|

市场调查报告书

商品编码

1689697

建议引擎:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Recommendation Engine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

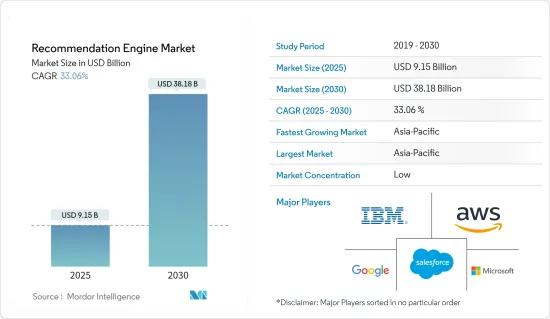

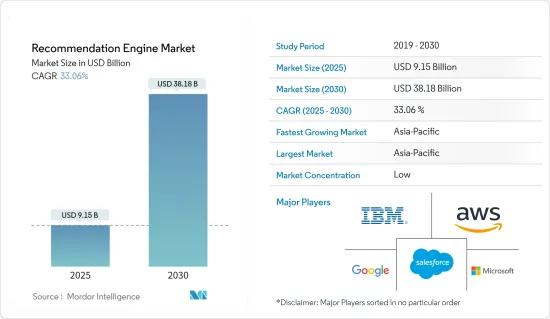

建议引擎市场规模预计在 2025 年为 91.5 亿美元,预计到 2030 年将达到 381.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 33.06%。

随着企业数量的增加和企业之间竞争的加剧,许多企业都希望将人工智慧 (AI) 等技术融入他们的应用程式、业务、分析和服务中。全球大多数组织都在进行数位转型,重点是改善客户和员工体验,而自动化解决方案可以实现这一点。

关键亮点

- 新兴国家日益数位化和电子商务市场的成长正在推动对建议引擎的需求。基于人工智慧的云端平台上机器学习模型的整合正在推动多个终端用户产业的自动化。

- 消费者通常在商店做出购买决定,这使得实体零售商更有能力了解和影响消费者的行为和偏好。然而,随着网路的普及率不断提高,以及电子商务、行动购物和智慧技术带来的新分销管道的出现,零售业正在适应新兴技术。这些技术,例如智慧 POS 解决方案和自助结帐系统亭,正在将传统的实体店转变为全通路商店。根据ZDNet报道,70%的公司已经或正在製定数位转型策略。

- 数位转型为零售商提供了吸引新客户、提高与现有客户的互动、降低营运成本和提高员工积极性的机会。这些好处对收益和利润率等产生了积极影响。预计这一正面影响将为预测期内建议引擎的采用创造重大机会。

- 由于用户偏好的变化而导致的错误标籤问题是建议引擎市场持续关注的问题。然而,开发人员正在不断努力提高建议的准确性和相关性。随着技术的进步,预计未来将出现更多有效的解决方案来应对这项挑战。

- 根据思科旗下 AppDynamics 最近发布的《转型推动者报告》,95% 的组织在 COVID-19 疫情期间改变了其技术重点,其中 88% 的组织报告称数位客户体验现在已成为其组织的优先事项。客户开始使用聊天、通讯和对话机器人等自助服务工具。因此,这些工具使企业能够提供卓越的客户经验,同时减少对社交距离店和实况活动的传统依赖,而这在社交疏离时代根本不可行。因此,随着这些公司越来越多地采用该技术,建议引擎所带来的收益预计将进一步增加。

建议引擎市场趋势

行动和网路对客製化数位商务体验的需求不断增长,推动了市场成长

- 公司正在探索能够透过提供高度个人化的客户体验为它们带来竞争对手难以复製的优势的方法和技术。这些体验使用专有资料为数百万个人客户创造更好的体验。成功取决于执行。如果做得好,个人化的客户体验可以让公司脱颖而出,赢得客户忠诚度和可持续的竞争优势。

- 顾客不再在实体店做出决定,而是在网路上,在数位货架前,使用网页浏览器或行动电话做出决定。对于零售企业来说,产品的价格、位置和促销不再只是与附近货架上的产品进行比较,而是与来自世界各地的网路零售商的替代产品进行比较。在这方面,由人工智慧和机器学习驱动的建议引擎等技术足以确保满足客户需求,确保他们的需求和您的产品保持一致,并使您领先于竞争对手一步。

- 在过去几年中,由于客户需求不断增加,许多组织的负责人越来越注重提升客户经验。例如,根据 Adobe 的说法,拥有最强大的全通路客户参与策略的公司可以实现 10% 的与前一年同期比较增长、10% 的平均订单价值的增长以及 25% 的成交率的增长。此外,拥有强大的全通路客户参与策略和消费者服务改善计画的品牌平均可以保留 89% 的客户,而全通路客户参与策略较弱的品牌则只有 33%。

- 随着管道数量的增加,科技使品牌能够在所有管道上传递一致的讯息。预计对更好的客户服务的需求不断增长将推动需求并在预测期内对市场产生积极影响。

- 总体而言,对个人化数位商务体验日益增长的需求正在推动建议引擎市场的发展。据泰雷兹集团称,在消费者资讯安全方面,银行和金融业被认为是值得信赖的。超过 40% 的全球消费者表示他们会将资料委託给数位银行和金融服务部门。医疗保健提供者是数位服务领域中第二大最受信任的行业,37% 的受访者表示该行业是最安全的行业之一。企业正在利用人工智慧技术提供有针对性的客户建议、推动销售并提高客户满意度。

亚太地区发展迅速

- 预计亚太地区将见证建议引擎市场最快的成长,其中以澳洲、印度、中国和韩国等国家为主导。

- 中国是亚太地区领先的技术采用者之一。该国拥有最快的互联网频宽,并且是阿里巴巴等强大电子商务参与企业的所在地。

- 而且中国是继美国之后全球第二大OTT市场。根据墨西哥联邦电信实验室(Instituto Federal 通讯)统计,中国每100户家庭就有68户订阅网络视频,有效提升了网络视频用户的比例。然而,围绕该行业、所使用的资料以及允许在国内传播的内容的规定非常严格。

- 中国严格的法规环境进一步巩固了三巨头(爱奇艺、腾讯和优酷)的主导地位,阻止了 FAANG(Facebook、亚马逊、苹果、Netflix 和谷歌)等国际参与企业在中国运营。这些国际参与企业大规模使用建议引擎,透过广告推动其他业务。这为该地区的国内参与企业留下了充足的机会,但与美国相比,其成长速度有所放缓。

- 此外,电子商务巨头阿里巴巴使用人工智慧和机器学习来推动建议。例如,AI·OS是阿里巴巴搜寻工程团队开发的集个人化搜寻、建议和广告于一体的线上平台。 AI·OS引擎体系支援各种业务场景,包括手机淘宝全搜寻页面、手机淘宝大促活动资讯流会场、淘宝首页商品建议、个人化建议、按类目和行业选品等。

建议引擎行业概览

建议引擎市场较为分散,主要企业包括 IBM 公司、Google有限责任公司 (Alphabet Inc.)、亚马逊网路服务公司 (Amazon.com Inc.)、微软公司和 Salesforce Inc.。该市场的参与企业正在采用联盟、合併和收购等策略来增强其产品供应并获得可持续的竞争优势。

- 2023 年 1 月-Coveo 宣布推出全新的 Coveo 商品中心。中心提供了丰富的功能,可协助您提供相关的购物旅程、建立忠诚度并提高盈利。该中心旨在帮助商家创造可转换的客製化体验。 Qubit 是一家总部位于伦敦的新兴企业,为时尚公司和零售商提供人工智慧客製化技术,于 2021 年 10 月被 Coveo 收购。

- 2022 年 10 月 - Algonomy 宣布推出适用于 Shopify 和 Commerceetools 的两个重要连接器。 Algonomy Connectors 提供了一种将网路商店与 Shopify 或 Commercetools 整合的简单方法,从而实现即时产品资料收集。连接器提供了对目录整合流程的改进控制和洞察,无需依赖外部组织或资源来定期更新目录资料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 市场影响评估

- 技术简介

- 空间意识

- 情境感知(机器学习与深度学习、自然语言处理)

- 新兴使用案例(主要使用案例跨多个最终用户利用建议引擎)

第五章市场动态

- 市场驱动因素

- 对行动和网路客製化数位商务体验的需求不断增长

- 零售商越来越多地采用管理商品行销和库存规则

- 市场限制

- 由于使用者偏好的变化导致错误标记的复杂性

第六章市场区隔

- 依实施类型

- 本地

- 云

- 按类型

- 协同过滤

- 基于内容的过滤

- 混合推荐系统

- 其他的

- 按最终用户产业

- 资讯科技/通讯

- BFSI

- 零售

- 媒体娱乐

- 医疗保健

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- IBM Corporation

- Google LLC(Alphabet Inc.)

- Amazon Web Services Inc.(Amazon.com, Inc.)

- Microsoft Corporation

- Salesforce Inc.

- Unbxd Inc.

- Oracle Corporation

- Intel Corporation

- SAP SE

- Hewlett Packard Enterprise Development LP

- Qubit Digital Ltd(COVEO)

- Algonomy Software Pvt. Ltd

- Recolize GmbH

- Adobe Inc.

- Dynamic Yield Inc.

- Kibo Commerce

- Netflix Inc.

第八章投资分析

第九章:市场的未来

The Recommendation Engine Market size is estimated at USD 9.15 billion in 2025, and is expected to reach USD 38.18 billion by 2030, at a CAGR of 33.06% during the forecast period (2025-2030).

With the growing number of enterprises and the rising competition among them, many companies are trying to integrate technologies, like artificial intelligence (AI), with their applications, businesses, analytics, and services. Most organizations globally are pursuing digital transformation, focusing on improving the experience of customers and employees, which is being leveraged by automation solutions.

Key Highlights

- The advancement of digitalization across emerging economies, coupled with the growth of the e-commerce market, has driven the demand for recommendation engines. Integrating the machine learning model across AI-based cloud platforms drives automation across multiple end-user industries.

- Consumers traditionally make purchase decisions at the store shelf, providing institutional brick-and-mortar retailers a high-power level to learn about and influence consumers' behavior and preferences. However, with the rise of internet penetration and the emergence of new sales channels through e-commerce, mobile shopping, and smart technologies, the retail industry is adapting to new and advanced technologies. These technologies, such as smart point-of-sale solutions and self-checkout kiosks, transform traditional brick-and-mortar stores into omnichannel ones. According to ZDNet, 70% of the companies either have a digital transformation strategy or are working with one.

- Digital transformation provides opportunities for retailers to acquire new customers, engage with existing customers better, reduce the cost of operations, and improve employee motivation. These benefits, among others, positively impact the revenue and margins. This positive impact will create significant opportunities for adopting recommendation engines over the forecast period.

- The challenge of incorrect labeling due to changing user preferences is an ongoing concern for the recommendation engine market. However, developers are continually working to improve the accuracy and relevance of recommendations. As technology advances, we can expect to see more effective solutions to this challenge in the future.

- According to the recent "Agents of Transformation Report" from AppDynamics, part of Cisco, technology priorities during the COVID-19 pandemic changed within 95% of organizations, and 88% reported that digital customer experience was the priority for their organization. Customers turned to self-service tools in the form of chats, messaging, and conversational bots. As a result, companies enabled these tools to deliver a great customer experience while reducing traditional dependencies on brick-and-mortar and live events, which were not feasible in a time of social distancing. This was further expected to increase the benefits achieved by recommendation engines due to the increased adoption of technologies in these companies.

Recommendation Engine Market Trends

Increasing Demand for Customization of Digital Commerce Experience Across Mobile and Web Drives the Market's Growth

- Enterprises are looking for ways and technologies to leverage the advantage that could be difficult for their competitors to imitate by providing highly personalized customer experiences. Such experiences use proprietary data to offer a better experience to millions of individual customers. The results depend on the execution. When executed well, personalized customer experience can enable businesses to differentiate themselves and gain customer loyalty and sustainable competitive advantage, which is much needed in the present scenario.

- Customers' decisions are no longer being made in a physical store but online on web browsers and mobile phones in front of the digital shelf. For the enterprises operating in the retail space, the price, place, and promotion of their products are no longer just being compared to products on neighboring shelves but to alternative products from retailers with websites worldwide. In this regard, technologies such as recommendation engines, using AI and ML, ensure customers' requirements are met and ensure that customers' needs and offerings are on the same level, enough to be one step ahead of their competitors.

- Over the years, many marketing professionals across organizations have increased their focus on enhancing customer experience due to the customers' growing demand. For instance, according to Adobe, companies with the most robust omnichannel customer engagement strategies could witness a 10% Y-o-Y growth, a 10% increase in average order value, and a 25% increase in close rates. Also, brands that adopted robust omnichannel customer engagement strategies and consumer service enhancement programs retain, on average, 89% of their customers, compared to 33% for brands with weak omnichannel customer engagement strategies.

- With a growing number of channels coming into play, technologies ensure that the brands provide a consistent message about their offerings across all channels. The growing demand for better customer service is expected to drive the demand and positively affect the market during the forecast period.

- Overall, the growing demand for personalized digital commerce experiences drives the recommendation engine market. According to Thales Group, the banking and financial sector was considered trustworthy for the security of consumers' information. Over 40% of consumers globally stated they trusted the digital banking and financial services sector with their data. Healthcare providers were the second-most trusted industry in the digital services sector, with 37% of the respondents indicating this sector as among the most secure. Businesses seek to leverage AI technology to deliver targeted customer recommendations, drive sales, and improve customer satisfaction.

Asia-Pacific to Witness the Fastest Growth

- Led by countries like Australia, India, China, and South Korea, the Asia-Pacific region is expected to witness the fastest growth in the recommendation engine market.

- China is one of the major countries in Asia-Pacific with growing technological adoption. The country is home to one of the fastest internet bands and strong e-commerce players, like Alibaba.

- Moreover, China is the second-largest OTT market in the world after the United States. According to Instituto Federal de Telecommunications (Mexico), there were 68 subscriptions per 100 homes in China, and the rate of online video users is increasing effectively. However, the country is very strict in terms of regulations surrounding the industry and the data used, as well as the content that is allowed to be circulated in the country.

- The tripartite (iQiyi, Tencent, Youku) domination is further secured by the strict regulatory environment in China, which prevents international players, such as the FAANG (Facebook, Amazon, Apple, Netflix, and Google), from operating in the country. These international players use the recommendations engine at a large scale and drive other businesses through advertising. This leaves the region ample opportunities for domestic players, thus leading to moderate growth compared to the United States.

- Furthermore, one e-commerce giant, Alibaba, uses AI and machine learning to drive its recommendations. For instance, AI OS is an online platform developed by the Alibaba search engineering team that integrates personalized search, recommendation, and advertising. The AI OS engine system supports various business scenarios, including all Taobao Mobile search pages, Taobao Mobile information flow venues for major promotion activities, product recommendations on the Taobao homepage, personalized recommendations, and product selection by category and industry.

Recommendation Engine Industry Overview

The recommendation engine market is fragmented with the presence of major players like IBM Corporation, Google LLC (Alphabet Inc.), Amazon Web Services Inc.(Amazon.com Inc.), Microsoft Corporation, and Salesforce Inc. Players in the market are adopting strategies such as partnerships, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- January 2023 - New Coveo Merchandising Hub's debut was announced by Coveo. The Hub offers a rich feature set that enables companies to deliver a highly relevant shopping journey that helps foster loyalty and boost profitability. It is designed to empower merchandisers to create tailored experiences that convert. Qubit, a London-based start-up that offers AI-powered customization technology for fashion companies and retailers, was acquired by Coveo in October 2021.

- October 2022 - Algonomy announced the availability of two significant connectors for Shopify and Commercetools, which will enable automatic and smooth data interchange between Algonomy's products and e-stores. Algonomy Connectors offer a simple method for integrating online shops with Shopify or Commercetools, enabling real-time product data collecting. Connectors give improved control and insight over the catalog integration process and remove the need for relying on external organizations and resources to update catalog data regularly.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of the Impact of COVID-19 on the Market

- 4.4 Technology Snapshot

- 4.4.1 Geospatial Aware

- 4.4.2 Context Aware (Machine Learning and Deep Learning, Natural Language Processing)

- 4.5 Emerging Use-cases (Key Use-cases Pertaining to the Utilization of Recommendation Engine Across Multiple End Users)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for the Customization of Digital Commerce Experience Across Mobile and Web

- 5.1.2 Growing Adoption by Retailers for Controlling Merchandising and Inventory Rules

- 5.2 Market Restraints

- 5.2.1 Complexity Regarding Incorrect Labeling Due to Changing User Preferences

6 MARKET SEGMENTATION

- 6.1 By Deployment Mode

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Types

- 6.2.1 Collaborative Filtering

- 6.2.2 Content-based Filtering

- 6.2.3 Hybrid Recommendation Systems

- 6.2.4 Other Types

- 6.3 By End-user Industry

- 6.3.1 IT and Telecommunication

- 6.3.2 BFSI

- 6.3.3 Retail

- 6.3.4 Media and Entertainment

- 6.3.5 Healthcare

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Google LLC (Alphabet Inc.)

- 7.1.3 Amazon Web Services Inc. (Amazon.com, Inc.)

- 7.1.4 Microsoft Corporation

- 7.1.5 Salesforce Inc.

- 7.1.6 Unbxd Inc.

- 7.1.7 Oracle Corporation

- 7.1.8 Intel Corporation

- 7.1.9 SAP SE

- 7.1.10 Hewlett Packard Enterprise Development LP

- 7.1.11 Qubit Digital Ltd (COVEO)

- 7.1.12 Algonomy Software Pvt. Ltd

- 7.1.13 Recolize GmbH

- 7.1.14 Adobe Inc.

- 7.1.15 Dynamic Yield Inc.

- 7.1.16 Kibo Commerce

- 7.1.17 Netflix Inc.