|

市场调查报告书

商品编码

1689704

智慧插头:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Smart Plug - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

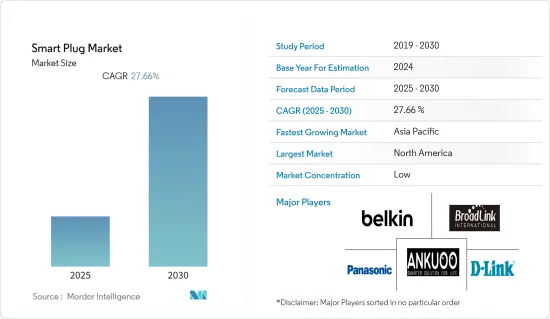

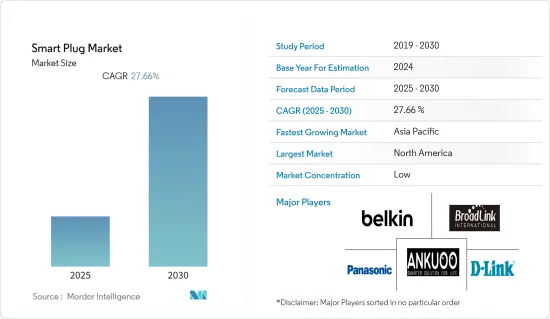

预测期内,智慧插头市场预计将以 27.66% 的复合年增长率成长。

市场扩张很大程度上归功于物联网(IoT)、智慧语音辨识等现代科技的快速应用。市场的主要驱动力是全球智慧家庭的广泛应用和物联网框架的发展。

主要亮点

- 美国、中国、印度等已开发国家及开发中国家对物联网(IoT)的接受度不断提升,协助智慧家居产业的建置。实现设备通讯的技术潜力正在促进市场需求。儘管供应链存在不一致,但疫情及其影响凸显了大幅改善网路连线和自动化招募的必要性。许多顾客在封锁期间购买了智慧家电。

- 智慧家庭设备可以实现对家庭各个元素的远端监控和控制,是一个蓬勃发展的领域,拥有主要製造商和大众采用者。在过去的两年中,随着自动化提高了智慧家庭用户的舒适度,许多技术发展增加了对智慧家电的需求。此外,节约能源对于保护环境和降低监控成本也很重要。智慧加热和冷却系统透过监控需求并进行有效管理使消费者能够节省能源。

- 智慧家电(尤其是冰箱、洗碗机、智慧电视、语音助理和微波炉)需求的显着增长推动了对基于 Wi-Fi 产品的需求,而互联网连接技术的进步则推动了智慧家庭设备市场的发展。

- 智慧插头变得越来越普遍,但也引发了安全疑虑。如果智慧插头受到威胁,使用者的安全和隐私就会受到损害。如果智慧插头用于商业或工业建筑的需量反应,那么如果受到攻击并被攻击者控制,其影响可能是严重的。智慧插头的安全问题已引起学术界和工业界的关注。

智慧插头市场趋势

物联网框架的进步有望推动市场成长

- 爱立信预计,未来两年内,预计近60%的行动电话动物联网(IoT)连接将是宽频连接,其中4G将占据大多数。随着 5G 新无线电 (NR) 在现有和新频段实施,该部分的吞吐量资料速率将显着提高。此外,大规模物联网 (Massive IoT)、NB-IoT 和 Cat-M 技术可服务于涉及大量低复杂度、低成本设备的广域使用案例,这些设备具有较长的电池寿命和低到中等的吞吐量,目前正在全球部署。

- 这些优势将使窄频物联网得到广泛的应用,从智慧电錶到智慧城市、智慧建筑基础设施控制和智慧农业。换句话说,哪里需要连接,哪里就能连结。智慧电錶是最突出的使用案例之一,智慧插头在这些应用中发挥关键作用。电錶、水錶和气表的联网是窄频技术的物联网领域。消费者不需要大量资料即可启用其电錶的物联网功能。此外,NB-IoT 的强大覆盖范围使其成为传输通常安装在地下的智慧电錶讯号的理想选择。

- 市场上许多公司正在投资产品开发,设计具有此类能源监控功能的智慧插头。 2022年11月,Smarteefi投资为其智慧开关产品线引进了一款新产品:16A WiFi智慧插头。该型号是世界上第一个具有内建手錶系统的型号,该时钟系统独立于互联网手錶週期。这为用户提供了独特的功能,例如可靠的时间表、保证的倒数计时器以及更准确的日常和即时能源监控。

- 此外,2022年10月,中国MOKO Smart推出了用于智慧家庭和能源计量产业能源管理应用的智慧插头,使客户和能源解决方案供应商受益。 MK117NB智慧插头可以远端系统管理负载开关,监控能源使用情况并降低电力消耗。其测量精度达0.5%,配备功率和能量计。

- 使用智慧型手机应用程序,您可以每小时、每天、每月甚至回顾性地监控总用电量。 MK117NB 智慧插头在许多国家都有销售,并且与多种插头类型相容。它使具有物联网功能的常见电器设备能够更深入地了解他们的能源使用情况,并将即时电力消耗量转化为准确的计费资讯。

北美引领智慧插头市场

- 北美是建筑自动化领域智慧技术的早期采用者,因为它具有使用方便、能源管理等多种应用领域,为该地区的市场供应商创造了机会。市场发展受到美国和加拿大等新兴经济体的推动。此外,包括贝尔金国际公司(Belkin International Inc.)在内的许多国际智慧家庭产品製造商都在美国开展业务。

- 该地区能源和电力领域的许多行业正在投资收购提供智慧插头产品的智慧家庭解决方案提供商,这表明北美市场的成长潜力。例如,2022年12月,NRG Energy Inc.的美国生产部门透过规划和投资28亿美元收购Vivint Smart Home Inc.,从大型电力企业发展成为零售消费者,后者提供包括智慧插头在内的多种智慧电子产品。

- 该地区的市场供应商正在与物联网平台提供商合作,加速推出智慧插头产品;具有内建高级功能和相容性的更新智慧插头可以安全地用于各种应用,从而推动市场成长。例如在加拿大,加速消费品牌数位转型的物联网(IoT)平台供应商Ayla Networks宣布,其物联网韧体将被整合到Canadian Tire的NOMA iQ智慧家居产品线中,该系列产品包括智慧照明、智慧插头和智慧空气清净器,用户可以透过一体化应用程式进行连接。

- 在这个市场中,各公司正在合作扩大其智慧家居产品阵容,其中包括智慧插头。透过这些合作,现有的传统电子公司正在利用最新的基于 Wi-Fi 的技术推出新的智慧家庭产品线,从而刺激市场成长。此外,公司正在开发各种线上和线下分销管道,以销售其产品并增加其在市场上的占有率。例如,2022 年 10 月,Roku 与智慧家庭产品公司 Wyze 合作增加了新的智慧家庭设备系列。该产品系列包括可视门铃、保全摄影机、智慧照明和智慧插头,将透过美国沃尔玛独家销售。

- 此外,2023 年 1 月,总部位于美国Alterco Robotics 的公司 Shelly 在拉斯维加斯举行的 2023 年消费性电子展上推出了多款智慧家庭自动化设备,其中包括 Shelly Plus Plug 的扩展版。该公司的这些智慧插头可供商业使用,并使用蓝牙连接和可配置的多色 LED指示器。因此,市场供应商努力在设计、功能、特性和连接性方面开发现代智慧插头以满足客户需求,从而推动市场采用并为北美供应商创造机会。

智慧插头产业概况

智慧插头市场高度分散,由几家主要企业组成。目前,只有少数几家大公司在市场市场占有率上占据主导地位。许多公司对研发计划进行大量投资,以开发创新、高品质的产品。报告中介绍的一些行业知名企业包括 Belkin International, Inc.、BroadLink Technology 和Panasonic Corporation。

TP-Link Technologies今年2月发布了亚马逊EP25P4 Kassasmart Wi-Fi插件,可与Siri和Apple HomeKit整合。此外,透过技术创新,公司优先为WLAN市场的客户、供应商和合作伙伴开发家庭和企业网路解决方案和服务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 评估新冠肺炎疫情对市场的影响

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 智慧家庭采用率显着成长

- 物联网框架的进步

- 市场限制

- 关于智慧插头和物联网的安全问题

第六章 市场细分

- 科技

- Bluetooth

- Wi-Fi

- 应用

- 产业

- 商业

- 家

- 地区

- 北美洲

- 欧洲

- 亚洲

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Belkin International Inc.

- Broadlink International

- Panasonic Holdings Corporation

- D-Link Corporation

- Ankuoo Electronics Inc.

- EDIMAX Technology Co. Ltd

- Vesync Co. Ltd(Etekcity Corporation)

- Xiaomi Inc.

- Sariana LLC(Satechi)

- Wipro Limited

- Revogi Innovation Co. Ltd

- Lenovo Group Limited

- Leviton Manufacturing Co. Inc.

- TP-Link Technologies Co. Ltd

- Shenzhen Tenda Technology Co. Ltd

第八章投资分析

第九章:市场的未来

The Smart Plug Market is expected to register a CAGR of 27.66% during the forecast period.

Market expansion was significantly impacted by the rapid adoption of contemporary technologies, including the Internet of Things (IoT), smart voice recognition, and others. The major driving factors of the market are the significant adoption of smart homes globally and the development of the IoT framework.

Key Highlights

- A rising Internet of Things (IoT) acceptance rate in developed and developing countries such as the United States, China, India, and so on has helped build the smart home industry. The potential of technologies to enable device communication has contributed to market demand. Even though there were supply chain inconsistencies, the pandemic and its effects highlighted significant improvements in internet connectivity and the need for adoption automation. Many customers made smart home appliance purchases during the lockdown.

- Smart home gadgets enable remote monitoring and control of home elements and are a booming sector with big manufacturers and mass adopters. Over the past two years, many technological developments have raised the demand for smart home appliances as automation enhances user comfort in smart homes. Further, conserving energy to protect the environment and reduce monitoring costs is critical. Smart heating and cooling systems enable consumers to conserve energy by monitoring and efficiently managing demand.

- A significant advancement in demand for smart home appliances, especially refrigerators, dishwashers, smart TVs, voice assistants, and microwave ovens, has pushed the demand for Wi-Fi-based products and technology advancements that enable Internet connectivity to power the market for smart home gadgets.

- Smart plugs are becoming increasingly common, raising security issues. Compromised smart plugs would compromise users' security and privacy. The effects of smart plugs being penetrated and under attackers' control could be severe if they are employed in commercial or industrial buildings for demand response. Smart plug security issues have garnered attention from academic and industrial groups.

Smart Plug Market Trends

Advances in IoT Framework is Expected to Drive the Market Growth

- According to Ericsson, almost 60% of cellular Internet of Things (IoT) connections are anticipated to be broadband connections by the next two years, with 4G connecting the vast majority. Throughput data rates for this segment will significantly rise as 5G New Radio (NR) is implemented in existing and new spectrums. Further, Massive IoT, NB-IoT, and Cat-M technologies, which offer wide-area use cases involving numerous low-complexity, low-cost devices with extended battery lives and low-to-medium throughput, are still being implemented globally.

- These benefits make it possible to employ Narrowband IoT in many different applications, from smart metering to smart cities and intelligent building infrastructure control to smart farming. In other words, anywhere objects need to be connected. Smart metering is one of the most prominent use cases, and smart plugs play a significant role in these applications. Electricity, water, and gas meter networking is an IoT field for narrowband technology. Consumers do not require much data to enable IoT functionality on a meter. Also, NB-IoT's robust coverage is ideal for transmitting signals from smart meters frequently installed in basements.

- Many companies in the market are investing in their product development to design smart plugs with these energy-monitoring features. In November 2022, Smarteefi invested capital in introducing a new product, the 16A WiFismart plug, to its line of smart switches. This model contains the world's first built-in clock system, allowing it to be independent of the internet clock cycle. It would give users unique features such as an assured schedule, a guaranteed countdown timer, and more accurate daily/real-time energy monitoring.

- Further, in October 2022, China-based MOKO Smart launched a smart plug for energy management applications in the smart home and energy metering industries to benefit customers and energy-solution providers. The "MK117NB Smart Plug" can remotely manage load switches, monitor energy use, and reduce power consumption. It has a measurement accuracy of 0.5% and includes a power and energy meter.

- With a smartphone app, users can monitor total energy consumption hourly, daily, monthly, and historically. The MK117NB Smart Plug can be used in many countries and supports many plug types. It makes it possible for common electrical devices to be IoT-enabled, giving users a greater understanding of their energy usage and the ability to translate real-time electricity consumption into precise billing information.

North America Leads in the Smart Plug Market

- The North American region has been an early adopter of smart technologies in building automation due to its various applications, including convenience in use and energy management, creating an opportunity for market vendors in the region. The market's growth is supported by two major developed economies in the region, including the United States and Canada. In addition, the United States is home to many international producers of smart home products, including Belkin International Inc.

- Many industries in the energy and power sector in the region are investing capital in acquiring smart home solution providers with smart plug product offerings, which shows the potential for the market's growth in North America. For instance, in December 2022, NRG Energy Inc.'s US production unit grew from a major power business to retail consumers by planning and investing USD 2.8 billion in Vivint Smart Home Inc., which provides a broad range of smart electronic products, including smart plugs.

- Market vendors in the region have been collaborating with IoT platform providers to accelerate the speed of their smart plug product launch, fueling the market's growth because, with inbuilt advanced features and compatibilities, these updated smart plugs can be utilized in various applications securely. For instance, in Canada, Ayla Networks, a company that provides Internet of Things (IoT) platforms that accelerate digital transformation for consumer brands, announced that its IoT firmware would power the line of smart home products from Canadian Tire called NOMA iQ comprising smart lighting, smart plugs, and smart air purifiers that users can connect to via an all-in-one app.

- Companies in the market are partnering to expand their smart home product offerings, including smart plugs. Established traditional electronic companies use the latest wi-fi-based technology through these partnerships and introduce new smart home product lines, fueling the market's growth. Additionally, the companies are developing various distribution channels for product sales, such as online and offline, to increase their market presence. For instance, in October 2022, Roku added a new line of smart home devices in collaboration with Wyze, a company in smart home products. The product line includes video doorbells, security cameras, smart lighting, and smart plugs and would be available exclusively through Walmart in the United States.

- In addition, in January 2023, Shelly, an Allterco Robotics US company, started several smart home automation gadgets at the 2023 Consumer Electronics Show in Las Vegas, including the extension of Shelly Plus Plugs. These smart plugs from the company would be commercialized and use Bluetooth connectivity and configurable multicolor LED indicators. This development of the latest smart plugs in terms of design, function, feature, and connectivity by the market vendor to match the customers' demand is fueling the market adoptions and creating an opportunity for the vendors in the North American region.

Smart Plug Industry Overview

The Smart Plug Market is highly fragmented and consists of several major players. Few of these major players currently dominate the market in terms of market share. Many organizations massively invest in research and developmental projects to develop innovative, high-quality products. Notable names in the industry profiled in the report are Belkin International, Inc., BroadLink Technology Co., Ltd., Panasonic Corporation, etc.

TP-Link Technologies Co. Ltd launched its EP25P4 Kassasmart Wi-Fi plug-in Amazon, which can be integrated with Siri and Apple HomeKit, in February this year. In addition, the company prioritizes developing home and business networking solutions and services for customers, providers, and partners in WLAN markets through its technological innovation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Assessment of The Impact of COVID-19 on the Market

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Substantial Growth in the Adoption of Smart Homes

- 5.1.2 Advances in IoT Framework

- 5.2 Market Restraints

- 5.2.1 Security Concerns Related to Smart Plugs and IoT

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Bluetooth

- 6.1.2 Wi-Fi

- 6.2 Application

- 6.2.1 Industrial Use

- 6.2.2 Commercial Use

- 6.2.3 Household Use

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Belkin International Inc.

- 7.1.2 Broadlink International

- 7.1.3 Panasonic Holdings Corporation

- 7.1.4 D-Link Corporation

- 7.1.5 Ankuoo Electronics Inc.

- 7.1.6 EDIMAX Technology Co. Ltd

- 7.1.7 Vesync Co. Ltd (Etekcity Corporation)

- 7.1.8 Xiaomi Inc.

- 7.1.9 Sariana LLC (Satechi)

- 7.1.10 Wipro Limited

- 7.1.11 Revogi Innovation Co. Ltd

- 7.1.12 Lenovo Group Limited

- 7.1.13 Leviton Manufacturing Co. Inc.

- 7.1.14 TP-Link Technologies Co. Ltd

- 7.1.15 Shenzhen Tenda Technology Co. Ltd