吊和鼓式煞车,以及专为适合 ConMet 的 eHub 而设计的主轴包装。两家公司也将继续联合评估互补的先进技术应用,以应对不断发展的电子移动市场趋势。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力模型

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 汽车模型

- 搭乘用车

- 商用车

- 应用

- 引擎零件

- 传播

- 内部的

- 外部的

- 其他的

- 分销管道

- 在线的

- 离线

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Magna International Inc.

- Continental AG

- ZF Friedrichshafen AG

- DENSO Corporation

- Robert Bosch GmbH

- Lear Corporation

- Flex-N-Gate Corporation

- Panasonic Automotive Systems Company of America

- Aisin World Corp. of America

- American Axle & Manufacturing Holdings Inc.

- Yazaki North America Inc.

- Adient PLC

- Faurecia

- Aptiv PLC

第七章 市场机会与未来趋势

The United States Aftermarket Automotive Parts & Components Market is expected to register a CAGR of 2% during the forecast period.

The impact of the COVID-19 pandemic on the US aftermarket automotive market was severe, and this can be attributed to several productions halts in the manufacturing industry due to lockdowns and travel restrictions imposed by governments across the world. The supply chain of the entire automotive industry is disrupted, impacting the production of automotive parts and components in the market.

However, the market is expected to have steady growth as demand for auto parts manufacturing is directly related to the performance of automakers, as they are the largest purchasers of industry products. The advantages of original replacement parts are one of the primary factors driving the growth of the automotive parts aftermarket in the US. The increasing availability of automotive parts on e-commerce platforms is one of the major aftermarket trends in the United States.

The emergence of 3D printing in the automotive aftermarket industry and the growing demand for hybrid and all-electric vehicles are likely to further boost the market growth during the forecast period. Furthermore, the rise in the sales of used cars is likely to create numerous opportunities for the key players operating in the US aftermarket automotive parts and components market.

USA Aftermarket Automotive Parts & Components Market Trends

Rising Online Aftermarket Automotive Parts and Components Sales

The US aftermarket automotive parts and components market is projected to have optimistic growth due to increased online activities by people. Advancement in technology, coupled with rapid improvement in logistics, has allowed manufacturers to offer high-quality goods faster and further boosts the growth of the market. E-commerce activities grow at a higher rate than the forecast rate due to the ongoing pandemic.

Despite the global COVID-19 pandemic, the automotive aftermarket once again demonstrated its resilience in 2020 with a greater-than-anticipated performance. The industry rebounded strongly in 2021. It is estimated that the overall light-duty vehicle aftermarket sales in the United States will rise around 11.2% to USD 325 billion in 2021. In general, the growth rate of online parts sales has historically been about 16% per year, but in 2021, due to the coronavirus pandemic, e-Commerce activities surged to a 30% increase. This includes replacement parts, aftermarket parts, and accessories. Thus, this pandemic has created lucrative opportunities for the major players in the market during the forecast period.

Automotive parts and components online shopping is growing. As automotive technology is changing, more hybrids and electric vehicles are entering the market, boosting the growth of the US aftermarket automotive parts and components market. In addition, mobile shopping is on the rise, and online platforms like Amazon and eBay are likely to influence the US online aftermarket automotive parts and components market.

Increasing Electric Vehicle Sales Likely to Impact Market

The market for electric vehicles is increasing year on year, impacting the growth of the automotive industry. The annual sales of plug-in electric vehicles in the United States crossed 172.1 thousand units in 2021, indicating the high demand for parts and components to cater to the needs of this market. In addition, the United States is the largest manufacturer of plug-in hybrid vehicles in the North American region. The country is also the largest market for these vehicles, with manufacturers such as Cadillac, GMC, Tesla, and Chrysler, leading the market.

With the automobile industry's continuous shift towards e-mobility, the sale of plug-in electric vehicles has been increasing in the United States for the past few years. While conventional powertrain vehicles have more than 2,000 components within them, electric vehicles have far fewer. For instance, Tesla revealed that in its drivetrain, there are only 17 moving parts, including two in the motor. Since the drivetrain is the heart of any electric vehicle, it is expected that automotive component manufacturers will first start with their associated part manufacturing. Also, it is estimated that out of the 590,000 U.S. employees engaged in auto parts manufacturing, nearly 150,000 are in component manufacturing for Internal Combustion Engines (ICE).

This number is expected to change over the forecast period as companies will dedicate some of them toward EV parts and component production. Power Inverters, DC-DC Converters, Battery & related parts, and Motor Control Units (MCU) are some of the other important parts that will also be manufactured by companies over time to stay relevant in the market. The adoption of EV-related spare parts will be slow in the after-market space initially, but with the industry seeing a paradigm shift, the rate is expected to grow considerably after some years.

USA Aftermarket Automotive Parts & Components Industry Overview

The US aftermarket automotive parts and components market is neither consolidated nor fragmented due to the presence of major tier-1 and tier-2 component manufacturers and a large number of unorganized players in the market. Companies are focusing on marketing their products and tying up with local dealers to garner more market share. Some of the major players in the market include Magna International Inc., Continental AG, ZF Friedrichshafen AG, DENSO Corporation, and Lear Corporation. Players are partnering with other key players to gain market share. For instance, in March 2022, Meritor, Inc. announced a collaboration agreement with ConMet under which Meritor will develop custom trailer suspensions and brakes, as well as tire inflation systems, to work with ConMet's PreSet Plus eHub to enable the production of zero-emissions refrigerated trailers. Meritor is redesigning its trailer suspension and drum brake, as well as a specially engineered spindle package to be compatible with ConMet's eHub, to deliver this electrified trailer solution. The companies will also continue to evaluate the application of complementary advanced technologies that address evolving e-mobility market trends in collaboration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD Billion)

- 5.1 Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 Application

- 5.2.1 Engine Components

- 5.2.2 Transmission

- 5.2.3 Interior

- 5.2.4 Exterior

- 5.2.5 Other Applications

- 5.3 Sales Channel

- 5.3.1 Online

- 5.3.2 Offline

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Magna International Inc.

- 6.2.2 Continental AG

- 6.2.3 ZF Friedrichshafen AG

- 6.2.4 DENSO Corporation

- 6.2.5 Robert Bosch GmbH

- 6.2.6 Lear Corporation

- 6.2.7 Flex-N-Gate Corporation

- 6.2.8 Panasonic Automotive Systems Company of America

- 6.2.9 Aisin World Corp. of America

- 6.2.10 American Axle & Manufacturing Holdings Inc.

- 6.2.11 Yazaki North America Inc.

- 6.2.12 Adient PLC

- 6.2.13 Faurecia

- 6.2.14 Aptiv PLC